November Market Recap: Top Trends of the Month

- Nifty 50 Performance in November

- November Market Roundup

- Sectoral Movements

- Company Performance

- Commodities Month's Change

- SME IPO Performance – November

- Top Reads From November!

- Interactive Zone!

In November 2025, the Indian stock market stabilized, primarily driven by global rate speculations and a strong surge in Domestic Institutional Investor (DII) flows. Although the market faced pressure from persistent Foreign Institutional Investor (FII) selling, it proved resilient. Strong corporate earnings, particularly from PSU banks and IT, supported sentiment.

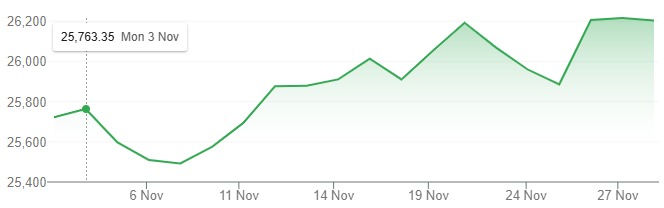

Nifty 50 Performance in November

November Market Roundup

November 2025 was a month driven by global rate expectations, sharp sector rotations, easing inflation, and a rebound in domestic liquidity flows. Despite persistent foreign selling early in the month, strong earnings from banks and IT, along with improving consumption indicators, helped the markets stabilise and close November on a positive note.

Nifty 50 Performance in November: The Nifty 50 traded above 26,200 in the last trading sessions of November and finished the month roughly in the 26.1k–26.3k area. The Sensex traded in the ~85.7k area around the same dates.

November 2025 Market Roundup: November was marked by a clear shift toward stability and selective accumulation, powered by:

Global central banks: Fed commentary in late November kept market focus on the timing of potential rate moves — that backdrop created intra-month volatility in risk appetite globally and in India.

Liquidity & domestic flows: Domestic Institution Investors (DIIs / mutual funds) remained an important source of demand throughout November; FIIs were net sellers for much of the month but flows softened late-November. Official FII/DII trading summaries and market coverage show this dynamic.

Key Highlights:

Corporate Earnings and Sector Leadership;

Banks (especially PSU banks) and select IT names posted reassuring quarters that supported market sentiment; PSU Bank indices recorded strong gains during November. Multiple market reports and sector pieces highlighted PSU bank strength and improving asset quality narratives.

Foreign Flows;

FIIs were net sellers for most of November (Net outflows reported during the month), while DIIs continued to buy — press coverage and NSE provisional trade summaries document the direction and quantum of these flows.

Commodities;

Gold: Rose in late-November amid renewed rate-cut speculation globally and Fed comments.

Brent Crude: Traded lower on weak global demand signals over the month (monthly decline in the November window). Historical commodity data shows Brent easing across the month.

Market performance & Outlook

Market Tone in November: The overall tone by month-end appeared neutral to mildly positive, supported by domestic liquidity and favourable corporate results, while intermittent global risk cues continued to influence sentiment. Closing-level reporting and live market coverage around Nov 28–30 show indices hovering near record/high ranges, with intra-month churn.

