Small-Cap vs Large-Cap Equity Mutual Funds Which is Right for You?

When it comes to investing in equity mutual funds, one of the pivotal decisions investors faces is whether to choose small-cap or large-cap funds. Each option presents unique advantages and risks, necessitating a thorough understanding of individual financial goals and risk tolerance. This guide delves into the characteristics of small-cap and large-cap equity mutual funds, offering insights to empower investors in making informed decisions.

Understanding Market Capitalization

Market capitalization measures a company’s value by evaluating the market’s perception of its worth for publicly traded firms, it’s calculated by multiplying the share price by the total number of outstanding shares. For instance, if ‘ABC’ Company has 20,000 outstanding shares priced at ₹20 each, its market capitalization would be ₹4,00,000.

Consequently, as market prices fluctuate, the market cap provides a current estimate of the company’s value.

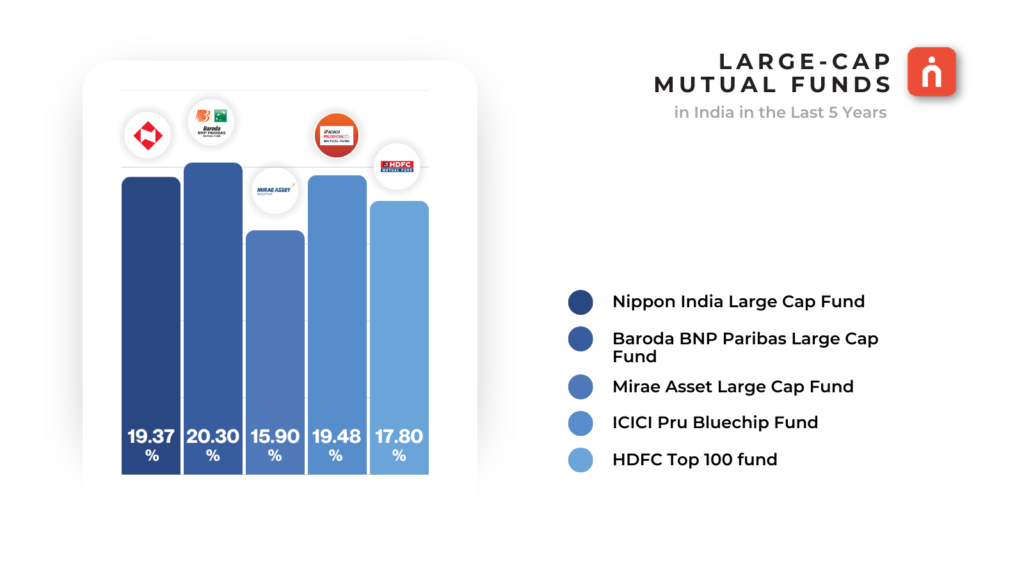

Large-Cap Equity Mutual Funds

Large-cap funds specialize in investing in stocks of well-established companies with large market capitalizations. When you invest in a large-cap equity mutual fund, your money is pooled with others and allocated to portfolios concentrated on the top 100 companies. These companies are industry giants with solid track records, providing stability and lower volatility compared to smaller companies. Investing in large-cap funds offers the potential for steady growth, consistent compounding, and regular dividends. They are particularly well-suited for long-term investment goals. Some examples of large-cap companies include TCS, Reliance, and Infosys.

Large-cap equity mutual funds offer a myriad of benefits, making them an attractive option for investors looking for stability and consistent returns. Here are some key points to consider:

🔸 Stability: Large-cap stocks are renowned for their stability and resilience in the face of market volatility, making them an ideal choice for investors prioritizing capital preservation and steady returns.

🔸 Income Generation: Additionally, many large-cap companies have a track record of paying dividends, providing investors with a reliable source of income alongside the potential for capital appreciation.

🔸 Risk Mitigation: Large-cap funds can play a crucial role as core holdings in a diversified portfolio, helping to mitigate overall portfolio risk during market downturns and enhancing long-term stability.

🔸 Suitable for Various Investors: With their moderate to low-risk profile, large-cap funds appeal to a broad range of investors, including those nearing retirement or seeking a balanced approach to investing.

