Navia Weekly Roundup (Sep 22 – 26, 2025)

- Week in the Review

- Indices Analysis

- Interactive Zone!

- Sector Spotlight

- Top Gainers and Losers

- Currency Chronicles

- Commodity Corner

- Top Blogs of the Week!

- N Coins Rewards

Week in the Review

Indian markets snapped three-week gaining streak, posting worst weekly fall in nearly six months amid persistent FII selling, fresh US tariff on pharma, higher visa fees, falling rupee and weakening dollar. However, continues DII support and GST implementation provided some support.

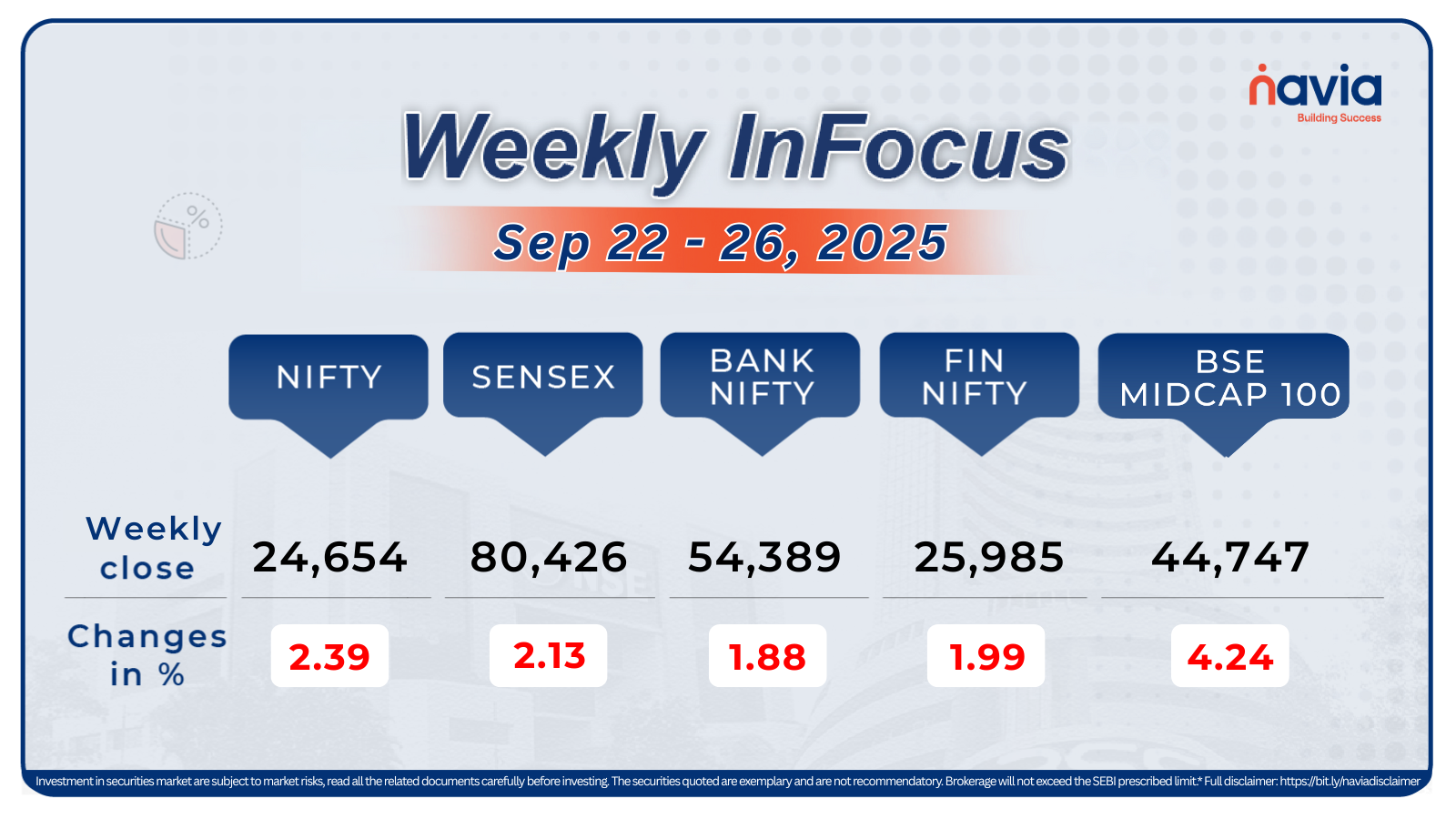

Indices Analysis

For the week, Nifty50 shed 2.39 percent to finish at 24,654.70, while the BSE Sensex index fell 2.13 percent to end at 80,426.46.

The BSE Small-cap index declined 4.2 percent with Shankara Building Products, Apollo Pipes, SML Isuzu, MIC Electronics, Prudent Corporate Advisory Services, Sigachi Industries, Cigniti Technologies, SMS Pharmaceuticals, Eimco Elecon (India), Vishnu Prakash R Punglia, IOL Chemicals and Pharmaceuticals, Parsvnath Developers shed up to 77 percent. Zuari Industries, TVS Electronics, Indo Thai Securities, OM Infra, RACL Geartech,Allcargo Terminals, Automotive Stampings and Assemblies rising between 20-30 percent.

The BSE Large-cap Index fell nearly 3 percent dragged by Tech Mahindra, Waaree Energies, Swiggy, Tata Consultancy Services, Indian Hotels Company, Divis Laboratories, LTIMindtree.

BSE Mid-cap Index shed 4.5 percent with Hexaware Technologies, Coforge, MphasiS, Kalyan Jewellers India, Laurus Labs, Persistent Systems down between 10-15 percent.

Foreign Institutional Investors (FIIs) remained net sellers throughout the week, extending their selling for the 13th consecutive week, as they offloaded equities worth Rs 19,570.03 crore, while Domestic Institutional Investors (DII) continued their buying in 24th week, as they purchased equities worth Rs 17,411.40 crore.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

