Navia Weekly Roundup (Nov 03 – Nov 07, 2025)

- Week in the Review

- Indices Analysis

- Interactive Zone!

- Sector Spotlight

- Top Gainers and Losers

- Currency Chronicles

- Commodity Corner

- Top Blogs of the Week!

- N Coins Rewards

Week in the Review

The Indian benchmark indices ended lower for the second consecutive week on mixed corporate earnings, persistent FII selling and uncertainty over tariff discussions with US.

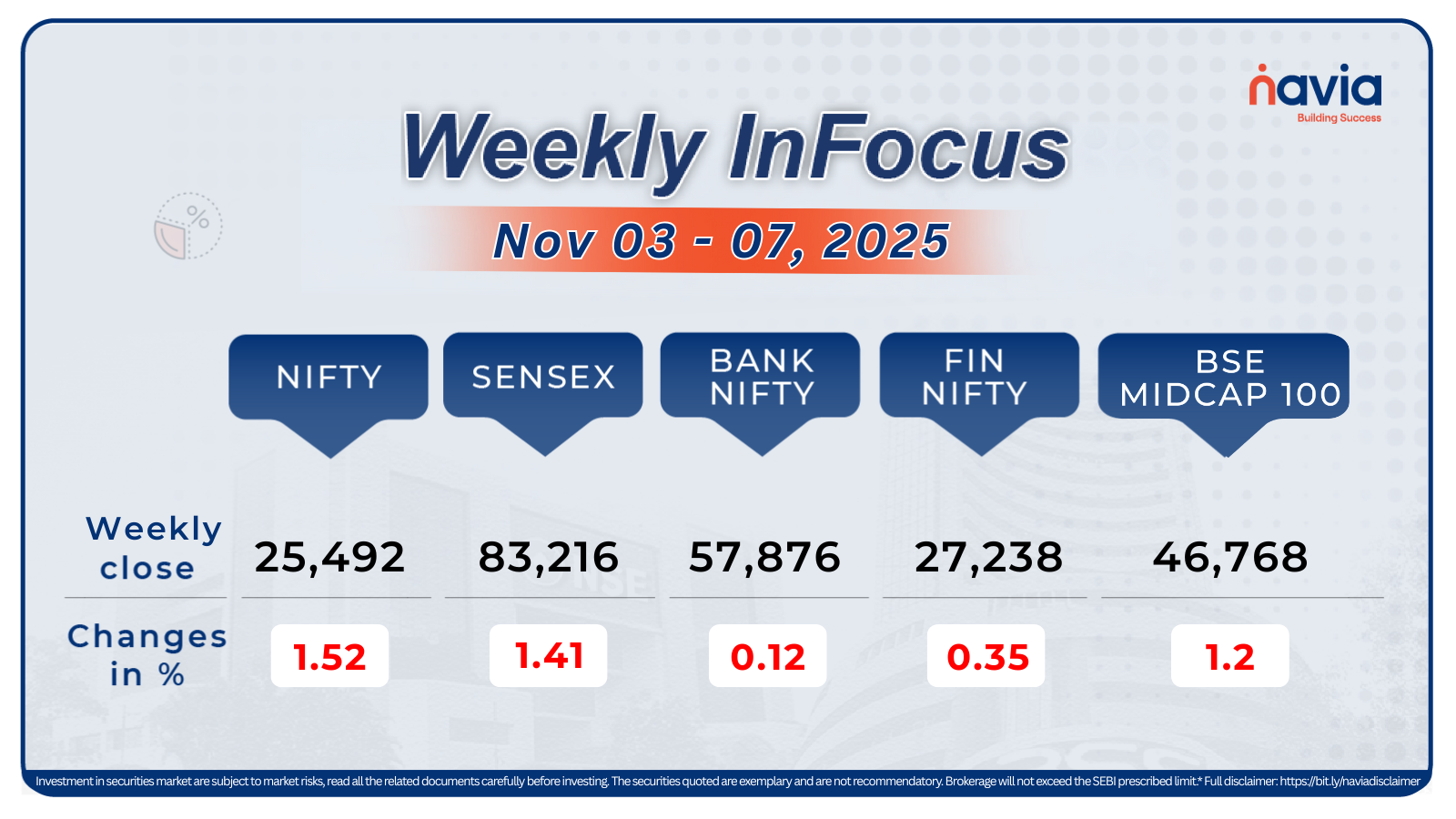

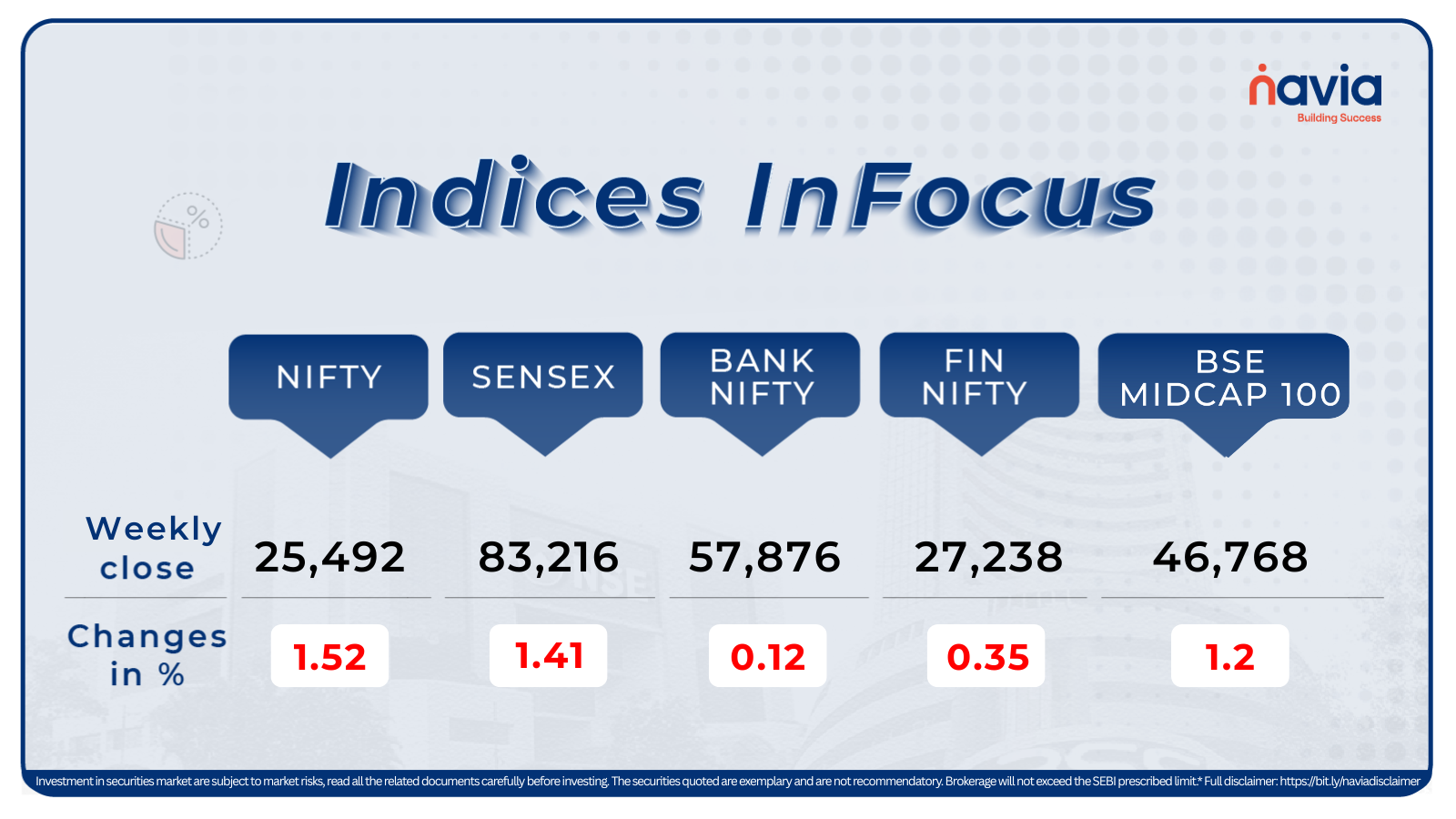

Indices Analysis

For the week, BSE Sensex index fell 1.41 percent to finish at 83,216.28 and Nifty50 shed 1.52 percent to end at 25,492.30.

