Navia Weekly Roundup (Mar 25- Mar 28, 2024)

Week in the Review

During the short week, Indian equity indices demonstrated substantial advances, edging closer to their all-time highs in the final session of the 2024 financial year. This progress occurred against a backdrop of mixed global markets, as Foreign Institutional Investors (FIIs) became net purchasers and there was a decrease in the current account deficit.

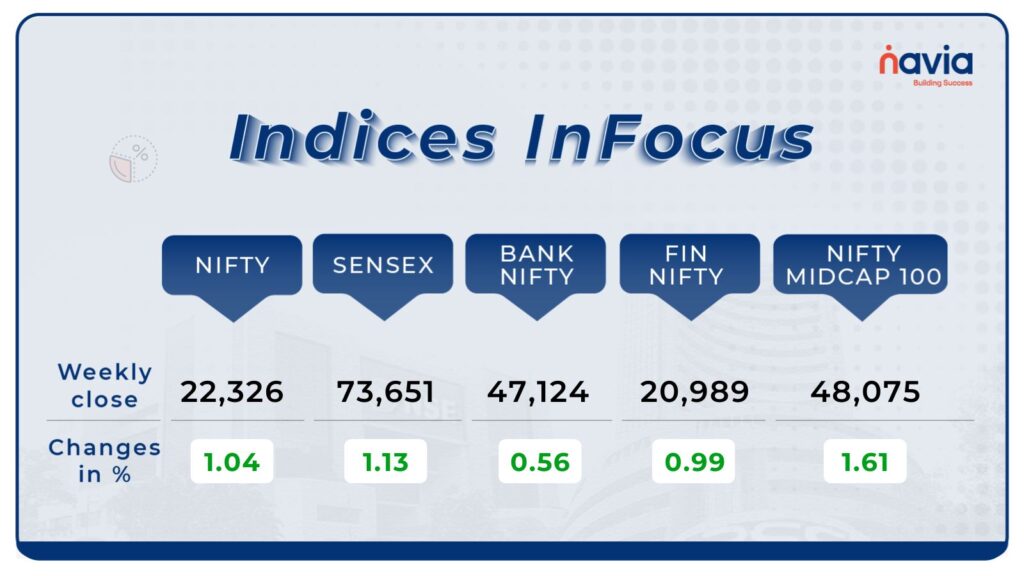

Indices Analysis

This week, both the BSE Sensex and the Nifty50 index showed impressive gains, with the Sensex rising by 1.13% to close at 73,651 and the Nifty50 increasing by 1.04% to end at 22,326.

Bank Nifty:

The Bank Nifty also made notable progress, climbing above the 47,000 mark after four days of consolidation. Trading above key moving averages, the index formed bullish candlestick patterns, signaling positive momentum. Overall, the market displayed a bullish sentiment driven by favorable global indicators, geopolitical stability, and upbeat investor sentiment.

Nifty50 Index:

The Nifty surged past 22,500 after maintaining momentum above 22,100, signaling increased optimism with a breakout in consolidation on the daily chart. Despite encountering resistance near the previous swing high of 22,526, sustaining the rally hinges on decisively surpassing the 22,525 level. Short-term support may be found around 22,200.

Interactive Zone!

Last week’s poll:

Q) Which of these authorities supervises India’s capital markets?

a) India’s Securities and Exchange Board (SEBI)

b) Reserve Bank of India (RBI)

c) The Insurance Regulatory and Development Authority (IRDA)

d) Agriculture and Rural Development National Bank (NABARD)

Last week’s poll answer: A) India’s Securities and Exchange Board (SEBI)

Poll for the week:

Q) Stock exchange help in?

a) Providing liquidity to existing securities

b) Contributing to economic growth

c) Pricing of securities

d) All of the above

IPO Corner: Ongoing IPO’s

Radiowalla Network IPO:

A Stellar Debut in the Primary Market!

