A Comprehensive Guide to Investing in Nifty Midcap 150 BeES ETF

The Nippon India ETF Nifty Midcap 150 (MID150BEES) is a popular exchange-traded fund (ETF) that tracks the performance of the Nifty Midcap 150 Index. This ETF provides exposure to midcap companies, which are often regarded as the next growth drivers in the Indian stock market. In this blog, we will explore the advantages of investing in the Midcap 150 BeES ETF, its relevance in stock market investing, and why it’s a smart choice for long-term investors. We will also highlight how using the Navia Zero Brokerage Stock Investing APP can enhance your investing experience.

What is Nifty Midcap 150 BeES ETF?

The Nifty Midcap 150 BeES ETF aims to replicate the performance of the Nifty Midcap 150 Index, which consists of the top 150 mid-cap stocks in India. These companies are positioned between the large-cap and small-cap segments and are considered to have significant growth potential.

Investment Objective: The primary objective of the Midcap 150 BeES ETF is to provide returns that closely correspond to the total returns of the Nifty Midcap 150 Index, before expenses. It’s an ideal tool for investors seeking broad exposure to midcap companies in India.

Why Choose Midcap 150 BeES for Stock Market Investing?

1. Diversified Exposure to Midcap Companies

The Nifty Midcap 150 BeES ETF offers diversified exposure to some of the most promising midcap companies in India. Midcap companies are generally considered to be at an expansionary stage, with the potential for significant growth. By investing in this ETF, you gain access to sectors like industrials, consumer cyclical, and financial services—sectors that are expected to grow as India’s economy continues to expand.

2. Cost Efficiency

Midcap 150 BeES is a low-cost ETF, with an expense ratio of just 0.21%. This makes it an attractive investment option for those who want exposure to high-growth midcap companies without the high fees typically associated with actively managed mutual funds. The lower fees help investors maximize returns over the long term.

With the Navia Zero Brokerage Stock Investing APP, investors can further benefit from zero brokerage on Midcap 150 BeES trades, making it one of the most cost-efficient ways to invest in India’s midcap segment.

3. Stock Market Systematic Investing with SIP

Midcap 150 BeES is an excellent option for stock market systematic investing through a Systematic Investment Plan (SIP). Investors can regularly invest a fixed amount in the ETF, accumulating units over time and reducing the risk of market volatility through rupee cost averaging.

The Navia Zero Brokerage Stock Investing APP allows investors to easily set up SIPs, starting with amounts as low as 1 unit. By consistently investing in Midcap 150 BeES, you can build a strong midcap portfolio that benefits from India’s economic growth.

4. Liquidity and Flexibility

As an ETF, Midcap 150 BeES offers the same liquidity and flexibility as individual stocks. It is traded on the stock exchange during market hours, allowing investors to buy or sell units easily. This makes it a convenient option for both long-term investors and short-term traders.

By using the Navia Zero Brokerage Stock Investing APP, investors can track real-time prices, monitor their portfolios, and execute transactions seamlessly without brokerage fees. This ensures an efficient and user-friendly experience for all types of investors.

Top 10 Holdings of Midcap 150 BeES

As of August 2024, the top 10 holdings of Midcap 150 BeES ETF are:

| Company | Sector | Weightage |

| Suzlon Energy Ltd | Energy | 2.37% |

| Max Healthcare Institute Ltd | Healthcare | 1.87% |

| Indian Hotels Co Ltd | Consumer Cyclical | 1.65% |

| Persistent Systems Ltd | Technology | 1.59% |

| Lupin Ltd | Healthcare | 1.59% |

| PB Fintech Ltd | Financial Services | 1.57% |

| Cummins India Ltd | Industrials | 1.50% |

| Dixon Technologies (India) Ltd | Technology | 1.46% |

| The Federal Bank Ltd | Financial Services | 1.36% |

| CG Power & Industrial Solutions | Industrials | 1.31% |

These top 10 holdings represent 16.28% of the fund’s total assets, providing exposure to a diverse range of sectors including energy, healthcare, consumer cyclical, financial services, and technology.

