Navigating the December IPO Buzz: Opportunities for Everyone

Introduction

December is a special month for companies wanting to go public, known as Initial Public Offerings (IPOs). This time of year is chosen strategically as it aligns with increased positivity from the holiday season and year-end financial reviews. Investors eagerly look forward to December IPO as a chance to invest early in exciting new companies.

Overview of the IPO Market

The current IPO market is buzzing with eight standout companies offering unique investment opportunities. Let’s take a closer look at a few of them:

1. Muthoot Microfin Limited

Target: Rs 960.00 crores

Focus: Providing micro-loans to rural women for livelihood, improvement, and health.

Minimum Investment for Retail Investors: ₹14,841 (51 shares)

About the Company: Muthoot Microfin Limited, a part of the Muthoot Pappachan Group, has been specializing in microfinance since its establishment in April 1992. With a commitment to empowering rural women, they aim to use funds raised from the IPO to strengthen their capital for future endeavors.

2. Suraj Estate Developers Limited

Target: Rs 400.00 crores

Specialization: Building real estate in South Central Mumbai.

Minimum Investment for Retail Investors: ₹14,760 (41 shares)

About the Company: Suraj Estate Developers Limited, established in 1986, has successfully completed 42 projects in South Central Mumbai. Their unique approach involves relying entirely on third-party contractors for construction services, distinguishing them in the competitive real estate market.

3. Motisons Jewellers Limited

Target: Rs 151.09 crores

Products: Diverse range of jewelry.

Minimum Investment for Retail Investors: ₹13,750 (250 shares)

About the Company: Motisons Jewellers Limited, founded in October 1997, is a renowned jewelry brand offering a wide range of designs, including gold, diamond, and kundan jewelry. With an extensive collection of over 300,000 designs, the company aims to utilize funds from the IPO for loan repayment, working capital, and general corporate purposes.

4. Happy Forgings Limited

Target: Rs 1,008.59 crores

Specialization: Designing and manufacturing heavy forgings.

Minimum Investment for Retail Investors: ₹14,450 (17 shares)

About the Company: Happy Forgings Limited, incorporated in July 1979, is a heavyweight in heavy forgings and high-precision machined components. With a product range including crankshafts, front axle carriers, and transmission parts, the company plans to use funds from the IPO to acquire new equipment, settle outstanding debts, and for general corporate purposes.

5. Mufti Menswear (Credo Brands Marketing Limited)

Target: Rs 549.78 crores

Products: Casual men’s clothing.

Minimum Investment for Retail Investors: ₹14,840 (53 shares)

About the Company: Credo Brands Marketing Limited, established in 1999, is the company behind the popular “Mufti” brand. Offering a wide range of casual men’s clothing, the company has grown from its initial offerings of shirts, T-shirts, and trousers to a comprehensive collection including sweatshirts, jeans, jackets, and more.

6. RBZ Jewellers Limited

Target: Rs 100.00 crores

Specialization: Antique gold jewelry.

Minimum Investment for Retail Investors: ₹15,000 (150 shares)

About the Company: RBZ Jewellers Limited, established in April 2008, is an Indian gold jewelry manufacturer known for its antique designs, particularly in jadau, meena, and kundan work. With a reach across 19 states and 72 cities in India, the company aims to use funds from the IPO for working capital and general corporate purposes.

7. Azad Engineering Limited

Target: Rs 740.00 crores

Specialization: Aerospace components.

Minimum Investment for Retail Investors: ₹14,672 (28 shares)

About the Company: Azad Engineering Limited, founded in 1983, is a manufacturer specializing in aerospace components and turbines. Serving sectors like aerospace, defense, energy, and oil and gas, the company plans to use funds from the IPO for capital expenditure, debt repayment, and general corporate purposes.

