Start your journey now

5 simple steps in 5 minutes

Aadhar Number + OTP

Enter PAN Number and Bank Account Details

Email Verification and Personal Details

*Document Upload & Selfie Photo

eSign + OTP

Download the Navia App Instantly!

Open Lifetime Free Account!

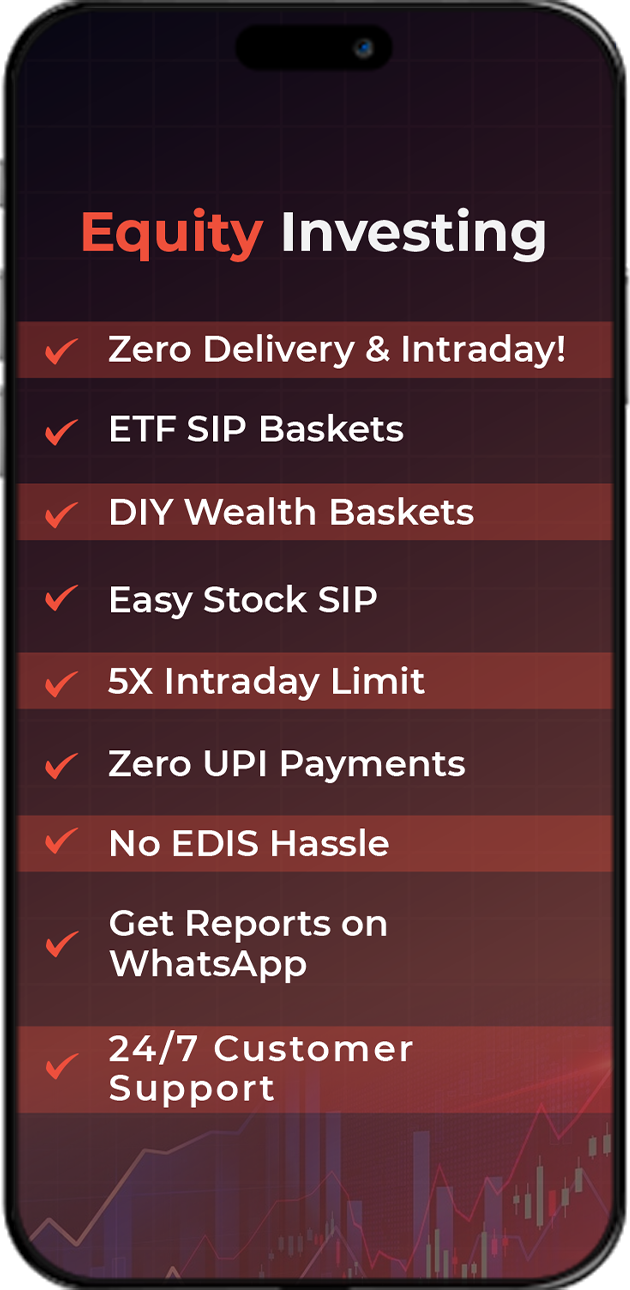

Free Intraday | Free Delivery

No Order Limit | No Subscriptions

Zero Charges* + Zero Interest on MTF*

New to Stock Market ? Confused about which company to invest in ? Start by investing in Exchange-Traded Funds (ETFs) which passively managed funds that mirror the performance of the underlying stock market index such as Sensex, NIFTY 50, NIFTY Bank, NIFTY Next 50 etc.

Now you can start with small investments to grow into large ones with Mutual Funds that invest in top stocks to meet your objectives. Invest directly in over 2500+ Mutual Funds at 0% commission. It only takes a few simple clicks. Invest Quickly, Simply, and Without Paperwork!.

Apply online with ease & invest in companies that will be listed on Indian Stock exchanges through an IPO (Initial Public Offering). Get it done in just a few clicks.