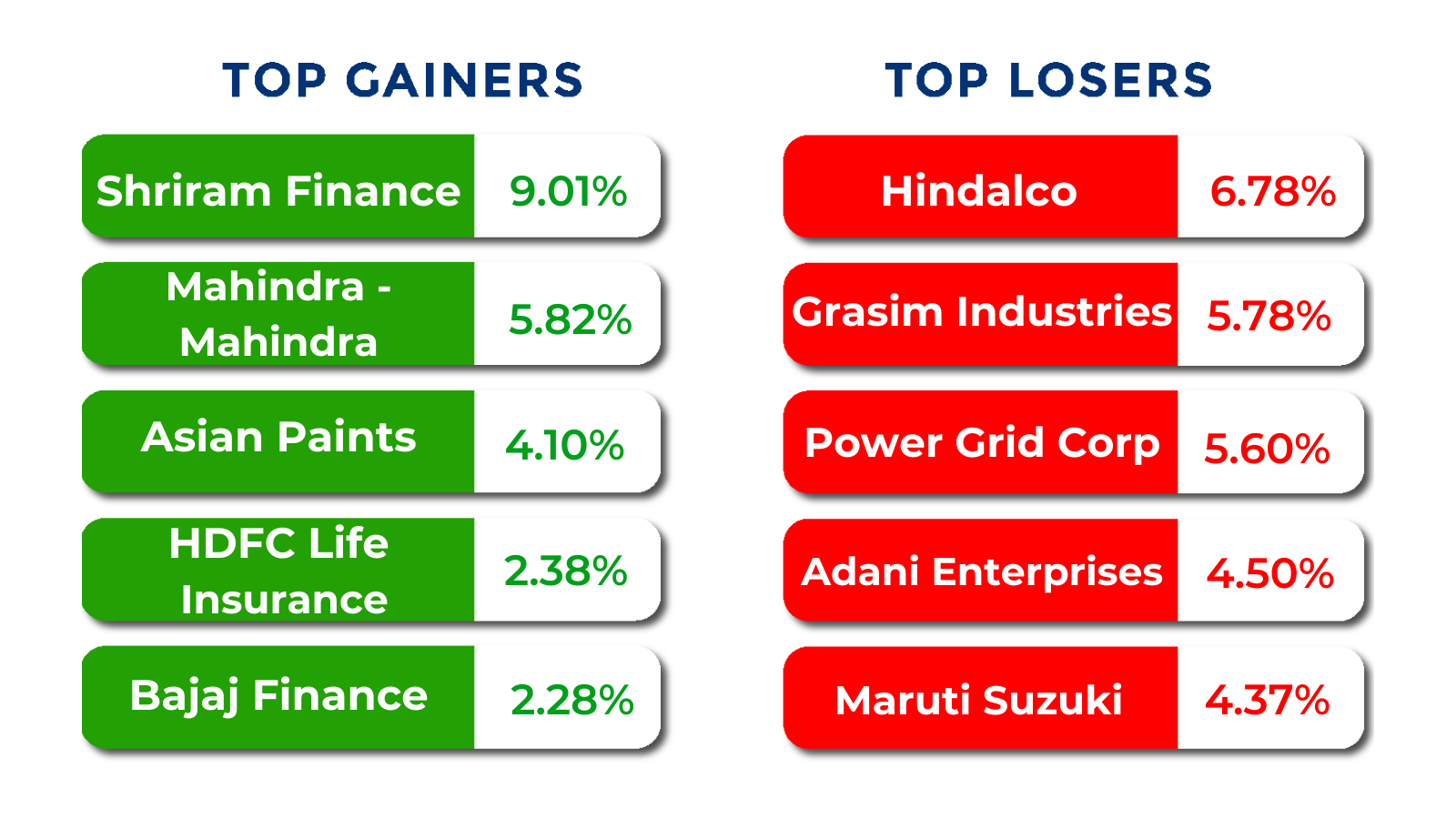

The BSE Large-cap Index shed nearly 1 percent dragged by Adani Green Energy, Hindalco Industries, Indian Hotels Company, Grasim Industries, Power Finance Corporation, Power Grid Corporation of India, Mankind Pharma, while Indus Towers, Vodafone Idea, Shriram Finance, Dabur India, Mahindra and Mahindra, Britannia Industries gained between 5-10 percent.

BSE Mid-cap Index declined 0.6 percent dragged by Blue Star, JK Cement, Delhivery, Kaynes Technology India, Clean Science & Technology, Ola Electric Mobility. However, 3M India, Hitachi Energy India, L&T Finance, Astral, Phoenix Mills, PI Industries gained between 5-10 percent.

The BSE Small-cap index fell 1.5 percent Worth Investment & Trading, Fischer Medical Ventures, Stallion India Fluorochemicals, Reliance Infrastructure, Bliss GVS Pharma, Utkarsh Small Finance Bank, VL E-Governance and IT Solutions, Reliance Power, Punjab Chemicals & Crop Protection shed between 15-46 percent. On the other hand, Thangamayil Jewellery, LG Balakrishnan and Brothers, Interarch Building Solutions, CCL Products India, BLS E-Services, ASM Technologies, Raghav Productivity Enhancers, IRIS Business Services, Privi Speciality Chemicals, Orchid Pharma, Dredging Corporation India, Redington added between 15-56 percent.

The Foreign Institutional Investors’ (FIIs) sold equities worth Rs 1,632.66 crore, while Domestic Institutional Investors (DII) bought equities worth Rs 16,677.94 crore.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

