Investing in the Motilal Oswal Nifty Smallcap 250 ETF: Tapping into India’s Emerging Smallcap Sector

NSE SYMBOL: MOSMALL250

The Motilal Oswal Nifty Smallcap 250 ETF (MOSMALL250) provides investors with a unique opportunity to gain exposure to India’s growing small-cap companies. Launched in March 2024, this ETF tracks the Nifty Smallcap 250 Total Return Index. As small-cap companies tend to outperform during bullish market phases, the MOSMALL250 ETF is ideal for investors looking for high-growth potential in the Indian stock market. In this blog, we will explore the key features, top holdings, and recent performance of the ETF and how it can be a part of your systematic investing strategy.

What is the Motilal Oswal Nifty Smallcap 250 ETF?

The Motilal Oswal Nifty Smallcap 250 ETF seeks to replicate the performance of the Nifty Smallcap 250 Total Return Index, which comprises the top 250 small-cap companies in India. These companies represent emerging sectors and businesses with high growth potential, offering investors an opportunity to tap into India’s expanding small-cap market.

Key Features of MOSMALL250 ETF

🔷 Stock Market Investing: Gain exposure to India’s top small-cap companies across multiple sectors.

🔷 Low-Cost ETF: The ETF boasts an expense ratio of 0.30%, making it an affordable option for investors.

🔷 Systematic Investing: Investors can utilize Systematic Investment Plans (SIPs) to invest small amounts regularly using the Navia Zero Brokerage Stock Investing APP, benefiting from cost averaging over time.

Top 10 Holdings of MOSMALL250 ETF

The Motilal Oswal Nifty Smallcap 250 ETF is well-diversified across different industries and sectors. Here are the top 10 holdings of the ETF:

| Company Name | Sector | Holding (%) |

|---|---|---|

| Crompton Greaves Consumer Electricals Ltd | Consumer Cyclical | 1.64% |

| Multi Commodity Exchange of India Ltd | Financial Services | 1.41% |

| Glenmark Pharmaceuticals Ltd | Healthcare | 1.38% |

| Central Depository Services Ltd | Financial Services | 1.36% |

| Exide Industries Ltd | Consumer Cyclical | 1.18% |

| Blue Star Ltd | Industrials | 1.18% |

| Computer Age Management Services Ltd | Technology | 1.08% |

| Amara Raja Energy & Mobility Ltd | Industrials | 0.99% |

| Karur Vysya Bank Ltd | Financial Services | 0.92% |

| Cyient Ltd | Industrials | 0.89% |

These top 10 holdings make up 12.04% of the ETF, offering broad-based exposure to industrials, financial services, healthcare, and technology sectors.

