IREDA IPO: Join the Green Energy Revolution!

Table of Contents

In the fast-evolving landscape of renewable energy, the Indian Renewable Energy Development Agency Ltd. (IREDA) is making waves with its upcoming Initial Public Offering (IPO). Let’s break down the key aspects of IREDA IPO and why it’s generating a buzz in the financial world.

Meet IREDA: Green Energy Game Changer

IREDA is like the superhero of green energy financing in India. It’s been around for more than 36 years, helping out with cash and support for new and renewable energy projects. Plus, they’re into cool stuff like making equipment and managing power transmission.

Why Should You Care About IREDA’s IPO?

Well, it’s not just any IPO; it’s a chance to be part of India’s big plan for renewable energy. The government wants to have 500 GW of non-fossil fuel energy by 2030 and be completely emission-free by 2070. IREDA is right in the middle of this exciting journey.

Key IPO Details – When, How Much, and What for?

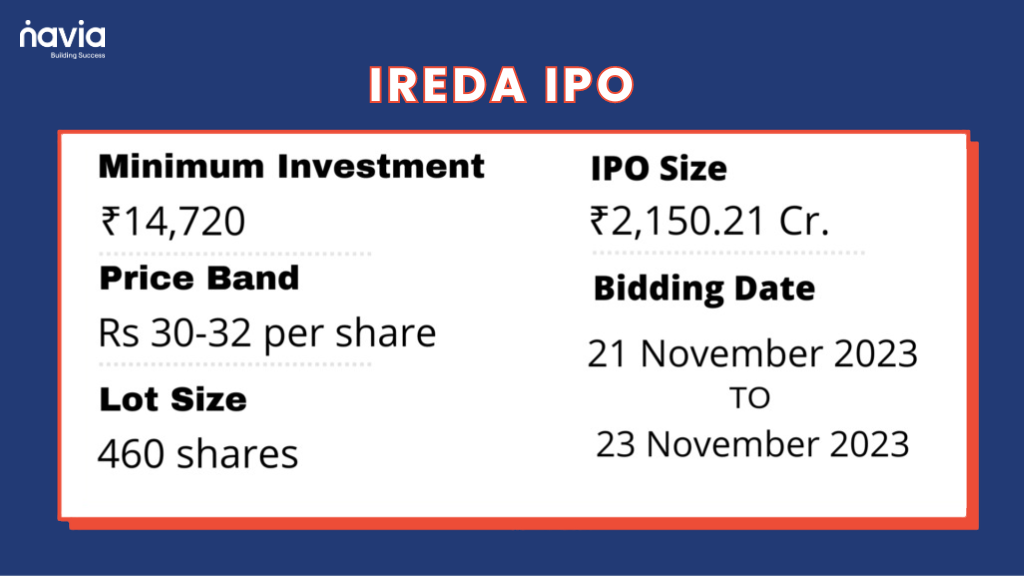

The IREDA IPO is happening from November 21, 2023 to November 23, 2023. If you’re thinking about jumping in, each share will cost you between ₹30 to ₹32, and the minimum amount you can invest is ₹14,720. Now, here’s the interesting bit – IREDA wants to raise ₹2,150.21 crores through this IPO. They’re selling new shares worth ₹1,290.13 crores and some shares from the government worth ₹860.08 crores.

Why Analysts Are Excited

Financial experts are saying good things about IREDA. They’re the big player in green energy financing, and they’re planning to get even bigger by diving into new green technologies like green hydrogen and battery storage. With India going all-in on renewable energy, IREDA is in a sweet spot.

Money Talk – Is It Worth It?

On the valuation front, IREDA aims for a market capitalization of ₹8,600 crores at the upper end of the price band. While Some experts say the price is a bit high compared to similar companies, but others think it’s a good deal, especially with the government’s ambitious plans for renewable energy transition make IREDA an attractive choice for both listing gains and long-term returns.

