Navia Weekly Roundup (Apr 01- Apr 05, 2024)

Week in the Review

During the tumultuous first week of the new financial year, Indian equity indices surged to unprecedented levels amidst fluctuating global signals. This was driven by a combination of factors including cautious statements from Fed officials regarding future rate cuts, increased yields, escalating crude oil prices, and the RBI policy outcome falling in line with expectations.

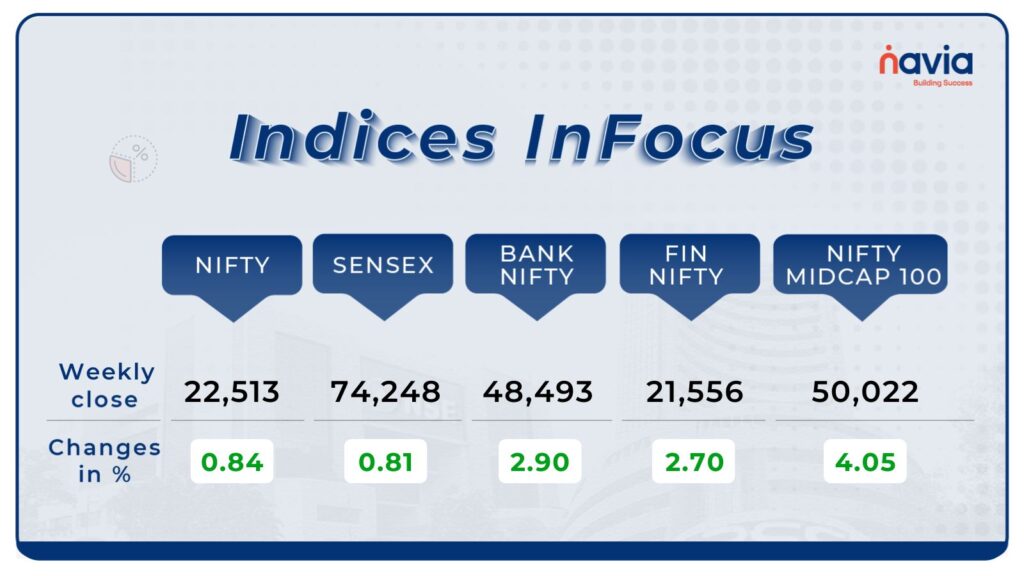

Indices Analysis

Nifty50 & Bank Nifty: Surging to New Heights

This week’s market headlines are dominated by the remarkable performances of both the Nifty50 and Bank Nifty indices. The Nifty50 index surged by 186.8 points or 0.83 percent, closing at a new high of 22,513.70, touching a peak of 22,619. Meanwhile, the Bank Nifty index also made significant strides, propelling the market to new heights.

Interactive Zone!

Last week’s poll:

Q) Stock exchange help in?

a) Providing liquidity to existing securities

b) Contributing to economic growth

c) Pricing of securities

d) All of the above

Last week’s poll answer: d) All of the above

Poll for the week:

Q) Blue chips stocks are the…

a) Stocks which are undervalued and trading below their intrinsic value.

b) Stocks of nationally recognized, well established and financially sound companies.

