Tata Technologies IPO: A Detailed Analysis

Introduction

Tata Technologies Limited, a significant subsidiary of Tata Motors Limited, is embarking on an exciting financial journey by making its Initial Public Offering (IPO) debut i.e. Tata Technologies IPO. This move marks a significant milestone as the first Tata Group company to go public in nearly two decades, following the successful IPO of Tata Consultancy Services (TCS) in the year 2004.

The Offering

The IPO show is about to start on November 22, 2023, and is planning to wrap up on November 24, 2023. Tata Technologies plans to throw in around 60 million shares for sale, and here’s the breakdown: the company itself is tossing in about 46 million shares, whereas Alpha TC Holdings Pte Ltd is adding roughly around 9.7 million, and Tata Capital Growth Fund I is bringing in nearly 4.9 million. It’s like a finance party, and everyone’s invited to buy a share!

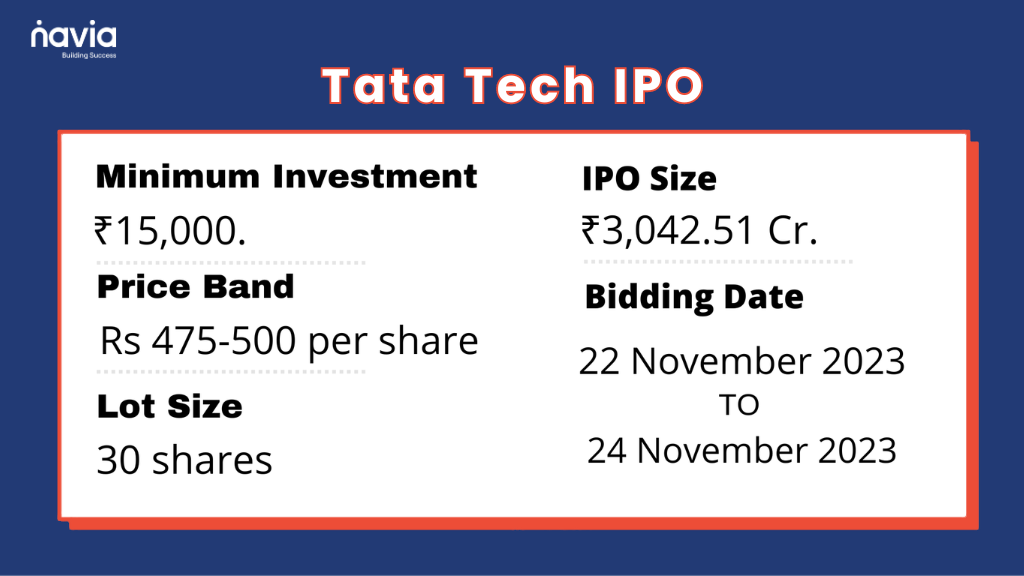

IPO Schedule and Offering Details

The Tata Technologies IPO is priced between ₹475 and ₹500 per share. If you’re a regular investor, you can start with a minimum of 30 shares, requiring at least ₹15,000 for investment. For more serious investors (sNII), the minimum investment is ₹210,000, involving 14 lots or 420 shares. Meanwhile, big players (bNII) need to invest at least ₹1,005,000 in 67 lots, equivalent to 2,010 shares.

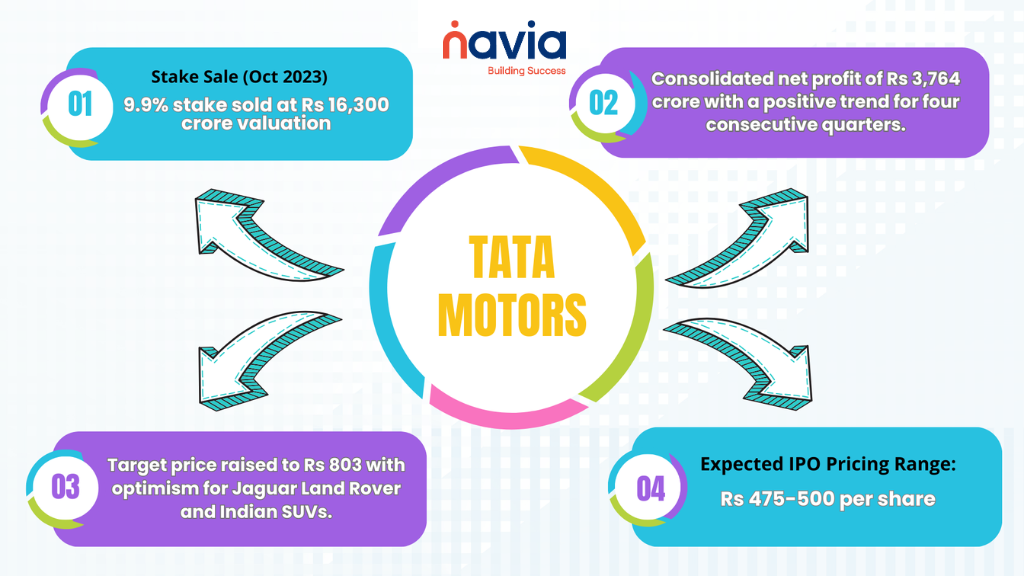

Behind the scenes: TATA MOTORS Move

Before we dive deeper into the IPO fun, let’s rewind a bit. Tata Motors, the parent company of Tata Technologies, decided to sell about 9.9% of its stake to new investors in October 2023. Why? Well, they had this “deleveraging agenda” going on, aiming to reduce some debts. A climate-focused private equity fund and Ratan Tata Endowment Foundation joined the party, and Tata Motors went from holding about 75% of Tata Technologies to a bit less.