Sector Spotlight

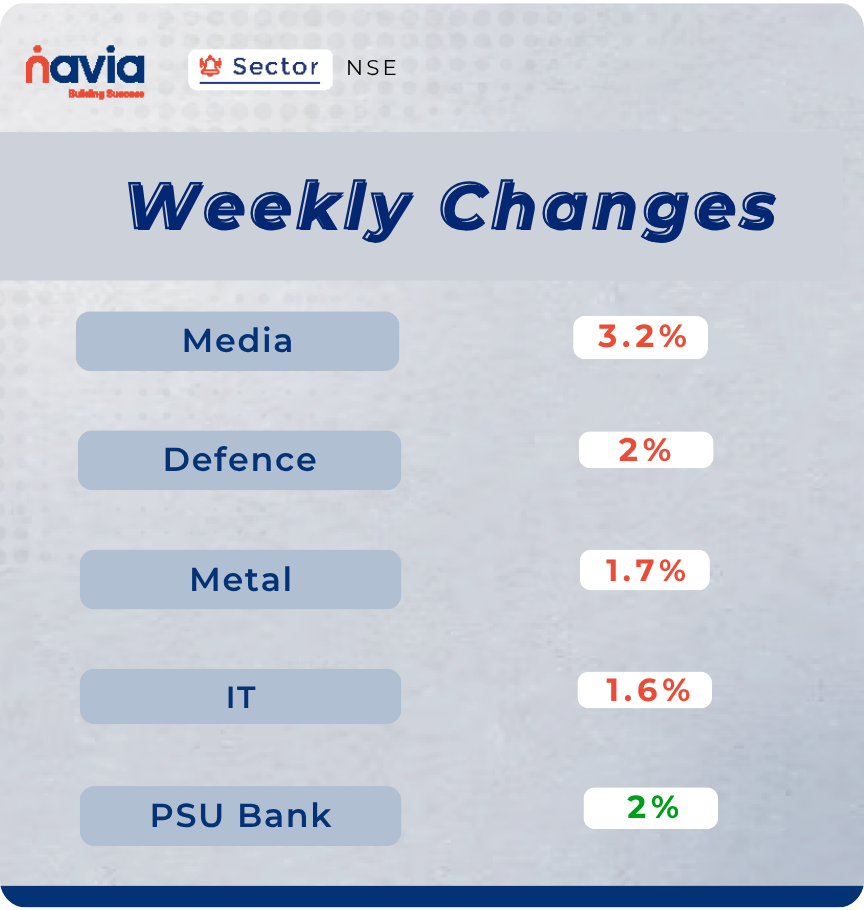

On the sectoral front, Nifty Media index shed 3.2%, Nifty Defence index fell 2%, Nifty Metal index declined 1.7%, Nifty IT index shed 1.6%, however, Nifty PSU Bank index gained 2%.

