Unlocking Opportunities: NSE’s Exciting Venture into Nifty Next 50 Index Derivatives

Introduction

Get ready for an investment revolution as the National Stock Exchange of India (NSE) gears up to launch derivatives based on its popular Nifty Next 50 index, starting April 24, 2024. This move, backed by regulatory approval from the Securities and Exchange Board of India (SEBI), promises to transform the way traders and investors navigate the market.

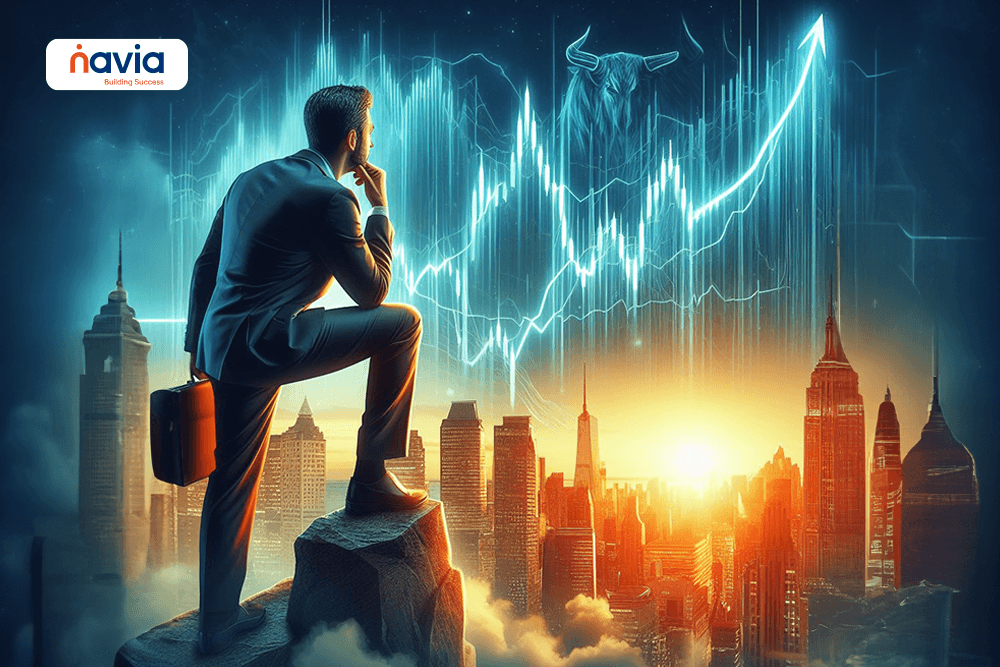

NSE’s Derivatives Dominance 🏆

NSE holds the prestigious title of being the world’s No. 1 derivatives exchange in 2023 based on contracts traded. Now, it’s all set to extend its winning streak with this exciting new offering.

