Navia Weekly Roundup ( Feb 10 – 14, 2025)

Week in the Review

The Indian market snapped two-week gaining streak and posted biggest weekly losses in two months amid volatility due to uncertainty on Trump’s tariff policies, mixed corporate earnings, relentless FII selling and rupee depreciation against the dollar.

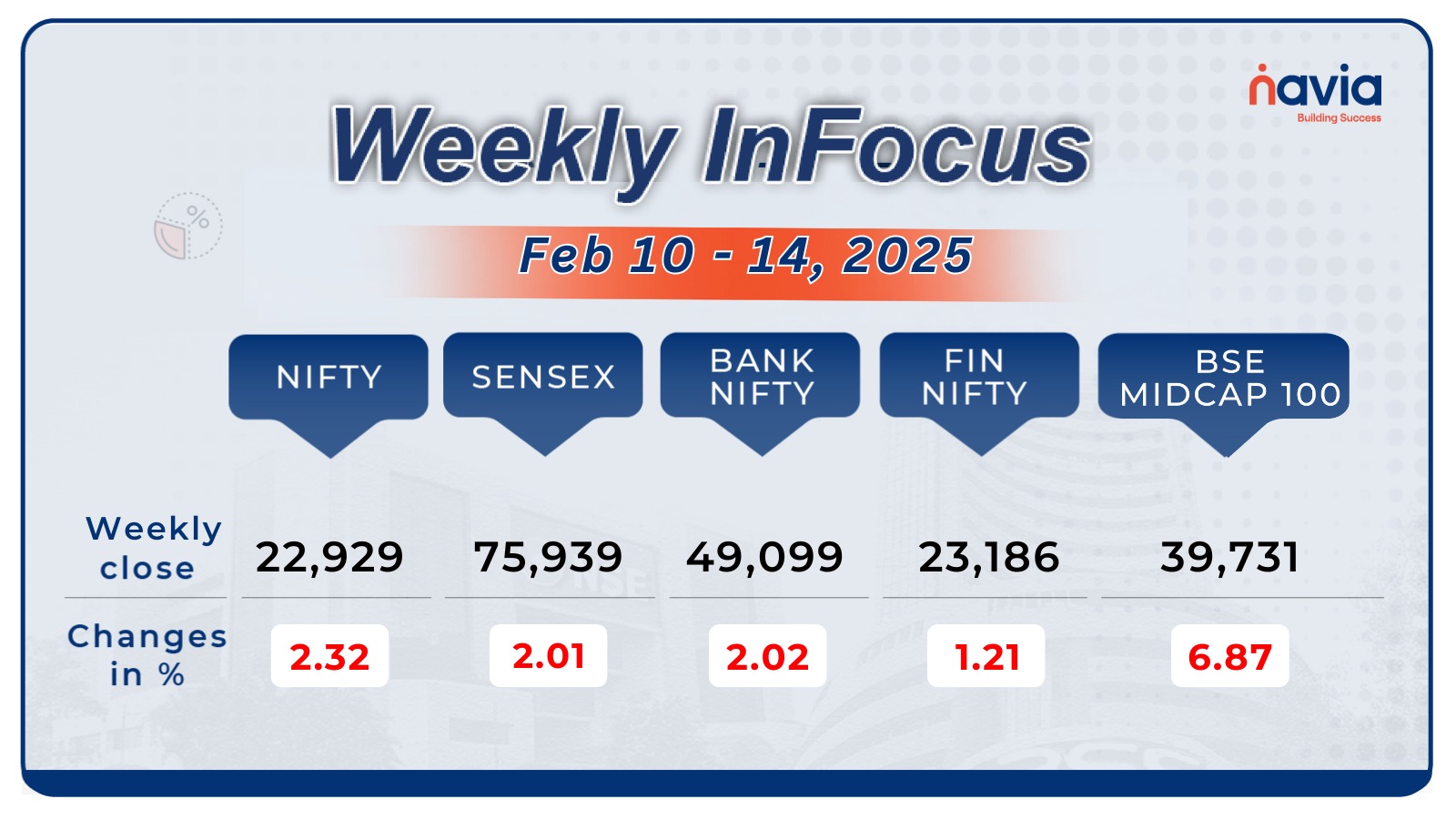

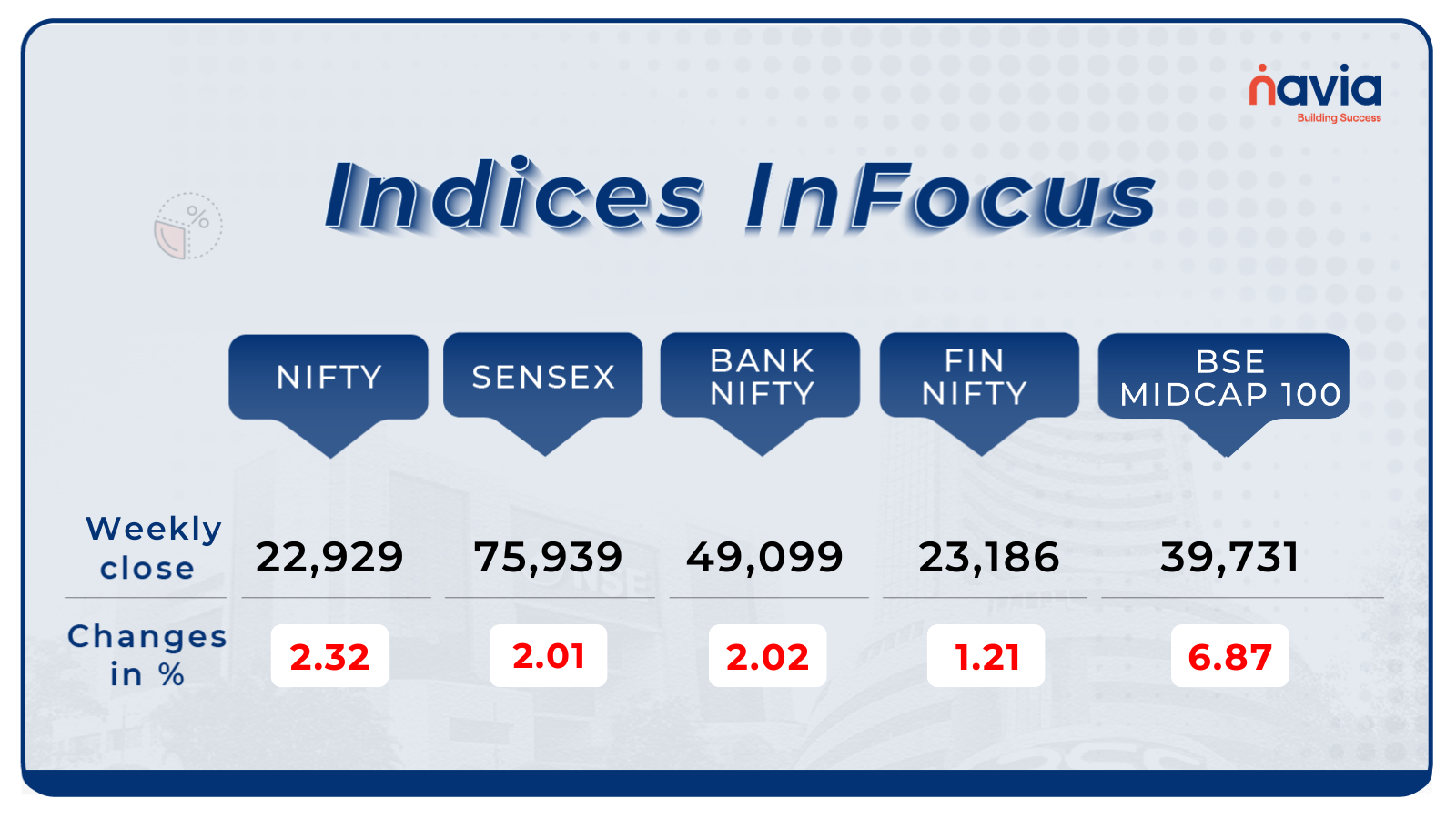

Indices Analysis

This week, BSE Sensex shed 1,920.98 points or 2.01 percent to close at 75,939.21, while the Nifty50 index fell 630.67 points or 2.32 percent to end at 22,929.25.

