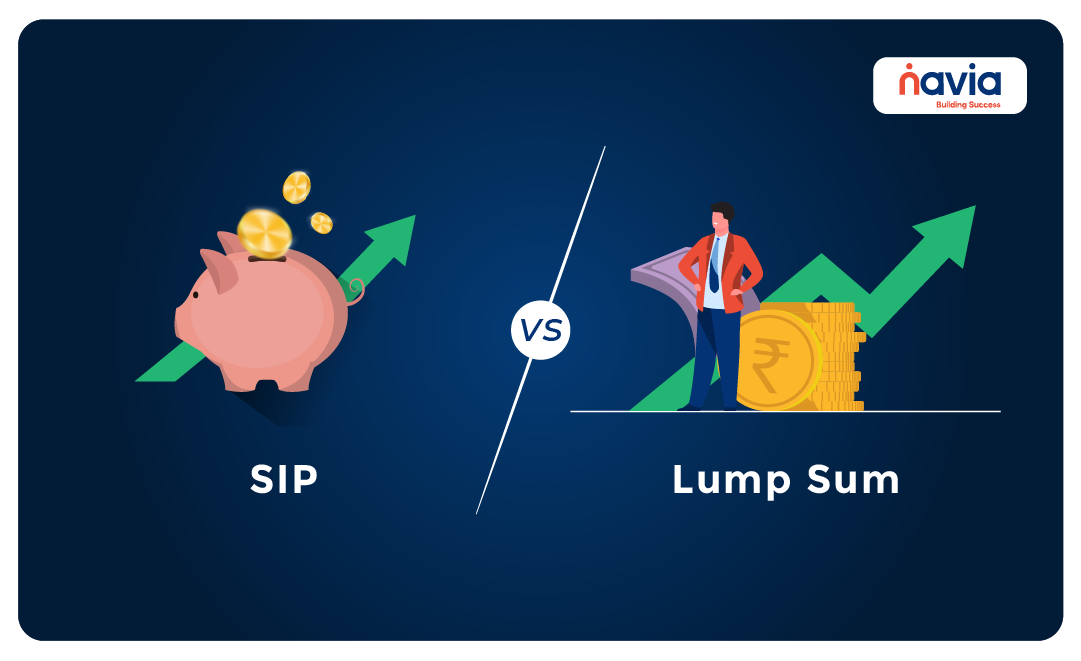

SIP vs Lump Sum: Choosing the Right Investment Strategy for You

Navigating the investment landscape with your hard-earned money can feel overwhelming, especially if you’re new to the world of finance. With numerous investment options available, it’s essential to understand the different strategies to make informed decisions. One of the most common dilemmas investors face is choosing between Systematic Investment Plans (SIPs) and Lump Sum investments. In this blog, we’ll break down these two investment strategies to help you decide which one suits you best.

Understanding SIP and Lump Sum Investments

SIP (Systematic Investment Plan)

SIP is a method of investing a fixed amount regularly in mutual funds. It allows investors to invest small amounts at regular intervals, typically monthly or quarterly. With SIP, investors can benefit from rupee cost averaging and the power of compounding over the long term.

Lump Sum Investments

Lump Sum investment, as the name suggests, involves investing a large sum of money at once. Instead of spreading investments over time, investors commit a significant amount upfront. Lump Sum investments offer the potential for higher returns, but they also come with increased risk, especially if timed poorly.

Factors to Consider When Choosing Between SIP & Lump Sum

Risk Tolerance

Your risk tolerance plays a crucial role in determining the suitable investment strategy. If you’re risk-averse and prefer a more conservative approach, SIPs might be the better option as they help mitigate the impact of market volatility over time. On the other hand, if you have a higher risk appetite and are comfortable with market fluctuations, Lump Sum investments could potentially offer greater returns.

Investment Horizon

Consider your investment horizon before deciding between SIP and Lump Sum. SIPs are ideal for long-term investors who aim to build wealth gradually over time. Since SIPs capitalize on the power of compounding, they tend to yield better results when invested for an extended period. Conversely, Lump Sum investments may be more suitable for short-term goals or when you have a lump sum of money available for investment.

