Navia Weekly Roundup (Apr 29 – May 03, 2024)

Week in the Review

India’s benchmark equity indices plunged to their lowest in three weeks due to speculation about changes in capital gains taxes on equities and election uncertainties. Investors turned cautious and bearish amidst concerns about tax alterations and broader political uncertainty, leading to increased market volatility and a risk-averse stance among investors.

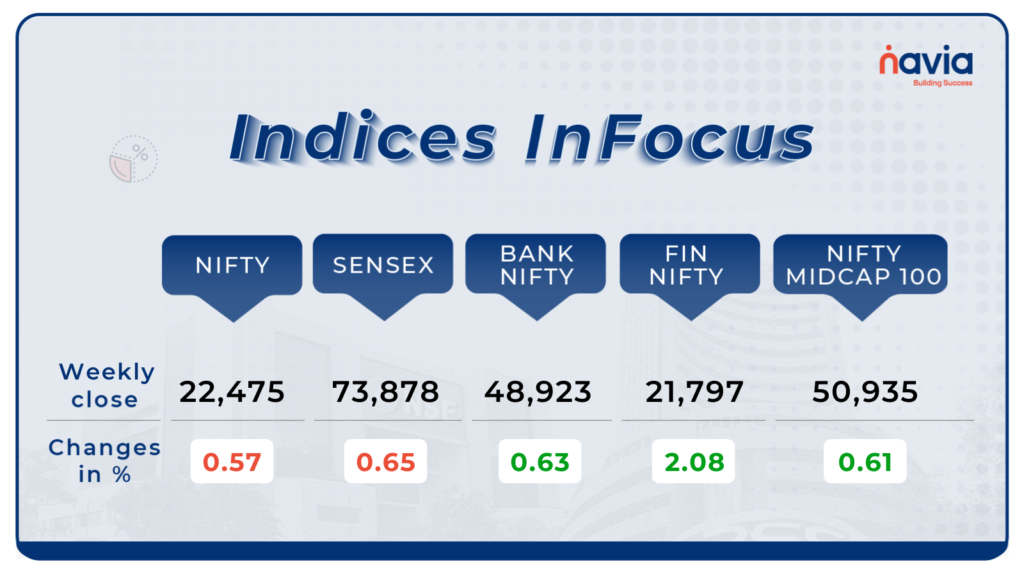

Indices Analysis

Nifty50 opened higher on Friday, clocking a record intraday high of 22,794.7 points, until it ended the day’s trading in the red.

Technically, the Nifty 50 smartly defended 22,300 level, hence as long as the index holds this level on closing basis, the upward move towards 22,700-22,800 levels after ongoing consolidation can’t be ruled out in the coming sessions, but breaking of 22,300 can drag it down towards 22,000 mark

Interactive Zone!

Last week’s poll:

Q) When was the National Stock Exchange Fifty (NIFTY) founded?

a) 1982

b) 1988

c) 1996

d) 1992

Last week’s poll Answer: c) 1996

Poll for the week: What is a defensive stock?

