Unlock the Magic of Muhurat Trading: A Comprehensive Guide

Introduction:

As we approach the festival of lights, Diwali, the Bombay Stock Exchange (BSE) has announced an eagerly awaited tradition for traders and investors – Muhurat Trading. This special trading session, also known as Mahurat Trading, is held on the auspicious occasion of Diwali. During this one-hour trading window, investors can make token trades, marking the start of the new Samvat (Hindu calendar year). Muhurat Trading is considered a good time to commence new ventures, including investing in the stock market. In this blog, we’ll delve into the significance, history, and details of Muhurat Trading, enabling even non-finance individuals to grasp its essence.

What is Muhurat Trading?

Before we explore the concept of Muhurat Trading, let’s understand the term “Muhurat.” In Hindu traditions, a Muhurat is an auspicious time when planetary alignments are believed to favor positive outcomes. Muhurat Trading is a customary practice in India, that takes place on the occasion of Diwali every year, there’s a one-hour window when it’s considered super lucky to invest in the stock market. This unique tradition is exclusive to the Indian stock markets.

Investors participating in Muhurat Trading believe that trading during this auspicious hour will bring them good luck and prosperity throughout the year. This practice aligns with the Indian cultural belief of invoking the blessings of Goddess Lakshmi, the deity of wealth and prosperity.

A Quick History Lesson:

Now, you might wonder where this tradition came from. Traditionally, stockbrokers usually open new accounts for their clients during the auspicious Muhurat. They’d even have a ritual where they’d worship their account books. There were some old beliefs that said Marwari traders sold stocks during Muhurat, thinking that money shouldn’t come into the house on Diwali. On the other hand, Gujarati traders bought stocks during this time. But today, this isn’t really a thing anymore.

Muhurat Trading has evolved into a symbolic gesture where people consider it an auspicious time to invest. Most Hindu investors perform a special prayer to Goddess Lakshmi and then invest in solid companies that they believe will do well in the long run.

What Happens During Muhurat Trading?

On Diwali, both the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE) open up for a short time. This one-hour session includes different parts:

1. Block Deal Session – In this session, two parties agree to buy or sell a security at a fixed price and report the transaction to the stock exchange.

2. Pre-Open Session –This session, lasting around eight minutes, determines the equilibrium price before the official trading commences.

3. Normal Market Session – The main one-hour trading session where most trading activity occurs.

4. Call Auction Session – Reserved for trading illiquid securities, defined by specific criteria set by the exchange.

5. Closing Session – Investors and traders can place market orders at the closing price, concluding the Muhurat Trading session.

When’s Muhurat Trading in 2023?

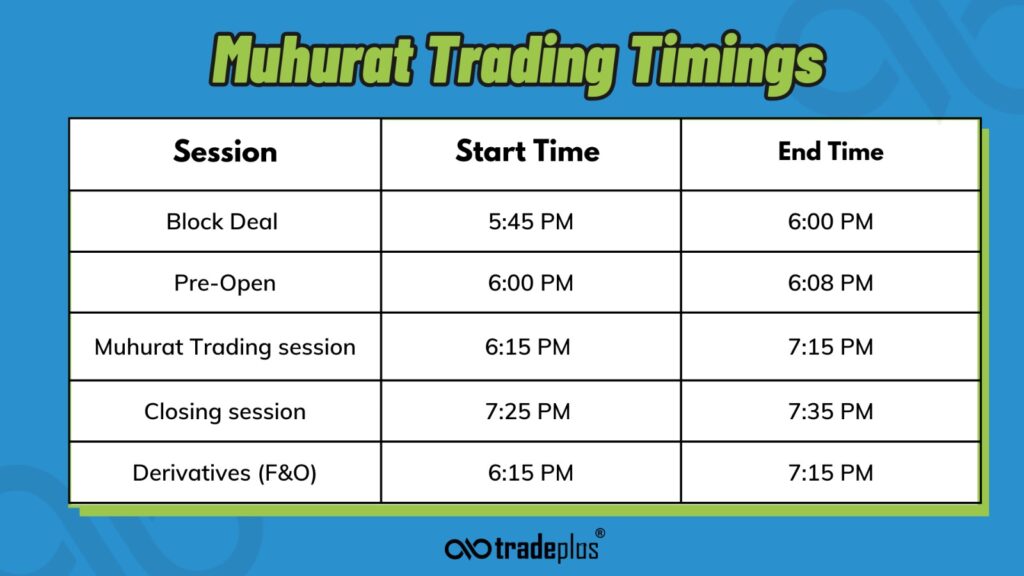

The Muhurat Trading session for 2023 is scheduled for November 12, 2023, falling on a Sunday. The actual timings will be notified in a separate circular by the exchanges, and they may vary. Historical data suggests that markets have been favorable on Muhurat Trading days in the past, offering short-term investment opportunities for risk-averse investors.