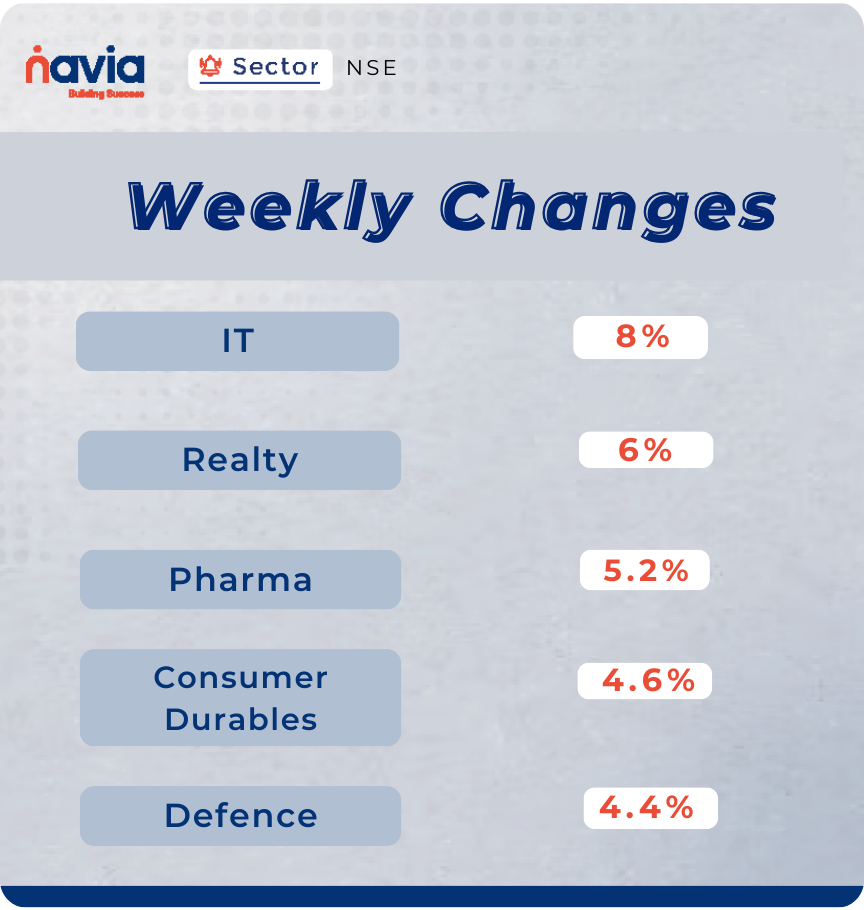

Sector Spotlight

All the sectoral indices gave a negative return during the week, with Nifty IT index plunged 8 percent, Nifty Realty index shed 6 percent, Nifty Pharma fell 5.2 percent, Nifty Consumer Durables slipped 4.6 percent, Nifty Defence index declined 4.4 percent.

