October Market Recap: Top Trends of the Month

- Nifty 50 Performance in October

- October Market Roundup

- Sectoral Movements

- Company Performance

- Commodities Month's Change

- SME IPO Performance – October

- Top Reads From October!

- Interactive Zone!

October 2025 proved that the Indian stock market is more resilient than rattled, navigating a tricky global landscape while absorbing a major domestic policy shift. Against a backdrop of cautious foreign fund outflows and fluctuating global cues, the recent GST rate cuts energized the economy.

Nifty 50 Performance in October

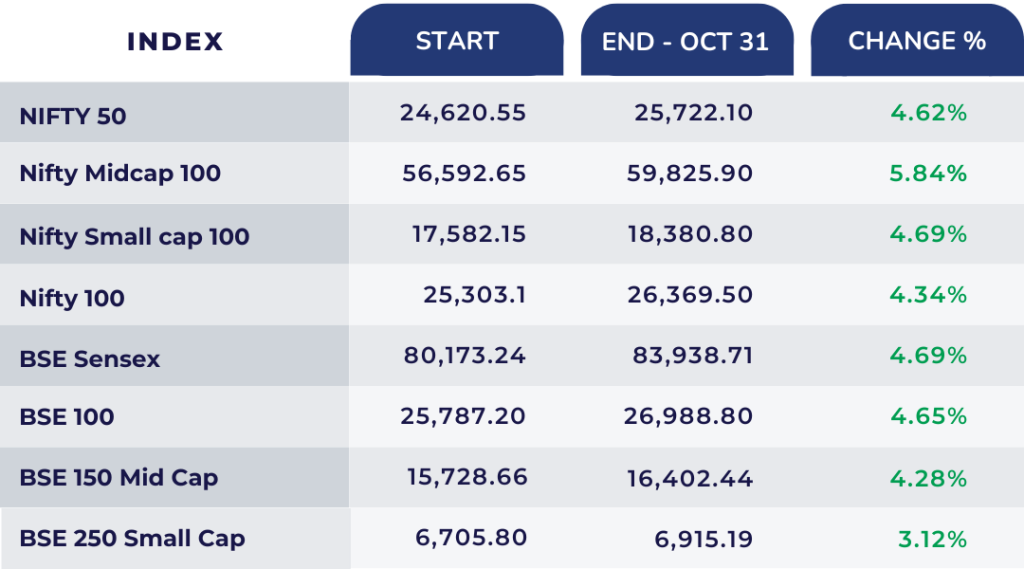

October Market Roundup

October 2025 saw the Indian stock market navigate ongoing global economic uncertainties and domestic policy changes, building on the GST rate cuts implemented in late September. The market showed mixed trends with cautious investor sentiment influenced by global cues such as US Federal Reserve policy, alongside steady domestic economic indicators.

Key Highlights:

GST Policy Impact and Economic Sentiment: The GST rate cuts introduced in late September continued to play a crucial role in shaping market dynamics through October. The simplification to two main GST slabs (5% and 18%) aimed to reduce tax burden and support consumption. Analysts highlighted that foreign institutional investors were watching GST reforms, alongside corporate earnings, for cues on investing in India. Corporate earnings showed signs of gradual recovery but remained cautious amid valuation concerns and global uncertainties.

Market Performance: The BSE Sensex closed October 2025 at around 83,938.71 down on the last trading day of the month compared to the previous day, with the NSE Nifty 50 closing 25,722.10 fall. Over the full month. Midcap and smallcap sectors experienced modest declines while PSU banks and oil & gas sectors showed relative resilience.

GST Collections and Economic Growth: Despite the rate cuts, GST collections remained robust in October, indicating continued economic activity and effective implementation of reforms. The government’s focus remained on enhancing ease of doing business with further GST compliance improvements expected.

Global and Domestic Factors: The US Federal Reserve’s decision to cut rates by 25 basis points met market expectations, but signals of a pause on further easing created cautious investor sentiment. Additionally, foreign fund outflows exerted some pressure, while domestic economic factors like a good monsoon and fiscal policies continued to support the growth outlook.