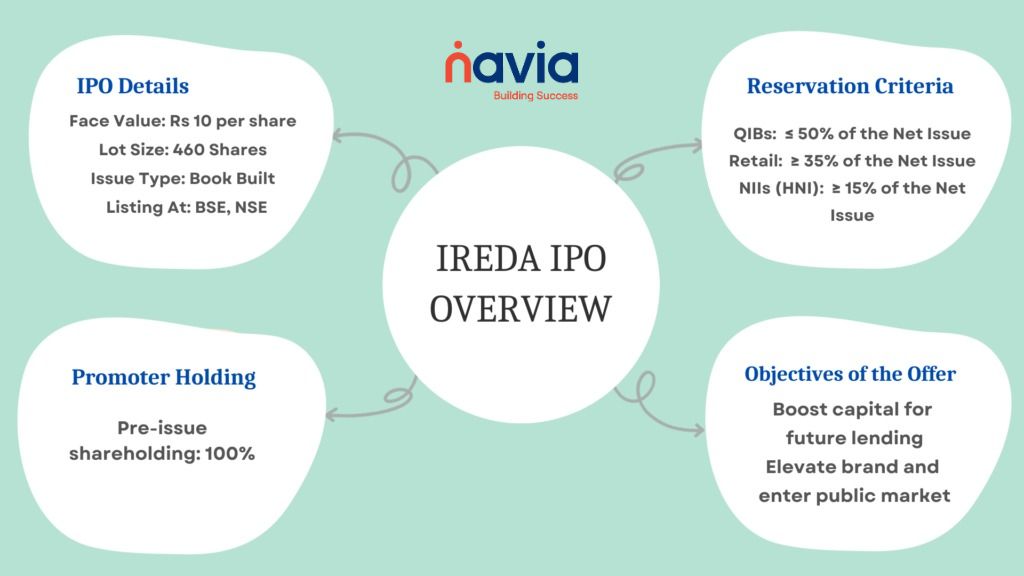

Objects of the Issue

The IREDA IPO has two parts: a Fresh Issue and an Offer for Sale. The money raised from the Fresh Issue, which is about ₹1,290.13 crores, will be used to strengthen the company’s financial foundation for future needs and to lend support to other projects. The Offer for Sale won’t directly help the company; instead, it gives the Promoter Selling Shareholder a chance to sell some shares and make some money. On top of that, getting listed on the stock market is expected to boost the company’s reputation, making more people aware of its shares and creating a public market for them in India.

IREDA IPO: Reservation Breakdown

Let’s break down the reservations for the IREDA IPO, offering a total of 671,941,177 shares. Qualified Institutional Buyers (QIB) have a 19.94% share, totaling 134,013,152 shares. Non-Institutional Investors (NII) secure 14.96%, equivalent to 100,509,864 shares. Retail Individual Investors (RII) claim the largest portion, with 34.90%, comprising 234,523,015 shares. Employees are in for 0.28%, representing 1,875,420 shares, while Anchor Investors grab 29.92%, totaling 201,019,726 shares.

IREDA IPO: Lot Size Insights

For those considering the lot size, here’s the scoop. The minimum bid is for 460 shares, and you can bid in multiples of that. Retail investors can bid for 1 lot (460 shares) up to a maximum of 13 lots (5,980 shares), with investments ranging from ₹14,720 to ₹191,360. Slightly High Net-worth Individuals (S-HNI) can bid for 14 lots (6,440 shares) to a maximum of 67 lots (30,820 shares), with investments ranging from ₹206,080 to ₹986,240.

IREDA IPO: Promoter Holding Before and After

The brains behind IREDA are The President of India, operating through The Ministry of New & Renewable Energy, Government of India. Before the IPO, they hold 100% of the shares. Post the IPO, their stake will be reduced to 75%.

Conclusion

To put it simply, consider IREDA IPO as your special invitation to India’s green energy party. If you like the idea of supporting a more sustainable future and maybe making some money too, this could be an opportunity you wouldn’t want to miss. Save the date – the IPO starts off on November 21!

We’d love to hear from you

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.