A Comprehensive Guide to Investing in Nifty Auto BeES ETF

The Nifty Auto BeES ETF is an exchange-traded fund (ETF) managed by Nippon India Asset Management Ltd, designed to provide investors with exposure to the top automobile companies in India. The ETF tracks the performance of the Nifty Auto Index, offering a unique opportunity to invest in one of the most important sectors of the Indian economy. This blog will explore the benefits of investing in Nifty Auto BeES, its relevance in stock market investing, and how systematic investment in this low-cost ETF can provide significant returns over time. We will also highlight how using the Navia Zero Brokerage Stock Investing APP can make investing in this ETF more cost-effective.

What is Nifty Auto BeES ETF?

The Nifty Auto BeES ETF seeks to replicate the performance of the Nifty Auto Index, which consists of the top automobile companies in India. The ETF provides investors with exposure to the Indian automotive sector, which includes passenger vehicles, two-wheelers, commercial vehicles, and auto components.

Investment Objective: The fund’s objective is to provide returns that closely correspond to the total returns of the Nifty Auto Index, before expenses, subject to tracking errors.

Why Choose Nifty Auto BeES for Stock Market Investing?

1. Diversified Exposure to India’s Automotive Sector

The Nifty Auto BeES ETF offers investors diversified exposure to India’s leading automobile companies. The Nifty Auto Index is composed of companies that span across the entire automotive value chain, including manufacturers of passenger vehicles, two-wheelers, and commercial vehicles. This diversification reduces the risk associated with investing in a single company while offering exposure to a critical sector of India’s economy.

2. Cost Efficiency

The Nifty Auto BeES ETF is a low-cost ETF with an expense ratio of 0.22%, making it an affordable way to gain exposure to India’s auto sector. Compared to actively managed funds, this low expense ratio allows investors to retain more of their returns over time.

By using the Navia Zero Brokerage Stock Investing APP, investors can benefit from zero brokerage, making investing in the Nifty Auto BeES ETF even more cost-efficient. This zero-brokerage feature makes it an ideal option for long-term investors looking to minimize costs and maximize returns.

3. Stock Market Systematic Investing with SIP

Investors can set up a Systematic Investment Plan (SIP) for Nifty Auto BeES, allowing them to invest regularly in the ETF. Stock market systematic investing through a SIP enables investors to accumulate units of the ETF over time, reducing the risk of market volatility through rupee cost averaging.

With the Navia Zero Brokerage Stock Investing APP, you can easily set up a SIP for Nifty Auto BeES, starting with as little as ₹100. This allows you to invest consistently and build a robust portfolio in the Indian automotive sector.

4. Liquidity and Flexibility

As an ETF, Nifty Auto BeES offers the same liquidity and flexibility as individual stocks. The ETF is traded on the stock exchange during market hours, allowing investors to buy or sell units as per their needs. This flexibility makes Nifty Auto BeES an attractive option for both long-term investors and short-term traders.

Using the Navia Zero Brokerage Stock Investing APP, you can monitor real-time prices, track your investments, and make transactions seamlessly without any brokerage fees. This ensures a convenient and cost-effective experience for investors.

Top 10 Holdings of Nifty Auto BeES

As of August 2024, the top 10 holdings of the Nifty Auto BeES ETF are:

| Company | Sector | Weightage |

| Mahindra & Mahindra Ltd | Consumer Cyclical | 21.88% |

| Tata Motors Ltd | Consumer Cyclical | 18.75% |

| Maruti Suzuki India Ltd | Consumer Cyclical | 13.17% |

| Bajaj Auto Ltd | Consumer Cyclical | 9.78% |

| Hero MotoCorp Ltd | Consumer Cyclical | 5.70% |

| Eicher Motors Ltd | Consumer Cyclical | 5.46% |

| TVS Motor Co Ltd | Consumer Cyclical | 5.27% |

| Samvardhana Motherson International Ltd | Consumer Cyclical | 4.26% |

| Bharat Forge Ltd | Industrials | 3.27% |

| Ashok Leyland Ltd | Industrials | 2.97% |

These top 10 holdings represent 90.49% of the total portfolio, providing exposure to India’s leading automobile manufacturers across various sub-sectors, including passenger vehicles, two-wheelers, and commercial vehicles.