Stake Sale and Financial Performance

Financial Health Check

Now, let’s take a look at Tata Motors’ financial checkup. In the September quarter, they reported a net profit of Rs 3,764 crore. This positive trend has been going on for four quarters straight. And the buzz around the market is that things are looking up for Tata Motors, especially with their British buddy Jaguar Land Rover which are expected to bring in better margins.

Market Talk and Expectations

As the IPO news spread, Tata Technologies’ unlisted shares saw a crazy jump in value. They went from a modest Rs 90-100 in 2020 to a whopping Rs 900. That’s like your favorite snack suddenly becoming the popular thing in town! Market experts are expecting the IPO to be priced between Rs 475-500, considering the recent stake sale by Tata Motors.

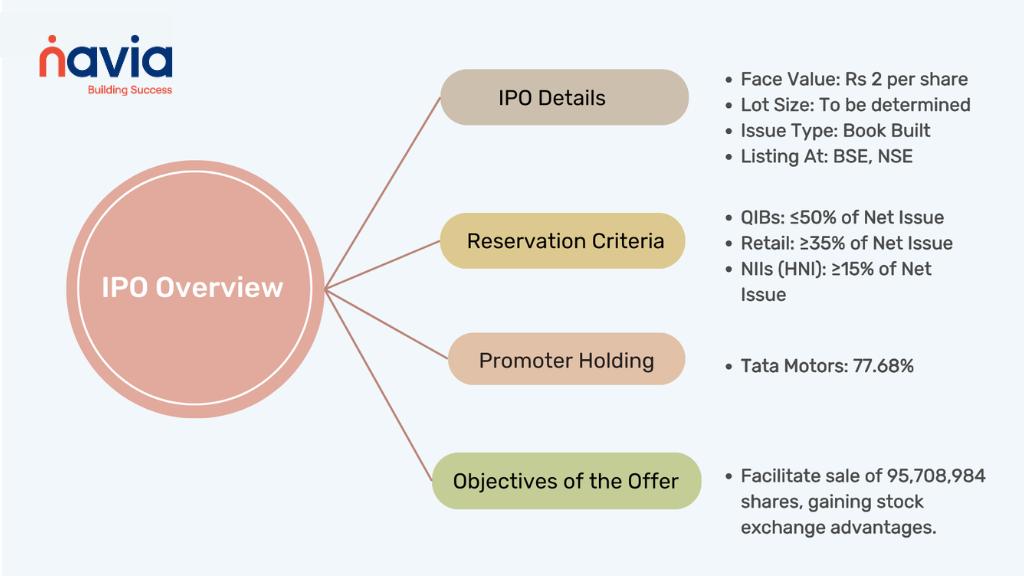

IPO Details and Reservation Criteria

What the Experts Say

Speaking of experts, foreign brokerage firm CLSA hiked up Tata Motors’ target price to Rs 803. You may wonder why? Well, they’re optimistic about Jaguar Land Rover doing well and Tata Motors having a strong lineup of SUVs in 2024. CLSA even predicts Tata Motors grabbing a big chunk of the SUV market in India over the next couple of years.

IPO Reservation and Promoter Holding

Investors eyeing the Tata Technologies IPO should take note of the reservation criteria. The Qualified Institutional Buyers (QIBs) are offered not more than 50% of the net issue, while Retail investors are assured not less than 35%. Non-Institutional Investors (NIIs), including High Net Worth Individuals (HNIs), are allocated not less than 15% of the net issue. Tata Motors Limited, the promoter, holds a significant pre-issue share of 77.68%.

Objectives of the Offer

The primary objectives of the Tata Technologies IPO are to achieve the benefits of listing the equity shares on the stock exchanges and to carry out the offer for sale of up to 95,708,984 equity shares by the selling shareholders

The Growth Chart

Lastly, let’s take a look at Tata Technologies’ growth chart. Tata Technologies Limited has displayed commendable financial growth, Between March 31, 2022, and March 31, 2023, as their revenue went up by around 25%, and their profit after tax shot up by a cool of 42.8%. That’s like acing your exams and getting a raise at your job – they’re doing pretty well!

Wrapping Up

So, to sum it up all – Tata Technologies IPO is getting ready to hit the market stage. Whether you’re a finance guru or just dipping your toes into the stock market pool, this IPO could be a show worth watching. Keep an eye out for updates, mark the dates on your calendar, and who knows, you might just grab a front-row seat in this financial concert!

We’d Love to hear from you

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.