Investing in ICICI Prudential Nifty FMCG ETF: A Gateway to India’s Leading Consumer Sector

NSE SYMBOL : FMCGIETF

The ICICI Prudential Nifty FMCG ETF is a robust investment vehicle that provides investors with exposure to the Nifty FMCG (Fast Moving Consumer Goods) Index, which consists of some of India’s largest consumer-focused companies. This ETF is ideal for investors looking to diversify their portfolios with companies from the consumer defensive sector—companies that produce essential goods such as food, beverages, and personal care products. In this blog, we will explore the key features of the Nifty FMCG ETF, its top holdings, historical performance, and the advantages of systematic investing.

What is the ICICI Prudential Nifty FMCG ETF?

The ICICI Prudential Nifty FMCG ETF aims to replicate the performance of the Nifty FMCG Index, which consists of companies from the FMCG sector that have demonstrated strong market positions and stable financials. The ETF offers a low-cost and diversified exposure to these companies, making it an attractive option for investors seeking stability in their portfolios.

Key Features of Nifty FMCG ETF

1) Stock Market Investing: The ETF provides exposure to the top consumer goods companies in India.

2) Low-Cost ETF: With an expense ratio of just 0.20%, the ETF is one of the most cost-effective ways to invest in India’s FMCG sector.

3) Systematic Investing: Investors can set up Systematic Investment Plans (SIPs) using the Navia Zero Brokerage Stock Investing APP, allowing them to invest regularly without incurring additional fees.

Top 10 Holdings of Nifty FMCG ETF

The ICICI Prudential Nifty FMCG ETF offers exposure to some of the most prominent companies in India’s consumer goods space. Here are the top 10 holdings of the ETF:

| Company Name | Sector | Holding (%) |

| ITC Ltd | Consumer Defensive | 34.84% |

| Hindustan Unilever Ltd | Consumer Defensive | 19.52% |

| Nestle India Ltd | Consumer Defensive | 7.02% |

| Tata Consumer Products Ltd | Consumer Defensive | 6.17% |

| Varun Beverages Ltd | Consumer Defensive | 5.68% |

| Britannia Industries Ltd | Consumer Defensive | 5.44% |

| Godrej Consumer Products Ltd | Consumer Defensive | 4.41% |

| Colgate-Palmolive (India) Ltd | Consumer Defensive | 3.82% |

| United Spirits Ltd | Consumer Defensive | 3.38% |

| Dabur India Ltd | Consumer Defensive | 2.93% |

These top 10 companies make up 93.21% of the total assets of the ETF, offering a concentrated exposure to the leaders in India’s FMCG sector.

Performance of Nifty FMCG ETF

The ICICI Prudential Nifty FMCG ETF has shown consistent performance over the years, particularly in periods of economic volatility, as FMCG companies tend to perform well in both good and bad economic times.

Annualised Returns:

1-Year Return: 28.54%

3-Year Return: 18.63%

5-Year Return: Not Available (since the fund was launched in August 2021)

Growth of ₹1 Lakh Investment

Let’s calculate how ₹1 Lakh would have grown over different periods based on the ETF’s historical returns:

| Period | Annualised Return | Investment Growth (₹) |

| 1 Year | 28.54% | ₹1,28,540 |

| 3 Years (Annualised) | 18.63% | ₹1,67,350 |

| 5 Years (Annualised) | Not Available | Not Available |

The ETF has demonstrated impressive returns, especially over the last year, making it a strong option for investors looking for stability and growth in the consumer goods sector.

Sector Allocation

The ICICI Prudential Nifty FMCG ETF focuses exclusively on the consumer defensive sector, providing a balanced exposure to companies that produce essential goods. The sector allocation is as follows:

| Sector | Weighting (%) |

| Consumer Defensive | 100% |

This concentrated exposure to the consumer defensive sector ensures that the ETF is resilient during periods of market volatility, as the demand for essential goods tends to remain stable.

Benefits of Investing in Nifty FMCG ETF

Low-Cost ETF:

With an expense ratio of only 0.20%, the Nifty FMCG ETF is one of the most affordable ways to invest in India’s top FMCG companies.