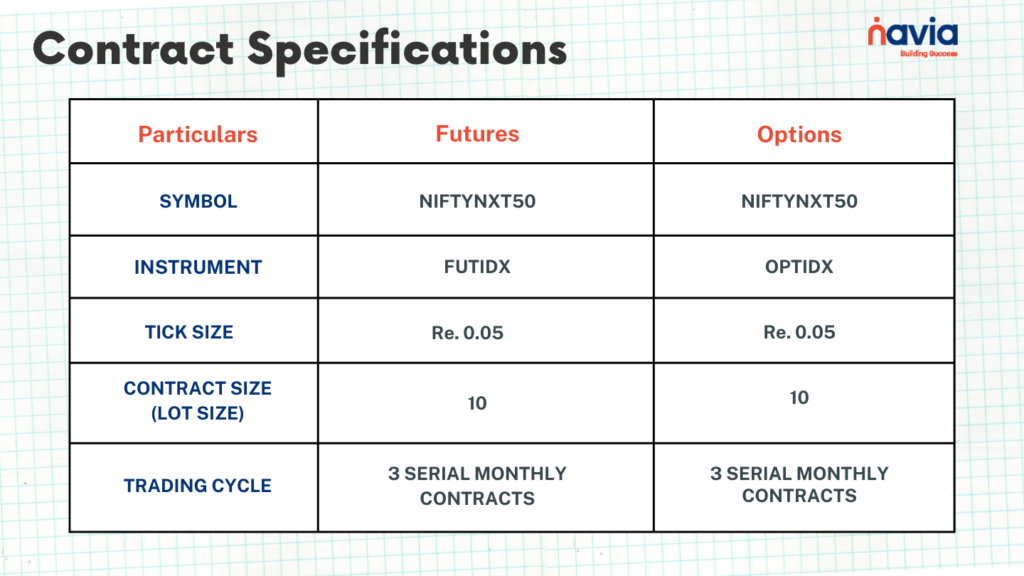

Exciting Offerings: Index Futures and Options 💡

Investors, get ready for a trio of opportunities with NSE’s derivatives launch! The exchange intends to introduce three consecutive monthly cycles of index futures and index options contracts. These contracts are designed to offer flexibility and risk management capabilities, catering to a wide range of investment strategies.

Market Capitalization and Turnover Insights 💰

The Nifty Next 50 index carries significant weight in the Indian market, boasting a market capitalization of Rs 70 trillion. This represents a substantial 18 percent of the total market capitalization of stocks listed on NSE as of March 29, 2024. Moreover, the index constituents contribute significantly to the cash market turnover, accounting for around 12 percent in FY24, showcasing their liquidity and investor interest.

Strategic Positioning of Nifty Next 50 🎯

Sriram Krishnan, Chief Business Development Officer at NSE, describes the Nifty Next 50 index as a bridge between the top large and liquid stocks in the Nifty 50 index and the top large and liquid mid-capitalized stocks in the Nifty Midcap Select index. This strategic positioning adds depth to the derivatives product suite, offering investors a diversified basket of investment opportunities.

Historical Significance and Future Prospects 📜

The Nifty Next 50 index boasts a storied past, having debuted on January 1, 1997, with a starting date and value set at November 3, 1996, and 1000, respectively. As of March 29, 2024, its market capitalization continues to soar, reflecting investor confidence and market performance.

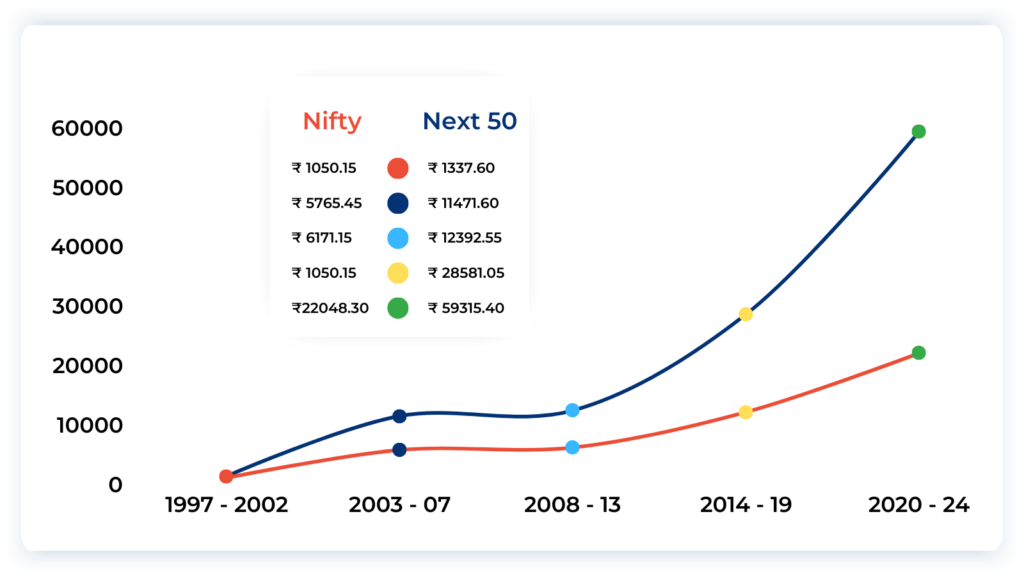

NIFTY 50 & NIFTY NEXT 50 : Values from the Year 1997 – 2024

Lastly, As NSE prepares to unveil derivatives linked to the Nifty Next 50 index, investors can anticipate a new chapter in their investment journey. With enhanced avenues for risk management, portfolio diversification, and strategic trading, these derivatives signify innovation and progress in India’s financial landscape. Stay tuned for the April launch and explore the possibilities that lie ahead in this dynamic market segment.