September Market Recap: Top Trends of the Month

- Nifty 50 Performance in September

- September Market Roundup

- Sectoral Movements

- Company Performance

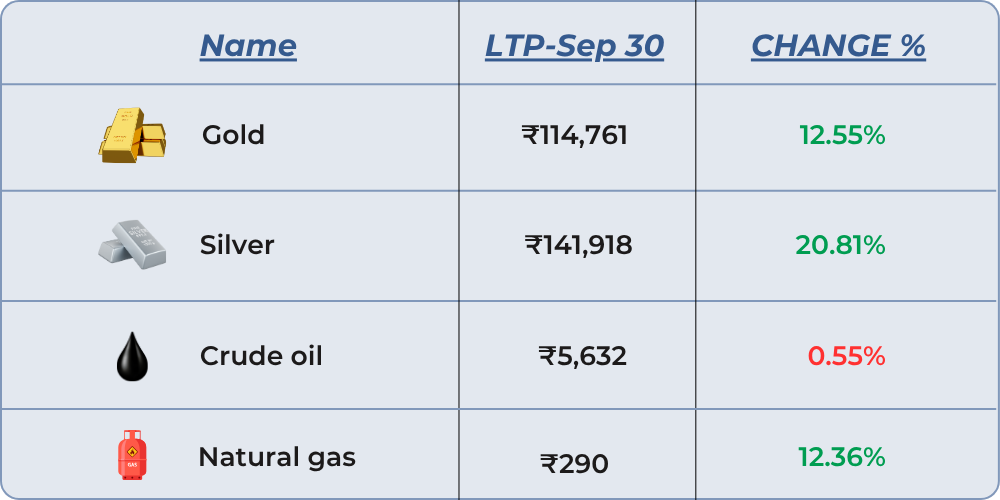

- Commodities Month's Change

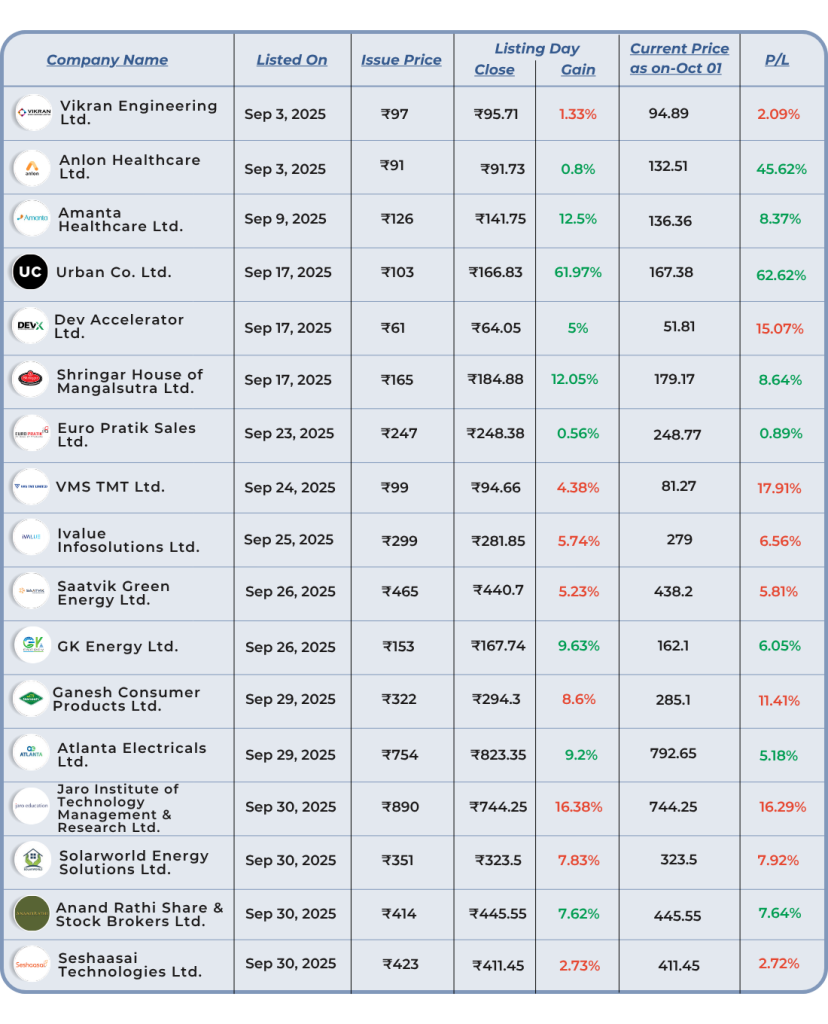

- SME IPO Performance – September

- Top Reads From September!

