Navia Weekly Roundup (Apr 22 – Apr 26, 2024)

Week in the Review

The market rebounded from the losses of the previous week and extended the rally from last week, buoyed by stable geopolitical conditions that contributed to a decline in crude oil prices. However, amidst sluggish US economic growth, elevated inflation, and a blend of earnings reports from Indian corporations, global markets displayed a mixed sentiment, prompting investors to take profits on the final day of the week.

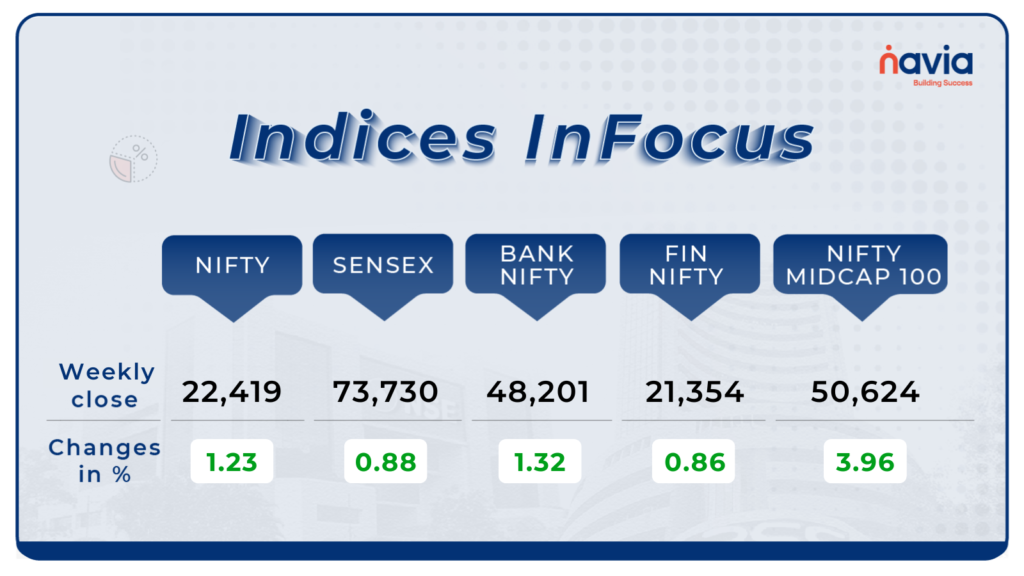

Indices Analysis

During the week, the BSE Sensex surged by 0.87 percent, closing at 73,730. Similarly, the Nifty50 index climbed 1.23 percent, to settle at 22,419.

The market has completed a leg of its rally, with 22,620/74,515 (last Friday’s high) now serving as crucial resistance for short-term traders. We anticipate that as long as the market remains below 22,620/74,515, a correction formation is likely to persist, potentially leading to a decline towards the 50-day SMA at 22,235/73,225.

Further downside movement could see the market slipping to 22,100/72,800. Conversely, a fresh uptrend rally may only occur upon surpassing 22,620/74,515, with potential targets at 22,775-22,900/75,124-75,500. For Bank Nifty, the 20-day SMA or 48,000 is a significant level, and a breach below it could shift sentiment, possibly testing levels around 47,500-47,250 or the 50-day SMA.

Interactive Zone!

Last week’s poll:

Q) While expecting price to go up, what position needs to be created?

a) Long Position

b) Short Position

Last week’s poll answer: a) Long Position

Poll for the week: When was the National Stock Exchange Fifty (NIFTY) founded?

