Navia Weekly Roundup (Apr 15- Apr 19, 2024)

Week in the Review

During another shortened week, the market ended a four-week streak of gains, remaining under pressure due to geopolitical tensions that drove crude prices above USD 90. However, a smart recovery on the final day of the week helped Nifty close above 22,100.

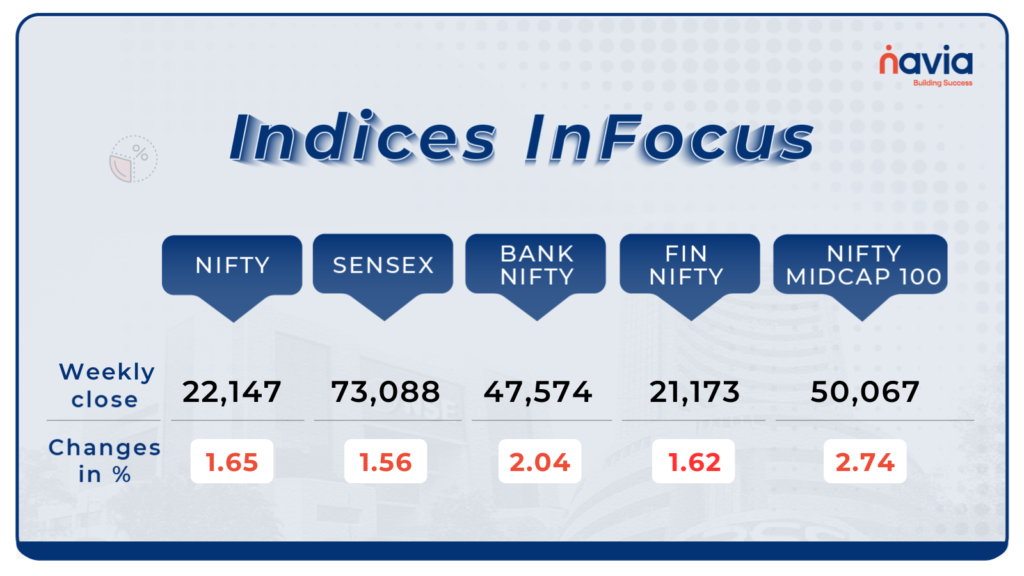

Indices Analysis

This week, the Nifty50 index shed 1.65 percent to end at 22,147, while the BSE Sensex fell 1.56 percent to close at 73,088.

Interactive Zone!

Last week’s poll:

Q) The shares we buy are stored in:

a) Trading Account

b) DEMAT Account

c) Bank Account

d) None of the Above

Last week’s poll answer: b) DEMAT Account

Poll for the week: While expecting price to go up, what position needs to be created?