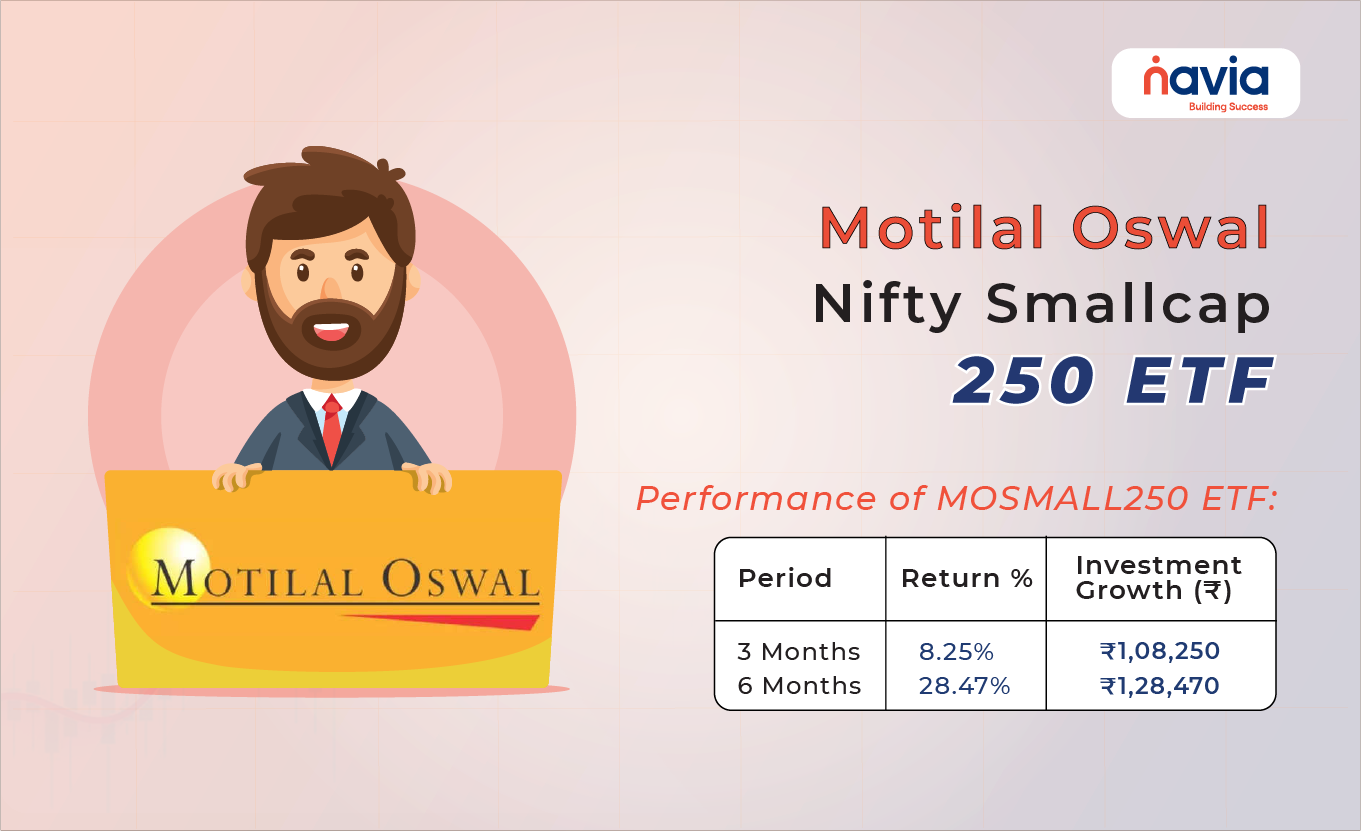

Performance of MOSMALL250 ETF

Since its launch in March 2024, the Motilal Oswal Nifty Smallcap 250 ETF has delivered strong returns, driven by the growing performance of small-cap companies. Given that it is a relatively new ETF, we will focus on its 3-month and 6-month returns.

Recent Returns:

● 3-Month Return: 8.25%

● 6-Month Return: 28.47%

Growth of ₹1 Lakh Investment

Let’s calculate how ₹1 Lakh would have grown over these periods based on the historical returns:

| Period | Return (%) | Investment Growth (₹) |

| 3 Months | 8.25% | ₹1,08,250 |

| 6 Months | 28.47% | ₹1,28,470 |

These impressive returns over a short period indicate the potential for high gains in the small-cap segment, particularly during periods of market recovery and expansion.

Sector Allocation

The MOSMALL250 ETF offers a well-diversified exposure to sectors that are crucial for India’s economic growth. Here’s the sector-wise breakdown:

| Sector | Weighting (%) |

| Consumer Cyclical | 11.48% |

| Financial Services | 19.72% |

| Industrials | 22.79% |

| Healthcare | 10.86% |

| Technology | 8.79% |

| Basic Materials | 13.20% |

| Utilities | 2.34% |

| Energy | 1.81% |

This diversified allocation ensures that the ETF benefits from the growth potential across various sectors, particularly in industrials and financial services.

Benefits of Investing in MOSMALL250 ETF

→ Low Cost:

With an expense ratio of 0.30%, the ETF provides an affordable way to gain exposure to a broad range of small-cap companies without incurring high fees.

→ High Growth Potential:

Small-cap companies often outperform larger firms during periods of market expansion, offering investors the opportunity for above-average returns.

→ Systematic Investment Plans (SIPs):

By setting up a SIP through the Navia Zero Brokerage Stock Investing APP, investors can benefit from rupee cost averaging, which smooths out market volatility by investing regularly.

→ Diversification:

The ETF invests in 250 small-cap companies across different sectors, providing a well-rounded portfolio that reduces individual stock risk.

Steps to set up a SIP for the Motilal Oswal Nifty Smallcap 250 ETF (or any stock/ETF) using the Navia APP:

1. Download and Log In to the Navia APP:

If you haven’t already, download the Navia APP from the app store, and log in using your credentials.

2. Go to Tools → Basket:

Navigate to the “Tools” section and select “Basket”. This feature allows you to create a basket of stocks/ETFs to invest in through a SIP.

3. Create a Basket:

Choose a name for your basket. Set up a Weekly or Monthly SIP depending on your preference.

🔶 For Weekly SIP, select the day of the week you want the SIP to be executed.

🔶 For Monthly SIP, choose the day of the month for the SIP to be executed.

4. Add MOSMALL250 ETF (or another stock/ETF) to the Basket:

Use the “Add” option to add the MOSMALL250 ETF or any other ETF/stock of your choice to the basket. Select the quantity and price at which you want to buy. The market price is preferable when setting up a SIP.

5. Confirm and Activate the SIP:

Once the ETF or stock is added, confirm and activate the SIP. You can also edit the stock price or quantity anytime by using the “Edit” option.

6. Pause or Modify SIP if Needed:

You can always pause or modify the SIP (e.g., change the quantity or the stock price) using the “Edit” option.

By following these simple steps, you can set up a systematic investment plan for Motilal Oswal Nifty Smallcap 250 ETF or any other stock/ETF using the Navia APP, making it easy to invest regularly and build wealth over time.

Is MOSMALL250 ETF Right for You?

The Motilal Oswal Nifty Smallcap 250 ETF is an excellent choice for investors looking to tap into the growth potential of India’s small-cap sector. The ETF’s low-cost structure, strong recent performance, and broad sector exposure make it an ideal option for investors with a long-term investment horizon.

Whether you’re a seasoned investor or a beginner, the MOSMALL250 ETF can be an essential part of your stock market systematic investing strategy. By investing in this ETF through a SIP on the Navia Zero Brokerage Stock Investing APP, you can build wealth over time while benefiting from the growth of India’s small-cap companies.

We’d Love to Hear from you-

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.