Diversified Exposure:

The ETF offers a well-diversified exposure to India’s leading consumer goods companies, which are known for their stable earnings and resilience during market downturns.

Systematic Investment Option:

Investors can easily set up a Systematic Investment Plan (SIP) using the Navia Zero Brokerage Stock Investing APP, allowing them to invest small amounts regularly without worrying about brokerage fees.

Stable Performance:

The ETF has demonstrated strong returns, particularly in the last year, thanks to the robust performance of companies in the consumer goods sector. This makes it an ideal option for investors looking for long-term stable returns.

Is Nifty FMCG ETF Right for You?

For investors looking to gain exposure to India’s top FMCG companies, the ICICI Prudential Nifty FMCG ETF is a compelling option. With its low-cost, high-performance, and diversified portfolio, it provides a great opportunity to tap into the growth of India’s consumer goods sector.

Whether you’re a systematic investor or a one-time investor, the Nifty FMCG ETF offers a balanced and cost-effective way to invest in the stock market. By setting up a SIP through the Navia Zero Brokerage Stock Investing APP, you can build wealth over time by investing regularly in this low-cost ETF.

With its diversified exposure and impressive performance, the Nifty FMCG ETF should be considered by any investor looking for stability, growth, and long-term returns in the consumer defensive sector.

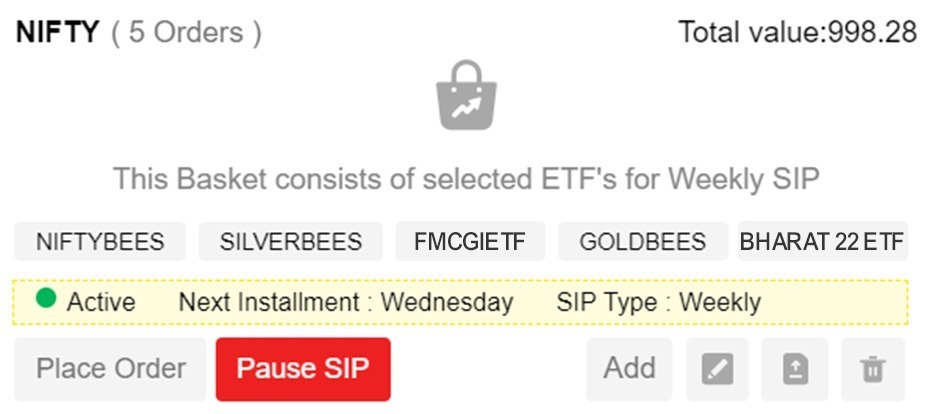

Steps to set up a SIP for the Nifty FMCG ETF using the Navia APP:

1. Download and Log In to the Navia APP:

If you haven’t already, download the Navia APP from the app store, and log in using your credentials.

2. Go to Tools → Basket:

Navigate to the “Tools” section and select “Basket”. This feature allows you to create a basket of stocks/ETFs to invest in through a SIP.

3. Create a Basket:

Choose a name for your basket. Set up a Weekly or Monthly SIP depending on your preference.

🔶 For Weekly SIP, select the day of the week you want the SIP to be executed.

🔶 For Monthly SIP, choose the day of the month for the SIP to be executed.

4. Add Nifty FMCG ETF to the Basket:

Use the “Add” option to add the FMCGIETF or any other ETF/stock of your choice to the basket. Select the quantity and price at which you want to buy. The market price is preferable when setting up a SIP.

5. Confirm and Activate the SIP:

Once the ETF or stock is added, confirm and activate the SIP. You can also edit the stock price or quantity anytime by using the “Edit” option.

6. Pause or Modify SIP if Needed:

You can always pause or modify the SIP (e.g., change the quantity or the stock price) using the “Edit” option.

By following these simple steps, you can set up a systematic investment plan for ICICI Prudential Nifty FMCG ETF or any other stock/ETF using the Navia APP, making it easy to invest regularly and build wealth over time.

We’d Love to Hear from you-

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.