Types of Alternative Investment Funds: A Deep Dive

In an era where traditional investment vehicles often move in tandem with the broader market’s ebbs and flows, savvy investors increasingly turn their gaze towards more esoteric arenas. Alternative Investment Funds (AIFs) stand out as a beacon for those seeking diversification, potential for higher returns, and access to unique investment opportunities. AIFs, veer off the beaten path of stocks, bonds, and cash, offering avenues into private equity, hedge funds, real estate, commodities, and beyond. This blog takes a deep dive into the varied landscape of AIFs, helping investors navigate this complex yet rewarding domain.

What Are Alternative Investment Funds?

At their core, AIFs are investment vehicles that pool funds from high net-worth individuals, institutional investors, and sometimes retail investors, to invest in non-traditional assets. Governed by the regulatory frameworks of their respective jurisdictions, these funds aim to achieve specific investment objectives with strategies that often include leverage, derivatives, and short selling, among others.

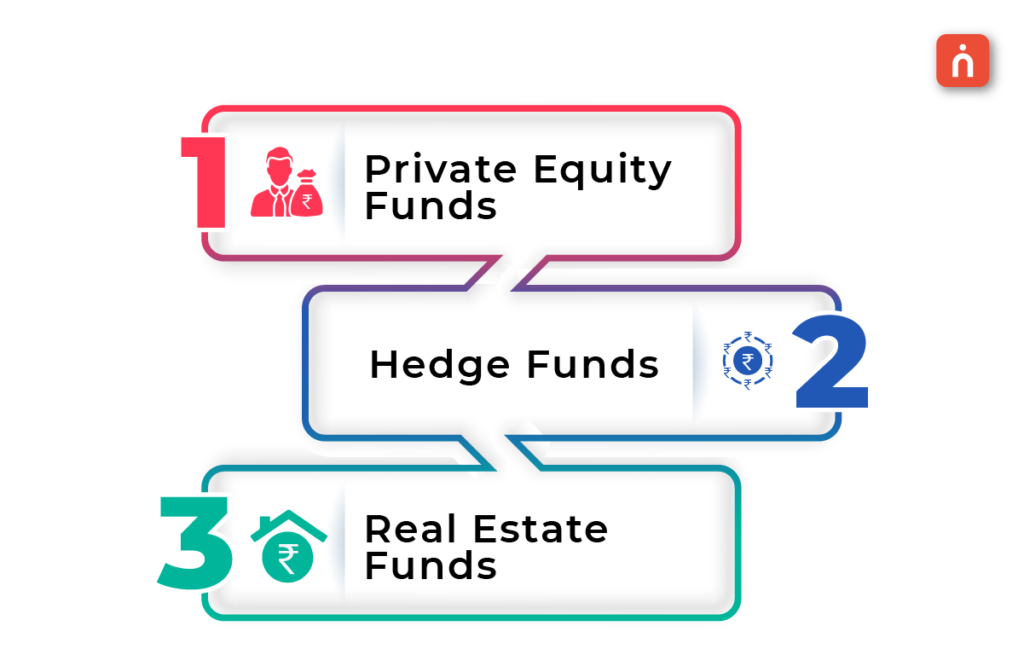

The Categories of AIFs

The world of AIFs is broad, yet most funds can be categorized into three primary types, each with its own characteristics, risk profiles, and investment strategies:

1. Private Equity Funds

Private Equity (PE) Funds are arguably the most well-known type of AIF. These funds invest in private companies, often acquiring significant stakes with the aim of influencing management decisions, restructuring, or steering the company toward an eventual exit strategy such as an IPO or sale. PE Funds are typically long-term investments, locking in capital for periods of 5 to 10 years, or even longer.

2. Hedge Funds

Hedge Funds are designed to “hedge” against market downturns, seeking to generate positive returns in both rising and falling markets. Employing a wide array of strategies, including leverage, short-selling, and derivatives, hedge funds aim for absolute returns rather than outperforming a benchmark. They are known for their aggressive investment strategies and, consequently, their higher risk and return profiles.

