A Comprehensive Guide to Investing in ICICI Prudential BSE Liquid Rate ETF

NSE / BSE SYMBOL : LIQUIDIETF

The ICICI Prudential BSE Liquid Rate ETF is designed to provide investors with returns that closely track the S&P BSE Liquid Rate Index. This ETF primarily invests in Tri-Party Repos, ensuring high liquidity while offering low-risk returns. In this blog, we will explore the benefits of investing in the Liquid ETF and its role in stock market investing. We will also highlight how using the Navia Zero Brokerage Stock Investing APP can further enhance your investing experience by eliminating brokerage fees.

What is ICICI Prudential BSE Liquid Rate ETF?

The ICICI Prudential BSE Liquid Rate ETF seeks to replicate the returns of the S&P BSE Liquid Rate Index by investing in safe and highly liquid instruments such as Tri-Party Repo agreements. It aims to provide low-risk returns, making it a suitable investment for risk-averse investors or those looking for a place to park their cash while earning modest returns.

Investment Objective: The fund’s objective is to generate returns before expenses that closely correspond to the returns of the S&P BSE Liquid Rate Index, subject to tracking errors.

Why Choose ICICI Liquid ETF for Stock Market Investing?

1. Low-Risk, High Liquidity

The ICICI Liquid ETF is primarily focused on low-risk investments such as Tri-Party Repos, which ensures that investors’ capital is secure while offering high liquidity. This makes it a perfect option for short-term parking of funds while earning consistent returns. Investors who want quick access to their funds while earning returns similar to a savings account will find the Liquid ETF to be a highly convenient option.

2. Cost Efficiency

This ETF offers a low-cost way to manage idle funds with an expense ratio of 0.25%. By investing in this ETF, investors can park their money in a highly liquid fund while minimizing expenses.

When investing through the Navia Zero Brokerage Stock Investing APP, you can take advantage of zero brokerage fees, making this already cost-efficient ETF even more attractive. Whether you’re looking to park large sums or manage short-term cash flow, this ETF offers a highly affordable way to do so.

3. Systematic Investment in Liquid ETF with SIP

Investors can set up a Systematic Investment Plan (SIP) with the Liquid ETF, allowing them to invest regularly in this fund. Stock market systematic investing ensures that investors build their portfolio over time, even in a low-risk asset class like Liquid ETF.

The Navia Zero Brokerage Stock Investing APP allows you to easily set up SIPs for the Liquid ETF, ensuring that your investments are consistent and automated. With a SIP, you can benefit from rupee cost averaging, which helps in accumulating Liquid ETF units consistently, irrespective of short-term fluctuations in returns.

4. Liquidity and Flexibility

As an ETF, Liquid ETF offers daily liquidity, making it an ideal investment vehicle for parking short-term funds. Investors can buy and sell units on the stock exchange during market hours, ensuring that they have quick access to their funds whenever required.

The Navia Zero Brokerage Stock Investing APP allows you to track real-time prices, manage your portfolio, and execute transactions with ease and zero brokerage fees. This ensures that you maintain flexibility without sacrificing returns.

Top Holdings of ICICI Liquid ETF

As of September 2024, the holdings of the ICICI Prudential BSE Liquid Rate ETF are dominated by Tri-Party Repo, which forms 99.56% of the portfolio. This allocation to liquid instruments ensures that the ETF provides consistent returns while maintaining high liquidity.

| Holding Name | Sector | Weightage |

| Tri-Party Repo | Repo | 99.56% |

| Net Current Assets | Cash | 0.44% |

This simple and highly liquid portfolio ensures that investors benefit from stable returns without worrying about credit or interest rate risks.

Performance Overview

The ICICI Liquid ETF has provided steady returns over the years, making it an attractive option for short-term investment or cash management. Below is a breakdown of the ETF’s performance as of

September 2024:

🔶 3-Month Return: 1.55%

🔶 6-Month Return: 3.10%

🔶 1-Year Return: 6.20%

These returns are reflective of the low-risk nature of the ETF, providing a reliable option for parking funds while earning modest returns.

Growth on ₹1 Lakh investment:

● 3-Month Growth:

With a 1.55% return, ₹1 Lakh would grow to approximately:

₹1,01,550

● 6-Month Growth:

With a 3.10% return, ₹1 Lakh would grow to approximately:

₹1,03,100

● 1-Year Growth:

With a 6.20% return, ₹1 Lakh would grow to approximately:

₹1,06,200

These figures demonstrate that while Liquid ETF may not offer high returns, it provides consistent and low-risk growth, making it an ideal option for investors looking to preserve capital while earning steady returns.

Why Investing in Liquid ETF is Better Than Keeping Money in a Savings Bank Account

When it comes to managing short-term funds or parking idle money, many people default to a savings bank account. While it’s convenient, investing in a Liquid ETF offers several advantages that can lead to better returns and more efficient capital use. Let’s explore why investing in a Liquid ETF is a smarter choice compared to a traditional savings account.

1. Higher Returns

● Savings Bank Account: Typically offers interest rates between 2.5% to 4% annually, which can barely outpace inflation.

● Liquid ETF: Offers returns in the range of 4% to 6% annually, depending on market conditions. The ICICI Liquid ETF, for instance, has delivered a 1-year return of 6.20%.

