Langar Lessons: Finding Balance with the Barbell Strategy

- Amid the Langar Lines at Golden Temple

- Mixing Wings for Safety: The Barbell Strategy

- How It Worked When I Tried It

- Start Your Barbell Meal Plan and Use the Right Tool

Amid the Langar Lines at Golden Temple

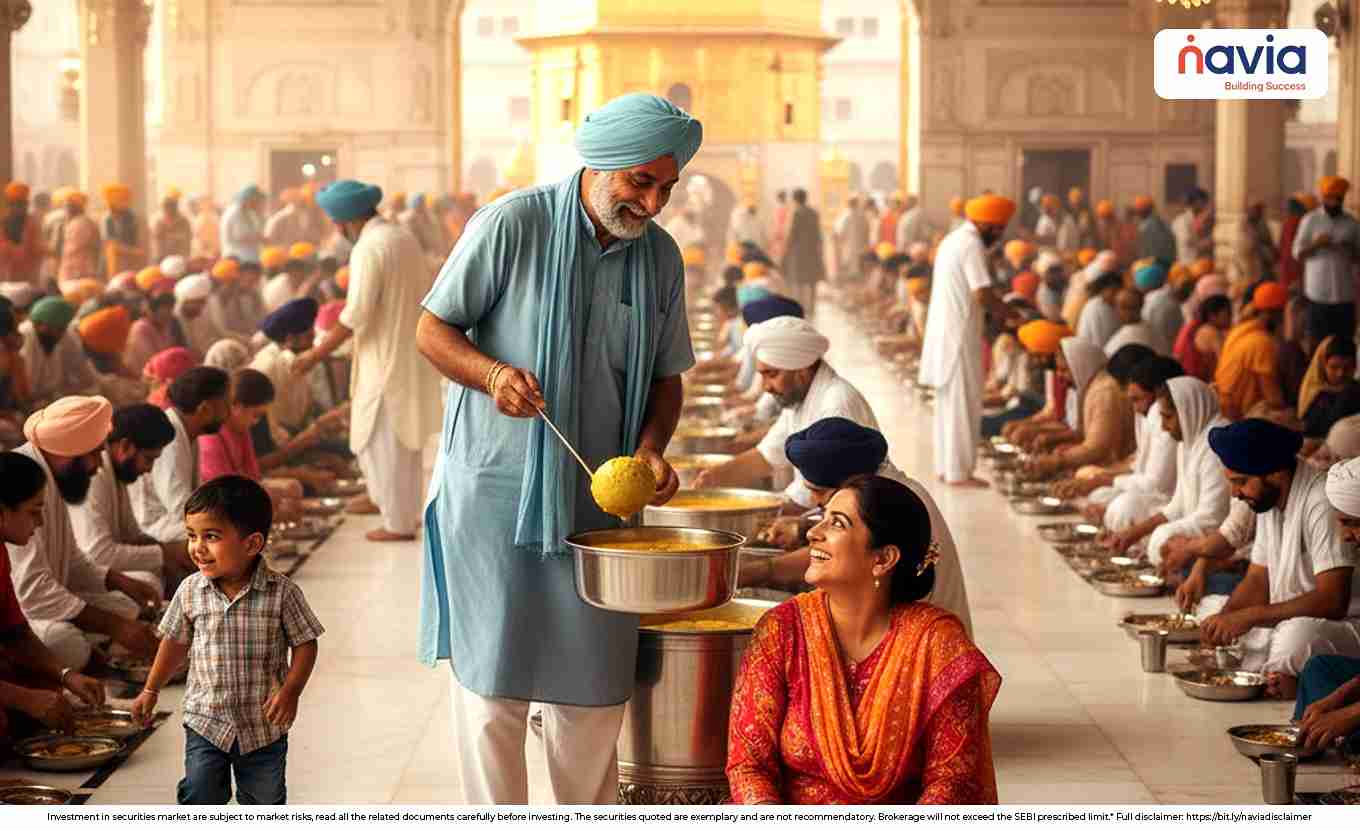

On Guru Nanak Jayanti morning in Amritsar, the marble courtyard of the Golden Temple shimmered with Sikh pilgrims and the gentle murmur of prayers. At the langar hall, rows of volunteers were quietly serving free meals. Among them was Harjit Singh, a middle-aged teacher wearing a light blue kurta and a neatly tied turban. He ladled dal into steel bowls with practiced ease. Sitting nearby on the marble floor, spoon in hand, was his old friend Paramjeet Kaur, who had come to volunteer after a hectic week in Delhi.