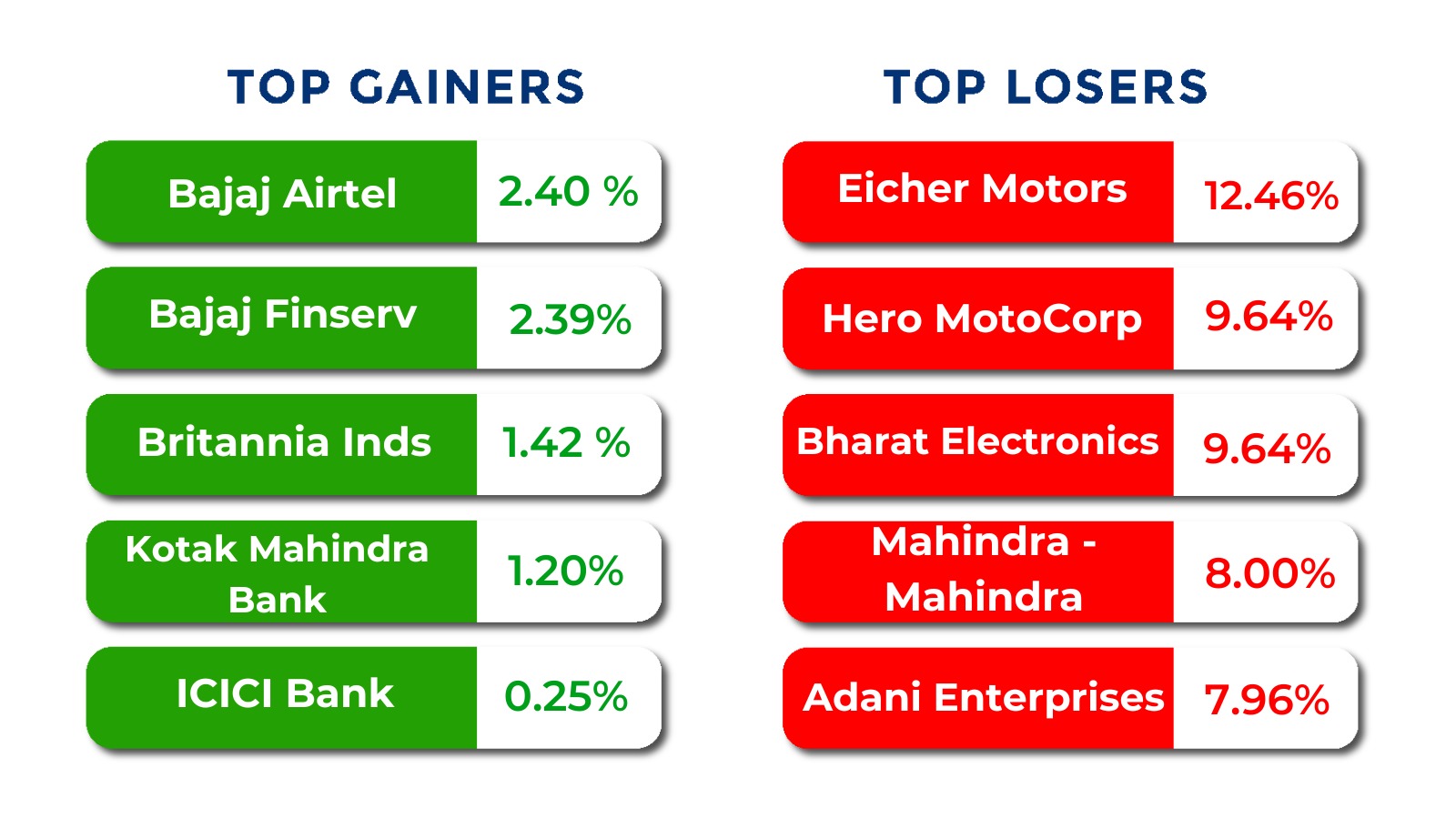

The BSE Large-cap Index fell 3.3 percent with Eicher Motors, Varun Beverages, DLF, REC, Jio Financial Services, Adani Green Energy falling 10-12 percent.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