3. Real Estate Funds

Investing in real estate through AIFs allows investors to access property markets without the need to directly purchase or manage properties. These funds invest in a variety of real estate projects, including residential, commercial, and industrial properties. They may focus on income-generating rental properties, real estate development projects, or a mix of both.

Who can invest in AIFs?

Potential investors aiming to diversify their investment portfolios can consider participation in AIFs if they fulfill the following eligibility criteria.

🔸Eligible investors include Resident Indians, NRIs, and foreign nationals.

🔸The minimum investment for general investors stands at Rs. 1 crore, while directors, AIFs typically impose a minimum lock-in period of three years. Employees and fund managers must commit a minimum of Rs. 25 lakhs.

🔸AIFs typically entail a minimum lock-in period of three years.

Benefits of AIF

Flexibility

AIFs typically offer investors a higher return potential compared to other investment options. The substantial pooled capital allows fund managers the flexibility to devise strategies aimed at maximizing returns. This flexibility, coupled with the expertise of fund managers, contributes to the potential for achieving attractive returns for investors.

Stability

AIFs stand apart from direct association with stock markets, resulting in lower volatility compared to traditional equity investments. This characteristic makes them an attractive option for risk-averse investors seeking stability in their portfolios. AIFs provide a more secure avenue for investment, aligning well with the preferences of cautious investors.

Opportunity

AIFs frequently offer avenues to invest in unlisted companies which are typically beyond the reach of ordinary investors. This grants investors access to potentially profitable investment prospects in the private sector, including early-stage startups, real estate projects, or distressed assets.

Steps to Follow Before Investing in AIFs

Research and Due Diligence: Begin your investment journey by conducting comprehensive research into the diverse array of alternative investment funds available in the market. Evaluate their unique strategies, historical performance, and track records diligently to make informed decisions.

Consult with Financial Service Providers: Seek guidance from seasoned financial advisors or specialists well-versed in the realm of alternative investments. Their expertise can provide invaluable insights and assist you in navigating the complexities inherent in these funds, ensuring your investment aligns with your objectives.

Understand the Investment Process: Familiarize yourself with the intricacies of the investment process associated with your chosen alternative investment fund. This entails understanding the minimum investment requirements, the subscription process, as well as any associated fees or charges to make well-informed investment decisions.

Completion of Necessary Documentation: Ensure compliance with regulatory and legal requirements by meticulously filling out the requisite forms and providing the necessary documentation for investing in alternative funds. Adhering to these formalities is crucial for a smooth and legally sound investment experience.

Regular Monitoring and Review: Stay proactive in managing your investments by consistently monitoring their performance and reviewing the progress of the fund. Keep track of any developments or changes within the fund, enabling you to adapt your investment strategy in line with your evolving goals and market dynamics.

Navigating the AIF Landscape with Navia Markets

Embarking on the journey of alternative investments can be daunting, but with the right partner, the path becomes clearer and more navigable. Navia Markets stands at the forefront of this journey, guiding investors through the intricacies of AIFs with expertise and insights. With over two decades of experience in the financial sector, Navia provides investment solutions that cater to the individual needs of its clients, ensuring a personalized approach to achieving diverse investment objectives. Whether you’re exploring private equity, hedge funds, or real estate investments, Navia’s strategic guidance is designed to empower investors to make informed decisions, leveraging the full potential of alternative investments.

Conclusion

Alternative Investment Funds offer a realm of possibilities for those looking to diversify beyond traditional investments. Whether it’s taking a stake in a promising startup, betting against market trends, or owning a piece of prime real estate, AIFs provide a gateway to unconventional investment strategies. As with any investment, the key lies in understanding the risks, aligning with your investment goals, and proceeding with an informed strategy. The depth and breadth of AIFs ensure that, for the investor, there’s always an opportunity to be found. With Navia Markets by your side, navigating the complexities of AIFs becomes a journey of discovery and opportunity.