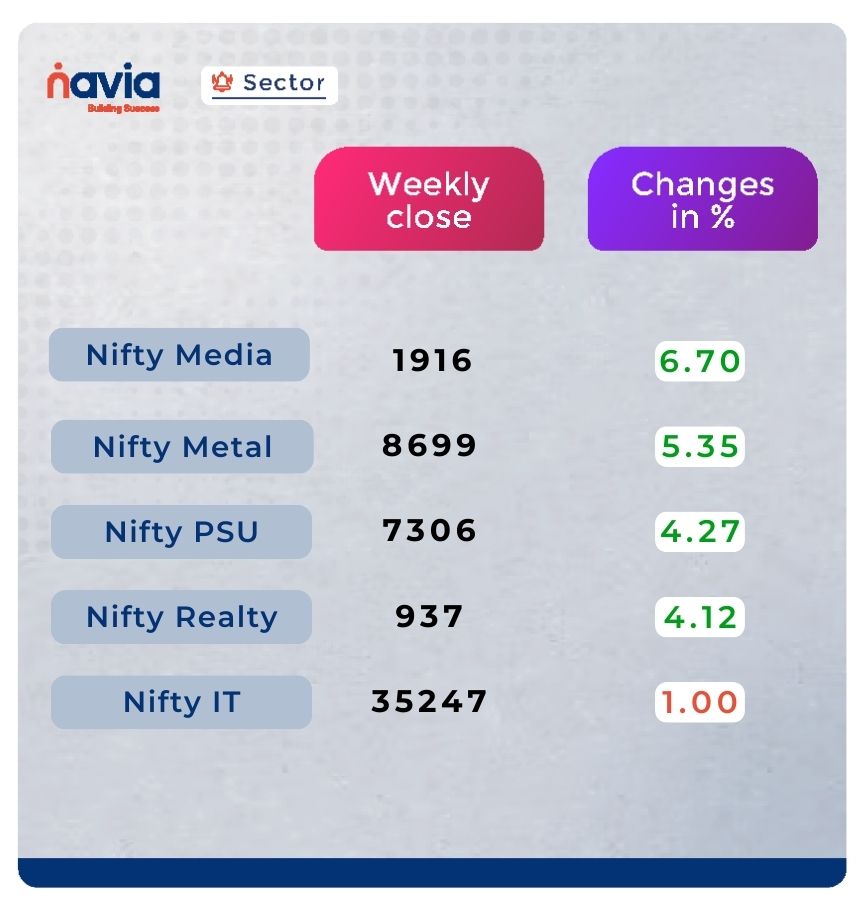

Sector Spotlight

This week’s Sector Spotlight brings exciting news as several sectors experienced significant gains. The Nifty Media index soared by an impressive 6.7 percent, signaling potential opportunities within the media industry. Additionally, the Nifty Metal index added 5.3 percent, reflecting positive momentum in the metal sector.

Moreover, the Nifty PSU Bank surged by 4.2 percent, showcasing strength in public sector banking. Investors also saw favorable returns as the Nifty Realty index rose by 4 percent, indicating potential growth in the real estate sector.

Explore Our Features!

Indices To Track: Stay informed with real-time updates on crucial market indices. Customize your investment overview effortlessly with our Navia App. Learn how to adjust indices to match your preferences. Watch our video for more insights.