Outlook

The Indian stock market demonstrated resilience in October 2025, absorbing global uncertainties while remaining buoyed by domestic reforms such as the GST rate cuts and steady economic activity. The market’s moderate gains reflect cautious optimism among investors, with expectations that consumption growth and corporate earnings will gradually improve. Continued monitoring of global monetary policy and domestic earnings trends will be critical going forward.

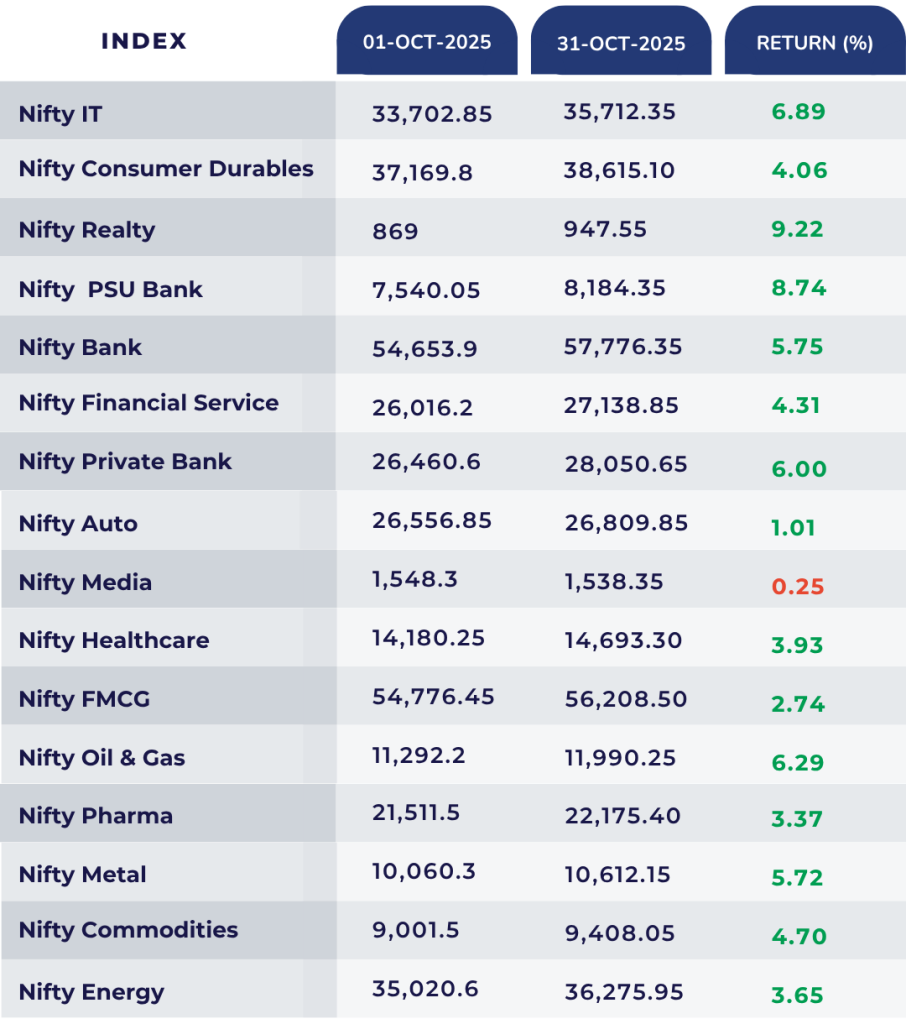

Sectoral Movements

Except Media (0.25) all other market sectors concluded the session with gains; specifically, the Realty, PSU Bank, IT, Bank, Private Bank, Oil & Gas, and Metal sectors recorded gains exceeding 5%.

