Navia Monthly Roundup (March 2024)

Month in the Review

In March 2024, the Indian stock market saw record highs followed by its largest weekly losses in five months due to mixed global and domestic data. FIIs reduced selling while DIIs provided support. Certain stocks plummeted while others gained. The market ended the month with moderate gains amidst high volatility, driven by various factors including the Fed’s interest rate decision and consistent FII selling. Despite fluctuations, Indian equity indices edged closer to all-time highs by the end of the financial year, supported by increased FII purchases and a decrease in the current account deficit.

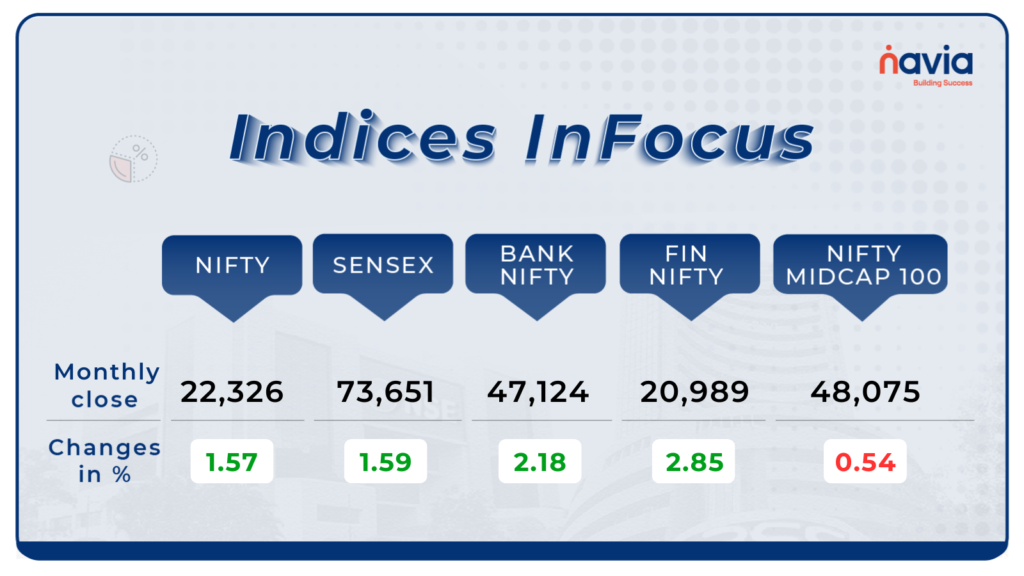

Indices Analysis

In March 2024, the Nifty index surged by 1.57% to reach 22,326, while the Sensex recorded a similar gain of 1.59%, closing at 73,651. The Bank Nifty outperformed both, posting a substantial gain of 2.18% to settle at 47,124, followed closely by the Financial Nifty, which rose by 2.85% to stand at 20,989. However, the Nifty Midcap 100 index experienced a slight decline, dropping by 0.54% to settle at 48,075, indicating a mixed performance across different segments of the market during March 2024.