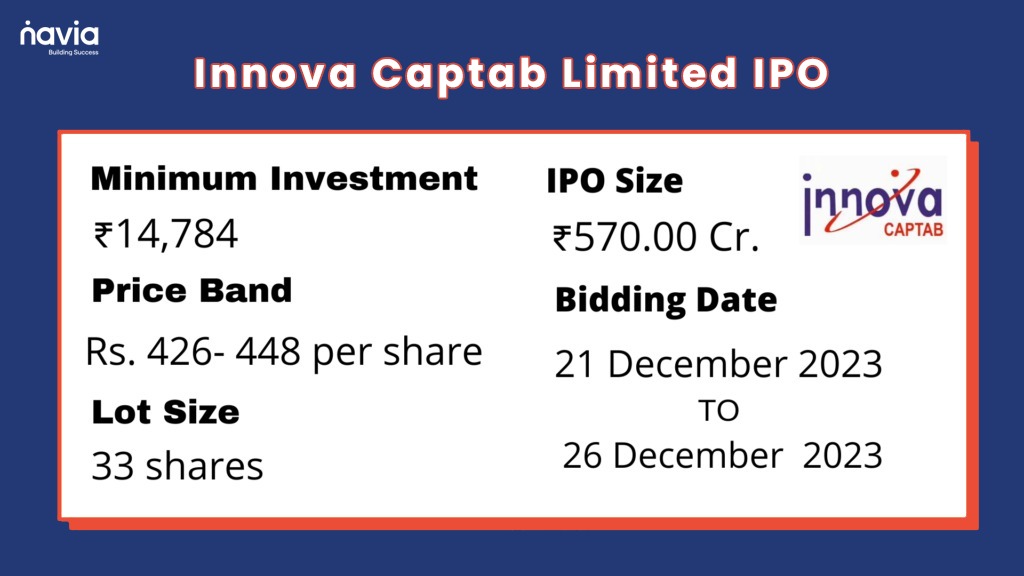

8. Innova Captab Limited

Target: Rs 570.00 crores

Operations: Pharmaceutical industry.

Minimum Investment for Retail Investors: ₹14,784 (33 Shares )

About the Company: Innova Captab Limited, established in January 2005, operates in three key segments within the pharmaceutical industry. With a product range including tablets, capsules, dry syrups, dry powder injections, ointments, and liquid medicines, the company aims to use funds from the IPO for loan repayment, subsidiary investment, working capital, and general corporate purposes.

Anticipated IPOs in December

1. AIK Pipes and Polymers Limited IPO

Total Issue Size: Rs 15.02 crores

Subscription Period: December 26 to December 28, 2023

Tentative Listing Date: January 2, 2024

Fixed Price: ₹89 per share

Minimum Lot Size for Retail Investors: 1600 shares (₹142,400)

2. Shri Balaji Valve Components Limited IPO

Issue Size: Rs 21.60 crores

Subscription Period: December 27 to December 29, 2023

Tentative Listing Date: January 3, 2024

Price Range: ₹95 to ₹100 per share

Minimum Lot Size for Retail Investors: 1200 shares (₹120,000)

3. Kay Cee Energy & Infra Limited IPO

Issue Size: Rs 15.93 crores

Subscription Period: December 28, 2023, to January 2, 2024

Tentative Listing Date: January 5, 2024

Price Band: ₹51 to ₹54 per share

Minimum Lot Size for Retail Investors: 2000 shares (₹108,000)

Ongoing IPOs:

After a robust November 2023, ongoing IPOs continue to energize the Indian market, with major players like Tata Technologies, Indian Renewable Energy Development Agency, Gandhar Oil Refinery, Fedbank Financial Services, and Flair Writing Industries. The market dynamics are shaped by strong sectors like technology and consumer discretionary.

Considerations for Investors:

Before jumping into the vibrant Indian IPO market, folks should consider a few things:

(i) Understand Market Trends: Focus on growth stocks, especially in technology and consumer discretionary sectors.

(ii) Assess Historical Performance: Look at how recent IPOs are performed to understand potential returns and risks.

(iii) Research Company Fundamentals: Check the financial health, business models, and growth prospects of companies going public.

(iv) Align Goals and Risk Tolerance: Make sure your investment goals and risk tolerance match the characteristics of each IPO.

(v) Seek Professional Advice: Stay informed about market dynamics and consider seeking professional advice for a well-rounded investment strategy.

Conclusion

In conclusion, December’s IPO lineup paints a picture of various stories, from supporting rural communities to creating timeless jewelry and exploring aerospace innovation. Each company provides a distinct chance for you to join in their growth. As you think about stepping into the world of investing, keep in mind to stay updated about market trends, look at how companies have done in the past, and make sure your goals match the right IPO. Getting advice from professionals can be like having a guide on your journey. Enjoy the excitement of investing and may your exploration of the IPO world be both fruitful and filled with smart choices. Happy investing!

We’d Love to Hear from you-

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.