Make investments even when you are short of funds. Get upto 66% funding on your equity delivery trades

| Segment | STT /CTT Description | STT/CTT | Transaction Charges* |

|---|---|---|---|

| Equity | Intra Day - Sale Side | 0.025% | NSE: 0.00306990% ( Investor Protection Fund of 0.00001%) BSE: 0.00375% For BSE Detailed Transaction Charges Click here |

| Delivery - Purchase & Sale | 0.10% | ||

| Equity Futures | Sale Of Futures | 0.02% | NSE Charge: 0.00182990% ( Investor Protection Fund of 0.00001% ) BSE Charge: NIL Clearing Charge: 0.0016% |

| Equity Options | Sale Of Options Premium | 0.1% | NSE Charge: 0.03552990% ( Investor Protection Fund of 0.00001% ) BSE Charge: 0.0325% Clearing Charge: 0.03% |

| S&P BSE SENSEX Options & S&P BSE BANKEX Options (all expiries) | 0.125% |

|

Equity |

||

|

|

Intra Day |

Delivery |

|

STT/CTT |

Sale Side: 0.025% |

Purchase & Sale: 0.10% |

|

Transaction Charges* |

NSE: 0.00306990% (Investor Protection Fund of 0.00001%) BSE: 0.00375% For BSE Detailed Transaction Charges Click here |

|

|

Equity F&O |

||

|

|

Equity Futures |

Equity Options |

|

STT /CTT |

Sale Of Futures: 0.02% |

Sale Of Options Premium: 0.1% S&P BSE SENSEX Options & S&P BSE BANKEX Options (all expiries): 0.125% |

|

Transaction Charges* |

NSE Charge: 0.00182990% (Investor Protection Fund of 0.00001%) BSE Charge: NIL Clearing Charge: 0.0016% |

NSE Charge: 0.03552990% (Investor Protection Fund of 0.00001%) BSE Charge: 0.0325% Clearing Charge: 0.03% |

| Segment | Other charges* |

|---|---|

| Call N Trade Charges | ₹50 + GST - (A - Each call connected on order placing queue of our dealing desk. B - Each Order executed by Admin for MIS square off, square off due to M-to-M losses, Shortfalls or for any other reason as required from time to time by our Risk Management Policy.) |

| Pay-in Charges | Payment Gateway - ₹ 9/- + GST per

transaction Cheque Payments - ₹ 50/- + GST per instrument NEFT/RTGS/IMPS - ₹ 50/- + GST per transaction |

| Physical Contract Note postage charges | ₹ 50 +GST per day |

| Margin Trade funding (MTF) interest rate | Starts from 1.25% per month |

Tax by the government when transacting on the exchanges. Charged as above on both buy and sell sides when trading equity delivery. Charged only on selling side when trading intraday or on F&O. When trading at Navia STT/CTT can be a lot more than the brokerage we charge. Important to keep a tab.

Transaction charges include the fees levied for executing trades on the exchange, such as NSE, BSE, or MCX, as well as the clearing charges, which are the fees charged by the clearing member, Orbis, for processing trades on behalf of Navia.

Additional charges of ₹50 + GST will be on

A)Each call connected on order placing queue of our dealing desk.

B)Each Order executed by Admin for MIS square off, square off due to M-to-M losses, Shortfalls or for any other reason as required from time to time by our Risk Management Policy.

Stamp charges as per the Indian Stamp Act of 1899 for transacting in instruments on the stock exchanges and depositories Click here.

Tax levied by the government on the services rendered. The current GST rate is 18% on Exchange Transaction Charges, Clearing Charges, SEBI charges and Brokerage, if any

Charged at ₹ 10 per crore by Securities and Exchange Board of India for regulating the markets.

Depository transaction charges are levied by the Depository (NSDL/CDSL) and depository participant (Navia Markets Ltd.) These charges are only levied when you sell your shares through us from your DP account with us. The charges are 0.03% of transaction value, subject to a minimum of 30 & maximum of 300 per transaction. NDU charges under Tariff : 0.05% of the value of securities upon creation of hold subject to a minimum of Rs. 50. There are so also other Depository related charges for one off activities like demating/ Pledging / Failed transactions etc. For list of complete charges Click here.

Brokerage will not exceed the rates specified by SEBI and the exchanges. All statutory and regulatory charges will be levied at actuals. Brokerage is also charged on expired, exercised, and assigned options contracts. Free investments are available only for our retail individual clients. These charges not applicable for Companies, Partnerships, Trusts, and HUFs.

Equity trading is the buying and selling of company stock shares on a stock exchange.

An investor buys shares of a company's stock through a brokerage account, and can later sell those shares for a profit (or loss) based on the stock's performance.

