A Comprehensive Guide to Investing in Nifty 50 BeES ETF

Nifty 50 BeES ETF, managed by Nippon India Asset Management Ltd, is one of the most popular exchange-traded funds (ETFs) in India. It is designed to provide investors with returns that closely correspond to the total returns of the Nifty 50 Index, India’s benchmark equity index. In this blog, we will explore the benefits of investing in Nifty 50 BeES, how it aligns with modern stock market investing strategies, and why it is a smart choice for both beginner and seasoned investors. We’ll also highlight how using the Navia Zero Brokerage Stock Investing APP can make investing in this low-cost ETF more accessible and cost-effective.

What is Nifty 50 BeES?

Nifty 50 BeES is an exchange-traded fund (ETF) that tracks the performance of the Nifty 50 Index, one of India’s most recognized stock market indices. This ETF was launched in 2001 and has since grown to be a trusted vehicle for investors looking for systematic stock market investing.

Investment Objective: The fund’s objective is to provide returns that, before expenses, mirror the total returns of the Nifty 50 Index. This makes it ideal for investors looking to diversify their portfolios while participating in the growth of India’s largest and most stable companies.

Why Choose Nifty 50 BeES for Stock Market Investing?

Diversified Exposure

Nifty 50 BeES provides investors with exposure to 50 of India’s largest and most liquid companies. The Nifty 50 Index represents approximately 65% of the free-float market capitalization of the stocks listed on the NSE, making it a barometer of the Indian economy.

By investing in Nifty 50 BeES, you gain access to a well-diversified portfolio across sectors such as financial services, technology, energy, and consumer goods. This diversification helps mitigate risk, as underperformance in one sector may be offset by gains in another.

Cost-Efficiency

One of the main advantages of investing in an ETF like Nifty 50 BeES is the low cost associated with it. Unlike actively managed funds, ETFs passively track an index, which leads to lower management fees. The expense ratio of Nifty 50 BeES is just 0.04%, making it one of the most cost-effective ways to invest in the Indian stock market.

In comparison to traditional mutual funds, where management fees can eat into your returns, this low-cost ETF allows you to maximize your profits over the long term. This aligns with the growing trend of low-cost ETFs becoming a preferred vehicle for stock market systematic investing.

Zero Brokerage with Navia

Another advantage of investing in Nifty 50 BeES is the opportunity to enjoy zero brokerage fees on all ETF trades when using the Navia Zero Brokerage Stock Investing APP. Whether you’re investing through SIPs or making lump sum investments, you can avoid brokerage fees that typically reduce your net returns.

Navia’s zero brokerage offering allows you to buy and sell Nifty 50 BeES without any trading costs, making it more accessible for investors, particularly those looking to invest in low-cost ETFs.

Systematic Investing with SIP

Investors can opt for a Systematic Investment Plan (SIP) in Nifty 50 BeES through free ETF baskets provided by Navia, which allows them to invest small amounts regularly. This strategy, known as stock market systematic investing, is a great way to build wealth over time without the need for large upfront capital.

With Navia, you can easily set up a SIP for Nifty 50 BeES, starting with as little as 1 unit. SIPs enable investors to take advantage of market fluctuations through rupee cost averaging, reducing the impact of market volatility and helping you accumulate units over time.

Liquidity and Flexibility

ETFs like Nifty 50 BeES are traded on the stock exchange, which means they offer the same liquidity and flexibility as individual stocks. Investors can buy or sell units of the ETF at any time during market hours. This liquidity allows you to react swiftly to market conditions, providing greater control over your investment.

Moreover, the Navia Zero Brokerage Stock Investing APP allows you to track real-time prices, place orders, and manage your portfolio seamlessly. Whether you’re an active trader or a long-term investor, the flexibility offered by ETFs like Nifty 50 BeES makes them an attractive investment option.

Key Holdings and Sector Breakdown

As of August 2024, Nifty 50 BeES had the following top holdings, which together account for over 55% of the fund’s total assets:

| Company | Sector | Weightage |

| HDFC Bank Ltd | Financial Services | 11.00% |

| Reliance Industries Ltd | Energy | 9.11% |

| ICICI Bank Ltd | Financial Services | 7.72% |

| Infosys Ltd | Technology | 6.26% |

| ITC Ltd | Consumer Defensive | 4.14% |

The fund is diversified across key sectors, providing exposure to financial services (32.60%), technology (14.17%), energy (12.68%), and consumer goods (8.47%). This broad sector exposure ensures that investors are not overly reliant on the performance of a single sector, thereby balancing risks and returns.