With a Liquid ETF, you’re likely to earn a better return on your idle funds compared to the average interest rates offered by savings accounts.

2. Low-Risk Investment

● Savings Bank Account: Considered risk-free, but with lower returns.

● Liquid ETF: Invests primarily in Tri-Party Repo and similar instruments that offer low-risk, stable returns. The ETF is structured to maintain liquidity while minimizing risk, similar to a savings account.

The Liquid ETF provides low-risk exposure, making it suitable for risk-averse investors, just like a savings account, but with better returns.

3. Daily Liquidity

● Savings Bank Account: Allows instant access to your money anytime, but it may come with withdrawal restrictions depending on the type of account.

● Liquid ETF: Offers daily liquidity through the stock exchange, enabling you to buy or sell units during market hours. While access to funds isn’t as instant as a savings account, it is still highly liquid, with proceeds available the next business day.

This makes Liquid ETF nearly as flexible as a savings account but with higher earning potential.

4. Tax Efficiency

● Savings Bank Account: Interest earned on savings accounts above ₹10,000 is taxable under the head “Income from Other Sources” at your applicable tax slab rate.

● Liquid ETF: Provides capital gains, which may be more tax-efficient than interest income. Gains held for more than three years benefit from indexation, reducing the taxable portion.

For investors in higher tax brackets, Liquid ETFs are more tax-efficient than savings accounts.

5. No Lock-In Period

● Savings Bank Account: Your money is available at any time but with lower returns.

● Liquid ETF: Provides liquidity on a daily basis without any lock-in period, similar to a savings account, but with the benefit of potentially higher returns.

This flexibility, combined with superior returns, makes Liquid ETFs an ideal choice for managing short-term funds.

Here’s a table comparison of other Liquid Rate ETFs available on NSE, with their NSE and BSE symbols included and returns as on 28th September 2024

| ETF Name | NSE Symbol | BSE Symbol | Expense Ratio | 1-Year Return | Underlying Index | Investment Objective |

| ICICI Prudential Liquid ETF | ICICILIQ | 590115 | 0.25% | 6.20% | S&P BSE Liquid Rate Index | Replicate the returns of the S&P BSE Liquid Rate Index by investing in Tri-Party Repo. |

| Nippon India ETF Liquid BeES | LIQUIDBEES | 590096 | 0.69% | 3.11% | Nifty 1D Rate Index | Generate returns in line with the Nifty 1D Rate Index by investing in Tri-Party Repo. |

| DSP Liquid ETF | DSPQLTD | 590136 | 0.35% | 6.10% | S&P BSE Liquid Rate Index | Provide returns similar to the S&P BSE Liquid Rate Index via liquid Tri-Party Repo. |

| Edelweiss Liquid BeES ETF | LIQUIDETF | 590111 | 0.58% | 3.00% | Nifty 1D Rate Index | Track the Nifty 1D Rate Index while providing liquidity via Tri-Party Repo instruments. |

Steps to Set up SIP for LIQUIDIETF on Navia:

1. Download and Log In to the Navia app.

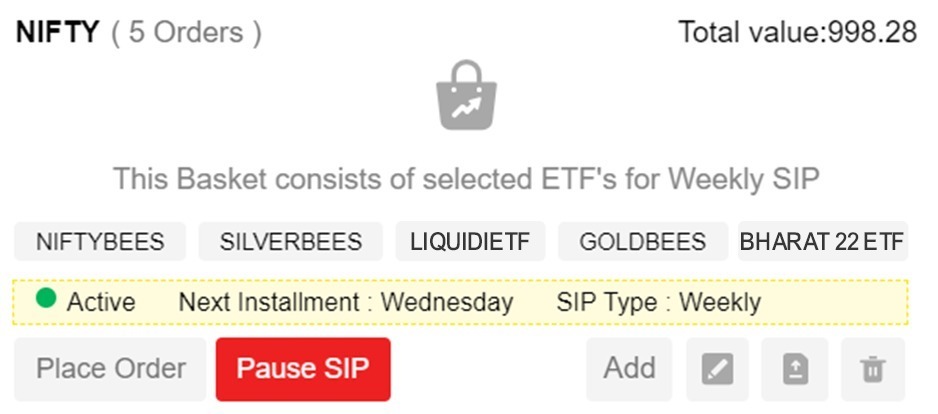

2. Goto Tools->Basket and create a Basket with name of your choice. Setup a Weekly or Monthly SIP. If you are setting a weekly SIP, select the day of the week. If you are setting a monthly SIP, selected the day of the month for the SIP to be executed.

3. Use the Add option to add LIQUIDIETF to the basket and select the quantity and price. Market price is most preferable if you are setting a SIP.

4. Confirm and Activate the SIP. You can always Pause the SIP when needed. You can also edit the Stock price and QTY in the SIP by using the Edit option.

With zero brokerage, setting up a SIP on the Navia app is cost-effective and hassle-free, making it an excellent option for long-term investors. Navia also provides FREE Ready made ETF baskets for hassle free SIP investment on selected TOP ETF’s. To know more about these curated basket click here

We’d Love to Hear from you-

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.