Navia Weekly Roundup (Apr 08- Apr 12, 2024)

Week in the Review

The Indian market extended its record-breaking streak during the shortened week ending April 12. However, it struggled to maintain these gains due to the strengthening US dollar, elevated crude oil prices, and the release of high US inflation data. These factors dampened hopes of a US Federal Reserve rate cut in the early stages of FY25.

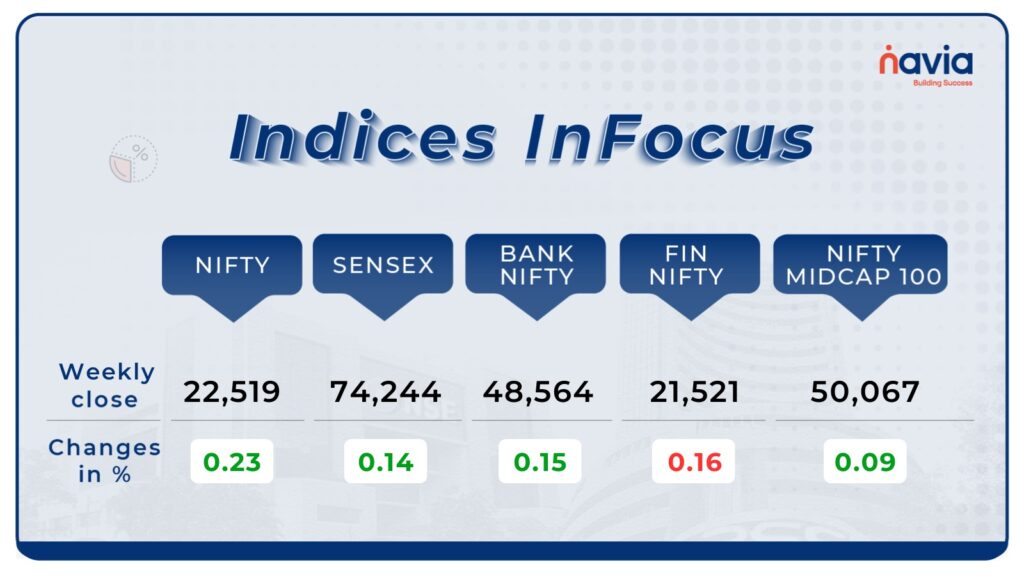

Indices Analysis

During the current week, the Nifty50 index reached a new peak of 22,775.7 on April 10 but ultimately closed unchanged at 22,519.40. Similarly, the BSE Sensex achieved a record high of 75,124.28 on April 9 but settled at 74,244.90 without any significant change.

Interactive Zone!

Last week’s poll:

Q) Blue chips stocks are the…

a) Stocks which are undervalued and trading below their intrinsic value.

b) Stocks of nationally recognized, well established and financially sound companies.

Last week’s poll answer: Stocks of nationally recognized, well established and financially sound companies.

Poll for the week: Q) The shares we buy are stored in:

