Understanding Stock Market During National Elections: A Historical Perspective

As national elections draw near, the air is thick with anticipation—not just in the political arena but also among the corridors of global financial markets. The prospect of policy changes, shifts in governance, and the potential for sweeping economic reforms significantly impacts investor sentiment, leading to periods of market volatility and uncertainty. This blog post takes a closer look at how stock markets have historically behaved during national election periods in various countries, including a detailed perspective on India. By presenting historical data, we aim to offer a factual basis for our readers to explore and derive their own insights without drawing explicit conclusions.

The United States: Presidential Election Cycles and Market Sentiments

In the United States, the Presidential Election Cycle Theory has piqued the interest of investors, suggesting a pattern where markets perform better in the latter half of a president’s term. Despite the intriguing premise, this pattern doesn’t hold consistently across all cycles, demonstrating the complexity of correlating political events with stock market performance directly.

The European Context: Elections and Market Reactions

Europe’s major economies—Germany, France, and the United Kingdom—exhibit heightened market sensitivity during national elections. The outcomes can influence not only domestic markets but also have broader implications across the Eurozone, with pro-EU parties generally fostering market stability through continued integration efforts.

Emerging Markets: Political Transitions and Economic Policies

Emerging markets, with their dynamic economies, present a varied picture. Elections leading to a government committed to reform and market-friendly policies can elicit positive market reactions, while uncertainty often results in volatility. The immediate effect of elections on market sentiment and performance in countries like India, Brazil, and South Africa underscores the significant impact of political transitions on economic policy direction.

The Indian Angle: Elections and Economic Optimism

In the Indian context, national elections wield significant influence over economic sentiment, particularly within the realm of stock market dynamics. The outcomes of these elections often shape investor perceptions and confidence, leading to notable fluctuations in market behavior.

A prime example of this phenomenon can be observed in the aftermath of the 2014 and 2019 general elections. The resounding victories of the Bharatiya Janata Party (BJP) in both instances spurred a wave of economic optimism among investors. The anticipation of a stable government, coupled with expectations of pro-business policies and economic reforms, fueled a remarkable surge in the stock market.

Similarly, the lead-up to the 2019 Lok Sabha elections was characterized by heightened market volatility as investors weighed the potential outcomes. However, once a decisive mandate emerged in favor of the ruling party, the market responded with renewed optimism. The continuity in economic policies and reform initiatives underpinned by the election results contributed to significant gains in market indices post-election.

Conversely, unexpected or inconclusive election results can trigger market volatility and uncertainty. Instances such as the 2004 Lok Sabha elections highlight the impact of political uncertainty on investor sentiment, leading to market downturns as stakeholders navigate the implications for future economic policies.

In essence, India’s electoral landscape serves as a crucial determinant of economic sentiment, exerting a profound influence on stock market dynamics. The clarity and direction provided by electoral outcomes play a pivotal role in shaping investor confidence and market trends, highlighting the intricate interplay between politics and economics in India’s financial ecosystem.

What should investors do!

Initial Uncertainty:

Elections can make the stock market uncertain at first. But as the election date gets closer, things usually settle down because people understand better what’s going on.

Pre-Election Opportunities:

Investing before elections lets investors benefit from any positive changes in market mood and possible gains after the results are known.

Post-Election Caution:

If the stock market drops after the election, it’s important for investors to focus on their long-term goals instead of reacting quickly. Panic selling might mean losing money and missing chances for the market to recover.

Policy Effects:

Elections often bring new rules that can affect different parts of the economy. Investing before elections helps investors be ready for good opportunities that might come from these new rules.

Currency Impact:

Election results can also affect how much the Indian rupee is worth compared to other money. If the outcome is good, more money might come in from other countries, making the currency stronger and helping foreign investors who put money into Indian stocks.

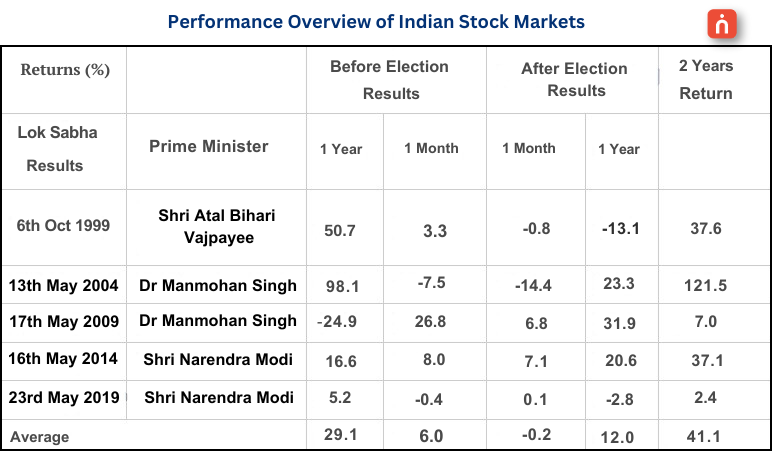

Historical Patterns and Market Response

Significant electoral events, such as the 2014 victory of the BJP, led to bullish market sentiment, reflecting optimism for pro-business policies and economic reforms. Conversely, unexpected outcomes or political uncertainty, like the 2004 elections, have led to market volatility, as investors navigated the implications for future economic policies.

Economic Reforms and Investor Sentiment

India’s experience further illustrates the importance of economic reforms and policy clarity in shaping market sentiment. Elections that pave the way for reform-oriented governments can stimulate investor optimism and confidence, contributing to bullish market trends.

Conclusion

The interplay between national elections and stock market performance is multifaceted, influenced by various factors including anticipated economic policies, political stability, and global economic conditions. While historical patterns offer insights into past market reactions, they serve more as a reflection of the complex dynamics at play rather than predictive tools. For investors and market participants, understanding these nuances can enrich their strategic approach to navigating market volatility during election periods.