Start your journey now

5 simple steps in 5 minutes

Aadhar Number + OTP

Enter PAN Number and Bank Account Details

Email Verification and Personal Details

*Document Upload & Selfie Photo

eSign + OTP

Download the Navia App Instantly!

Open Lifetime Free Account!

Mutual Funds are a smart & simple way to build your wealth. They can help you succeed in meeting your financial goals as they have the potential to generate higher-than-inflation returns.

Start Now

The fact that your money is managed by seasoned financial experts is one of the main advantages of participating in these funds.

Mutual funds have higher liquidity than other instruments because you can buy and sell them whenever you want.

Historically, mutual fund returns have outperformed other traditional investment options such as bank FDs, RDs, PPFs, and so on.

You don't need a lot of money to start investing. You can start with just Rs. 500, a month.

You can possess a diverse portfolio even with a small investment because mutual funds invest in a variety of securities, including stocks, bonds, and other assets. This helps to lower risk.

The SEBI regulates mutual fund schemes. The stringent regulations ensure transparency and protect the interests of investors.

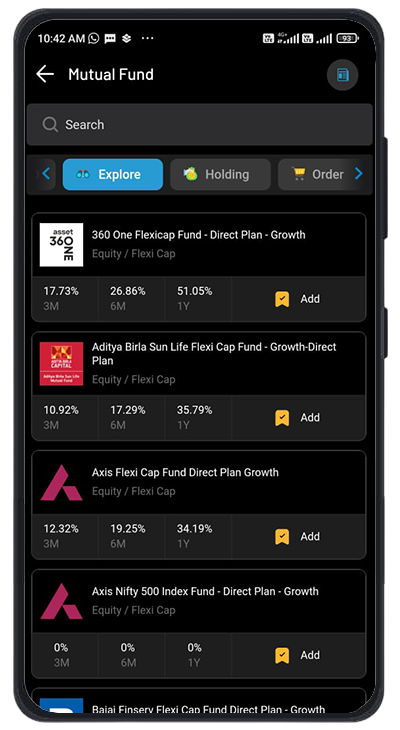

Mutual funds in India are classified according to the asset class in which they invest. The following are some popular categories.

It is an investment vehicle in which multiple investors pool their funds. The fund manager then invests this pooled money across various asset classes such as equity, debt, gold, and other securities to generate returns. The gains and losses from such investments are distributed to investors in proportion to their share of the investment.

There is no straight answer to this question. Different funds have different risk-return profiles. You need to choose a fund based on your risk-taking capabilities and the time horizon you have in your mind for the investment. So, you need to find a balance between your risk tolerance and the risk of the fund you are planning to invest in. For example, if you are willing to take high risk but your investment horizon is less than 3 years, you shouldn't invest fully in equity funds.

You may consider investing in a mix of equity and debt with more exposure to debt funds. Therefore, you need to choose the best mutual fund based on your risk appetite and time horizon.

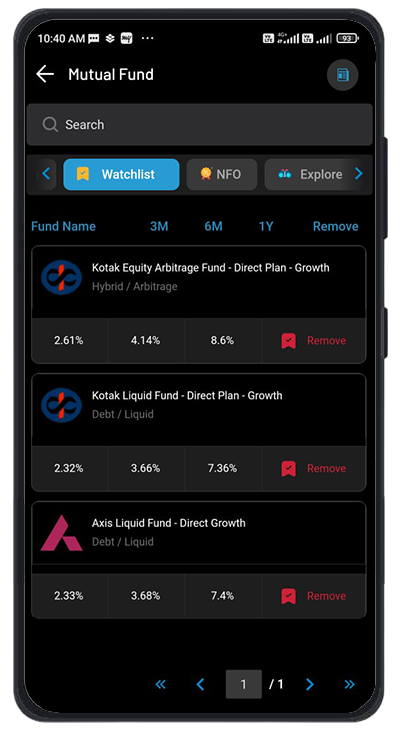

How to invest in mutual funds?

On withdrawal, if your redemption value is higher than the purchase price of a mutual fund, the same will be classified as capital gains. The gains from both equity (above a threshold limit) and debt funds are taxable. The gains are classified as short-term capital gains (STCG) or long-term capital gains, depending on the holding period.

In the case of equity funds, if you sell your investments before one year, gains will be classified as STCG otherwise, LTCG. In the case of debt mutual funds, if you sell your funds after 3 years, the gains will be classified as LTCG. However, gains on holdings sold before 3 years will be classified as STCG.

There are two ways of investing in mutual funds - via a systematic investment plan (SIP) or investing through a one-time lump sum method. The primary difference between the two is in a lump sum you have to invest the whole amount in one go and in SIP, you can invest in a mutual fund at fixed intervals such as monthly SIP.