Market Conditions

Market conditions can significantly influence the performance of your investments. During periods of market volatility, SIPs provide a disciplined approach, allowing you to buy more units when prices are low and fewer units when prices are high, thereby averaging out the cost of investment. Lump Sum investments, on the other hand, require careful timing and may be more susceptible to market fluctuations.

Investment Objectives

Your investment objectives should align with your chosen investment strategy. If your goal is wealth accumulation over the long term with a disciplined approach, SIPs offer a systematic way to achieve this objective. On the contrary, if you have a specific financial goal or a lump sum of money available for investment, Lump Sum investments may be more suitable, provided you have the risk appetite and time horizon to support it.

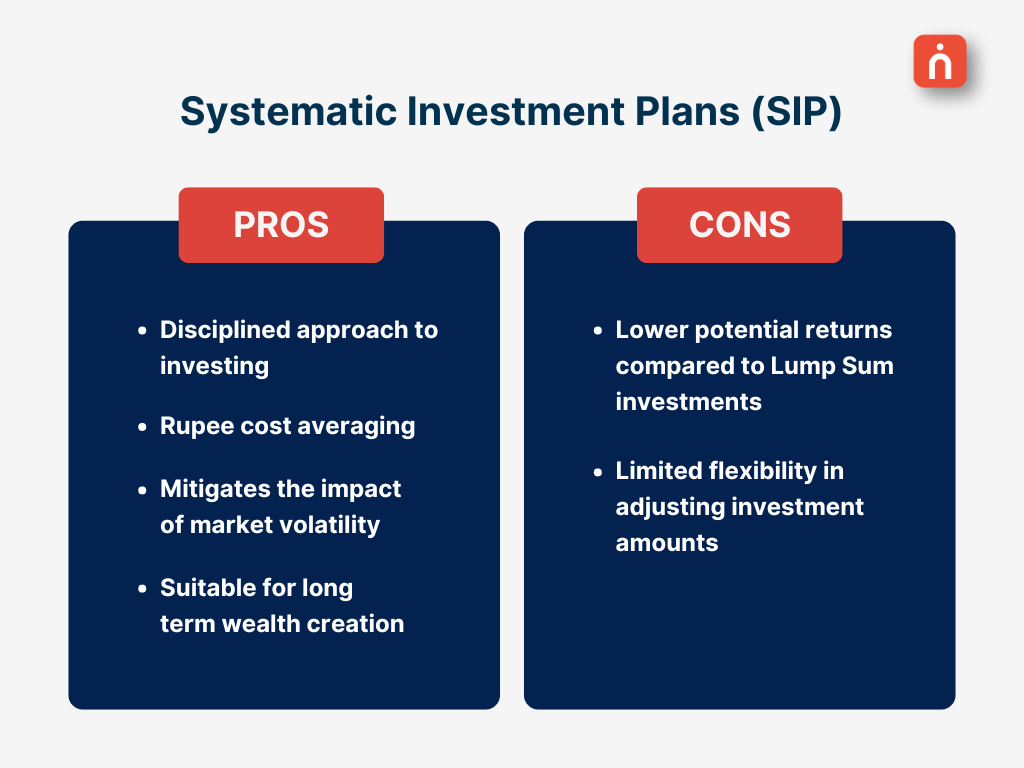