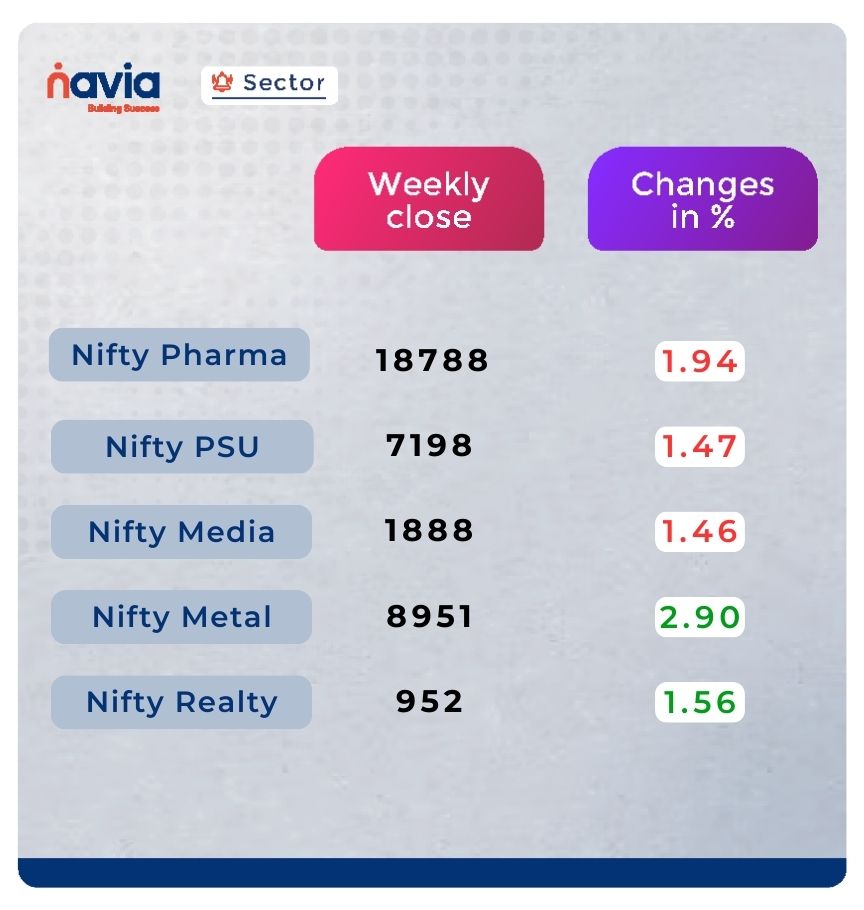

Sector Spotlight

Among sectors, the Nifty Pharma index experienced a 1.94 percent decline. The Nifty PSU Bank index shed 1.47 percent, while the Media index also dropped by 1.46 percent. Meanwhile, the Nifty Metal index surged by 2.90 percent, and the Nifty Realty index added 1.56 percent.

Explore Our Features!

Curated Watchlist: Ready to take charge of your stock portfolio? Master your investment game with Navia’s curated watchlist, ensuring effortless monitoring. Watch our quick tutorial on how to effortlessly add stocks to your Navia App watchlist

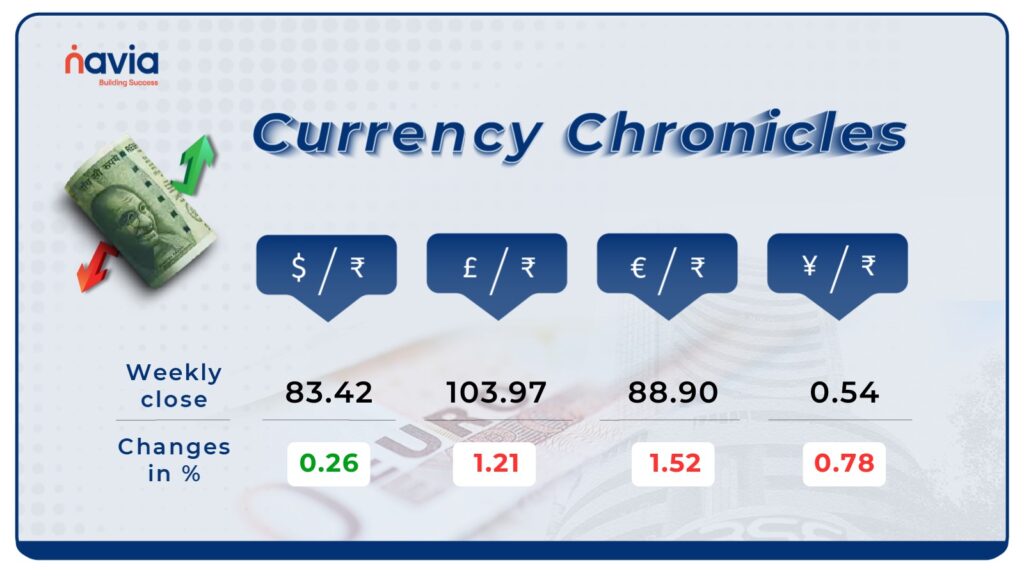

Currency Chronicles

USD/INR:

The Indian rupee reversed its gains from the previous week and closed lower compared to the US dollar. It declined by 14 paise, finishing at 83.42 on April 12, in contrast to its closing value of 83.28 on April 5.

EUR/INR:

The EUR to INR exchange rate witnessed a significant decrease of -1.52% throughout the week. Despite this decline, the sentiment in the EUR/INR market remains bullish, indicating positive expectations among traders and investors. As of the latest analysis, the EUR to INR rate Reached ₹ 88.9 by the end of the week.

JPY/INR:

Similarly, the JPY to INR exchange rate experienced a decline of -0.78% for the week. Despite this decrease, bullish sentiment persists in the JPY/INR market, suggesting confidence among market participants. At present, the JPY to INR rate reached ₹ 0.546139 by the end of the week.

