Investing in International ETFs: A Smart Strategy, But Beware of Overpaying

International ETFs offer an easy and efficient way for investors to gain exposure to global markets, diversify their portfolios, and participate in the growth of leading international companies. However, while investing internationally is a great way to hedge against domestic risks and access high-growth sectors, one must be cautious about not overpaying for these ETFs.

Currently, many international ETFs are trading at a premium to their Net Asset Value (NAV), meaning investors are paying more than the actual worth of the underlying assets. This could lead to potential losses if the premium shrinks over time.

Understanding ETF Premiums and Why They Matter

An ETF’s NAV (Net Asset Value) represents the true value of the underlying assets per unit of the ETF. However, in the market, ETFs can trade at a premium (higher than NAV) or a discount (lower than NAV) based on demand and supply dynamics.

1. A high premium means investors are paying more than the ETF’s intrinsic value, which can be risky.

2. A discount suggests the ETF is trading below its NAV, which could be an opportunity if the gap corrects over time.

Currently, all six major international ETFs in India are trading at a premium, making them expensive compared to their intrinsic value.

International ETFs Trading at a Premium (As of Feb 1, 2025)

| ETF Name | NAV (₹) | Market Price (₹) | Premium (%) |

| Mirae Asset NYSE FANG+ ETF | 115.79 | 132.70 | 12.7% |

| Mirae Asset S&P 500 Top 50 ETF | 49.43 | 54.70 | 9.6% |

| Motilal Oswal Nasdaq Q50 ETF | 75.45 | 87.32 | 13.6% |

| Motilal Oswal NASDAQ 100 ETF | 181.69 | 199.75 | 9.0% |

| Mirae Asset Hang Seng Tech ETF | 17.49 | 19.80 | 11.7% |

| Nippon India ETF Hang Seng BeES | 321.61 | 353.38 | 9.0% |

As seen above, some ETFs are trading at a premium of more than 10%, meaning investors are paying significantly more than the ETF’s intrinsic value.

What Should Investors Do?

✅ Check the iNAV Before Investing

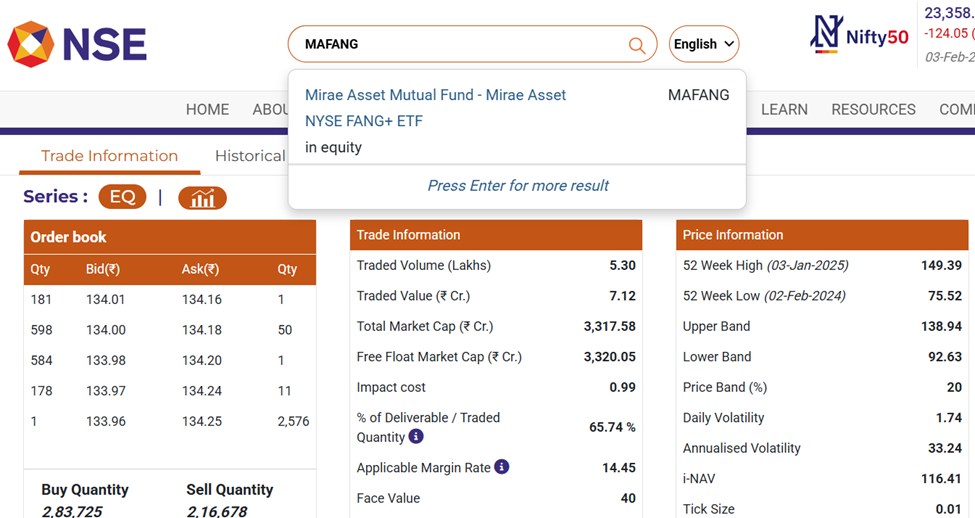

The iNAV (Indicative Net Asset Value) provides real-time updates on an ETF’s fair value during market hours. Investors should check this on stock exchange websites or the fund house’s website before making a purchase. See image below.

✅ Avoid Buying at High Premiums

Since the premium may reduce over time, it is advisable to invest only when the premium is on the lower side to minimize the risk of overpaying.

✅ Consider Long-Term Market Trends

If an ETF consistently trades at a premium, it could indicate strong demand, but that does not always mean it will continue to do so. Investors should evaluate the broader market trends before making investment decisions.

Final Thoughts

International ETFs are an excellent way to diversify and gain global exposure. However, buying them at a high premium could result in paying more than the actual worth of the assets, leading to potential losses if the premium declines. Investors should be mindful of the price they pay and use tools like iNAV to ensure they are making informed decisions.

By staying patient and buying at the right time, investors can enjoy the benefits of international investing without the risk of overpaying. 🚀

Do You Find This Interesting?

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.