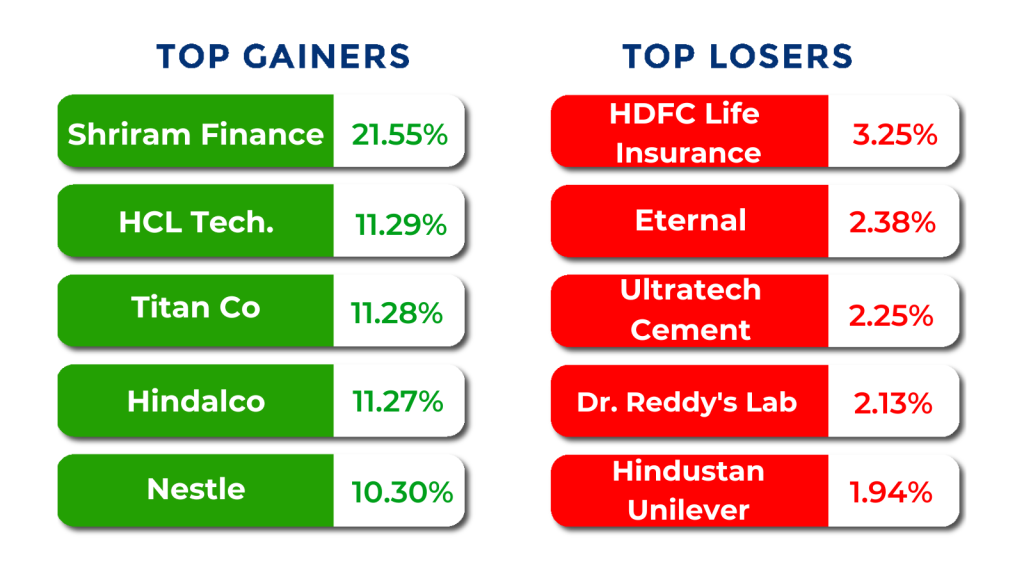

Company Performance

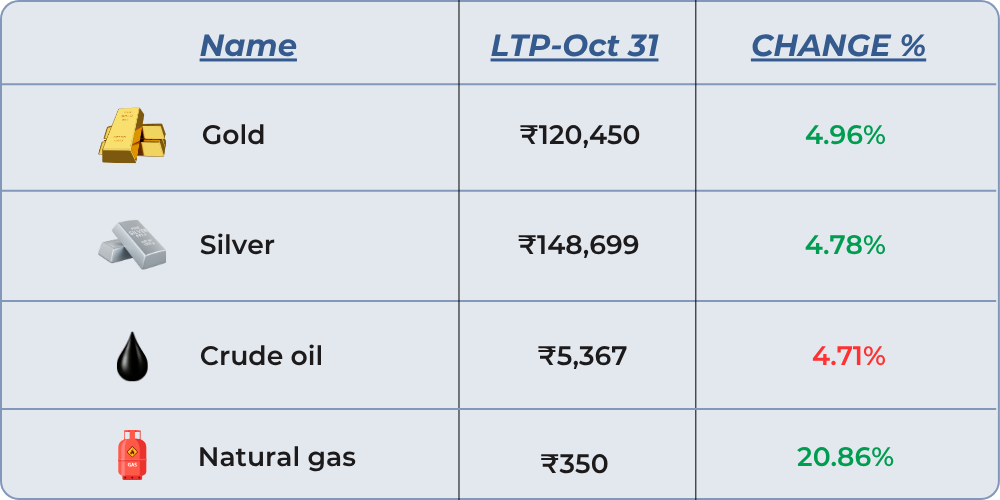

Commodities Month’s Change

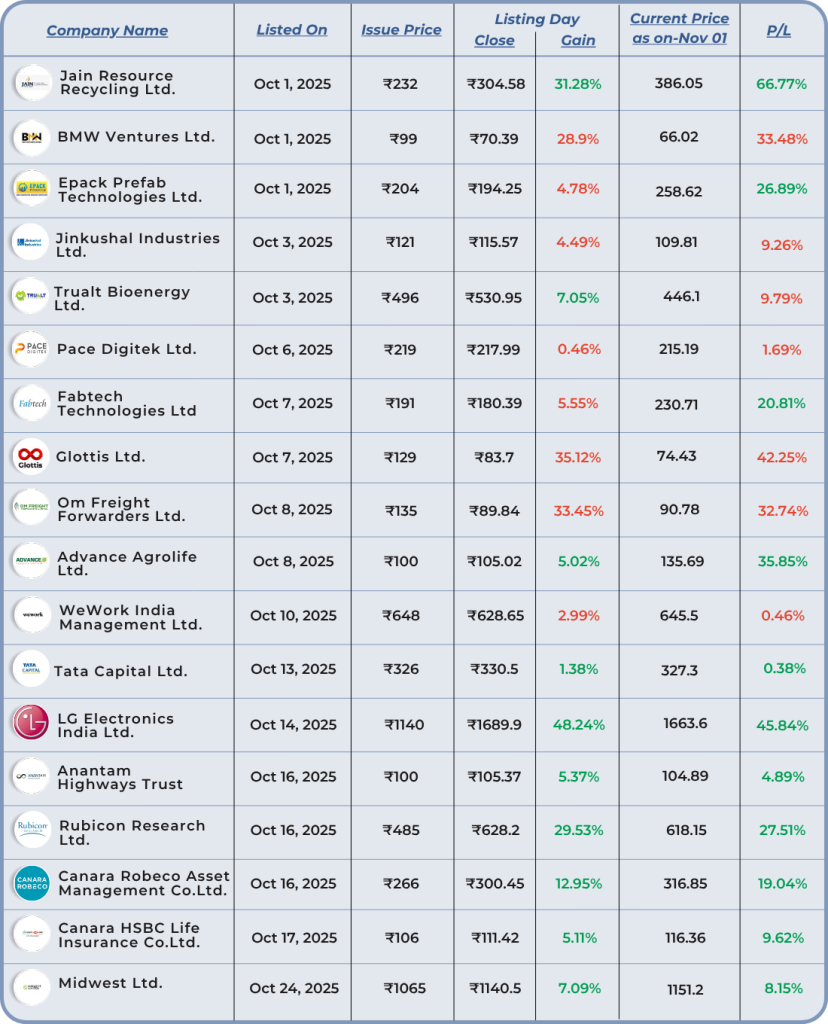

SME IPO Performance – October

October SME IPO:

India’s IPO market in October 2025 continued to show a mixed performance for investors. Standout performers included Jain Resources Recycling Limited (66.77%) and LG Electronics India Limited (45.84%), which rewarded shareholders with impressive listing gains. However, not all debuts were positive—Glottis Ltd (42.25%), BMW Ventures Ltd (33.48%), and Om Freight Forwarders Ltd (32.74%) slipped below the issue price, reminding investors of the risks associated with IPO investing.

Disclaimer: The IPO performances mentioned are historical examples and not investment recommendations.

Top Reads From October!

We’ve curated our October blogs, packed with expert trading strategies and practical investment tips, to help you make smarter financial choices this month.

● Why Do We Cling to Things That Don’t Work?

● Why We Fear Losses More Than We Enjoy Gains?

● Breaking Promises to Our Future Self

● Mental Shortcuts in Investing: When Heuristics Hurt More Than They Help

● The Auspicious Hour: A Complete Guide to Muhurat Trading 2025

● The Overconfidence Trap in Investing – When Being Too Sure Backfires

● The Endowment Effect: Why We Overvalue What We Own

● When Ego Manages Your Portfolio?

● Knowledge Does Not Beat Emotions!

● Why Investors Sell Winners and Hold on to Losers – Understanding the Disposition Effect

● Pivot Points and VWAP: Essential Technical Tools for Day Traders

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others.

Ready to take a guess?

Do You Find This Interesting?

DISCLAIMER: Investment in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Full disclaimer: https://bit.ly/naviadisclaimer.