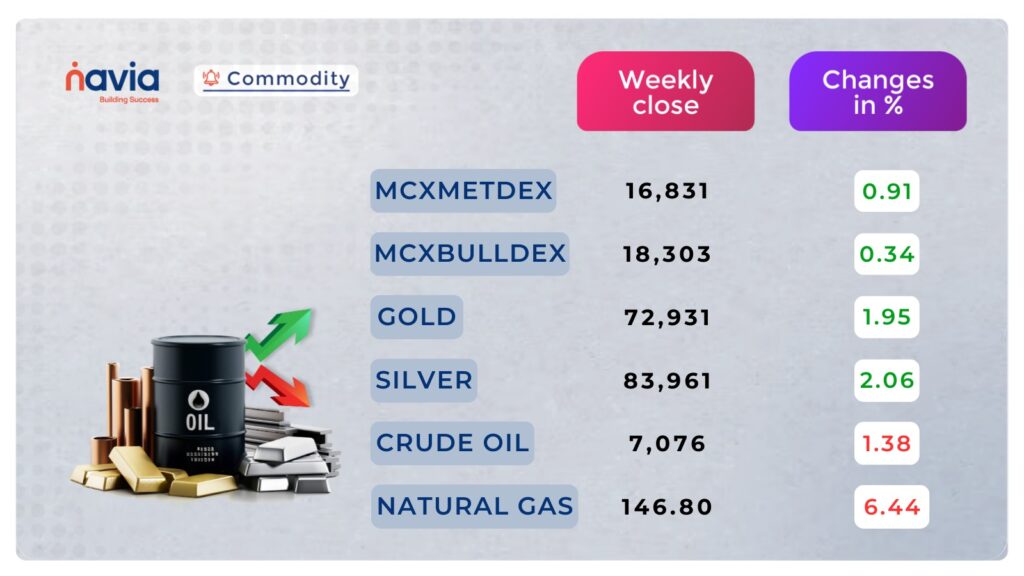

Commodity Corner

Crude oil

crude oil closed 1.38% Negative. Ongoing geopolitical tensions are giving positive momentum to crude oil. The current resistance level (R1) is placed at 7,153, and the support level (S1) is placed at 7,086.

Gold

Gold closed with a positive gain of 1.95%. The overall outlook remains optimistic due to geopolitical tensions, which are boosting demand for safe-haven assets like gold. The current resistance level (R1) is positioned at 71,697, while the support level (S1) is set at 71,240.

Blogs of the Week!

Delve into the global impact of Elections on stock markets, empowering you to fine-tune your investment strategies. Check out our latest blog for deeper insights.

Curious about how to safeguard yourself from online scams? Dive into our blog for expert tips that’ll keep you one step ahead of cyber threats!

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

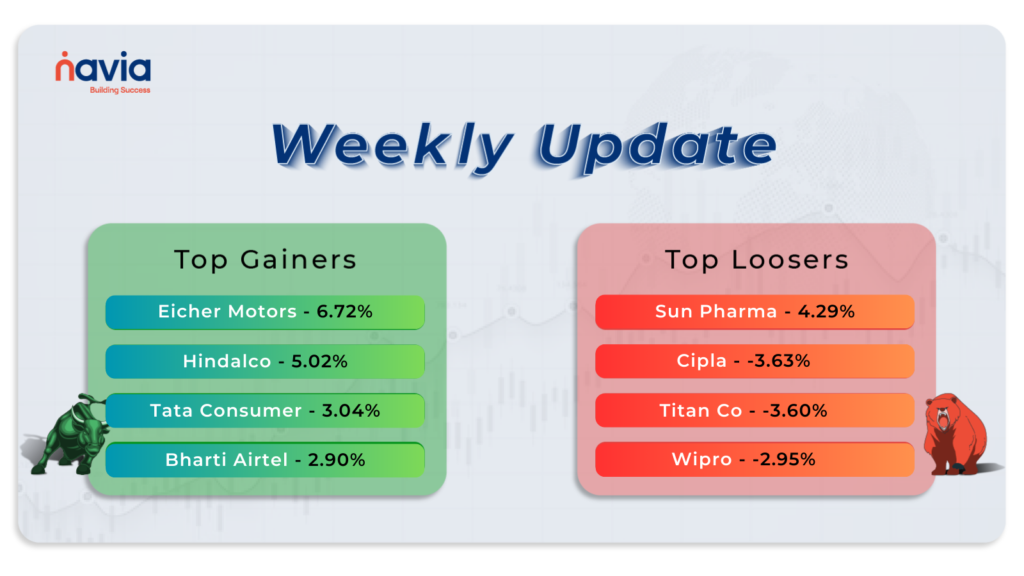

Top Gainers and Losers

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Do You Find This Interesting?