Radiowalla Network Limited’s IPO has taken the primary market by storm. With a price band of ₹72 to ₹76 per share, the company aims to raise ₹14.25 crore through this completely fresh offer. The IPO, which opened on March 27, will remain open until April 2, 2024. Within just a few hours of opening, the public issue was fully subscribed, indicating strong demand from investors. Shares of the company are also trading in the grey market with a premium of ₹38. Stay tuned for further developments as Radiowalla Network gears up for listing on the NSE SME Emerge platform.

Yash Optics & Lens IPO:

Moderate Interest in the Optical Market!

Yash Optics & Lens IPO has seen a subscription rate of 0.80 times so far on the second day of bidding. With bids for 36.20 lakh equity shares against 45.28 lakh shares offered, the IPO is witnessing mixed interest across different investor categories. Retail investors have subscribed 0.65 times, QIBs 1.70 times, and NIIs 0.16 times. The IPO, which opened on March 27, will conclude on April 3, with allotment expected on April 4 and listing tentatively scheduled for April 8 on the NSE SME platform.

K2 Infragen Ltd IPO:

A Slow Start for Engineering and Construction Firm!

K2 Infragen Ltd’s IPO opened with tepid demand, achieving a subscription rate of 76% on the first day. The public issue received bids for 18.76 lakh shares against 22.1 lakh shares on offer. While QIBs and NIIs showed moderate interest, retail investors demonstrated strong enthusiasm, subscribing 89% of their allotted shares. K2 Infragen aims to raise ₹40.54 crore through this IPO on the NSE SME platform, with proceeds slated for working capital requirements, capital expenditure, and general corporate purposes.

TAC Infosec IPO:

Impressive Response from Investors!

TAC Infosec IPO has garnered significant attention from investors, with a subscription rate of 20.88 times on day 2. Retail investors have subscribed 35.37 times, NIIs 11.37 times, and QIBs 2.67 times. The public issue received bids for 3,92,89,200 shares against 18,81,600 shares on offer. With such overwhelming demand, TAC Infosec is set to make a mark in the market.

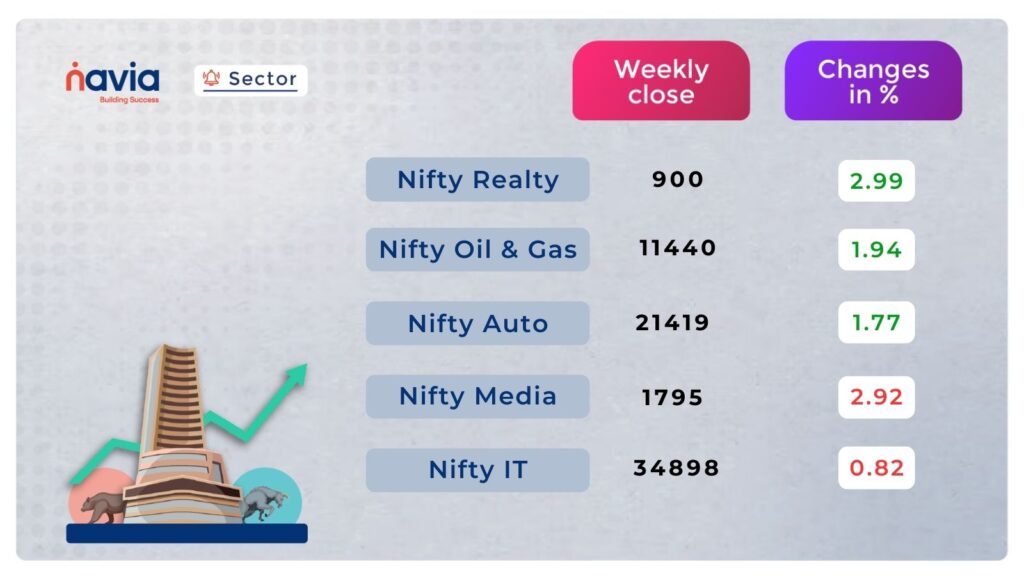

Sector Spotlight

In this week’s Sector Spotlight, we witnessed diverse movements across key sectors. Notably, the Nifty Realty index surged by 2.99 percent, Additionally, the Nifty Oil & Gas index rose by 1.94 percent,

Meanwhile, Nifty Auto added 1.77 percent, However, the Nifty Media index experienced a decline, shedding 2.92 percent, Lastly, the Nifty Information Technology index lost 0.82 percent,

Explore Our Features!

