DOMS Industries IPO: Your Guide to Financial Odyssey

If you’ve heard about the DOMS IPO and are wondering what it’s all about, you’re in the right place. We’re here to simplify things for you. In this guide, we’ll break down the key points of the DOMS Industries IPO, making it easy for everyone to understand, regardless of their financial background. Embark on a journey into the financial landscape with DOMS Industries, as they set to raise ₹1200 crores through its upcoming Initial Public Offering (IPO), which is scheduled to open on December 13 and close on December 15, this IPO is anticipated to make waves in the market.

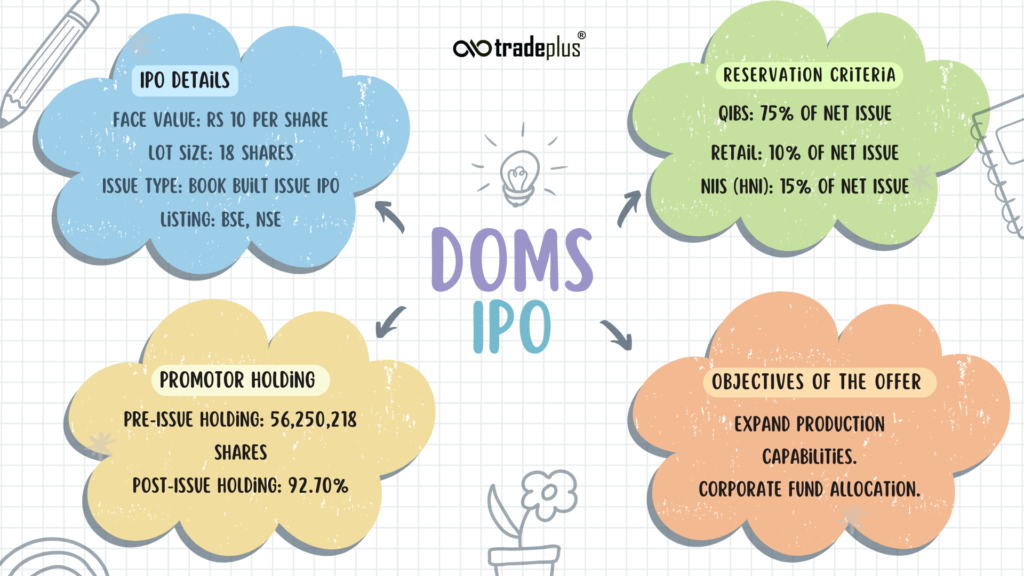

IPO Details

1. Price Band and Market Lot: Setting the Parameters

The DOMS IPO sets its price band between ₹750 to ₹790 per share, offering investors a window to participate. The minimum market lot is 18 shares, requiring an application amount of ₹14,220. Retail investors can apply for up to 14 lots, totaling 252 shares or ₹199,080.

2. Fundraising Dynamics: Understanding the Numbers

Breaking down the financial dynamics, the DOMS IPO aims to raise ₹1200 crores. This comprises a fresh issue of ₹250 crores and an offer for sale of up to ₹850 crores with a face value of ₹10 each. The allocation strategy earmarks 10% for retail, 75% for QIBs, and 15% for HNIs.

3. GMP Buzz: A Strong Market Indication

The Grey Market Premium (GMP) for DOMS IPO is creating a buzz, currently standing strong at the 400 level. Market speculations suggest a premium listing for DOMS IPO, adding an element of excitement. Stay tuned for daily updates on DOMS IPO GMP through dedicated portals or the IPO Watch App.

4. The Essence of DOMS Industries: A Creative Legacy

Founded in 1976 as R.R. Industries, DOMS Industries evolved into a powerhouse of creativity, launching its flagship brand “DOMS” in 2005. As an Indian stationery and art materials manufacturing company based in Valsad, Gujarat, DOMS is a leading player in India’s ‘stationery and art’ products market.

5. Holistic Approach: A Creative Products Company

DOMS Industries stands out as a holistic creative products company, crafting a diverse range of stationery and art materials. Their flagship brand ‘DOMS’ has not only made a mark in the domestic market but has also expanded its reach to over 40 countries globally.

6. Market Dominance

DOMS Industries has clinched significant market shares, with 29% for pencils and 30% for mathematical instrument boxes by value in Fiscal 2023. This dominance positions them as a key player in the ‘stationery and art’ market.

7. Product Portfolio: A Spectrum of Creativity

Diving into their product portfolio, DOMS offers a spectrum of well-designed and quality ‘stationery and art material’ products, spanning seven categories. From scholastic stationery to fine art products, their offerings cater to a diverse audience.

8. Global Distribution Network: Reaching Across Continents

As of March 31, 2023, DOMS Industries boasts a robust, global multi-channel distribution network across the Americas, Africa, Asia Pacific, Europe, and the Middle East. This expansive reach positions them as a global player in the creative products market.

As the DOMS IPO unfolds, investors can anticipate a dynamic financial journey, blending market dynamics with the creative legacy of DOMS Industries. Stay informed, stay engaged, and let the financial odyssey begin!