Paramjeet smiled at Harjit. “Thank you ji, this langar always feels so peaceful. My mind was full of market worries when I arrived.”

Harjit paused, bowl in hand. “Worries? You trade stocks, yes?”

She nodded slowly. “Yes, but these days I feel confused. Prices of big companies keep going up, and I worry I might get stuck when they fall.”

Harjit set down his ladle thoughtfully. “You’re right to be cautious. Actually, I was reading something last night about a way to mix two worlds, growth and safety. It reminded me of langar, mixing many grains to feed many people.”

Paramjeet tilted her head. “Tell me more, what’s this method?”

Mixing Wings for Safety: The Barbell Strategy

Harjit took a deep breath. “It’s called the barbell strategy. Instead of putting everything in one type of stock, you divide your money into two extreme parts. Some in very safe, low-risk assets and some in high-potential, higher-risk assets. The idea is you protect yourself with the safe side and give yourself a chance to grow with the other.”

Paramjeet rustled her skirt, intrigued. “So I don’t have to pick just moderate stocks? I can have two sides?”

“Yes,” Harjit nodded, ladling chapati into bowls. “For example, you could keep a large part in steady companies that pay dividends or even fixed-income type funds. That’s your safety net. Then a smaller part goes into companies with higher growth potential, maybe in new tech or emerging areas. The key is knowing one side protects you while the other aims to grow you.”

Paramjeet paused, reflecting on her portfolio. “That sounds sensible. I feel like I’m either all risk or all safe, with nothing in between.”

Harjit nodded and added, “Experts are discussing this more in 2025 because some growth stocks are very expensive and the safest ones yield little. The barbell gives balance.”

How It Worked When I Tried It

They sat back for a moment, watching children pass by with bowls of khichdi. Paramjeet leaned in. “Harjit ji, did you try this? How did it go?”

He chuckled softly. “Yes, I did. A year ago I split part of my portfolio, one portion into established dividend-paying firms and bond type funds, the other into a few small companies with growth potential. When the market turned volatile, my safe part held steady. Later, when one of the growth companies reported good results, the other part saw gains. I didn’t hit a jackpot, but I slept peacefully, no worries.”

She smiled. “That’s the kind of trading I can live with. But how do I pick the two sides?”

Harjit spoke quietly, as though part of the temple hush. “The safe side should have reliable businesses or conservative funds. The risk side you accept might fluctuate, so you only put a modest amount there. Over time, you adjust when one side grows too large. The risk side is like your active langar members, spicy and bold. The safe side is like simple khichdi, nourishing and steady.”

Start Your Barbell Meal Plan and Use the Right Tool

The bells rang softly across the courtyard. Paramjeet took a deep breath. “Okay Harjit ji, I want to try this. How do I start tomorrow?”

He smiled kindly. “Start small. Pick a firm you understand for the safe side, a stable business, maybe one that pays dividends. Then pick one or two smaller firms with strong growth ideas. Decide you won’t panic when things go quiet. Use modern apps like Navia All in One Trade and Invest to study and track your investments easily.”

Paramjeet’s eyes lit up, the temple’s lights reflecting in them. “Thank you, Harjit ji. I’m ready.”

As they stood and joined the queue again to serve more bowls, Paramjeet felt a fresh resolve. The golden sanctity of the temple, the simple act of service, and a calmer way to invest.

Do You Find This Interesting?

DISCLAIMER: This story is a fictional illustration created for educational purposes. Investment in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit. Full disclaimer: https://bit.ly/naviadisclaimer