Maximizing Your Wealth: Practical Tips for Gen-Z Investors

Generation Z is not just the future; they are the present, especially when it comes to shaping the landscape of investments. With a keen eye for financial independence and a thirst for innovation, Gen-Z investors are revolutionizing the way wealth is accumulated and managed. Here are some straightforward strategies tailored to help Gen-Z investors turbocharge their wealth planning and navigate the intricate world of investing.

Embrace Digital Learning

Gen-Z is the first generation to grow up in a world dominated by smartphones and social media. Platforms like YouTube have become go-to sources not just for entertainment but for invaluable learning opportunities. Dive into online resources to enhance your financial literacy and gain insights that will empower you to make informed investment decisions.

Explore New Investment Horizons

Beyond the conventional options of stocks and bonds, Gen-Z investors are increasingly venturing into alternative avenues such as cryptocurrencies and real estate trusts. Diversifying your investment portfolio across various asset classes can help spread risk and potentially boost returns. Be open to exploring new investment options to stay ahead in today’s ever-evolving financial landscape.

Insight:

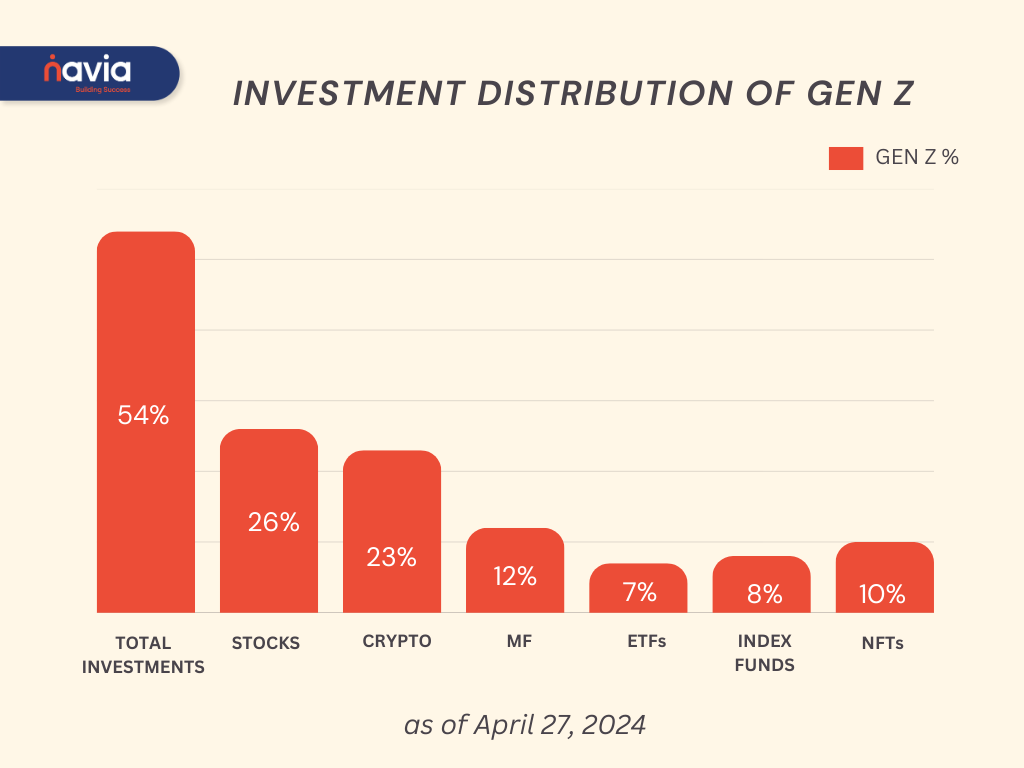

A study reveals that about a quarter of Gen-Z investors hold both cryptocurrencies and stocks, with one in 10 also owning NFTs. Interestingly, men are nearly twice as likely as women to own cryptocurrencies and NFTs. Despite their active involvement, Gen-Z ranks cryptocurrency lowest in terms of financial knowledge. This highlights the importance of bridging the gap between interest and understanding in emerging financial technologies.

Leverage Technological Advancements

Digital platforms have democratized investing, making it more accessible and transparent. Take advantage of online tools such as Navia App’s pre-assembled stock baskets, starting from just Rs.300. These baskets simplify diversification and allow you to manage your portfolio effortlessly. By utilizing such innovative platforms, Gen-Z investors can streamline their investment process or even consider investing in Unit Linked Insurance Plans (ULIPs) for a seamless blend of investment and insurance. Technology has made investing easier than ever before, so embrace it to your advantage. To know how to start investing in ETF Baskets and other cool tools check out our easy-to-follow guide. Read more

Additionally, Navia App offers zero brokerage fees, making it an even more attractive option for Gen-Z investors looking to minimize costs and maximize returns. With zero brokerage fees, you can invest without worrying about excessive charges eating into your profits, allowing you to make the most of your investment opportunities. Whether you’re a seasoned investor or just starting out, Navia’s user-friendly interface and cost-effective investment options make it an ideal choice for Gen Z investors seeking to build their wealth efficiently.