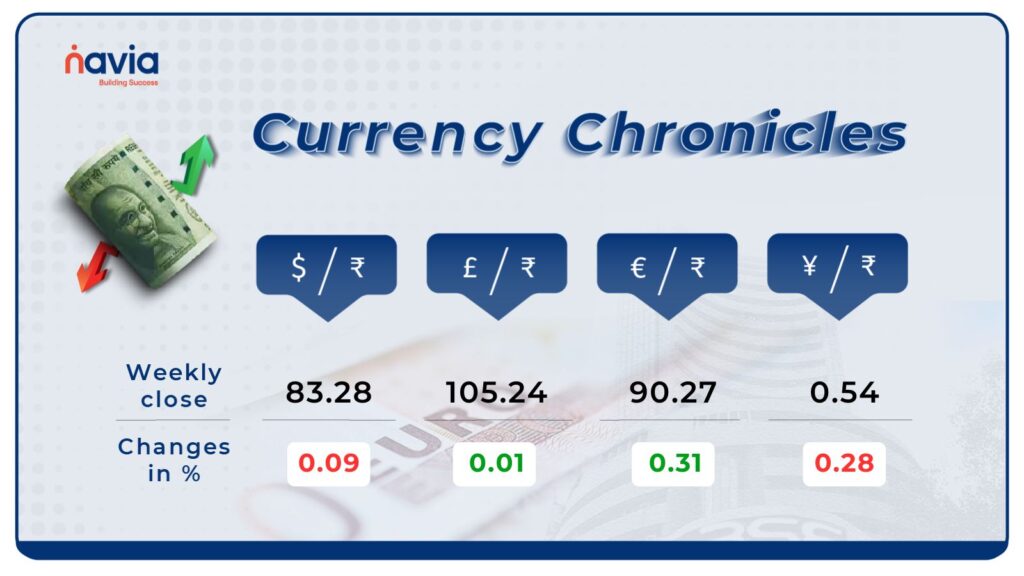

Currency Chronicles

USD/INR

Throughout the week, the Indian rupee exhibited strength against the US dollar, showcasing resilience in the face of market fluctuations. Despite initial challenges, the domestic unit managed to gain ground, closing 12 paise higher at 83.28 on April 5 compared to its March 28 closing of 83.40. This slight appreciation reflects the underlying stability and confidence in the Indian currency amidst global economic dynamics.

EUR/INR

The EUR to INR exchange rate increased by 0.31% throughout the week, signaling a positive trend in the market. Currently, bullish sentiment prevails in the EUR/INR market, reflecting optimism among traders and investors. By the end of the week, the EUR to INR rate reached ₹ 90.27, marking a notable uptick.

JPY/INR

Conversely, the JPY to INR exchange rate experienced a decrease of -0.23% for the week. However, despite this decline, bullish sentiment persists in the JPY/INR market, indicating confidence among market participants. At this moment, the JPY to INR rate is estimated to reach ₹ 0.546742 by the end of the week.

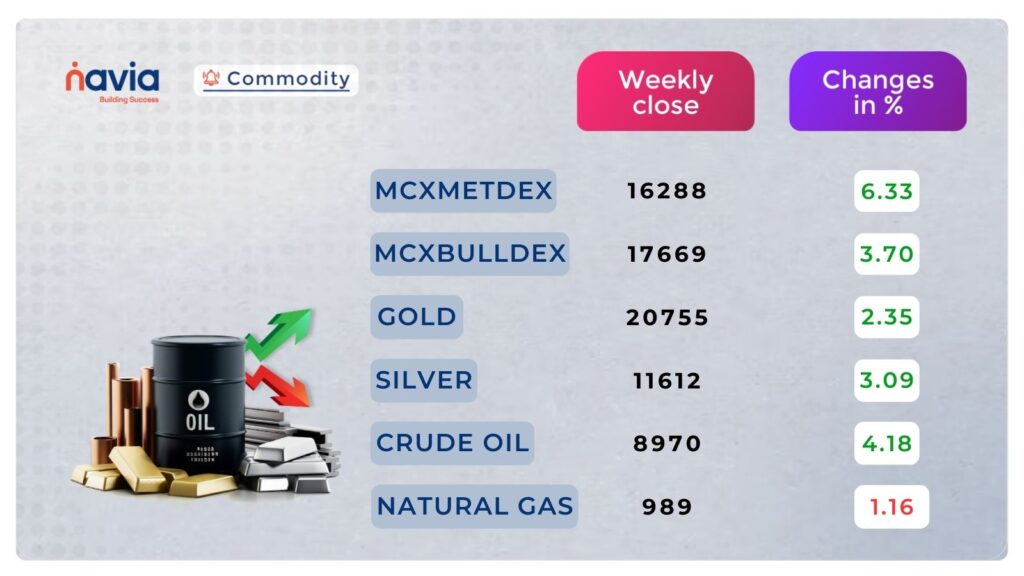

Commodity Corner

Gold Outlook: Ahead of U.S. Employment Data

Gold prices are on track for their third consecutive week of gains, supported by strong safe-haven inflows and expectations of lower U.S. interest rates. The recent upward trend in gold prices, driven by geopolitical tensions and anticipated Federal Reserve rate cuts, underscores investor confidence in the precious metal.

Impact of U.S. Employment Figures

The upcoming release of U.S. non-farm payrolls data carries significant implications for gold markets. Positive data may reinforce expectations of sustained higher interest rates, while weakness could reignite expectations of a rate cut as early as June.

Stay tuned for updates as gold continues to respond to evolving economic dynamics and central bank policies.

Blogs of the Week!

