Forget Indicators: How to Trade the Market Using Pure Price Action

- What is Price Action?

- Why Choose Price Action?

- Price Action Trading Strategies

- Step-by-Step: How Price Action Works in the Stock Market

- Conclusion

- Frequently Asked Questions

In the stock market, there are mountains of complex indicators, oscillating lines, and confusing mathematical formulas. Some traders use a much simpler approach; they look at the raw movement of the price itself. The methodology is called price action.

If you looked at a naked chart and wondered, “what is price action?” or “how price action works in the stock market?”, you are in the right place. This guide will break down everything you need to know to start trading with price action effectively.

What is Price Action?

Let’s start from the beginning, what is price action? It is the study of the movement of security prices over time. Instead of relying on lagging indicators like moving averages or RSI, price action helps to analyze the patterns formed by the price itself, primarily through candlesticks. And it also predicts future market movements.

Now, you have the confusion of “what price action signals should I look for?”. You are essentially looking for the ‘footprints’ of big institutional buyers and sellers. How price action trading works, actually that determines the balance of supply and demand.

In simple words, if the price is making higher highs and higher lows, the bulls are in control; if it’s making lower highs and lower lows, the bears have the upper hand.

Why Choose Price Action?

Before diving into specific price action trading strategies, it is important to know why this method is so popular. Here you can see some of the features that make the method always first in action.

🔸 Relevance: Indicators are “lagging,” meaning they tell you what has already happened. Price action is “leading” because it tells you what is happening now.

🔸 Clarity: It removes the “noise” from your charts. A clean chart allows you to see support and resistance levels clearly.

🔸 Versatility: Whether you are day trading, swing trading, or investing for the long term, price action works across all timeframes and asset classes.

After understanding the features of price action trading, people have the doubt of, “is price action trading profitable?” The answer is yes, because the price action focuses on the source of the data (the price); it often provides better entry and exit points than indicator-based systems.

Price Action Trading Strategies

To master what price action trading you need to recognize the structures the market builds. Here you can see some of the strategies (for educational purpose only) for beginners before starting trading.

Support and Resistance Levels

We can call support and resistance levels like a “bread and butter” of price action. Support is a price level where a downtrend tends to pause due to a concentration of demand (buying power). Resistance is the opposite, a level where an uptrend pauses due to a concentration of supply (selling power).

How to Trade it: Look for the price to “bounce” off these levels. A bullish candlestick at support or a bearish candlestick at resistance provides a high-probability entry.

The Breakout Strategy

We know that the market doesn’t stay in a range forever. When the price moves convincingly above a resistance level or below a support level, it is called a breakout.

How to Trade it: Wait for a strong “candle close” outside the level. Many traders wait for a retest (where the price comes back to touch the broken level) before entering to ensure the move is genuine.

Trendlines and Channels

Prices rarely move in a straight line; they move in waves. By drawing trendlines connecting the lows in an uptrend or the highs in a downtrend, you can visualize the “path of least resistance”.

How to Trade it: Buying at the touch of a rising trendline is a classic price action setup that allows for a tight stop-loss and high reward.

Candlestick Patterns

How price action works in stock market psychology is best seen through individual candles.

🔹 The Pin Bar: A candle with a long “tail” or “wick” suggests a rejection of a certain price level.