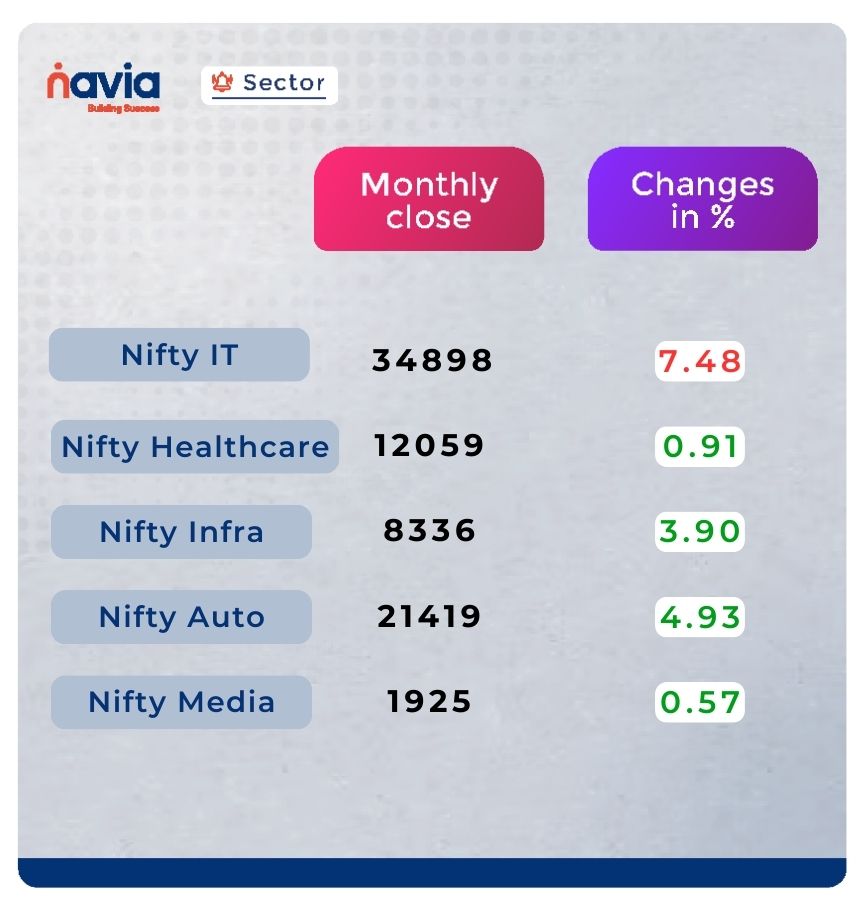

Sector Spotlight

The Nifty IT index faced significant challenges, declining sharply by 7.48% to 34,898, possibly due to global economic conditions or regulatory changes. Conversely, the Nifty Healthcare index showed modest growth, increasing by 0.91% to 12,059, reflecting ongoing demand for healthcare services. The Nifty Infrastructure index performed well, rising by 3.90% to 8,336, likely driven by positive sentiment towards infrastructure projects.

Nifty Auto index demonstrated strong growth, increasing by 4.93% to 21,419, possibly due to improving economic conditions. Lastly, the Nifty Media index showed marginal growth, edging up by 0.57% to 1,925, influenced by factors like advertising spending and digitalization trends. These sectoral performances paint a mixed picture of the Indian stock market in March 2024, with challenges in some sectors and growth in others.

Explore Our Features!

“Streamline your investments with Navia App’s pre-assembled stock baskets, starting from just Rs.300. Simplify diversification and manage your portfolio effortlessly. Read More..

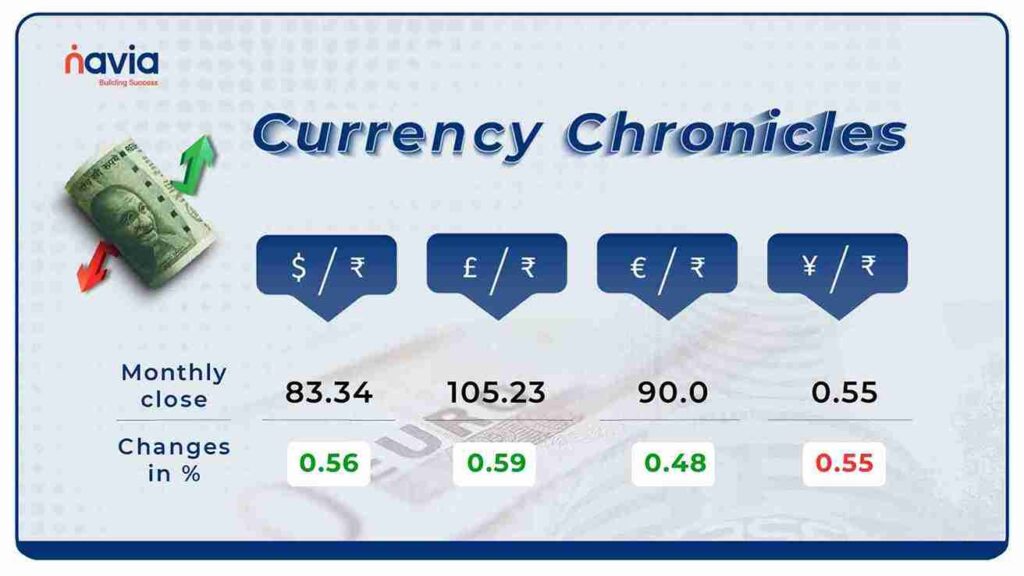

Currency Chronicles

The USD/INR exchange rate stood at 83.34, representing a modest increase of 0.56%. Similarly, the GBP/INR exchange rate experienced a slight uptick, reaching 105.23, marking a 0.59% rise. The EUR/INR exchange rate reached 90.0, indicating a 0.48% increase, while the JPY/INR exchange rate was recorded at 0.55, with a corresponding 0.31% rise.