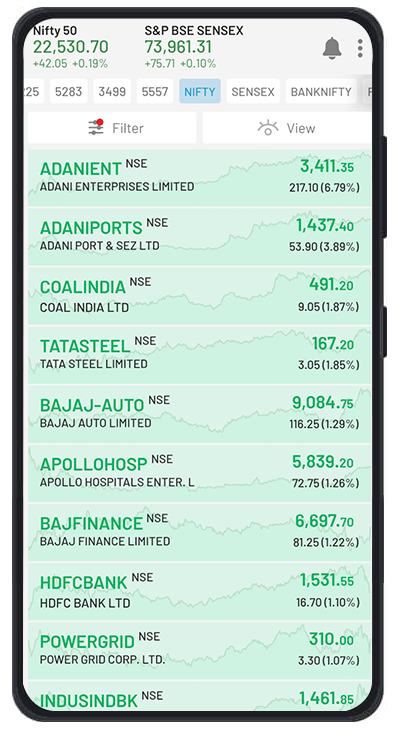

The most common equity markets are the National Stock Exchange of India (NSE) and the Bombay Stock Exchange (BSE).

The primary risk of equity trading is that the stock price may decrease, resulting in a loss for the investor. Other risks include economic conditions and market fluctuations, as well as changes in the specific company's performance.

The potential for high returns is the main advantage of equity trading. Additionally, owning stock in a company can also provide a sense of ownership and can make an investor feel more connected to the company.

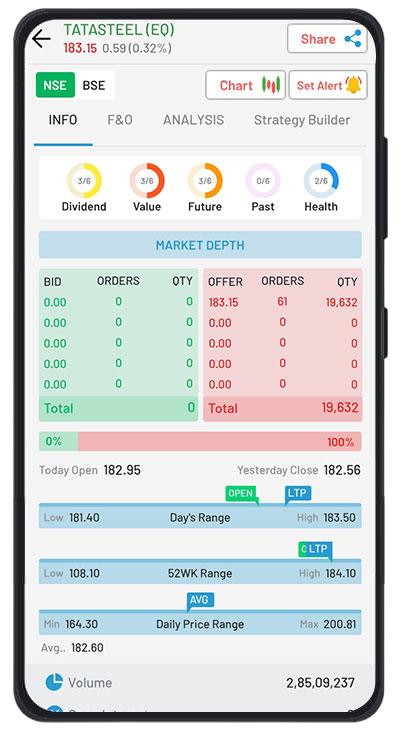

Common metrics used to evaluate a stock include price-to-earnings ratio (P/E), earnings per share (EPS), and dividend yield.

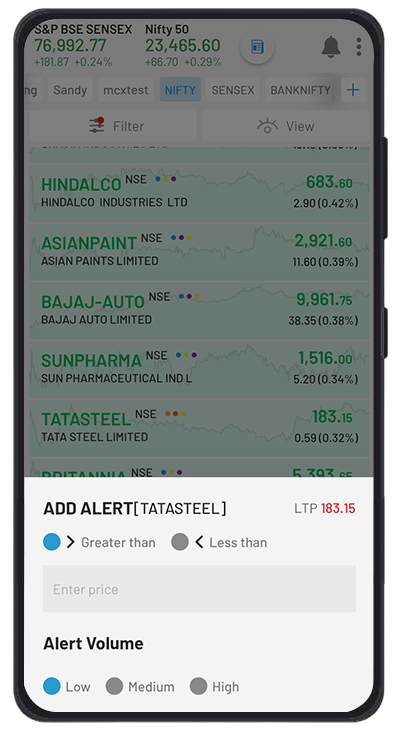

An order to buy or sell shares of a stock can be placed through a broker or trading platform. An investor can specify the number of shares and the price at which they wish to buy or sell the stock.

The minimum amount required to start investing in equities can vary depending on the Company you intend to purchase.

Additionally, commission-free online trading platforms are also available, which may allow you to start investing with as little as Rs.1.

It is also worth noting that there are fractional shares trading like ETF, which allow you to buy a portion of a share instead of a full share. This can make it easier for investors with less capital to invest in high-priced stocks.

However, regardless of the minimum required amount, it is important to remember that equity investing is generally considered a long-term strategy, and it's advisable to invest only what you have as surplus funds and always diversify your portfolio. Additionally, it is important to keep in mind that you should always do your due diligence and research when choosing stocks to invest in and make sure you understand the risks and potential returns of your investments.

Types of trading in India are Intraday, Delivery, Short Sell, Buy Today Sell Tomorrow (BTST), Sell Today Buy Tomorrow (STBT), and Margin Trading.