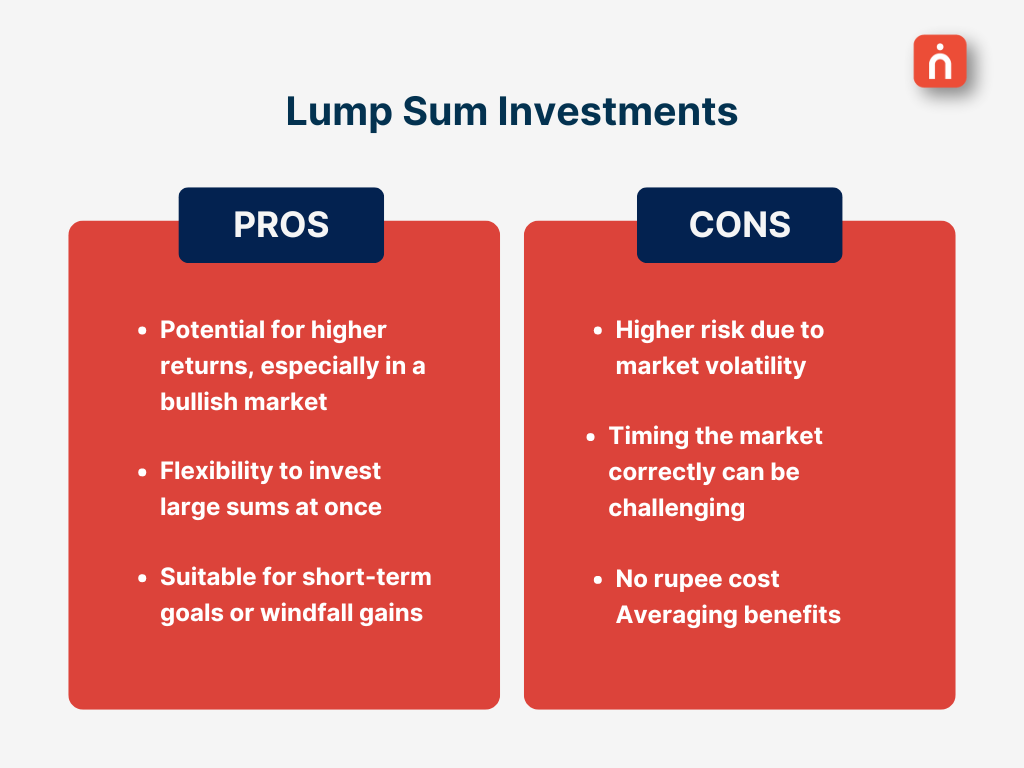

Pros and Cons of SIP and Lump Sum Investments

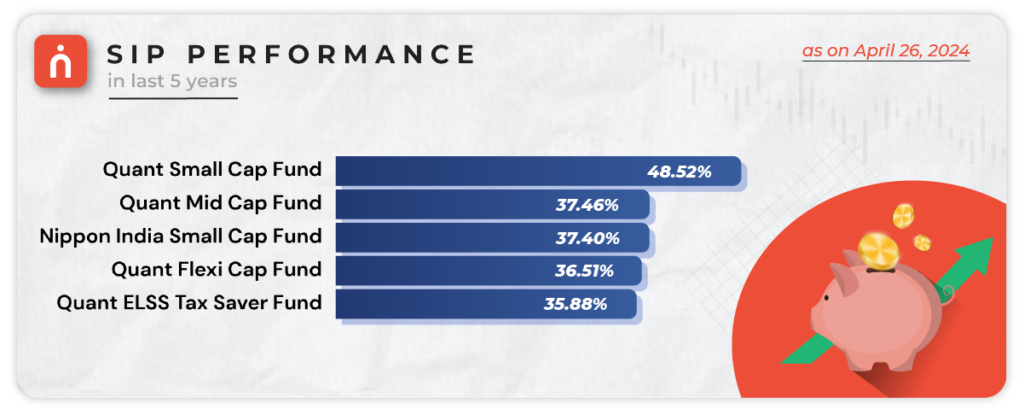

SIP Performance in Last 5 Years

Now, let’s turn our attention to the performance of SIP investments over the past five years across various mutual funds. Evaluating the historical returns of SIPs can provide valuable insights into their effectiveness in generating wealth over time. Here are the annualized returns of selected funds from the SIP perspective over the last five years:

These figures illustrate the potential returns that SIP investors have realized over the past five years across different mutual funds. It’s important to note that SIP performance can vary based on factors such as fund selection, investment horizon, and market conditions. Conducting thorough research and consulting with financial advisors can help investors make well-informed decisions regarding their SIP investments.