- Interactive Zone!

September 2025 was a month of adjustment for the Indian stock market, shaped by significant GST rate cuts and ongoing US trade tariffs. While initial concerns over tariffs weighed on sentiment, domestic economic measures and positive forecasts provided support.

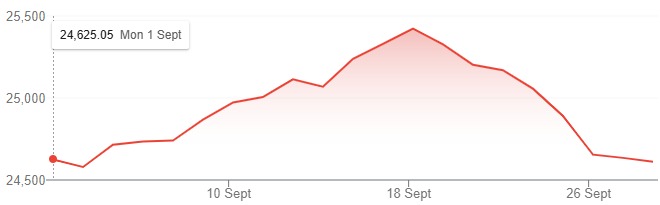

Nifty 50 Performance in September

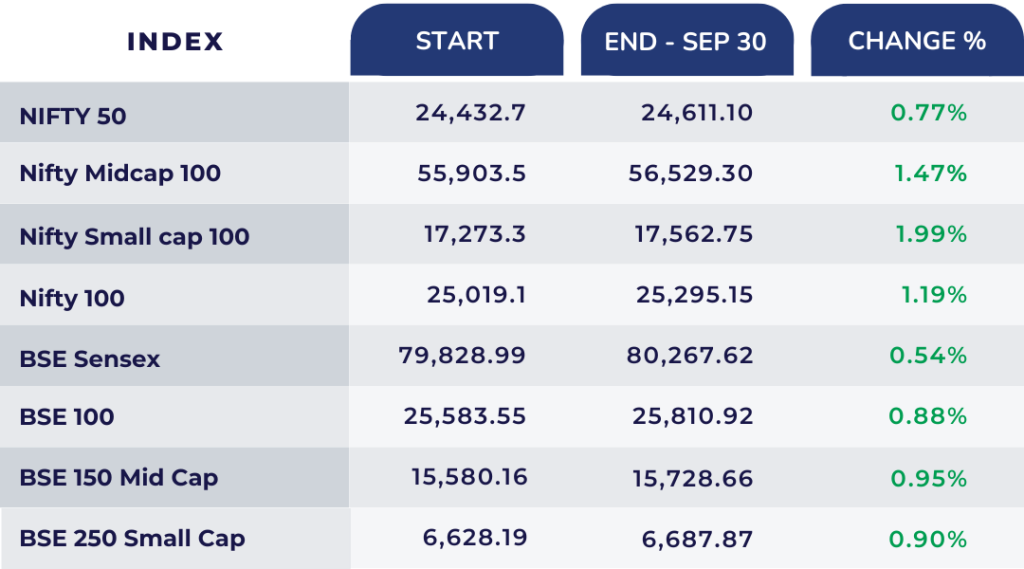

September Market Roundup

September 2025 proved to be a month of adjustment for the Indian stock market, largely influenced by the implementation of significant GST rate cuts and the continuing impact of US trade tariffs. While initial anxieties surrounding the tariffs persisted, the domestic economic stimulus from the GST revisions and ADB forecast provided a counterbalance.

Key Highlights:

GST Rate Cuts & Economic Impact: The sweeping GST rate cuts implemented on September 22nd, reducing the number of slabs to primarily 5% and 18%, were a major talking point. These cuts aimed to simplify the tax structure and reduce prices for consumers. The government cautioned e-commerce platforms to pass on the benefits to consumers. Initial reports suggest the cuts are expected to positively influence the economy and offset some of the negative impact of US tariffs.