Discover the intricacies of investor mindset as we dissect the differences between stocks and mutual funds. Check out our blog for further insights.

Embark on a journey through Marketpur with Omkar, the Guardian of Trust. Dive into our blog to experience the adventure.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Industry News & Updates

NSE Unveils 4 New Indices: Debuting April 8

The National Stock Exchange (NSE) announces the launch of four new indices in both the cash and futures and options segments, effective April 8.

🔸 Nifty Tata Group 25% Cap: A curated index featuring 10 leading companies like TCS, Tata Motors, and Titan Company.

🔸 Nifty500 Multicap India Manufacturing: Reflecting the manufacturing sector’s performance with 75 constituents, including Reliance Industries and Sun Pharma.

🔸 Nifty500 Multicap Infrastructure: Tracking infrastructure stocks with giants like Larsen & Toubro and RIL among the top constituents.

🔸 Nifty MidSmall Healthcare: Focused on midcap and small-cap healthcare stocks, offering a diversified view of the sector.

BSE’s Game-Changing Move!

In a bold move to beef up risk control, BSE is introducing the Limit Price Protection (LPP) mechanism on April 16, 2024. This means tighter reins on order prices to keep things on the straight and narrow.

Forget the old playbook – the Price Reasonability Check is out, and LPP is in! But don’t worry, they’ve got your back with a mock trading session on April 13, 2024, so you can test the waters before diving in.

This isn’t just about rules; it’s about keeping the market shipshape. The LPP mechanism acts as a watchdog, sniffing out any fishy business and shutting it down before it causes a splash.

And BSE isn’t alone in this game – the National Stock Exchange (NSE) paved the way back in 2022. It’s a united front, committed to keeping the market fair and square.

But wait, there’s more! BSE is all ears for feedback and promises to keep tweaking things for the better. It’s a win-win for everyone, ensuring a safer, smoother ride in the stock market jungle.

So, brace yourselves – with the Limit Price Protection mechanism, BSE is raising the bar for safety and stability in the equity derivatives arena!

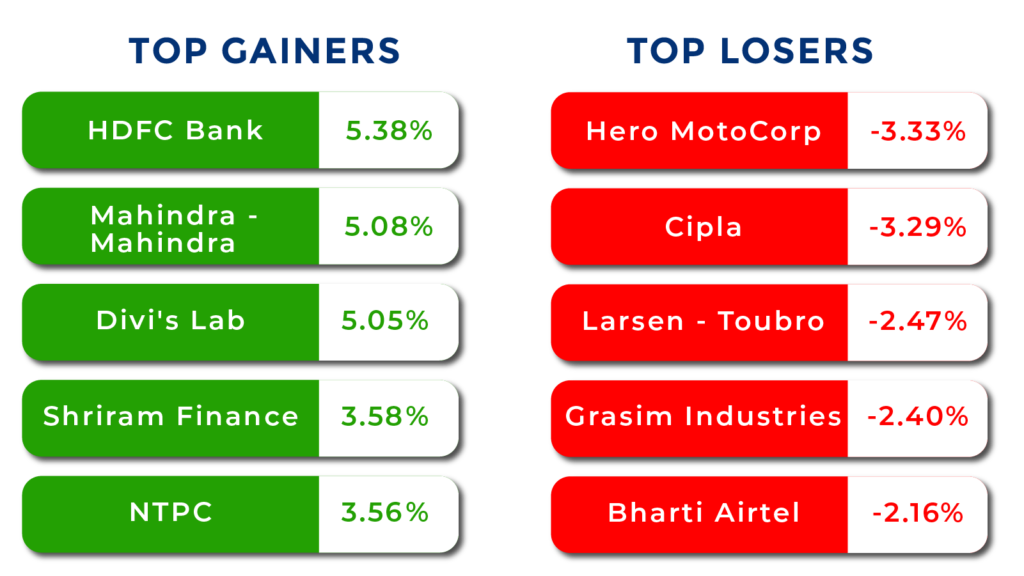

Top Gainers and Losers

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Do You Find This Interesting?