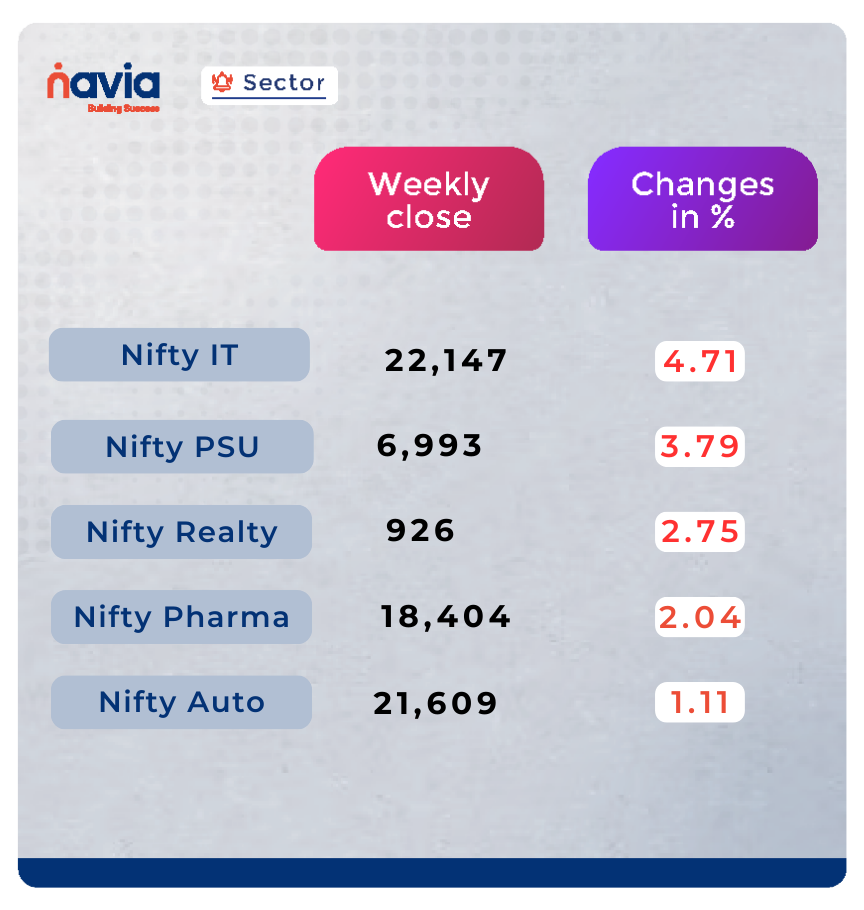

Sector Spotlight

All the sectoral indices ended in the red. Nifty Information Technology index shed 4.7 percent, Nifty PSU Bank fell 3.79 percent, Nifty Realty Index shed 2.75 percent, and Nifty Pharma index shed 2.04 percent.

Explore Our Features!

Strategy Builder & Payoff Charts: 📈 Craft and visualize your trading strategies effortlessly with Navia’s Strategy Builder & Payoff Charts. Watch our quick tutorial on how to seamlessly view and analyze charts on the Navia App.

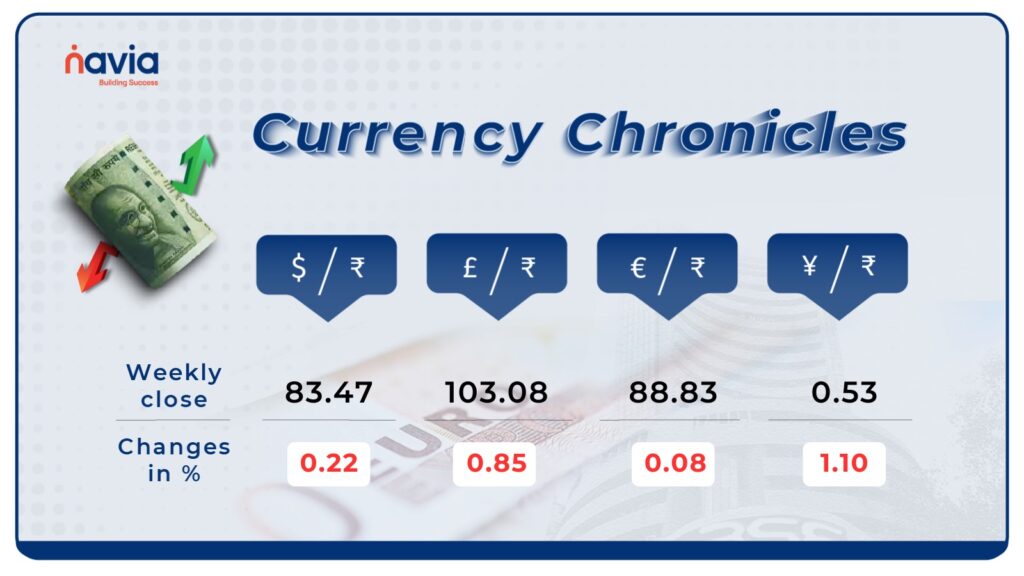

Currency Chronicles

USD/INR:

The Indian rupee faced significant pressure during the week, touching a record low before closing marginally lower at 83.47 on April 19 compared to its April 12 closing of 83.42. This volatility underscores the challenges and uncertainties in the global economic landscape affecting the Indian currency.

EUR/INR:

Despite fluctuations, the EUR to INR exchange rate saw a modest increase of 0.08% for the week. Bullish sentiment prevails in the EUR/INR market, reflecting optimism among traders and investors. As of the latest analysis, the EUR to INR rate is projected to reach ₹ 88.83 by the end of the week.

JPY/INR:

Conversely, the JPY to INR exchange rate experienced a notable decrease of -1.10% for the week. Despite this decline, bullish sentiment persists in the JPY/INR market, indicating confidence among market participants. As of now, the JPY to INR rate has reached ₹ 0.536556 by the end of the week.