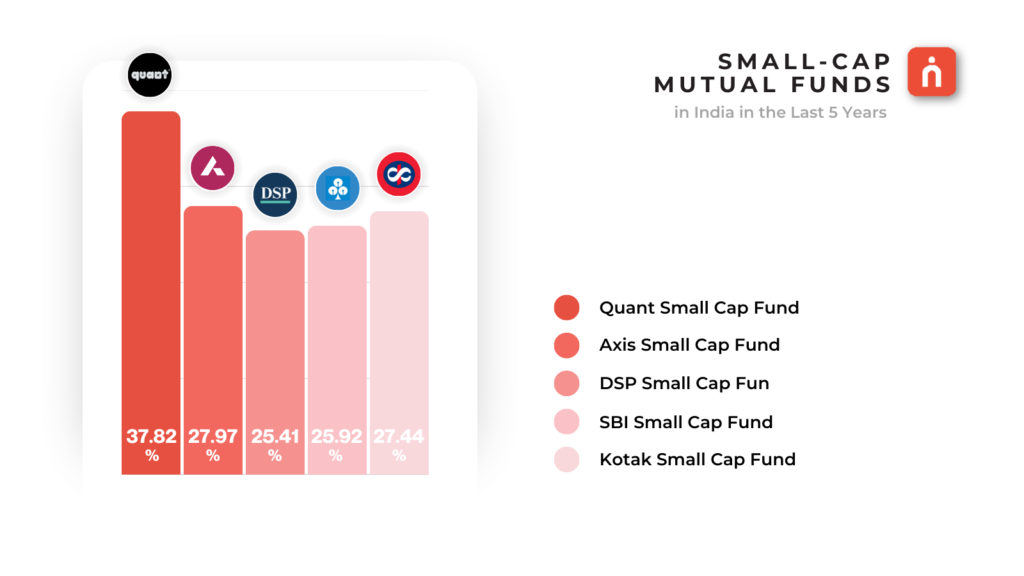

Small-Cap Equity Mutual Funds

Small-cap mutual funds primarily invest in smaller companies, typically ranking below the top 250 in market value. These companies are often new players in the market, which translates to higher volatility and increased risk. However, they also offer significant potential for growth. Investors who choose small-cap funds should be comfortable with risk and willing to invest for the long term. These funds are best for those seeking higher growth opportunities over time. Examples of companies that small-cap funds might invest in include Jindal Steel & Power, Canara Bank, and Mankind Pharma.

Here are some key insights to consider when evaluating small-cap stocks:

🔹 Growth Potential: Small-cap stocks have the potential for substantial growth, often emerging with innovative products or services.

🔹 Unpredictability: Due to their smaller size and early-stage nature, small-cap stocks tend to be more unpredictable and sensitive to market fluctuations.

🔹 Long-Term Investment Duration: Investors with a high-risk tolerance and a long-term investment horizon may find small-cap funds appealing as part of a diversified portfolio, aiming to capture potential long-term growth opportunities.

Large-Cap vs. Small-Cap Equity Funds: A Comparison

Choosing the Right Option

Both large-cap and small-cap funds possess distinct advantages and disadvantages that shape their characteristics and reactions to market changes. The best choice between these equity mutual funds depends on various factors, Here are some considerations to keep in mind:

Risk Tolerance

Investors willing to tolerate higher volatility and seeking higher growth potential may lean towards small-cap funds, while those prioritizing stability and capital preservation may prefer large-cap funds.

Investment Duration

Investors with a longer investment horizon can better weather the short-term volatility associated with small-cap funds and potentially benefit from their long-term growth prospects.

Portfolio Diversification

A balanced approach to investing may involve allocating investments across both small-cap and large-cap funds, as well as other asset classes, to achieve diversification and manage risk effectively.

Choosing between small-cap and large-cap equity mutual funds requires careful consideration of individual financial circumstances and investment objectives. While small-cap funds offer higher growth potential but come with higher volatility, large-cap funds provide stability and income generation. Ultimately, investors should align their investment choices with their risk tolerance, investment horizon, and overall portfolio diversification strategy. Consulting with a financial advisor can help investors navigate the decision-making process and build a well-rounded investment portfolio tailored to their needs.