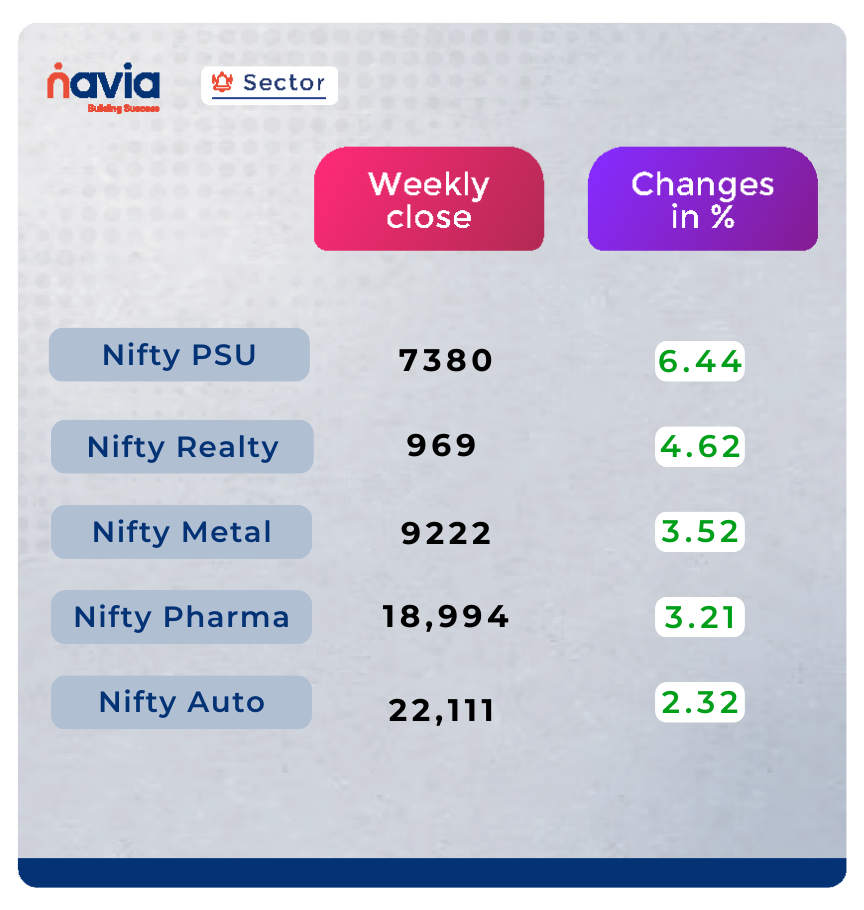

Sector Spotlight

All sectoral indices closed positively, with the Nifty PSU Bank index leading the gains with a surge of 6.44 percent. Additionally, the Nifty realty index saw a rise of 4.62 percent, while the Nifty Metal index climbed by 3.52 percent, and the Nifty Pharma index recorded a gain of 3.21 percent.

Explore Our Features!

Streaks to Monitor Investments & Stocks: Unlock the secrets of effective stock analysis using the Navia App! Watch our quick tutorial on how to add stocks to your watchlist, obtaining quick snapshots, and delve into detailed analyses. Seamlessly track the performance of your investments and individual stocks with Navia’s Streaks feature.

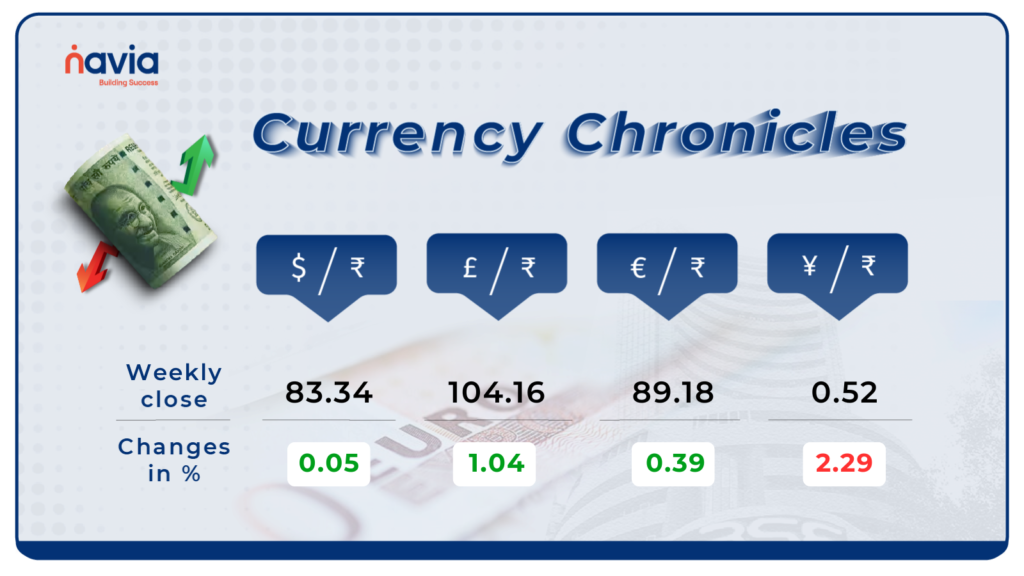

Currency Chronicles

USD/INR:

The Indian rupee staged a recovery from the previous week’s record low level, ending 13 paise higher at 83.34 on April 26 compared to its April 19 closing of 83.47. This rebound indicates a resurgence in confidence in the Indian currency following recent volatility in global markets.

EUR/INR:

Throughout the week, the EUR to INR exchange rate recorded a notable increase of 0.39%. Bullish sentiment prevails in the EUR/INR market, reflecting positive expectations among traders and investors. As of the latest analysis, the EUR to INR rate reached ₹ 89.18 by the end of the week.

JPY/INR:

Conversely, the JPY to INR exchange rate experienced a significant decrease of -2.29% for the week. Despite this decline, bullish sentiment persists in the JPY/INR market, indicating continued confidence among market participants. At this moment, the JPY to INR rate is estimated to reach ₹ 0.520587 by the end of the week.