Top Gainers and Losers

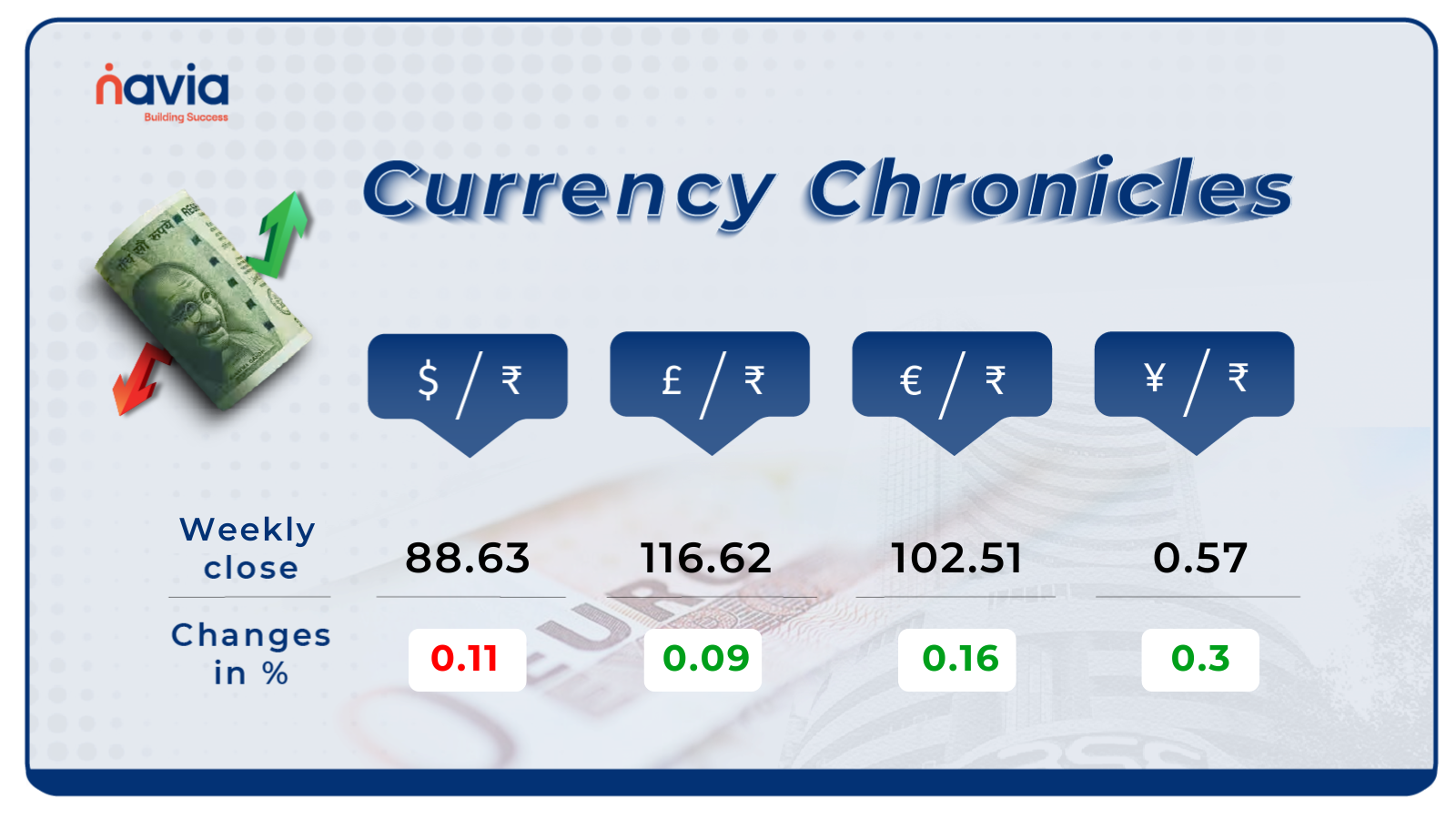

Currency Chronicles

USD/INR:

The USD/INR rate closed at ₹88.63 per dollar, losing 0.11% during the week, reflecting a bearish market sentiment.

EUR/INR:

The EUR/INR rate closed at ₹102.51 per euro, gaining 0.16% during the week, reflecting a bullish market sentiment.

JPY/INR:

The JPY/INR rate closed at ₹0.57 per yen, gaining by 0.3% during the week, reflecting a bulish market sentiment.

Stay tuned for more currency insights next week!