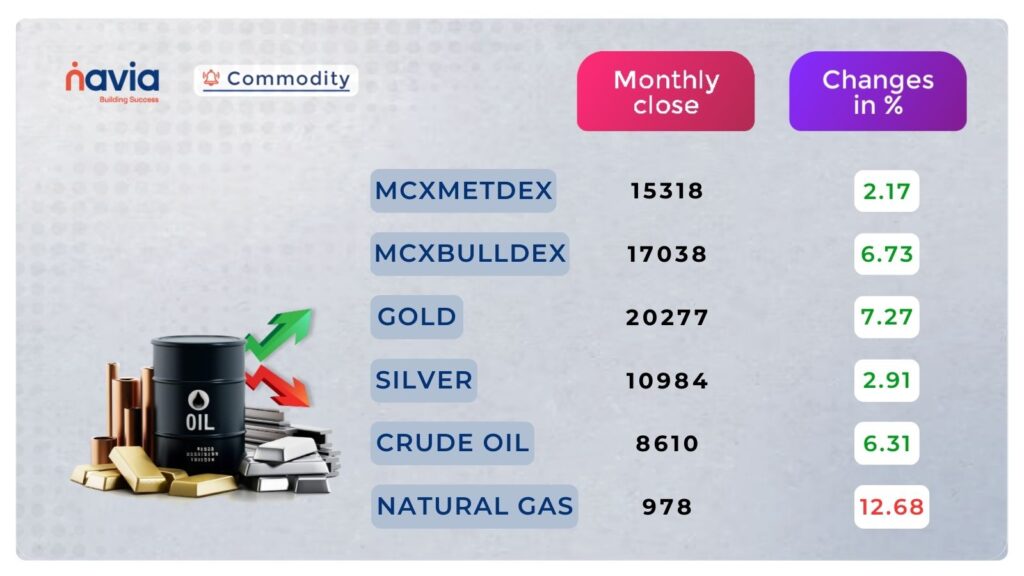

Commodity Corner

Gold hit a record high final week in March after the U.S. Federal Reserve anticipated three rate cuts in 2024. Traders are currently pricing in a 64% chance of a June rate cut, according to CME’s FedWatch tool..

More signs of cooling price pressures may reinforce expectations around the Fed cutting rates’ ultimately boosting appetite for gold. However, a sticky report will likely drag the precious metal lower

Global oil demand is forecast to rise by a higher-than-expected 1.7 mb/d in 1Q24 on an improved outlook for the United States and increased bunkering. While 2024 growth has been revised up by 110 kb/d from March month’s Report, the pace of expansion is on track to slow from 2.3 mb/d in 2023 to 1.3 mb/d, as demand growth returns to its historical trend while efficiency gains and EVs reduce use.

Blogs of the Month

Discover the timeless wisdom of Aarav in “The Wise Farmer’s Harvest: A Tale of Patience, Vision, and Resilience” – a captivating story of perseverance

Discover the stability and growth potential of Indian PSUs – perfect for diversifying your portfolio. To delve deeper, Read more on our latest blog about Indian PSUs.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

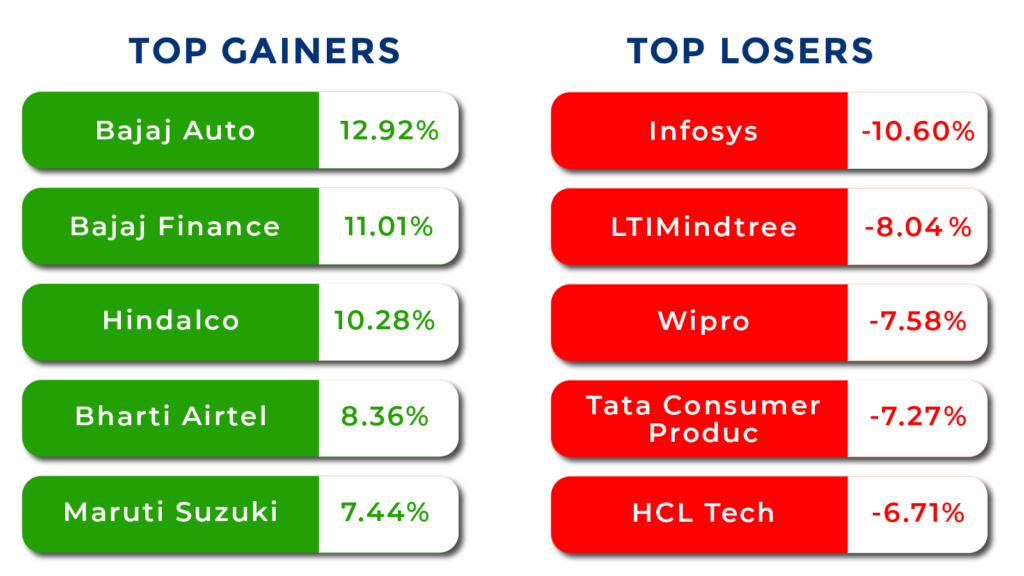

Top Gainers and Losers

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Do You Find This Interesting?