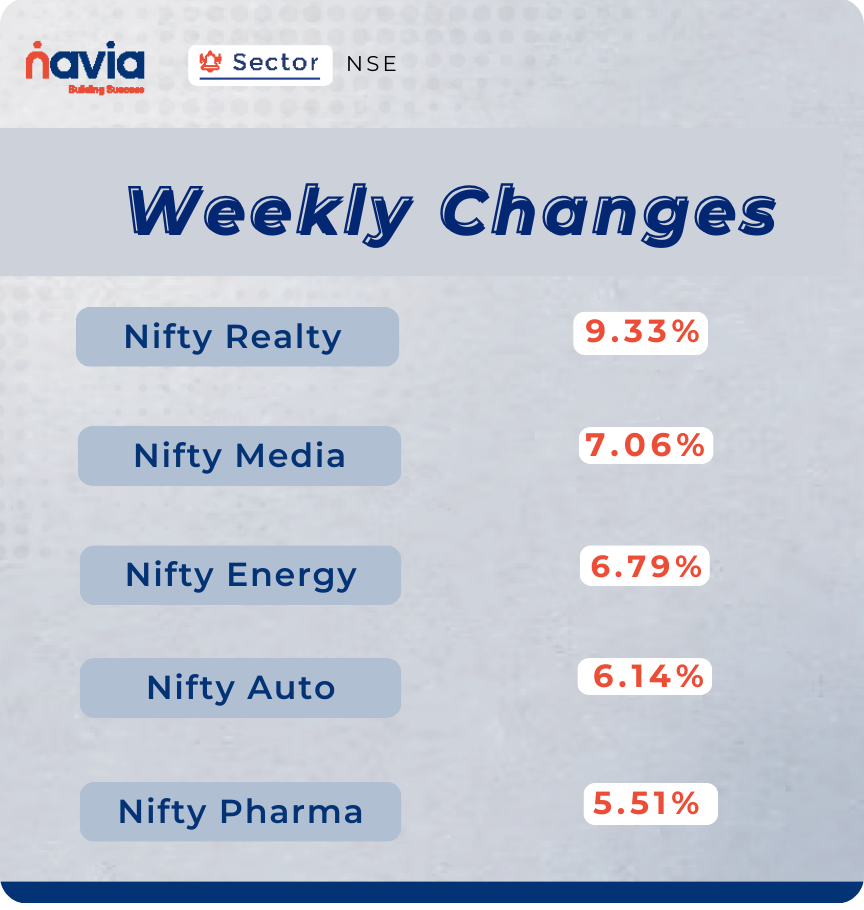

Sector Spotlight

All the sectoral indices ended in the red this week. Nifty Realty index shed 9.4 percent, Nifty Media fell 7 percent, Nifty Energy index declined nearly 7 percent, Nifty Auto index shed 6 percent and Nifty Pharma down 5.5 percent.