Opening a demat account with Navia offers numerous benefits, including seamless integration with the Navia App’s investment features, zero brokerage fees, and access to a wide range of investment options. Whether you’re interested in stocks, mutual funds, or other financial instruments, Navia provides the tools and resources you need to start investing with confidence. Explore more

Ready to turbocharge your investment journey? Download the Navia App now, open your demat account in just 10 minutes, and start investing with confidence. Don’t miss out on the exciting vouchers and offers awaiting you! Seize the opportunity to take control of your financial future today.

Set Clear Financial Goals

Having clear, achievable financial goals is essential for any investor, and Gen-Z is no exception. Whether it’s saving for a big purchase, funding education expenses, or planning for retirement, defining your objectives will keep you focused and motivated on your investment journey. Take the time to map out your financial goals and develop a plan to achieve them.

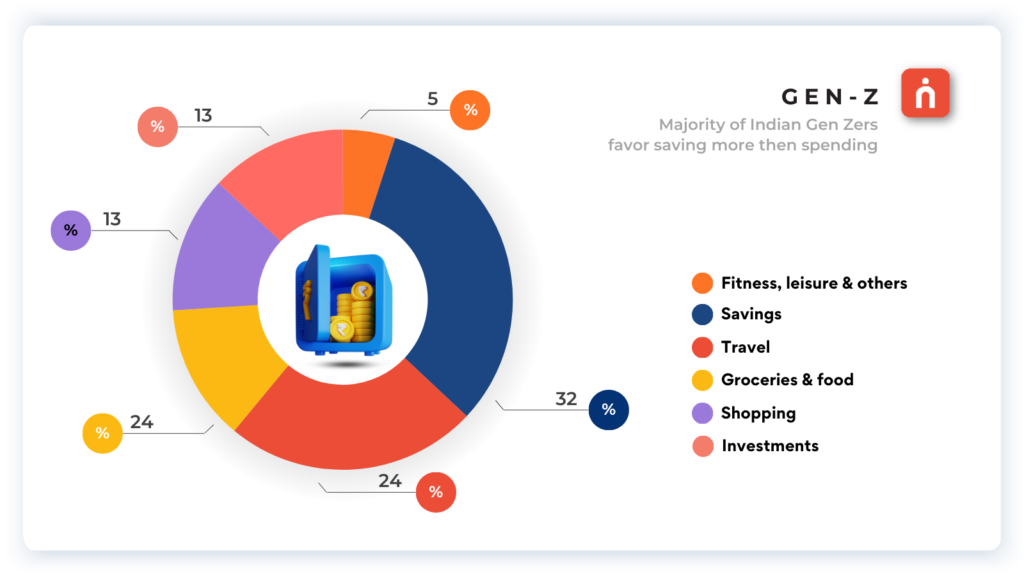

Now, let’s take a look at how Gen-Z allocates their expenses. Understanding where your money goes is key to effective financial planning. Below is a pie chart illustrating the typical allocation of expenses among Gen Z individuals:

As you can see, the largest portion of their expenses goes towards savings, comprising 32% of their budget. This reflects a commitment to building financial security and preparing for future goals. Travel and leisure activities also make up significant portions, highlighting the importance of balancing financial responsibility with enjoying life experiences. By gaining insight into your spending habits, you can better align your financial goals with your lifestyle aspirations.

Stick to Investment Fundamentals

In a world dominated by market trends and fads, it’s crucial to stay grounded in investment fundamentals. Avoid the temptation to chase after the latest hype and instead focus on factors like a company’s financial health and growth prospects. Adopting a disciplined and goal-oriented approach will serve you well in the long run.

Seek Professional Guidance

While self-education is invaluable, there may be times when seeking professional advice is necessary. Don’t hesitate to consult with financial advisors who can offer personalized guidance tailored to your specific goals and circumstances. Their expertise can provide valuable insights and help you navigate the complexities of the financial markets with confidence.

By embracing these practical strategies and staying disciplined in their approach, Gen-Z investors can set themselves up for financial success and pave the way for a brighter future. With a proactive mindset and a commitment to lifelong learning, the possibilities for wealth creation are limitless. It’s time for Gen-Z to seize the reins of their financial future and embark on a journey toward lasting prosperity.