Performance Overview

Nifty 50 BeES has delivered competitive returns over various time periods:

1-Year Return: 33.81%

3-Year Annualized Return: 14.62%

5-Year Annualized Return: 19.04%

These returns make Nifty 50 BeES an attractive option for investors seeking long-term capital appreciation. Its track record of consistent performance highlights its effectiveness in delivering returns closely aligned with the Nifty 50 Index.

Risk Measures

While ETFs generally carry market risks, Nifty 50 BeES exhibits a relatively stable risk profile compared to other equity instruments. Some of the key risk measures include:

3-Year Beta: 0.96 (indicating slightly less volatility than the market)

3-Year Sharpe Ratio: 0.76 (suggesting favorable risk-adjusted returns)

These risk metrics indicate that Nifty 50 BeES is well-suited for investors looking for exposure to large-cap Indian stocks while maintaining a manageable risk profile.

Why Nifty 50 BeES is a Smart Choice for Investors

In conclusion, Nifty 50 BeES offers a low-cost, diversified, and flexible way to invest in the Indian stock market. Whether you’re a seasoned investor or a beginner, this ETF provides an easy and cost-effective way to participate in the growth of India’s top companies.

By investing in Nifty 50 BeES through the Navia Zero Brokerage Stock Investing APP, investors can further enhance their returns by eliminating brokerage fees and leveraging tools for systematic investing, like stock SIPs. With zero brokerage, free SIP Basket options, and real-time portfolio management, Navia makes it easier than ever to invest in low-cost ETFs and build a robust investment portfolio.

Here is a list of other NIFTY ETF’s and their returns as on 28th September 2024

| ETF Name | 30 Day Return | 365 Day Return | Live NAV |

| NAVINIFTY (Navi Nifty 50 ETF) | 6.17% | 35.69% | Click here |

| HDFCNIFTY (HDFC Nifty 50 ETF) | 4.62% | 35.18% | Click here |

| SETFNIF50 | 4.70% | 35.29% | Click here |

| NIFTYBEES (Nifty 50 ETF) | 4.67% | 35.32% | Click here |

| NIFTYIETF (ICICI Prudential Nifty 50 ETF) | 4.91% | 35.48% | Click here |

| BSLNIFTY (Aditya Birla Sun Life Nifty 50 ETF) | 4.52% | 35.47% | Click here |

| UTINIFTETF (UTI Nifty 50 ETF) | 4.43% | 35.09% | Click here |

| IDFNIFTYET (IDFC Nifty 50 ETF) | 4.94% | 35.50% | Click here |

Steps to Set up SIP for NIFTY 50 BeES ETF on Navia APP

1.Download and Log In to the Navia app.

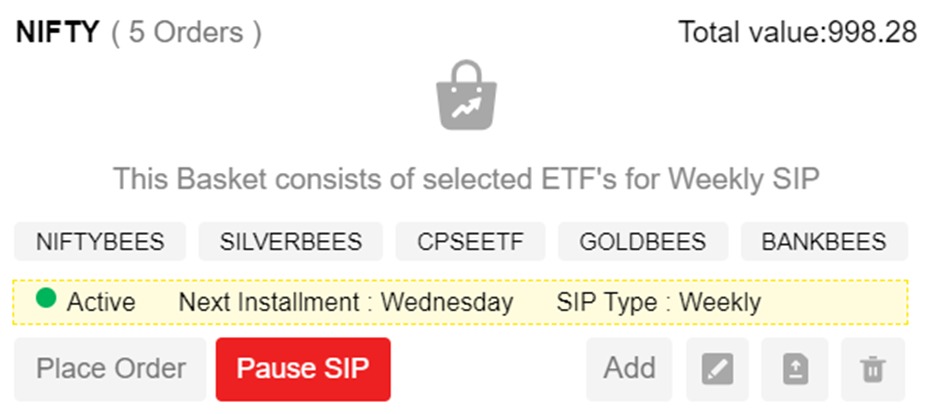

2. Goto Tools->Basket and create a Basket with name of your choice. Setup a Weekly or Monthly SIP. If you are setting a weekly SIP, select the day of the week. If you are setting a monthly SIP, selected the day of the month for the SIP to be executed.

3. Use the Add option to add Nifty 50 beEs to the basket and select the quantity and price. Market price is most preferable if you are setting a SIP.

4. Confirm and Activate the SIP. You can always Pause the SIP when needed. You can also edit the Stock price and QTY in the SIP by using the Edit option.

With zero brokerage, setting up a SIP on the Navia app is cost-effective and hassle-free, making it an excellent option for long-term investors. Navia also provides FREE Ready made ETF baskets for hassle free SIP investment on selected TOP ETF’s. To know more about these curated basket click here

If you’re looking for a reliable, long-term investment option with low costs and strong returns, Nifty 50 BeES is an excellent choice for your portfolio. Happy investing!

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.

We’d Love to Hear from you