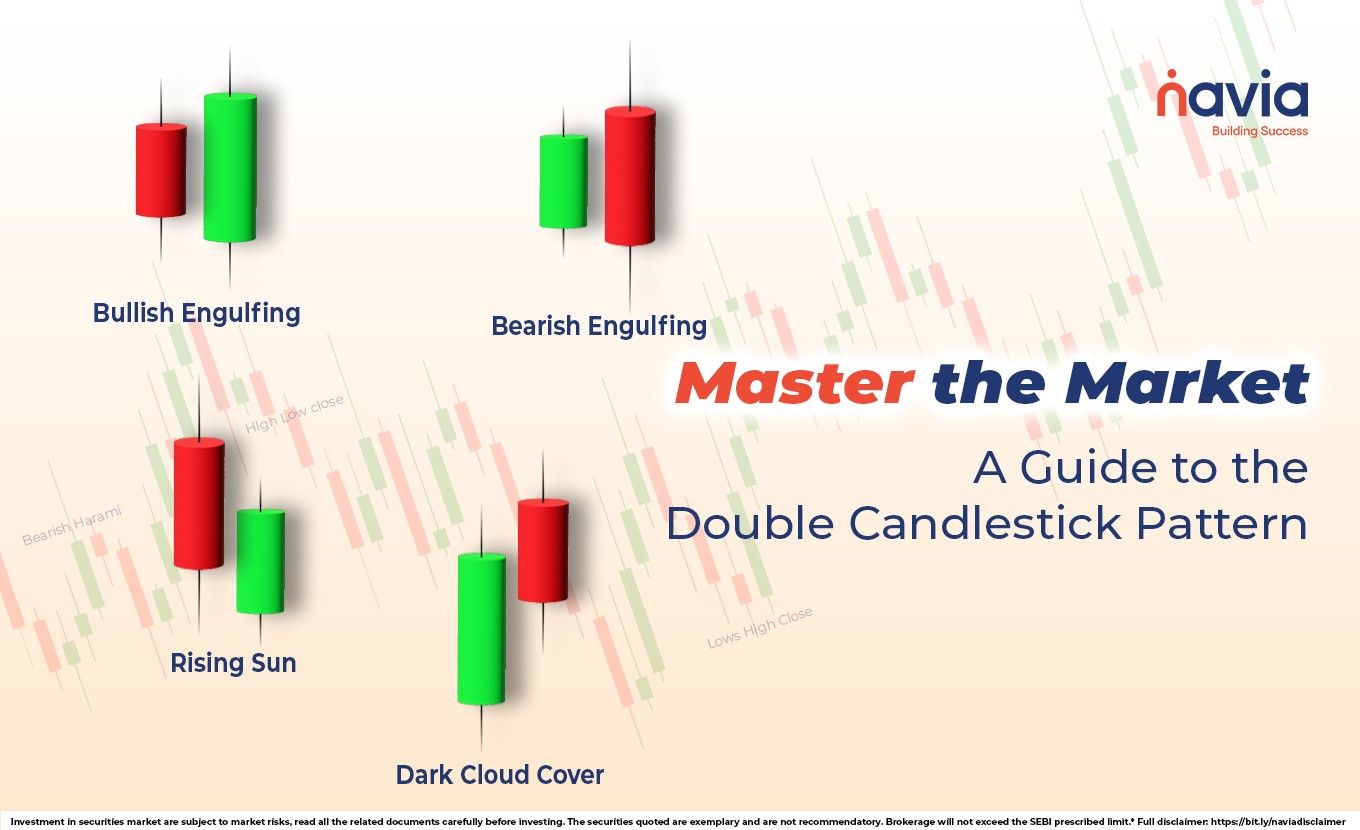

🔹 Engulfing Patterns: When a large candle completely “swallows” the previous candle, it signals a massive shift in momentum.

Step-by-Step: How Price Action Works in the Stock Market

If you are ready to start trading with price action, follow this simplified workflow:

| Clean Your Charts | Remove all indicators that don’t add value. Focus on the candlesticks. |

| Identify the Trend | Look at the higher timeframes (like the Daily or 4-Hour chart) to see the overall direction. |

| Mark Key Levels | Draw your horizontal support and resistance lines based on historical “turning points” where the price reacted strongly. |

| Wait for a Signal | Don’t just trade because the price is at a level. Wait for a “trigger” candle like a Pin Bar or an Engulfing pattern to confirm the rejection. |

| Manage Risk | Even though price action is powerful, no trade is 100% certain. Always place a stop-loss beyond the signal candle or the support/resistance level. |

Conclusion

Mastering what is price action is the first step toward becoming a self-reliant trader. By focusing on the raw movement of the market, you learn to listen to what the “Big Boys” are doing in real-time. Whether you are using breakouts, retests, or candlestick rejections, price action trading strategies offer a timeless way to navigate the complexities of the stock market.

The market tells a story through every tick and every candle. Your job as a price action trader is to learn that language, stay patient, and wait for the market to reveal its next move.

Do You Find This Interesting?

Frequently Asked Questions

What is price action trading?

Is price action trading profitable?

Yes, many professional and institutional traders rely on it exclusively. However, its profitability depends on your discipline. While price action gives cleaner signals than indicators, it requires practice to overcome subjectivity and strictly manage your risk-to-reward ratios.

Can AI predict price action movements?

By leveraging historical data, financial reports, and sophisticated market indicators, AI-driven predictive models can forecast future stock price movements and pinpoint high-probability trading opportunities. This technology empowers investors to move beyond guesswork, facilitating data-backed decisions on the optimal timing for buying or selling assets.

What are the 7 pricing strategies?

Businesses utilize various pricing models, including price skimming, penetration, cost-plus, value-based, competitive, dynamic, and bundle pricing, to strategically set rates based on production costs, consumer perceived value, competitor behavior, or shifting demand.

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.