A Comprehensive Guide to Investing in CPSE ETF

CPSE ETF, managed by Nippon India Asset Management Ltd, is a specialized exchange-traded fund (ETF) designed to provide investors with exposure to a basket of select Central Public Sector Enterprises (CPSEs). These enterprises are some of the largest and most profitable public sector companies in India. In this blog, we’ll explore the benefits of investing in CPSE ETF, its importance in stock market investing, and how systematic investment in this low-cost ETF can provide long-term returns. We will also discuss how using the Navia Zero Brokerage Stock Investing APP can make investing in this ETF more accessible and cost-effective.

What is CPSE ETF?

CPSE ETF aims to replicate the performance of the Nifty CPSE Index, which consists of 11 public sector companies that play a crucial role in India’s economy. The ETF’s objective is to closely track the total returns of the Nifty CPSE Index, offering investors exposure to government-owned entities in sectors like energy, utilities, and industrials.

Investment Objective: The scheme’s investment objective is to generate returns before expenses that closely mirror the performance of the Nifty CPSE Index. However, due to tracking errors, there may be slight deviations between the fund’s performance and the index.

Why Choose CPSE ETF for Stock Market Investing?

1. Diversified Exposure to India’s Public Sector

CPSE ETF offers investors diversified exposure to India’s largest public sector companies. The ETF includes top holdings like NTPC Ltd (20.71%), Power Grid Corporation of India Ltd (18.51%), Oil and Natural Gas Corporation Ltd (16.50%), and Coal India Ltd (15.31%), among others. These companies are key players in sectors such as energy, power, and industrials, and contribute significantly to India’s economic growth.

For investors looking to align their portfolios with government policies and benefit from the growth of state-owned enterprises, CPSE ETF provides an excellent opportunity.

2. Cost-Efficient Investment Option

CPSE ETF is one of the most low-cost ETFs available, with an expense ratio of just 0.07%. This is significantly lower than many actively managed funds, making it an attractive choice for cost-conscious investors.

By using the Navia Zero Brokerage Stock Investing APP, investors can further enhance the cost-efficiency of their investment in CPSE ETF. With zero brokerage, you can buy and sell units of CPSE ETF without incurring any trading costs, making it more affordable for long-term investors.

3. Stock Market Systematic Investing with SIP

CPSE ETF is a great option for stock market systematic investing through a Systematic Investment Plan (SIP). Investors can start a SIP with a small amount and invest regularly in CPSE ETF, taking advantage of rupee cost averaging. This strategy helps in reducing the impact of market volatility and ensures consistent accumulation of ETF units over time.

With Navia, you can set up a SIP for CPSE ETF quickly and easily, allowing you to systematically invest in a basket of India’s largest public sector companies without the hassle of timing the market.

4. Liquidity and Flexibility

As an ETF, CPSE ETF offers the same liquidity and flexibility as individual stocks. It can be traded on the stock exchange during market hours, allowing investors to buy or sell units at their convenience. This liquidity makes CPSE ETF an ideal investment for both short-term traders and long-term investors.

Additionally, using the Navia Zero Brokerage Stock Investing APP, investors can monitor real-time prices, track portfolio performance, and make transactions instantly without any brokerage fees. This provides an efficient and user-friendly experience for all types of investors.

Expanded Top 10 Holdings of CPSE ETF

As of August 2024, CPSE ETF includes the following top 10 holdings, which collectively account for 98.21% of the fund’s total assets:

| Company | Sector | Weightage |

| NTPC Ltd | Utilities | 20.71% |

| Power Grid Corp of India Ltd | Utilities | 18.51% |

| Oil & Natural Gas Corp Ltd | Energy | 16.50% |

| Coal India Ltd | Energy | 15.31% |

| Bharat Electronics Ltd | Industrials | 13.71% |

| Oil India Ltd | Energy | 5.09% |

| NHPC Ltd | Utilities | 3.83% |

| Cochin Shipyard Ltd | Industrials | 1.71% |

| NBCC (India) Ltd | Industrials | 1.63% |

| SJVN Ltd | Utilities | 1.21% |

This ETF is heavily focused on the utilities (45.69%) and energy (37.14%) sectors, providing exposure to companies that are critical to India’s infrastructure and energy production. The ETF is also highly concentrated, with its top five holdings making up over 84% of the total portfolio.