Top Gainers and Losers

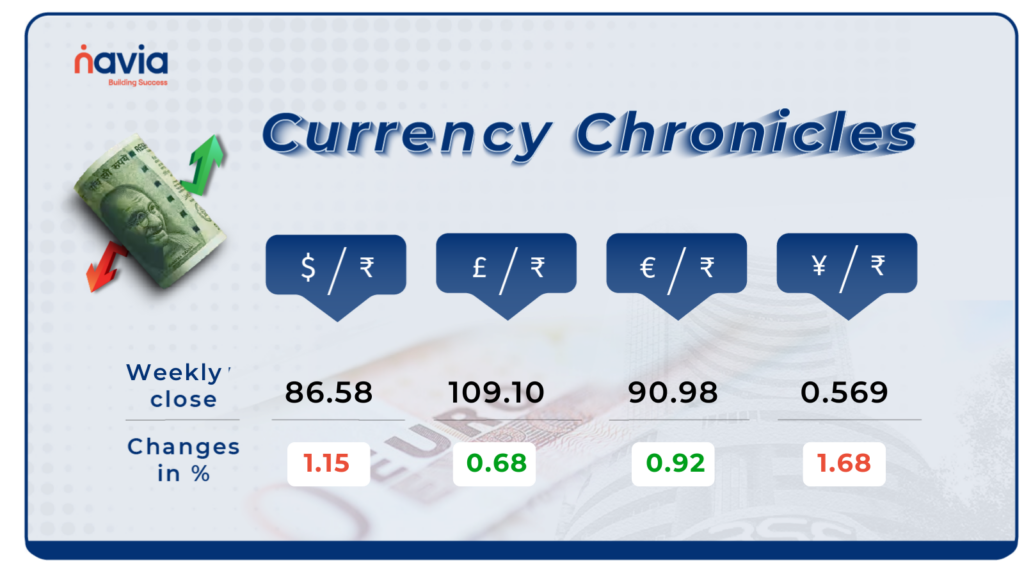

Currency Chronicles

USD/INR:

During the week, the Indian rupee tested fresh record low of 87.95 but managed to close 59 paise higher at 86.83 per dollar on February 14 against the February 7 closing of 87.42.

EUR/INR:

The euro gained 0.92% this week, closing at ₹90.98. Sentiment in the EUR/INR market remains bullish, indicating strong support for the euro.

JPY/INR:

The Japanese yen declined by 1.68% this week, closing at ₹0.569. Sentiment in the JPY/INR market remains neutral, reflecting a balanced outlook for the yen.

Stay tuned for more currency insights next week!

Commodity Corner

Crude oil is trading in a broadening descending wedge pattern on the 3-hour chart, with the last session closing down by 30 points at 6,194. A strong close above the 6,495–6,510 range could push prices higher, while failure to do so may create negative sentiment. Intraday momentum is expected above 6,245 and below 6,190. Brent crude is currently trading at $75.18, up by 0.20 points.

Oil prices are driven by multiple factors, including peace talks between Russia and Ukraine, which have weakened oil prices as markets anticipate a potential ceasefire and reduced supply disruptions. Additionally, economic concerns in Russia, such as lower oil prices, budget constraints, and rising corporate debt, could impact its oil production and exports. The market is also reacting to reports that major economies are seeing mixed growth signals, affecting overall demand expectations.

Gold prices are currently trading within an ascending channel pattern, closing at 85,769 in the last session, up by 858.09 points. In recent days, gold has shown limited momentum and is slightly consolidating, with intraday movement expected above 86,000 for an upward push or below 85,300 for downside pressure.

The movement in gold prices is influenced by factors like JPMorgan Chase and HSBC transferring gold from London to New York due to price differences. Additionally, global demand is shifting, with a significant drop in jewelry sales in India amid high prices, while China is offering discounts post-Lunar New Year. On the supply side, Northern Star’s new high-value gold deposit could impact future production.

Natural gas is trading in an ascending channel on the 30-minute chart, respecting its support and resistance levels. In yesterday’s session, it slightly attempted a breakdown, closing up by 8.3 points at 315.2. Further intraday momentum can be expected above 319.5 and below 308. The prices are driven by factors such as cold weather boosting demand, fluctuations in U.S. storage reports, and the shifting global supply-demand dynamics, including geopolitical tensions and infrastructure developments in the energy sector.

Silver has been trading in a broken ascending channel, and in the last session, it fell and closed at 97,780, down by 269 points. Silver needs to sustain above 96,400 to confirm a further uptrend. A fall below 94,700 could add negative sentiment, while a breakout above 96,400 could provide a buying opportunity.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Blogs of the Week!

Investing in International ETFs: A Smart Strategy, But Beware of Overpaying

Ever wondered why some international ETFs cost more than their actual value? Paying a premium might seem harmless—until it isn’t. Find out why this happens, which ETFs are affected, and what smart investors should do next in this blog!

Commodity Trading: Unlocking the Secrets to a Profitable Market

Gold, crude oil, wheat—ever wondered how their prices fluctuate and why traders profit from them? Commodity trading isn’t just for experts; it’s a powerful tool to hedge, diversify, and grow wealth. Read on to uncover the secrets of successful commodity trading in India!

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?