Tariff Impact Continues: The effects of the 50% US tariffs on Indian imports continued to weigh on investor sentiment throughout September. However, the market gradually adjusted, and the initial panic subsided.

Positive GST Collection: Despite the rate cuts, GST collections for September rose by 9.1% year-on-year to ₹1.89 lakh crore, indicating continued economic activity.

RBI Outlook: The Reserve Bank of India (RBI) views the GST cuts alongside a good monsoon as positive factors supporting economic growth.

Market Performance: The BSE Sensex closed the month at 80,267.62 a decrease and the NSE Nifty settled at 24,611.10 down. The market showed resilience amidst the ongoing global economic uncertainties.

Downward Revision Attributable to Domestic Factors: Current downward revisions in market projections are also attributable to domestic factors, including the recent GST rate cuts and a favourable monsoon season.

Economic Growth Projections: The Asian Development Bank (ADB) revised its growth projection for India to 6.5% for both FY26 and FY27, indicating continued confidence in the Indian economy despite global headwinds.

Outlook

September’s performance demonstrates the Indian stock market’s ability to adapt to evolving economic conditions. The GST rate cuts are anticipated to stimulate consumer spending and boost economic activity in the coming months. With the ADB projections, the Indian economy remains on a positive trajectory, and the long-term outlook remains optimistic.

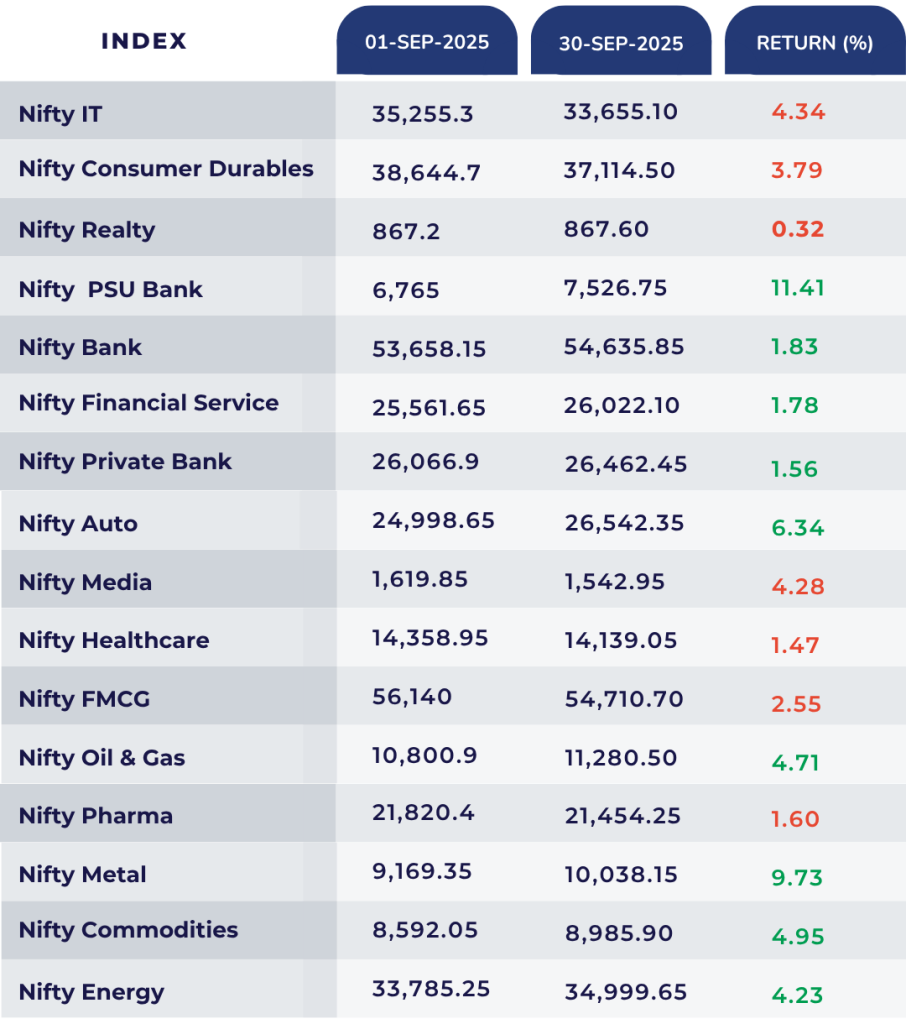

Sectoral Movements

Nifty PSU Bank, Metal, and Auto led the gains, while Nifty IT, Media and Consumer Durables were the major laggards, each falling over 3%.