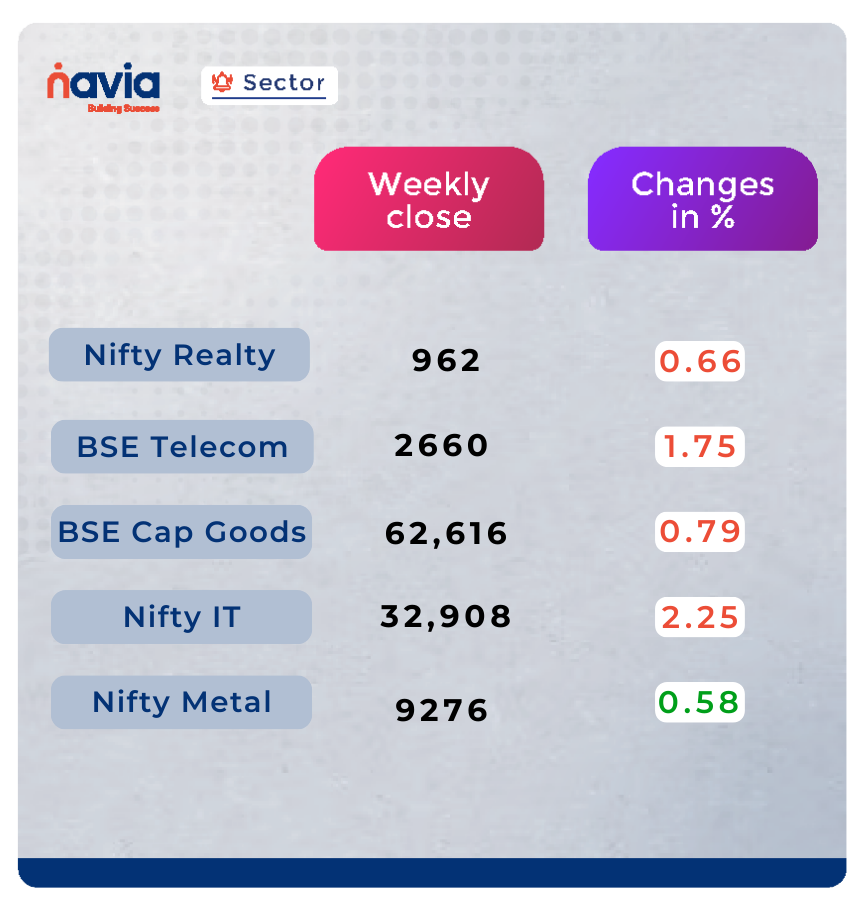

Sector Spotlight

Among sectors, except metal, all other sectoral indices ended in the red with capital goods down 0.79%, realty down 0.66%, and telecom down 1.75%, while Information Technology dropped 2.25%.

Explore Our Features!

PRICE ALERTS 🚨: Stay informed about your stocks effortlessly! Learn how to set personalized price alerts on the Navia App with our quick tutorial. Never miss a beat in the market again! 📈

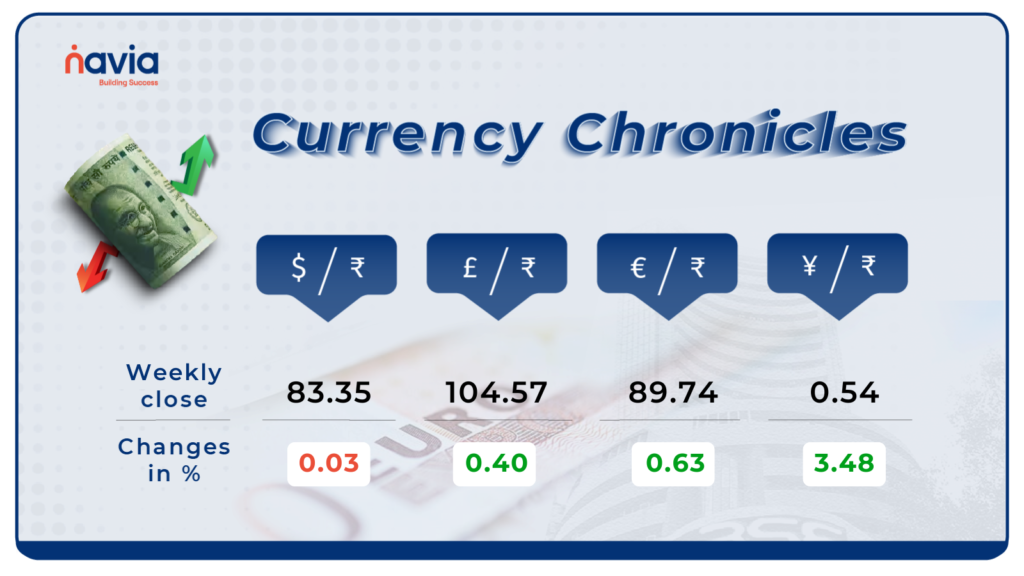

Currency Chronicles

USD/INR:

The rupee ended weaker despite an uptick in its Asian peers, as dollar demand from foreign banks weighed on the local currency. India’s Manufacturing PMI was revised lower to 58.8 in April 2024 from preliminary estimates and March’s final 59.1. Additionally, India’s central bank’s FX intervention eased as conditions turned favorable for the rupee. The rupee closed at 83.35 against the INR, representing a decrease of 0.03%.

EUR/INR:

Euro steadied as investors digested the US Federal Reserve’s latest policy decision, where the central bank opted to maintain interest rates and struck a somewhat dovish tone. Meanwhile, the industry confidence indicator in the Euro Area plummeted to -10.5 in April 2024 from a downwardly revised -8.9 in the previous month. The euro closed at 89.74 against the INR, marking an increase of 0.63%.

JPY/INR:

The Japanese yen remained in range amid another suspected intervention by Japanese authorities, marking the second occurrence this week. Japan’s government declined to confirm whether it was behind the short-lived rallies in the yen observed recently. Additionally, Japan’s Kanda stated that they would disclose results at the end of next month and would take appropriate action in the FX market as needed. The yen closed at 0.54 against the INR, reflecting an increase of 3.48%.