“Streamline your investments with Navia App’s pre-assembled stock baskets, starting from just Rs.300. Simplify diversification and manage your portfolio effortlessly. Read More..

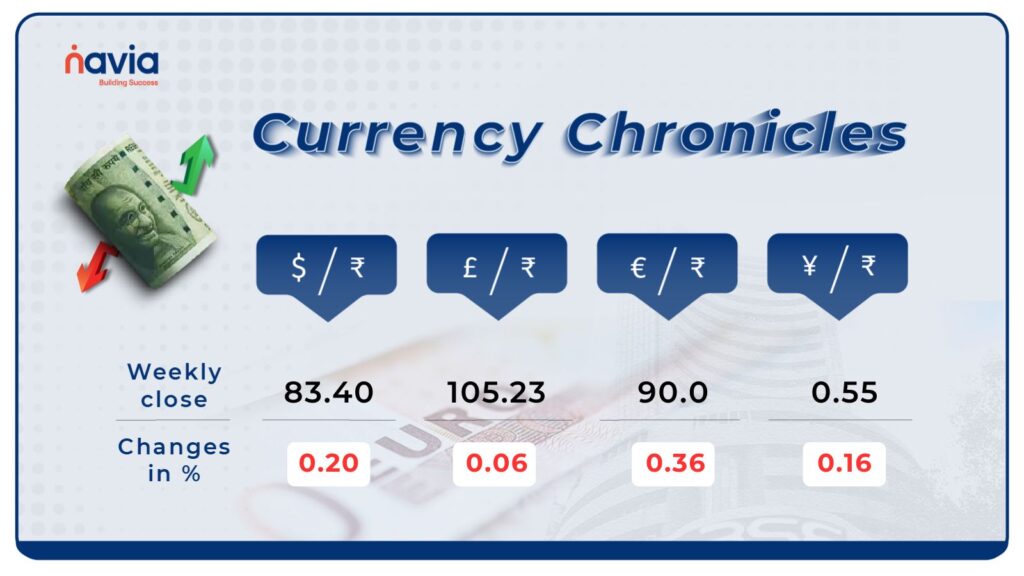

Currency Chronicles

USD/INR

The Indian rupee concluded the week ending March 28 flat against the US dollar, maintaining its position at 83.40 compared to its March 22 closing of 83.42. Despite minor fluctuations, the rupee remained relatively stable against the dollar throughout the week.

EUR/INR

Throughout the week, the EUR to INR exchange rate is decreased by -0.36%. Despite this projection, bullish sentiment prevails in the EUR/INR market, indicating a positive outlook among traders and investors. By week’s end, the rate reached ₹ 90.00, showing a slight decrease but still maintaining a favorable position.

JPY/INR

The JPY to INR exchange rate is decreased by -0.16% for the week. Despite this decrease, bullish sentiment is observed in the JPY/INR market, suggesting confidence among market participants. By the end of the week, the rate reached ₹ 0.550888, reflecting a minor decline but still indicating stability in the exchange rate.