Performance Overview

The CPSE ETF has delivered strong returns over the past few years, outperforming many other sectoral funds. Below is a breakdown of its performance as of August 2024:

1-Year Return: 93.08%

3-Year Annualized Return: 53.08%

5-Year Annualized Return: 33.32%

Here’s how much an investment of ₹1 Lakh in CPSE ETF would have grown based on its annualized returns:

5-Year Growth:

With an annualized return of 33.32%, ₹1 Lakh invested 5 years ago would have grown to approximately:

● ₹4,24,265

3-Year Growth:

With an annualized return of 53.08%, ₹1 Lakh invested 3 years ago would have grown to approximately:

● ₹3,71,617

These returns demonstrate the ETF’s potential to provide significant gains, especially for investors who are willing to take on sector-specific exposure. The high returns are a testament to the performance of public sector enterprises in key areas like energy, utilities, and industrials.

Risk Measures

CPSE ETF carries market risks, particularly due to its concentration in a few sectors like energy and utilities. However, for investors who believe in the long-term growth of public sector companies, This ETF offers a compelling opportunity. Key risk metrics include:

● 3-Year Sharpe Ratio: 2.19 (indicating strong risk-adjusted returns)

● 3-Year Standard Deviation: 19.66 (reflecting moderate volatility)

These risk metrics suggest that while the ETF has experienced volatility, it has delivered strong returns relative to the risk taken.

By setting up a SIP, you can regularly invest a fixed amount in the CPSE ETF, benefiting from rupee cost averaging and ensuring disciplined investing. This strategy allows you to accumulate units of the ETF over time, regardless of market fluctuations, and helps in building wealth in the long run.

Steps to Set up SIP for CPSE ETF on Navia:

1. Download and Log In to the Navia app.

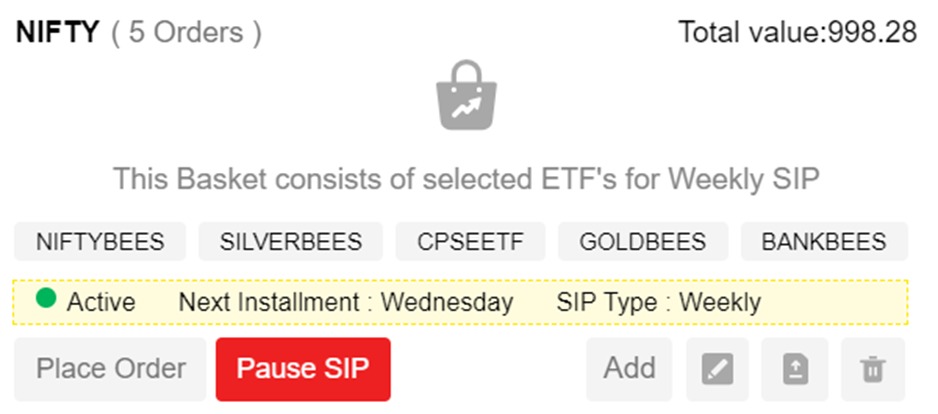

2. Goto Tools->Basket and create a Basket with name of your choice. Setup a Weekly or Monthly SIP. If you are setting a weekly SIP, select the day of the week. If you are setting a monthly SIP, selected the day of the month for the SIP to be executed.

3. Use the Add option to add CPSEETF to the basket and select the quantity and price. Market price is most preferable if you are setting a SIP.

Confirm and Activate the SIP. You can always Pause the SIP when needed. You can also edit the Stock price and QTY in the SIP by using the Edit option.

With zero brokerage, setting up a SIP on the Navia app is cost-effective and hassle-free, making it an excellent option for long-term investors. Navia also provides FREE Ready made ETF baskets for hassle free SIP investment on selected TOP ETF’s. To know more about these curated basket click here

Why CPSE ETF is a Smart Choice for Investors

For investors looking to gain exposure to India’s public sector enterprises, CPSE ETF offers a cost-effective, diversified, and flexible investment option. With its focus on large, government-owned companies in sectors like energy and utilities, CPSE ETF provides stability and the potential for long-term growth.

By investing in CPSE ETF through the Navia Zero Brokerage Stock Investing APP, investors can maximize their returns by avoiding brokerage fees and taking advantage of the app’s powerful tools for systematic investing. Whether you’re looking to build a long-term portfolio or take advantage of the ETF’s liquidity for short-term trading, CPSE ETF offers a compelling investment opportunity.

With its low-cost ETF structure, high returns, and government-backed holdings, this ETF is an excellent choice for those seeking exposure to India’s public sector while keeping costs low.

We’d Love to Hear from you-

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.