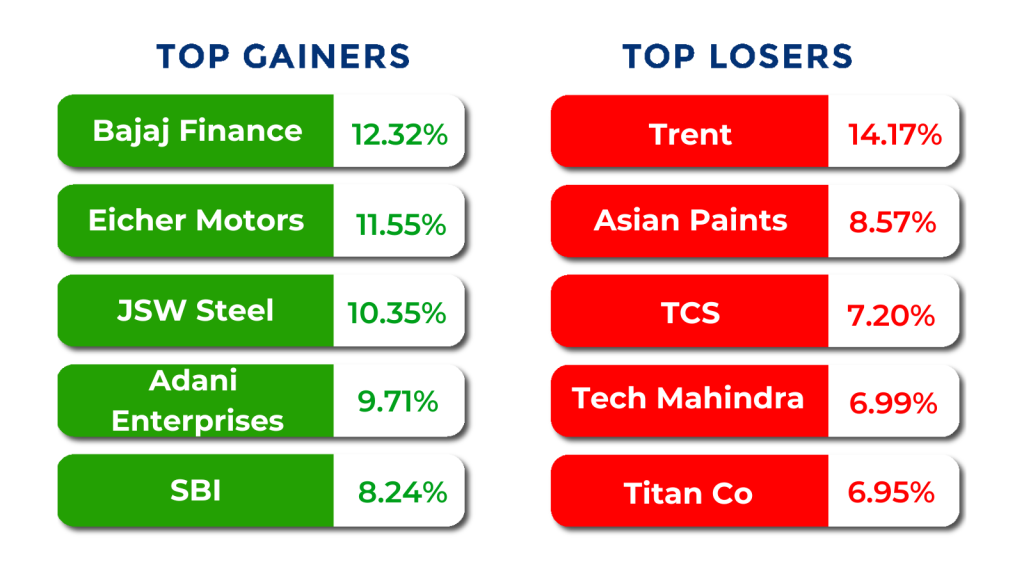

Company Performance

Commodities Month’s Change

SME IPO Performance – September

September SME IPO:

India’s IPO market in September 2025 continued to show a mixed performance for investors. Standout performers included Urban Co. Ltd. (62.62%) and Anlon Healthcare Ltd. (45.62%), which rewarded shareholders with impressive listing gains. However, not all debuts were positive—VMS TMT Ltd. (17.91%), Jaro Institute of Technology Management & Research Ltd. (16.29%), and Dev Accelerator Ltd. (15.07%) slipped below the issue price, reminding investors of the risks associated with IPO investing.

Disclaimer: The IPO performances mentioned are historical examples and not investment recommendations.

Top Reads From September!

Explore our September blogs with expert trading strategies and investment tips designed to guide you toward smarter financial choices.

● Navia Market Price Protection (MPP) – Trade Fast, Stay Protected

● Limit Price Protection (LPP) – How Navia Keeps Your Trades Safe

● Introducing Navia Backup: An Emergency-Mode Trading Safety Net

● Mental Accounting in Personal Finance – Why All Money Should Be Treated Equally

● Framing Effect in Investing – A Tale of Two Investors

● The Overconfidence Trap in Investing – When Being Too Sure Backfires

● Anchoring Bias in Investing – The Trap of Sticking to Old Prices

● The Availability Heuristic in Investing – Why Recent News Shapes Your Decisions

● Have You Chosen Financial Freedom as Your Goal?

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others.

Ready to take a guess?

Do You Find This Interesting?

DISCLAIMER: Investment in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Full disclaimer: https://bit.ly/naviadisclaimer.