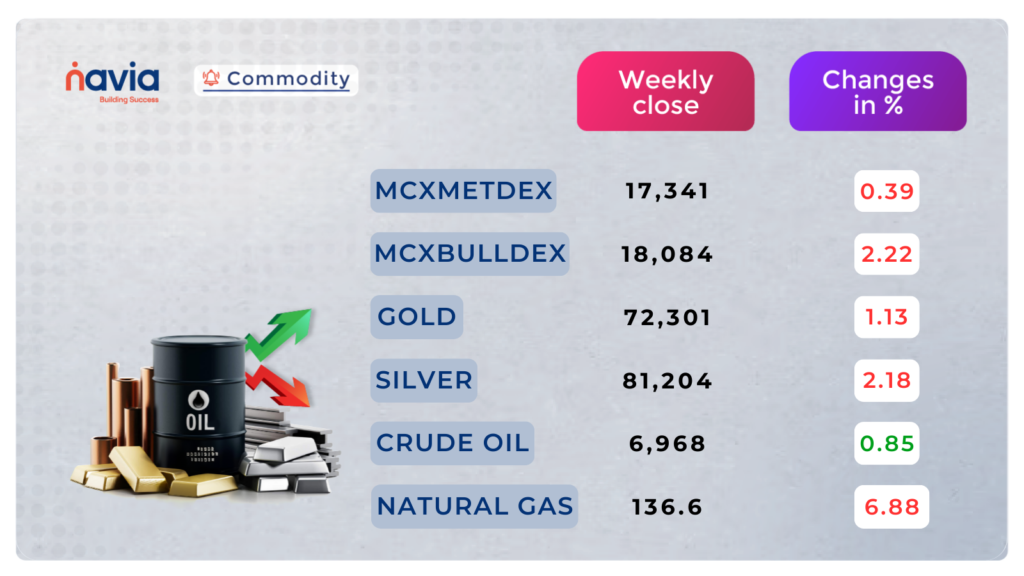

Commodity Corner

This week crude oil closed at 0.85% positive, underpinned by an improving demand outlook and persistent supply risks related to the Middle East conflict influencing the upcoming price. Current R1 is placed at 7023, and S1 is placed at 6900 levels.

Over the past three trading sessions, gold has shown consolidation in the range of 70531-71451 levels. In the week, it closed at 1.13% negative.

Blogs of the Week!

SIP vs Lump Sum: Choosing the Right Investment Strategy for You

Unlock the secrets to smarter investing! Discover which works for you, whether it’s SIPs or Lump Sum investments, through our latest blog, filled with expert tips, insights, and more.

The Lantern Festival: Guiding Lights to Wise Investments

Illuminate your financial journey with insights inspired by the wisdom of Leela from Indrapur. Catch the story Now!

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

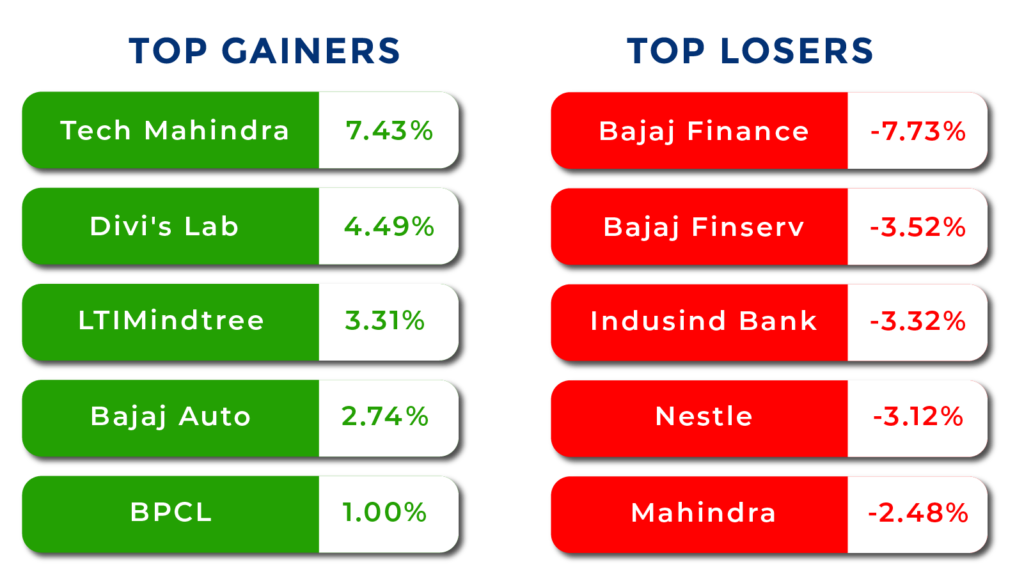

Top Gainers and Losers

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Do You Find This Interesting?