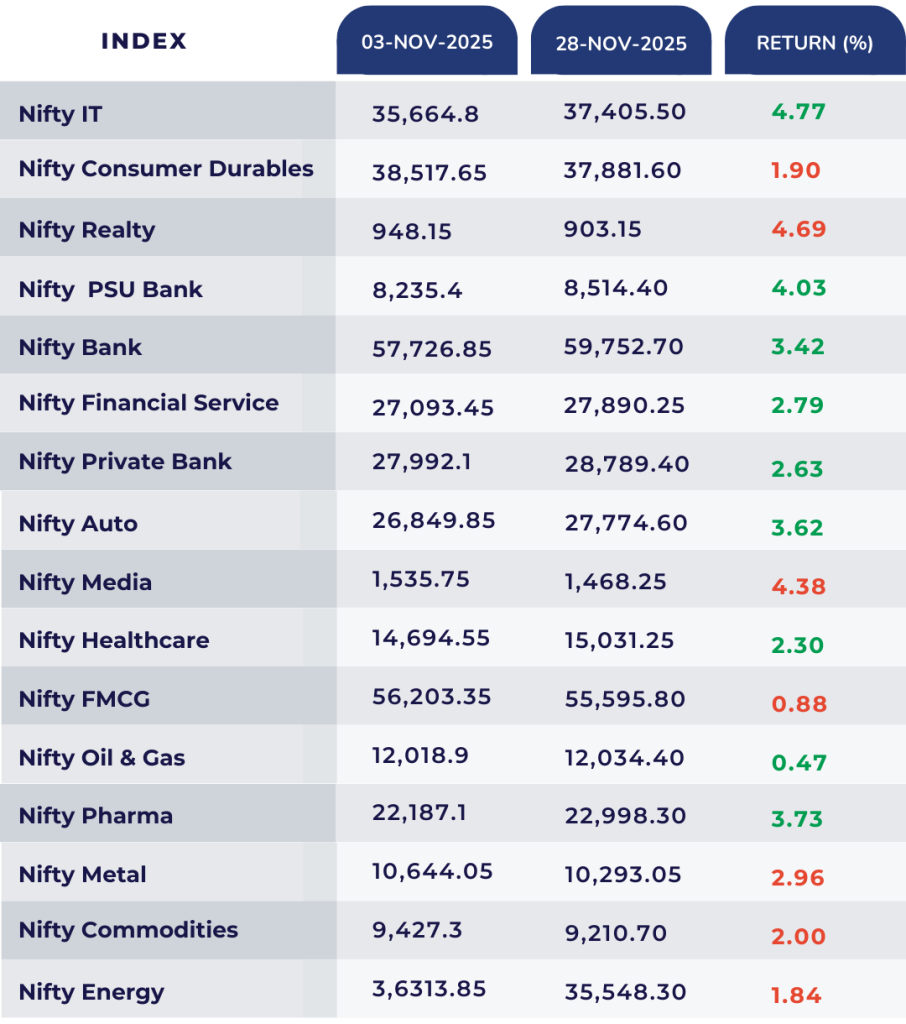

Sectoral Movements

November 2025, the monthly sectoral performance was marked by strong gains across most sectors, with seven major indices closing in the red. The top performers were the IT sector, which led the gains with a rise of 4.77%, and the PSU Bank sector, which followed closely with an increase of 4.03%. Conversely, the Media sector, which was the steepest loser with a fall of 4.38%, and the Realty sector, which declined by 4.69.