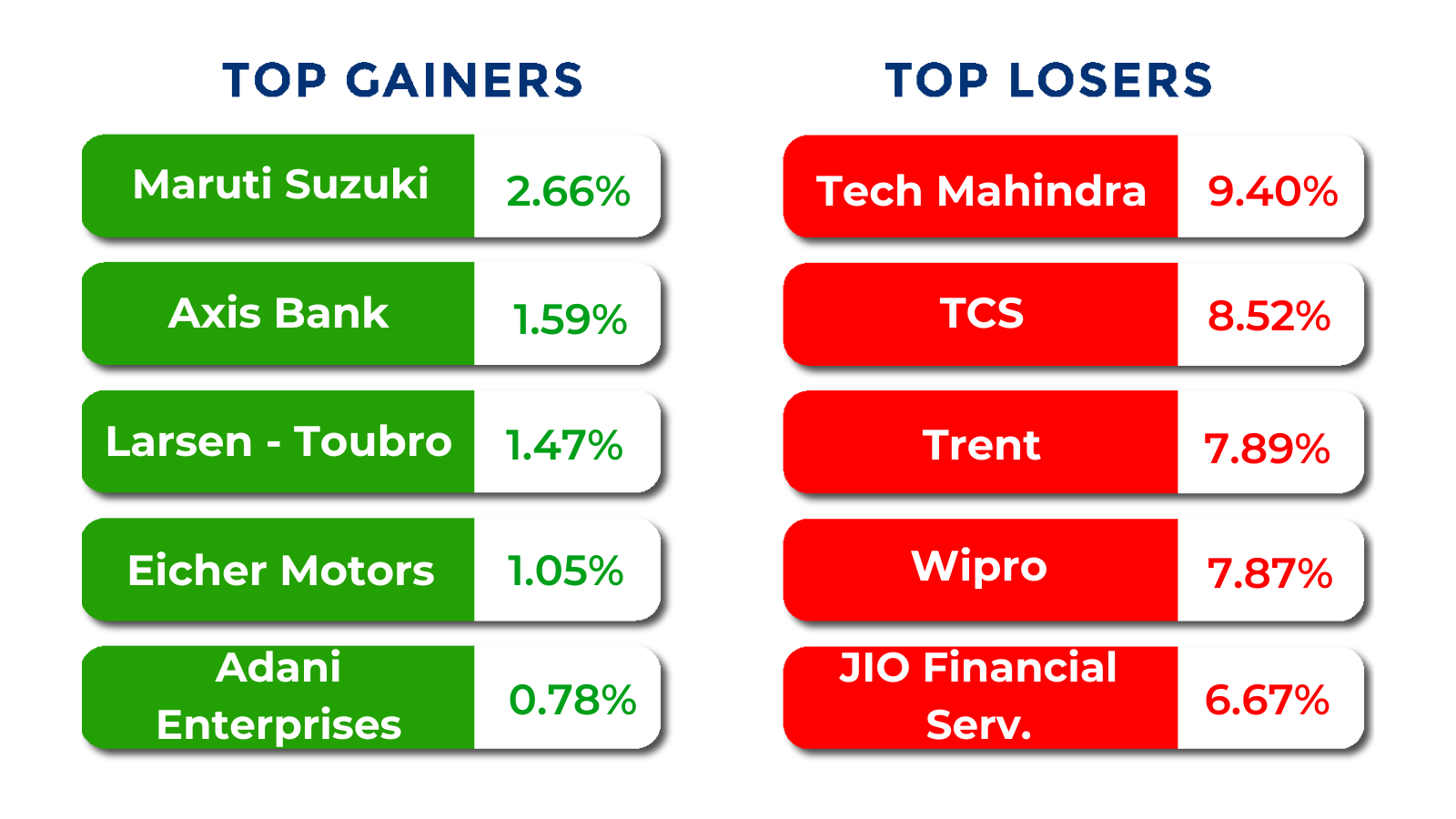

Top Gainers and Losers

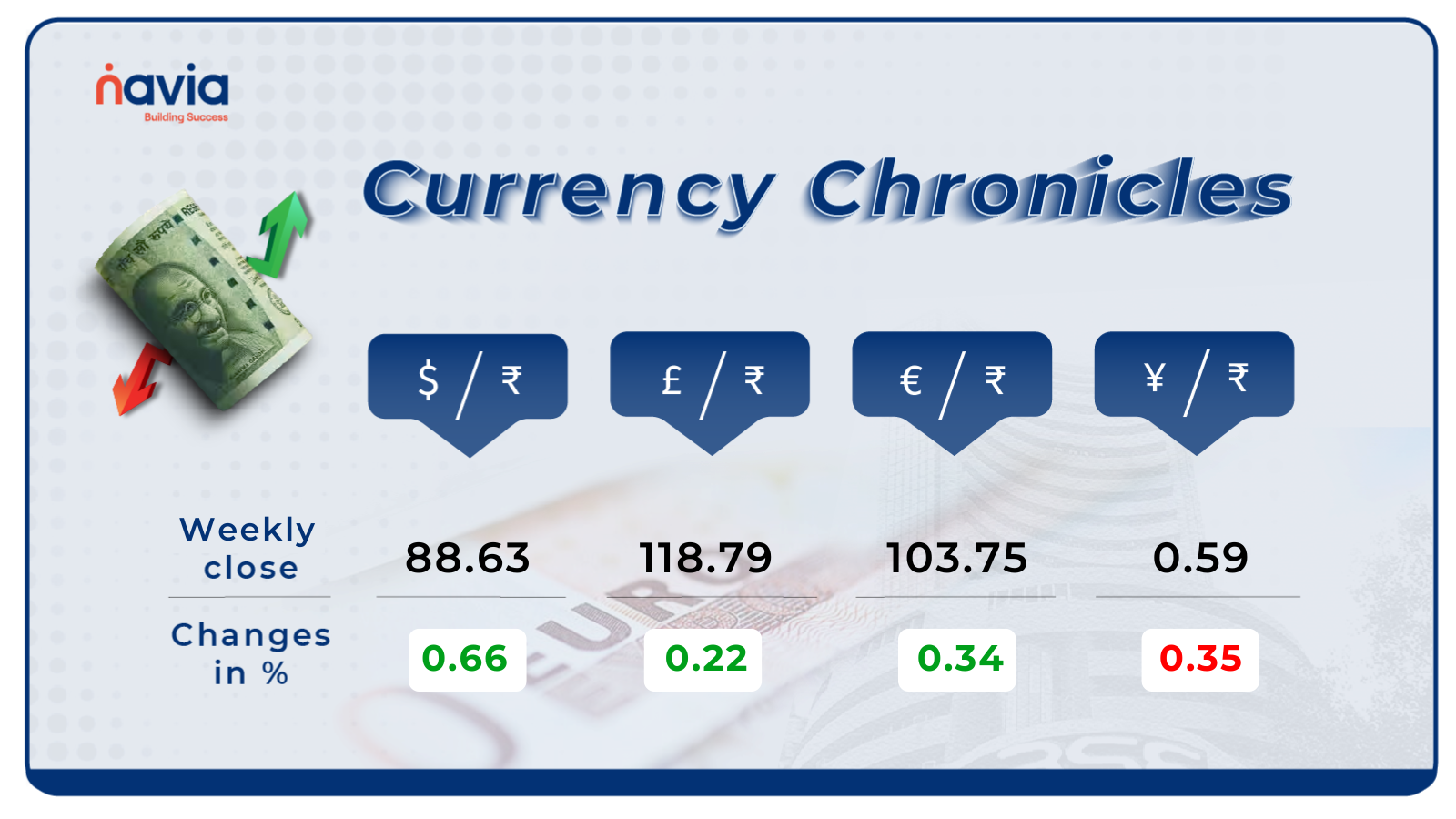

Currency Chronicles

USD/INR:

The USD/INR rate closed at ₹88.63 per dollar, gaining 0.66% during the week, reflecting a bullish market sentiment.

EUR/INR:

The EUR/INR rate closed at ₹103.75 per euro, gaining 0.34% during the week, reflecting a bullish market sentiment.

JPY/INR:

The JPY/INR rate closed at ₹0.59 per yen, losing by 0.35% during the week, reflecting a bearish market sentiment.

Stay tuned for more currency insights next week!