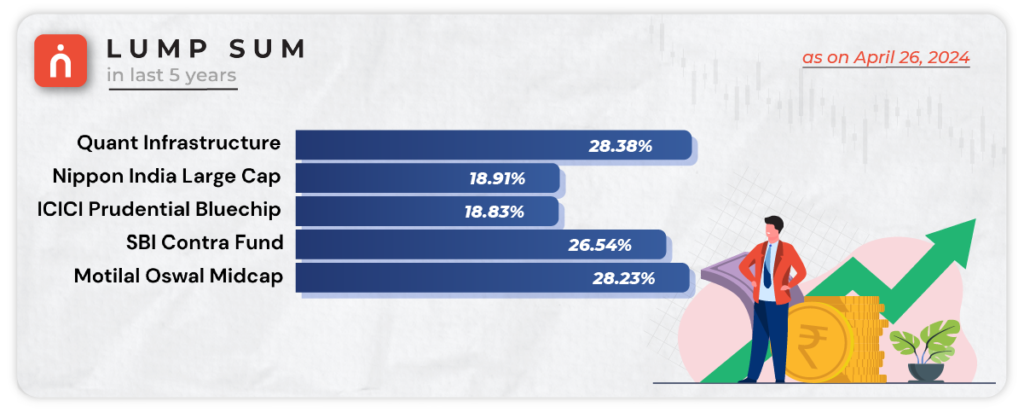

Lump Sum Performance in Last 5 Years

Similarly, evaluating the performance of Lump Sum investments over the past five years is crucial for assessing their viability as an investment strategy. Let’s delve into the performance of Lump Sum investments to understand their returns and how they compare to SIPs over the same period.

These figures highlight the varying performance of Lump Sum investments across different funds and market segments. It’s essential to analyze historical performance along with other factors such as fund strategy, market conditions, and risk profile before making investment decisions.

Who Should Consider SIP Investments?

SIPs offer a suitable investment avenue for various types of investors, including:

🔸 Long-Term Savers: SIPs serve as an excellent choice for investors aiming for retirement or other distant financial objectives.

🔸 Risk-Averse Individuals: For those preferring a cautious approach to investing, SIPs provide a steady and less volatile option.

🔸 Gradual Portfolio Builders: Investors seeking to incrementally build their investment portfolio over time can opt for SIPs to maintain consistency and discipline.

🔸 Compounding Enthusiasts: Those looking to capitalize on the power of compounding find SIPs particularly appealing due to their systematic investment approach.

Determining the Ideal SIP Investment Amount

In addition to understanding the benefits and considerations of SIP investments, determining the right SIP amount is crucial for achieving your financial goals. Here’s how you can calculate the ideal SIP investment amount:

➱ Assess Your Requirements: Evaluate your financial objectives and the amount you need to achieve them. Consider factors like future expenses, retirement planning, and other financial goals.

➱ Consider Investment Tenure: Determine the duration for which you plan to invest through SIP. Longer investment tenures typically yield higher returns due to the power of compounding.

➱ Utilize SIP Calculator: Once you have clarity on your requirements, use SIP calculator to estimate the amount you should invest. Input your desired SIP amount, investment duration, and expected annual rate of return to get a projection of your potential returns.

Who Should Consider Lump Sum Investments?

Lump sum investments cater to a distinct set of investors, including:

🔸 High Capital Investors: Individuals with a significant amount of capital at their disposal may find lump sum investing preferable, allowing for immediate deployment of funds.

🔸 Market Confidence Holders: Investors confident in their market analysis and choice of fund may opt for lump sum investments to take advantage of potential market opportunities.

🔸 Risk-Tolerant Individuals: Those comfortable with higher levels of market risk and volatility may opt for lump sum investments, which offer the potential for higher returns over time.

🔸 Patient Investors: Lump sum investments are well-suited for individuals willing to wait patiently for returns to materialize, especially in the case of longer-term investment horizons.

In conclusion, both SIP and Lump Sum investments have their merits and drawbacks. By understanding the nuances of each strategy and considering your individual financial goals and risk tolerance, you can choose the investment approach that best suits your needs. Remember, investing is a journey, and it’s essential to stay disciplined and focused on your long-term financial objectives. Happy investing!

Wrapping Up

Investing can seem overwhelming, but with the right knowledge and guidance, you can navigate the financial markets with confidence. Whether you opt for SIP or Lump Sum investments, the key is to stay informed, stay disciplined, and stay focused on your long-term financial goals. Happy investing!