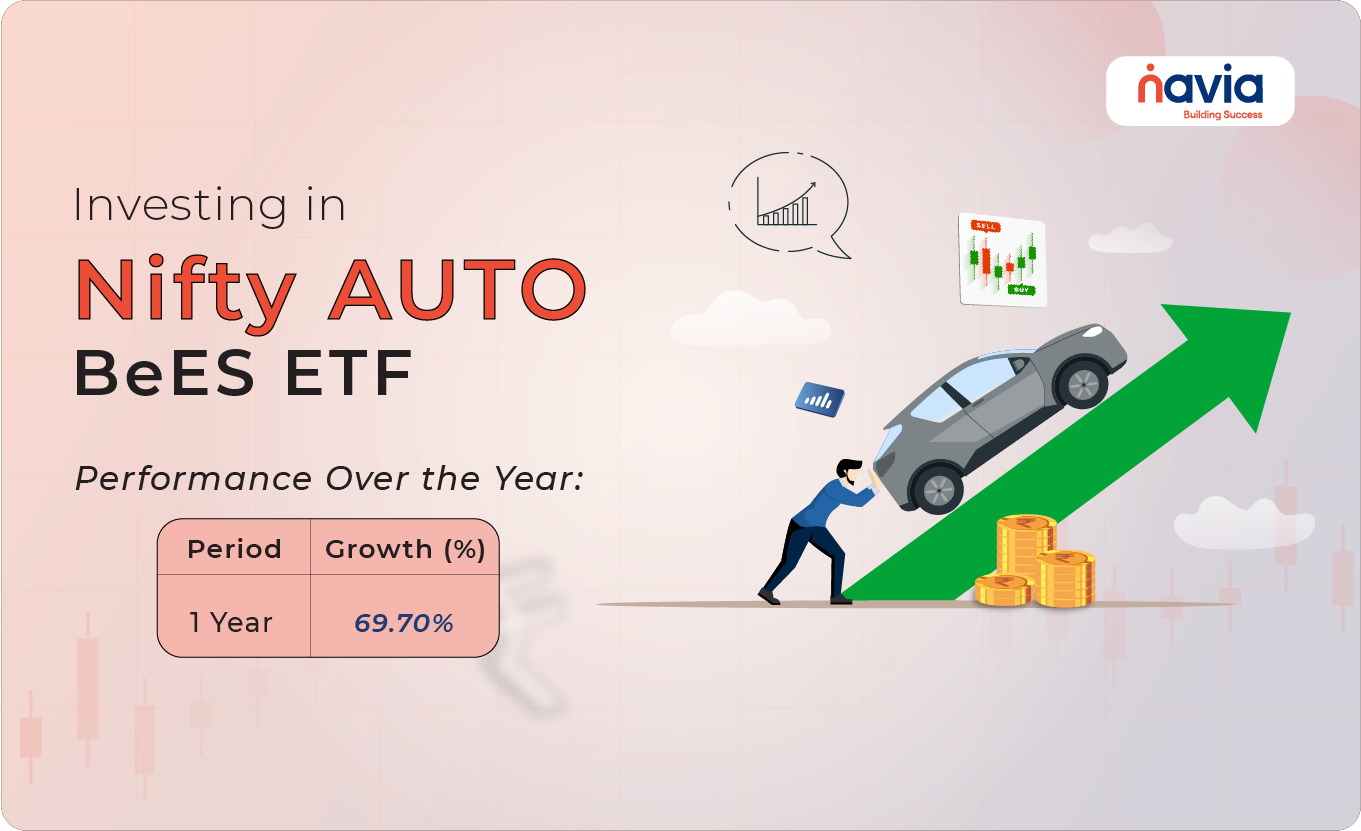

Performance Overview

The Nifty Auto BeES ETF has delivered competitive returns since its inception. Below is a breakdown of its recent performance:

● 1-Year Return: 69.70%

● 3-Year Annualized Return: N/A (ETF launched in 2022)

● 5-Year Annualized Return: N/A (ETF launched in 2022)

Since the ETF is relatively new, 5-year performance data is not available. However, based on its recent 1-year performance, it has shown significant growth.

How Much Would Rs. 1 Lakh Invested in Nifty Auto BeES Have Grown?

Although 5-year and 3-year returns are not available due to the fund’s launch in 2022, we can estimate growth based on the 1-year return of 69.70%.

1-Year Growth:

With a return of 69.70%, ₹1 Lakh invested 1 year ago would have grown to approximately:

● ₹1,69,700

This demonstrates the potential for substantial gains in the Nifty Auto BeES ETF, especially in a sector experiencing strong growth.

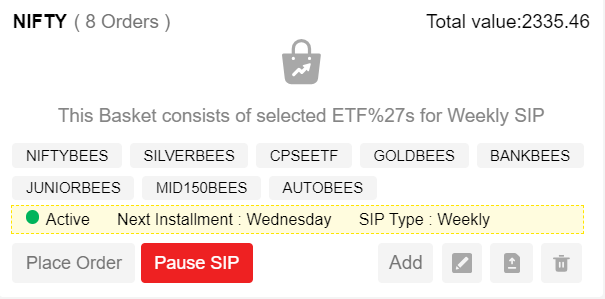

Steps to Set Up a SIP for Nifty Auto BeES Using the Navia APP

Investing in the Nifty Auto BeES ETF through the Navia Zero Brokerage Stock Investing APP is easy and convenient. Follow these steps to set up a SIP:

(i) Download and Log In to the Navia app.

(ii) Navigate to Tools -> Basket and create a basket with a name of your choice.

(iii) Set up a Weekly or Monthly SIP, selecting the day of the week or month for the SIP to be executed.

(iv) Use the Add option to include Nifty Auto BeES in your basket, and select the quantity and price (market price is preferred for SIPs).

(v) Confirm and Activate the SIP. You can pause, edit the stock price, or adjust the quantity anytime using the Edit option.

With zero brokerage, setting up a SIP on the Navia app is cost-effective and hassle-free, making it an excellent option for long-term investors. Navia also provides FREE Ready made ETF baskets for hassle free SIP investment on selected TOP ETF’s. To know more about these curated basket read here

Why Nifty Auto BeES is a Smart Choice for Investors

The Nifty Auto BeES ETF offers investors a cost-effective and diversified way to gain exposure to India’s automotive sector. With its low expense ratio, strong performance, and potential for growth, it is an attractive option for long-term investors.

By using the Navia Zero Brokerage Stock Investing APP, investors can further reduce costs and take advantage of features like zero brokerage and SIP setup. Whether you are a seasoned investor or just starting, the Nifty Auto BeES ETF provides an excellent opportunity to invest in the growth of India’s automotive industry and build a strong investment portfolio.

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.

We’d Love to hear from you