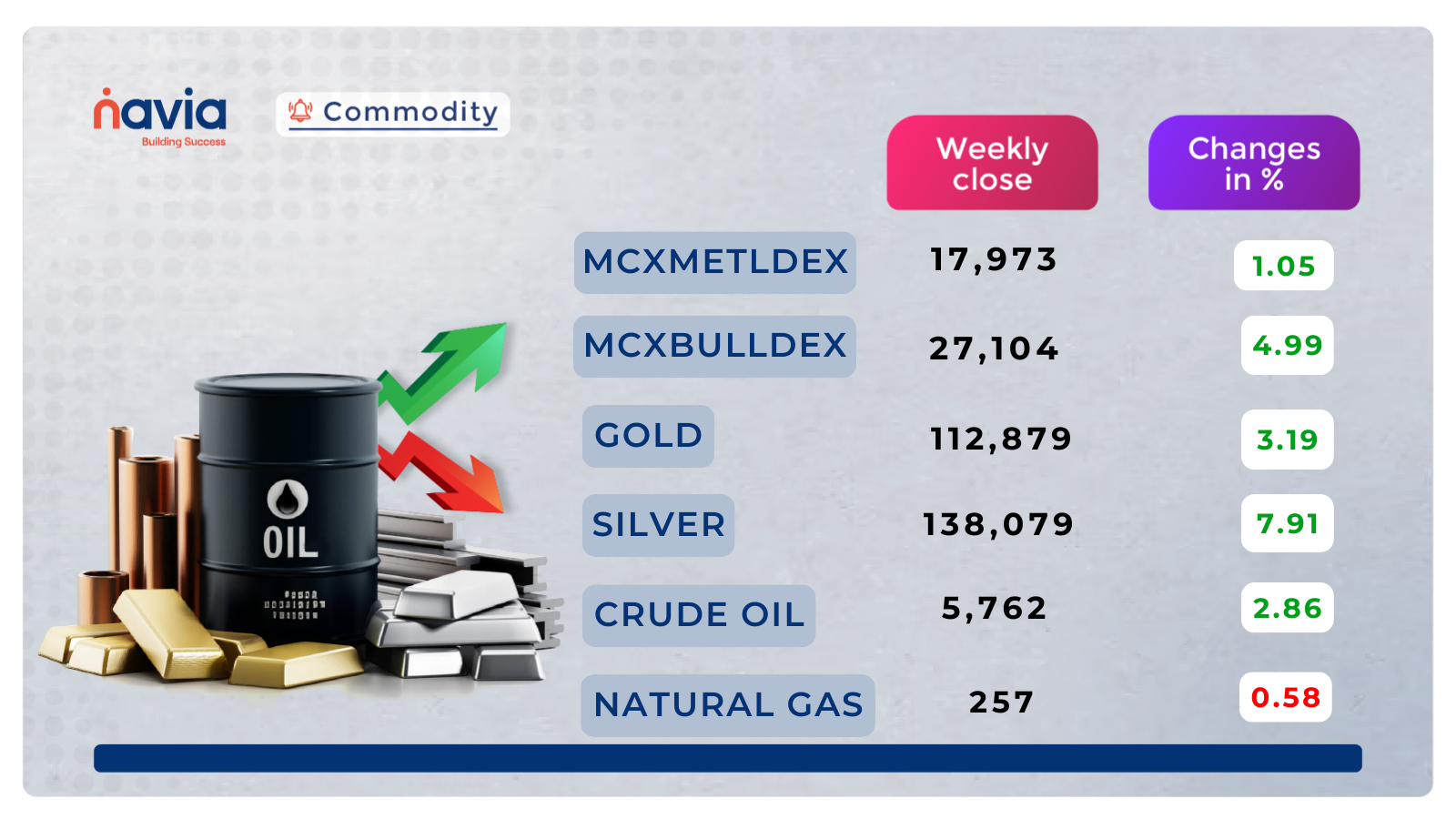

Commodity Corner

MCX Crude Oil futures an ascending trendline shows buyers are gradually stepping in. Price is now close to retesting the resistance near 5800. Last candles show bullish momentum, but nearing resistance. If it breaks above 5820 with volume, upside can extend towards 5950–6000. Failure to cross this level may lead to a pullback towards 5650–5600. As long as crude holds above 5600, momentum favors buyers. A decisive close above 5820 will confirm bullish breakout and target 5950–6000 range. Crude oil is in an uptrend but at a key resistance. Next move depends on whether 5820 breaks or holds.

In the last session, Gold closed at 112,879. MCX Gold futures is moving inside a rising parallel channel. After a strong rally, Gold corrected slightly but is holding the channel. Current price near lower trendline support (112,500–112,600), showing buyers stepping in. If price sustains above 112,500, momentum likely remains bullish. As long as price stays inside/upholding the rising channel, Gold remains in an uptrend. A close above 113,200 can fuel rally towards 114,500–115,000. If price breaks below 112,500 trendline support, then correction may deepen towards 111,000–109,000. Gold is in a strong uptrend but at a crucial support zone. Sustaining above 112,500 keeps bulls in control; losing this level could trigger profit-booking.

Natural Gas futures is trading around 257 after a small pullback. Stuck between 245 support and 278 resistance. As long as price holds above 245–250, Natural Gas may attempt another rally. Breakout above 278–280 could open room towards 290–300. If it slips below 245, downside pressure may extend towards 230–225. Natural Gas is in a sideways consolidation after breaking its downtrend. Watch for a decisive move above 278 will lead to a bullish breakout and below 245 a bearish breakdown.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Top Blogs of the Week!

Anchoring Bias in Investing – The Trap of Sticking to Old Prices

Anchoring Bias is the trap where investors fixate on a past price (like the purchase or IPO price), making decisions based on that irrelevant “anchor” instead of current fundamentals. It’s dangerous because it prevents objective decision-making, like forcing an investor to hold a weak stock too long just to “break even.” Overcome it by asking, “Would I buy this stock today?” and focusing purely on current data and future outlook.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?

DISCLAIMER: Investment in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Full disclaimer: https://bit.ly/naviadisclaimer.