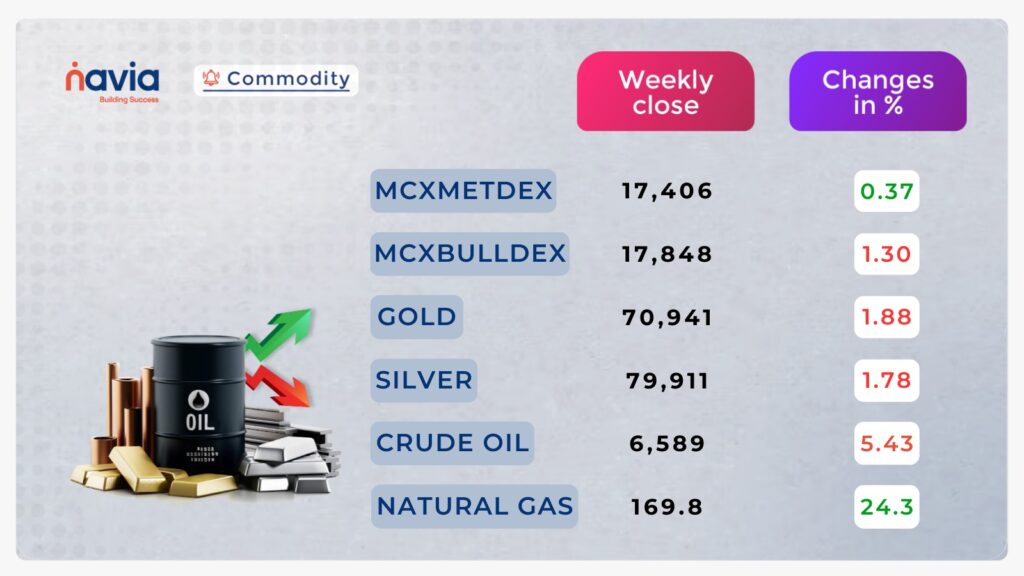

Commodity Corner

Over the past four trading sessions, crude oil has shown a strong downtrend due to a buildup in U.S. crude inventories, softening demand, and progress in Israel-Hamas ceasefire talks, all of which have weighed on oil prices. crude oil closed at a 5.43% negative. Current R1 is placed at 6748, and S1 is placed at 6462 levels.

Easing geopolitical risks in the Middle East is also reducing attraction for haven assets like gold and silver, so currently, gold is showing consolidation. Gold closed at 1.88% negative. Current R1 is placed at 71695, and S1 is placed at 69838.

Blogs of the Week!

Small-Cap vs Large-Cap Equity Mutual Funds Which is Right for You?

Small-Cap vs Large-Cap Mutual Funds: Find Your Best Fit! 📈 Discover the differences and make smarter investment choices with our latest blog.

The Chess Master’s Investment: Strategy Beyond the Board

Unlock the secrets of strategic investing with insights from Arjun, the Chess Master. Discover how the principles of chess translate into successful trading and investing strategies.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

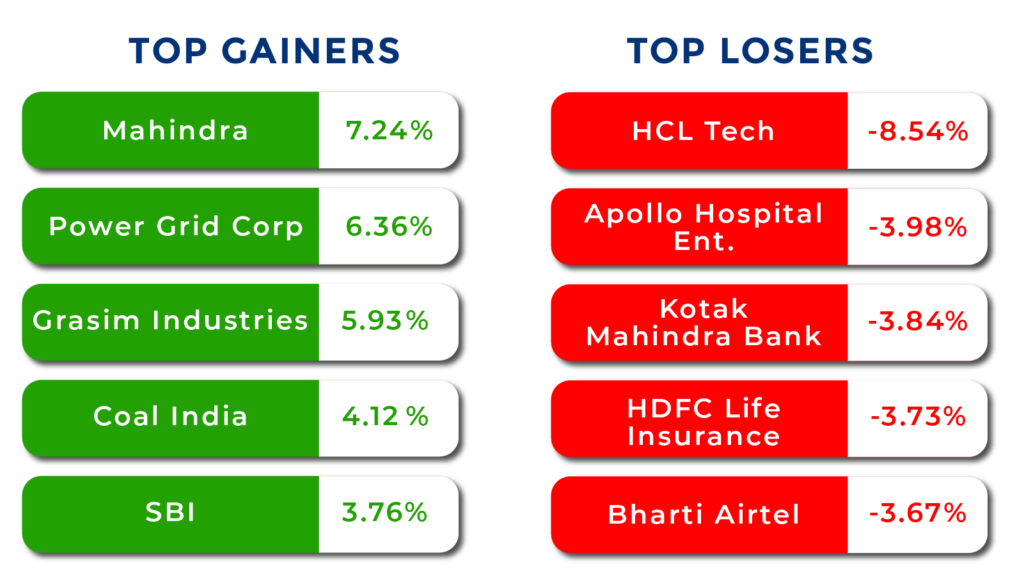

Top Gainers and Losers

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Do You Find This Interesting?