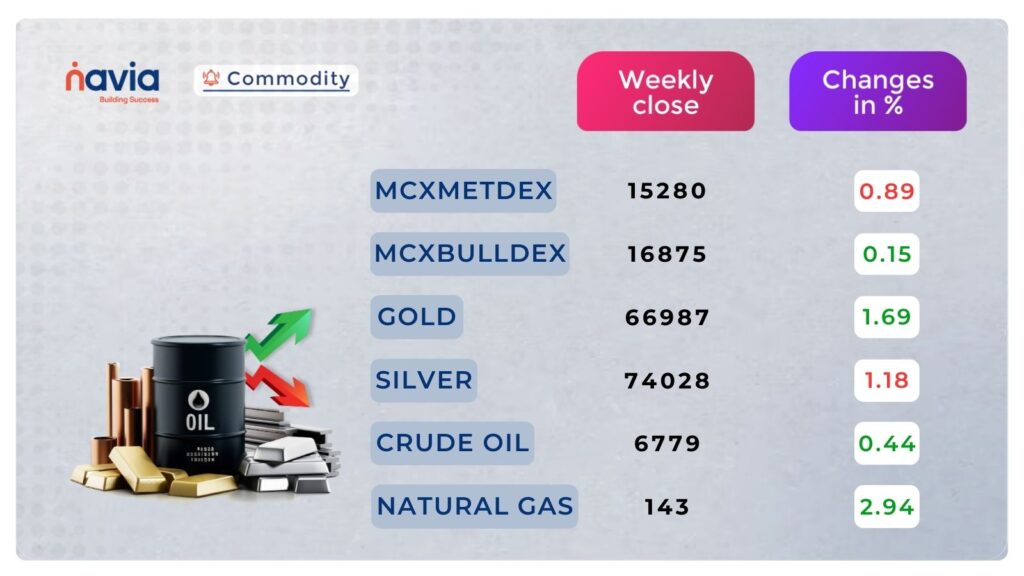

Commodity Corner

Gold

Gold closed at 1.69% positive as investors cautiously awaited a key US inflation reading that could influence the outlook for Federal Reserve monetary policy. The current resistance level 1 (R1) is placed at 66,757, and support level 1 (S1) is placed at 66196.

Crude oil

crude oil closed at 0.44% Positive. The negative momentum may continue in the upcoming session due to ongoing geopolitical tensions and OPEC cutbacks. The current resistance level 1 (R1) is placed at 6860, and support level 1 (S1) is placed at 6769 levels.

Blogs of the Week

In the interconnected web of global finance, the flutter of a butterfly’s wings can indeed cause a hurricane halfway across the world. Such is the case with US inflation Read More..

In the ever-evolving landscape of finance, the stock market frequently emerges as a promising avenue for seizing opportunities. Whether you’re aiming to save for retirement Read More..

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

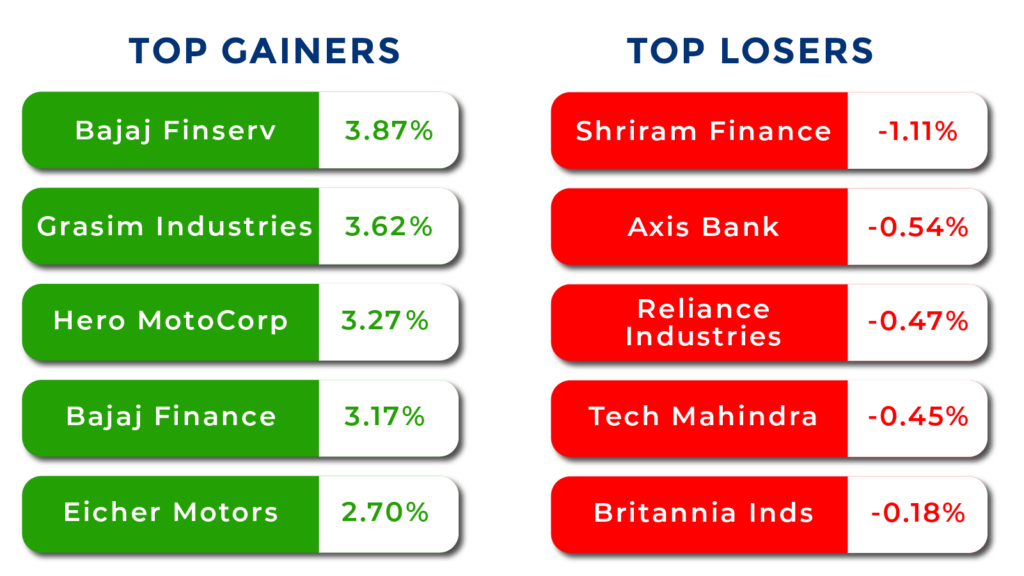

Top Gainers and Losers

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Do You Find This Interesting?