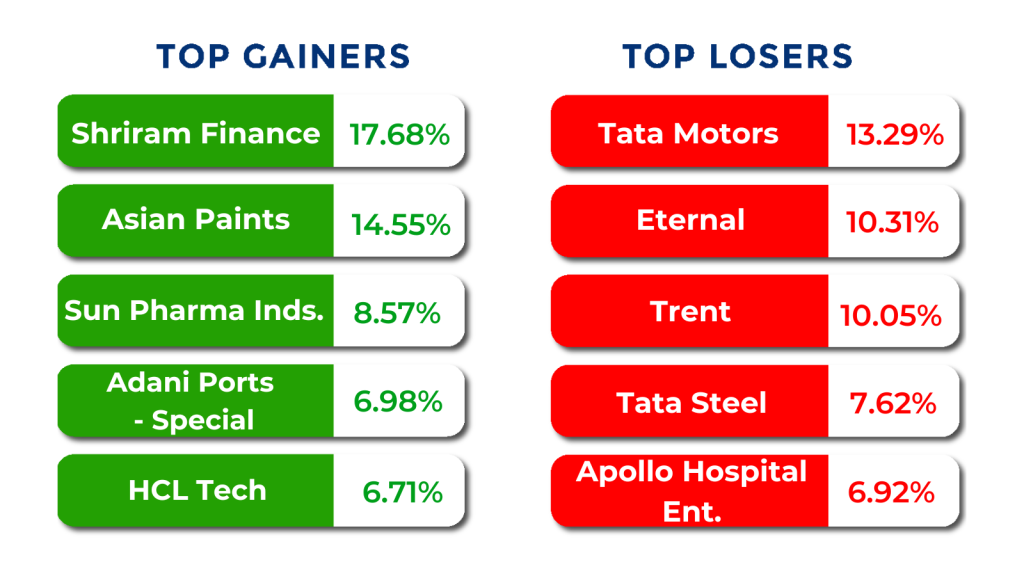

Company Performance

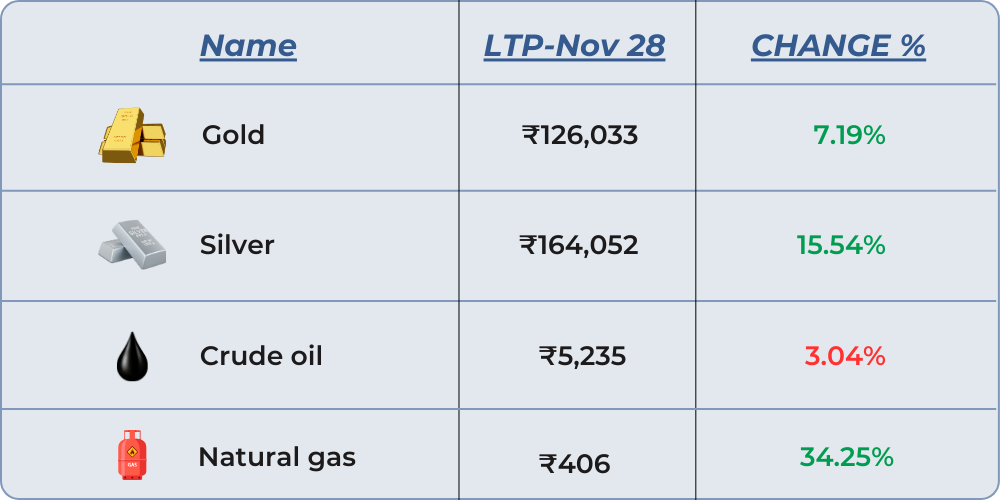

Commodities Month’s Change

SME IPO Performance – November

November SME IPO:

In November 2025, the Indian IPO market presented a nuanced picture for investors, with 12 companies listing during the month. The market celebrated significant gains for a few, led by Billionbrains Garage Ventures Ltd. (58.85%) and supported by strong performances from Sudeep Pharma Ltd. (30.47%) and Tenneco Clean Air India Ltd. (21.88%). These companies recorded strong listing-day gains during the period. These outcomes are historical and not indicative of future performance. However, the month also saw underperformance, with certain debuts listing below their issue price. The top losers included Orkla India Ltd. (11.21%), Fujiyama Power Systems Ltd. (8.16%), and Studds Accessories Ltd. (6.44%), serving as a reminder of the inherent risks in the primary market.

Disclaimer: The IPO performances mentioned are historical examples and not investment recommendations.

Top Reads From November!

Explore our November reading list for key educational insights across markets, strategies, and investor behaviour!

● A Great Company ≠ A Great Investment

● Glittering Hedge or Dead Money? The Truth About Investing in Gold

● What Schools and Colleges Don’t Teach About Investing – The Behavioral Side

● SIP, STP, and SWP—Which Systematic Plan Wins in 2025?

● Navigating Financial Tides: What the Current Ratio Reveals About a Company’s Health

● Trading Forecast: Navigating the Markets with the Ichimoku Cloud

● Marubozu Candlestick Pattern: When One Candle Shows Full Market Control

● The Strategy that Creates New Demand: A Guide to Blue Ocean Success

● How Copper Futures Can Energize Your Trading Portfolio?

● Smart Investing: Which SIP is Right?

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others.

Ready to take a guess?

Do You Find This Interesting?

DISCLAIMER: Investment in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Full disclaimer: https://bit.ly/naviadisclaimer.