Note: The precise timings for Muhurat Trading will be notified by the BSE in the upcoming days, however, as a general practice, Muhurat Trading session typically takes place in the above mentioned timings.

Significance of Muhurat Trading:

Muhurat Trading holds great significance, serving as an opportunity for investors to initiate their investment journey on an auspicious note. It’s an ideal time for experienced investors to diversify their portfolios or increase their holdings in existing stocks. Over the last two Muhurat Trading sessions, both the Sensex and Nifty indices experienced gains, reflecting the optimistic spirit of the occasion.

Who Can Benefit from Muhurat Trading?

Muhurat Trading appeals to a broad spectrum of market participants:

1. First-Time Investors – For those who have never invested in stocks, Diwali presents a favorable day to begin. It aligns with the festive spirit of prosperity and wealth, making it an auspicious time to start your investment journey.

2. Long-Term Investors – Consider purchasing stocks of high-quality companies with a long-term horizon and in alignment with your investment plan.

3. New Traders – If you’re venturing into stock trading, observing the markets during Muhurat Trading and engaging in paper trading can be an essential way to familiarize yourself with the dynamics. Be cautious, as the limited trading window can lead to volatility.

4. Experienced Day Traders – Seasoned day traders can leverage this session by taking positions after careful consideration. Even if the main goal is the gesture itself and not making money, smart trading decisions can still lead to profits.

However, it’s essential to remember that Muhurat Trading is a one-hour session, and market movements can be volatile.

What to Keep in Mind:

Before participating in Muhurat Trading, here are some key considerations:

1. Auspicious Timing – Recognize that this period is considered auspicious for investments.

2. Timings – Muhurat Trading for 2023 will be held on November 12, 2023, and the markets will be closed on that day for Laxmi Puja.

3. Market Volatility – Muhurat Trading can be marked by market volatility with no specific direction. Therefore, keep resistance and support levels in mind when making trading decisions.

4. Stock Volumes – Opt for stocks with good trading volumes if you aim to profit from the session. The limited trading window makes liquidity crucial.

5. Fundamentals and Risk Tolerance – When you make investment decisions, think about a company’s basics, and stick to your investment plan while considering how much risk you’re comfortable with

6. Settlement Obligations – Any open positions at the end of the trading session will result in settlement obligations.

Muhurat trading this year for Equities, Equity F&O, Currency F&O, and Commodities will be conducted on Sunday, November 12, 2023

| Equity Segment | |||||

| Market Schedule | Start Time | End Time | |||

| Pre-Open | 6:00 PM | 6:08 PM | |||

| Normal Market | 6:15 PM | 7:15 PM | |||

| Closing Session | 7:25 PM | 7:35 PM | |||

| Derivative segment | |||||

| F&O, Currency, MCX | 6:15 PM | 7:15 PM | |||

Any Derivative credits (i.e. premium from options sold, marked-to-market profit, intraday profits, etc.) from November 10th and intraday equity profits from November 10th will not be included in the available funds during the Muhurat trading session due to the Settlement Holiday.

All intraday positions will be squared off 15 mins prior to market closing. After Market Orders (AMO) will be collected until 5:50 PM for All segments on November 12th to be placed in the Muhurat trading session.

In conclusion, Muhurat Trading is a unique and culturally significant tradition in the Indian stock market. It offers an opportunity to start your investment journey on a positive note and allows experienced investors to make strategic moves. While it’s celebrated for its auspiciousness, always remember that investing wisely is key to long-term success in the stock market. So, as you prepare for the upcoming Muhurat Trading session, Mix the excitement of the occasion with smart decisions to build a bright financial future.

Happy investing and a very happy Diwali!