Performance Overview

Midcap 150 BeES has consistently delivered strong returns over various time periods, demonstrating its potential as a long-term growth investment. Below is a breakdown of its performance as of August 2024:

● 1-Year Return: 55.47%

● 3-Year Annualized Return: 26.57%

● 5-Year Annualized Return: 17.49%

These returns highlight the strong growth potential of midcap companies and the benefits of investing in this ETF over the medium to long term.

How Much Would Rs. 1 Lakh Invested in Midcap 150 BeES Have Grown?

5-Year Growth:

With an annualized return of 17.49%, ₹1 Lakh invested 5 years ago would have grown to approximately:

- ₹2,24,480

3-Year Growth:

With an annualized return of 26.57%, ₹1 Lakh invested 3 years ago would have grown to approximately:

- ₹2,02,472

This illustrates the significant growth potential of the Midcap 150 BeES ETF, making it an ideal investment for those looking to capture the returns of high-growth midcap companies.

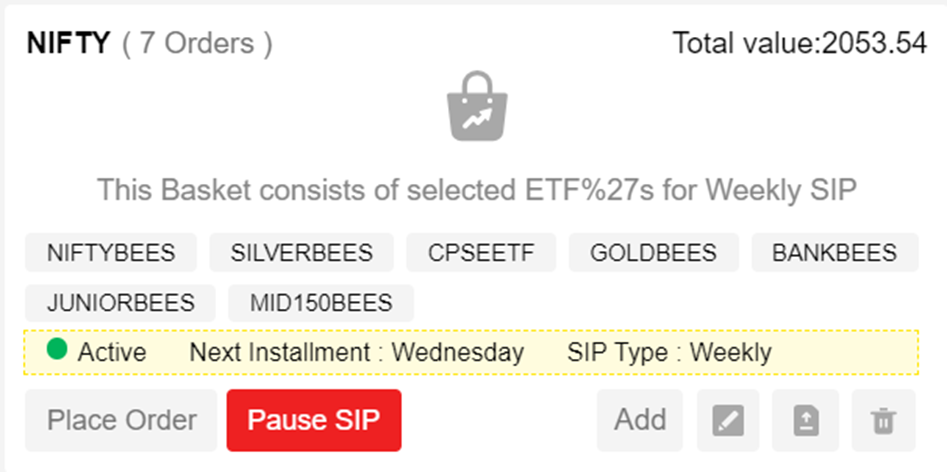

Steps to Set Up a SIP for Midcap 150 BeES Using the Navia APP

Investing in Midcap 150 BeES using the Navia Zero Brokerage Stock Investing APP is simple and convenient. Follow these steps to set up a SIP:

1) Download and Log In to the Navia app.

2) Go to Tools -> Basket and create a basket with a name of your choice.

3) Set up a Weekly or Monthly SIP, selecting the day of the week or month for the SIP to be executed.

4) Use the Add option to add Midcap 150 BeES to your basket and select the quantity and price (market price is preferred for SIP).

5) Confirm and Activate the SIP. You can pause, edit the stock price, or adjust the quantity anytime using the Edit option.

With zero brokerage, setting up a SIP on the Navia app is cost-effective and hassle-free, making it an excellent option for long-term investors. Navia also provides FREE Ready made ETF baskets for hassle free SIP investment on selected TOP ETF’s. To know more about these curated basket read here

Why Midcap 150 BeES is a Smart Choice for Investors

Nifty Midcap 150 BeES ETF offers investors a cost-effective and diversified way to invest in India’s high-growth midcap segment. With its low expense ratio, diversified portfolio, and strong historical performance, it is an ideal investment option for long-term wealth creation.

By using the Navia Zero Brokerage Stock Investing APP, investors can further reduce their costs and take advantage of powerful tools for systematic investing, including the ability to set up SIPs. Whether you are a seasoned investor or a beginner, Midcap 150 BeES provides an excellent opportunity to participate in the growth of midcap companies and build a strong investment portfolio for the future.

We’d Love to Hear from you-

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.