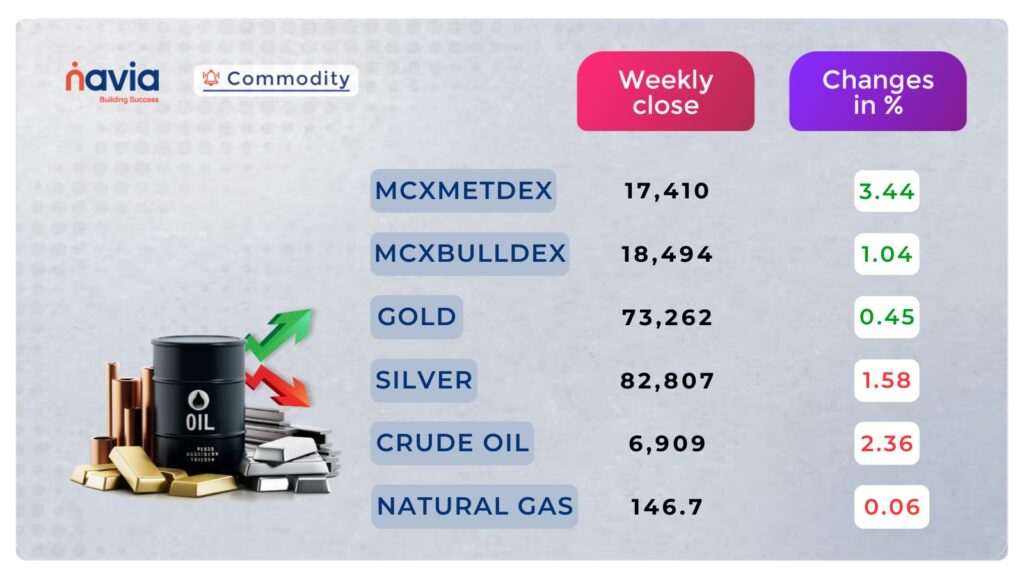

Commodity Corner

Uncertainty and tension in the Middle East are giving positive momentum to crude oil price movement. In the previous week, crude oil closed 2.36% negative, forming a doji candle, indicating indecision in the movement. Current R1 is placed at 7047 and S1 is placed at 6799.

Gold traded in a narrow range and closed 0.45% positive. Geopolitical issues contributed to an uptrend rally in price movement. Current R1 is placed at 73926 and S1 is placed at 71595 levels.

IPO CORNER

JNK India IPO

Next week, the JNK India IPO returns to the mainboard after a brief hiatus. From April 23 to 25, investors can participate, with allocation to anchor investors on April 22. With a fresh issue of ₹300 crore and an offer-for-sale, it’s an opportunity not to miss. Finalizing on April 26, refunds on April 29, and shares credited on the same day, the IPO culminates with the listing on BSE and NSE on April 30

Emmforce Autotech IPO

Emmforce Autotech is revving its engines for an IPO launch on April 23, aiming to raise ₹53.90 crores. Specializing in manufacturing niche automotive drive train parts like Differential Housings and 4WD Locking Hubs, they cater primarily to 4-wheel drive and performance racing vehicles. Despite a slight revenue dip from ₹71.38 crores in 2022 to ₹48.75 crores in 2023, Emmforce Autotech remains poised for growth. Investors can grab a piece of the action with an IPO price band set at ₹93 to ₹98 per equity share.

Blogs of the Week!

Dive into the future of Indian investment with NSE’s groundbreaking move into Nifty Next 50 Index Derivatives! Explore the potential of these innovative offerings through our latest blog.

Join Eshan and Navia Markets on a journey through financial market insights. Read our latest blog for expert navigation tips.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

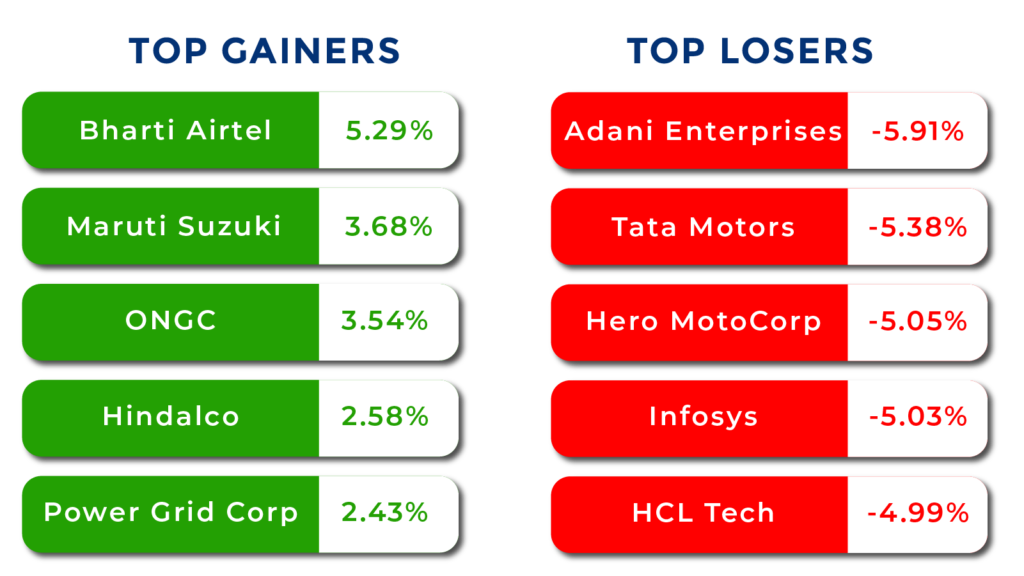

Top Gainers and Losers

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Do You Find This Interesting?