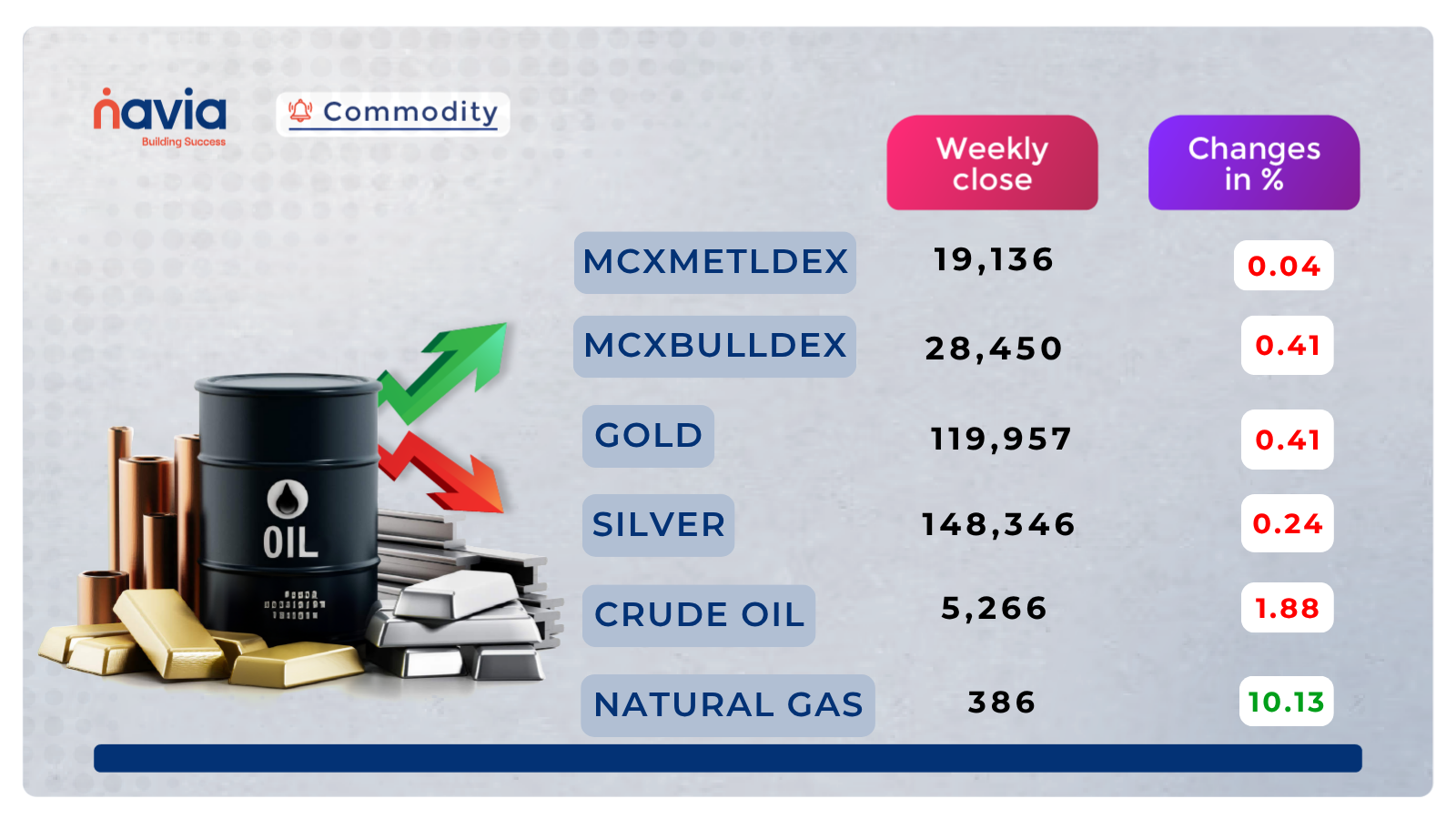

Commodity Corner

Crude Oil futures are currently trading near 5,259, hovering close to short-term support after multiple rejections from the descending trendline. The price continues to move in a lower high–lower low formation, signaling ongoing bearish momentum. Immediate support lies at 5,230–5,200, and a breakdown below this zone could trigger further downside toward 5,050–5,000.On the upside, 5,430–5,450 acts as a strong resistance. A sustained breakout above this level would indicate a reversal, opening the path toward 5,600. Until then, rallies may face selling pressure at higher levels.

In the last session, Gold closed at 119,957. Gold futures are trading near 120,700, showing mild weakness after facing rejection near the descending trendline resistance. The broader structure indicates that gold remains under selling pressure below 121,500, with strong support seen near 118,350. A breakout above 121,500–121,800 may trigger fresh upside momentum toward 124,400, while failure to cross this level could lead to continued consolidation or a slide toward 119,000–118,350. The trend remains neutral-to-bearish in the short term, with traders watching for a decisive breakout to confirm direction.

Natural Gas futures are currently trading 386, maintaining a strong bullish structure after a breakout from a falling wedge pattern. The recent breakout above 363 confirms bullish momentum, with price action now consolidating just below the next resistance zone at 394–400. Momentum indicators suggest mild overbought conditions, hinting at a possible short-term pullback toward 363–355, which would act as a strong demand zone. However, if prices sustain above 382–385, continuation toward 410–420 cannot be ruled out.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Top Blogs of the Week!

A Great Company ≠ A Great Investment

It’s a critical investment fallacy: a great company does not automatically equal a great investment. Even strong blue-chip firms can deliver poor returns if purchased at an inflated valuation (high P/E).

What Schools and Colleges Don’t Teach About Investing – The Behavioral Side

While schools teach the mechanics of finance and earning money, they fail to teach the most critical factor in investing: human behavior. Investing success is driven less by spreadsheets and more by Emotional Intelligence (EQ).

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?

DISCLAIMER: Investment in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Full disclaimer: https://bit.ly/naviadisclaimer.