Investing in Hang Seng ETF: A Smart Way to Gain Exposure to the Asian Market

NSESYMBOL : HNGSNGBEES

The Nippon India Hang Seng BeES ETF provides Indian investors with a convenient way to gain exposure to Hong Kong’s stock market through the Hang Seng Index. This ETF replicates the performance of the Hang Seng Index, offering a diversified portfolio of large-cap stocks from various sectors in Hong Kong. In this blog, we will explore the key aspects of investing in the Hang Seng ETF, its top holdings, past performance, and how it can fit into your portfolio as part of stock market systematic investing.

What is the Nippon India Hang Seng BeES ETF?

The Nippon India ETF Hang Seng BeES aims to provide returns that closely correspond to the total returns of securities as represented by the Hang Seng Index. The ETF achieves this by investing in the same proportion as the index.

The Hang Seng Index represents the largest companies in Hong Kong and gives exposure to high-growth sectors such as technology, financial services, and telecommunications. The ETF offers a low-cost, diversified option for investors looking to gain exposure to international markets, particularly the Greater China region.

Key Features of the Hang Seng ETF

➝ Stock Market Investing: Exposure to top companies in the Hong Kong stock market.

➝ Low-Cost ETF: With an expense ratio of 0.93%, the ETF offers a cost-effective way to invest internationally.

➝ Systematic Investing: The ETF allows for easy investments through systematic plans such as SIP, which can be set up using the Navia Zero Brokerage Stock Investing APP.

Top 10 Holdings of the Hang Seng ETF

One of the attractive features of this ETF is its diversified exposure to some of the largest and most well-known companies in Hong Kong. Here’s a look at the top 10 holdings of this ETF:

| Company Name | Sector | Holding (%) |

| Tencent Holdings Ltd | Communication Services | 8.28% |

| Alibaba Group Holding Ltd | Consumer Cyclical | 8.21% |

| HSBC Holdings PLC | Financial Services | 8.19% |

| Meituan Class B | Consumer Cyclical | 6.25% |

| AIA Group Ltd | Financial Services | 5.59% |

| China Construction Bank Corp | Financial Services | 5.33% |

| China Mobile Ltd | Communication Services | 4.18% |

| Industrial And Commercial Bank of China Ltd | Financial Services | 3.13% |

| Xiaomi Corp Class B | Technology | 3.04% |

| CNOOC Ltd | Energy | 3.00% |

These 10 companies make up 55.22% of the total assets of the ETF, providing a balanced exposure to sectors such as technology, finance, and telecommunications. The ETF focuses primarily on large-cap stocks in Hong Kong, making it a suitable option for investors looking for stability and growth.

Performance of the Hang Seng ETF

The ETF has shown strong performance over the years, particularly in the last 1 and 3 years.

Annualised Returns:

1-Year Return: 27.65%

3-Year Return: 2.13%

Growth of ₹1 Lakh Investment

Let’s break down how an investment of ₹1 Lakh would have grown over different periods:

| Period | Annualised Return | Investment Growth (₹) |

| 1 Year | 27.65% | ₹1,27,650 |

| 3 Years (Annualised) | 2.13% | ₹1,06,530 |

These returns highlight the ETF’s potential for strong short-term gains and modest growth over longer periods, particularly when the Hong Kong market performs well.

Sector Allocation

The Hang Seng ETF has a diversified portfolio, with exposure to various sectors in the Hong Kong market. The largest sectors in the portfolio include Financial Services, Communication Services, and Consumer Cyclical.

| Sector | Weighting (%) |

| Financial Services | 33.19% |

| Communication Services | 14.18% |

| Consumer Cyclical | 23.92% |

| Energy | 6.52% |

| Technology | 5.03% |

This sectoral distribution makes the ETF well-suited for investors looking for exposure to various industries driving the Hong Kong economy.

Benefits of Investing in the Hang Seng ETF

Low Cost

The ETF’s expense ratio of 0.93% makes it an affordable option for Indian investors looking to gain international exposure.

Diversification

By investing in the Hang Seng ETF, you are gaining exposure to the top 82 companies listed in Hong Kong, spread across multiple sectors. This diversification helps reduce risk while capitalizing on the growth of the Hong Kong market.

International Exposure

Investing in the Hang Seng ETF allows Indian investors to diversify their portfolio beyond the domestic market and tap into growth opportunities in Hong Kong and Greater China.

Systematic Investment Plans (SIP)

Investors can set up SIPs to invest in the Hang Seng ETF through the Navia Zero Brokerage Stock Investing APP, making it easier to invest small amounts regularly without worrying about brokerage fees.

Steps to Set up SIP for Hang Seng BeES ETF on Navia:

1. Download and Log In to the Navia app.

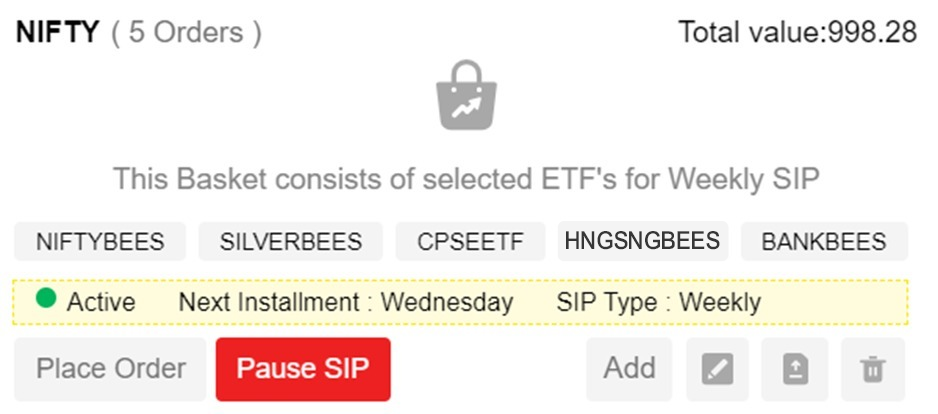

2. Goto Tools->Basket and create a Basket with name of your choice. Setup a Weekly or Monthly SIP. If you are setting a weekly SIP, select the day of the week. If you are setting a monthly SIP, selected the day of the month for the SIP to be executed.

3. Use the Add option to add Hang Seng BeES ETF to the basket and select the quantity and price. Market price is most preferable if you are setting a SIP.

4. Confirm and Activate the SIP. You can always Pause the SIP when needed. You can also edit the Stock price and QTY in the SIP by using the Edit option.

With zero brokerage, setting up a SIP on the Navia app is cost-effective and hassle-free, making it an excellent option for long-term investors. Navia also provides FREE Ready made ETF baskets for hassle free SIP investment on selected TOP ETF’s. To know more about these curated basket click here

Is the Hang Seng ETF Right for You?

For Indian investors looking to diversify their portfolios by gaining exposure to international markets, particularly in Asia, the Nippon India Hang Seng BeES ETF is an attractive option. It provides exposure to the largest companies in Hong Kong, offers low costs, and has the potential for strong returns over the long term.

Whether you are a stock market systematic investor or someone looking to make a one-time investment, the Hang Seng ETF offers a balanced, diversified, and affordable option. And with the ability to set up SIPs using the Navia Zero Brokerage Stock Investing APP, investing in international markets has never been easier.

By including this low-cost ETF in your portfolio, you can benefit from the growth potential of the Greater China region while spreading your risk across various sectors.

We’d Love to Hear from you-

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.