Does a SIP Top-Up Make Sense, and Who Should Consider It?

Investors often wonder if increasing their SIP contribution periodically makes sense. SIP Top-Up allows investors to boost their monthly investment, leveraging future income growth or reduced expenses. The report by WhiteOak Capital Mutual Fund highlights key insights into who should consider this feature.

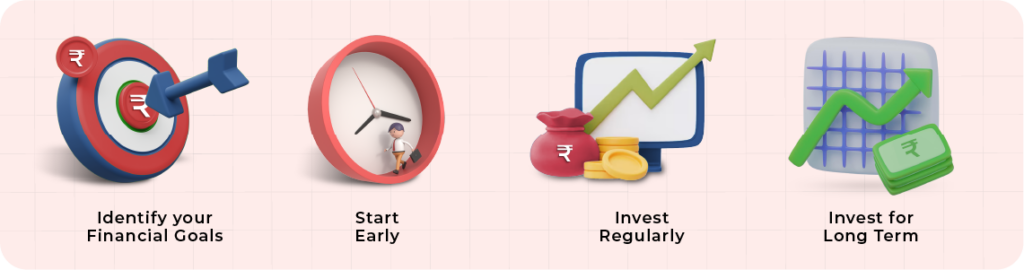

Successful SIP: The Smart Investor’s Choice!

A successful SIP is more about “Starting Early”, maintaining the discipline of “Investing Regularly”, investing for the “Long Term” to achieve our “Financial Goals” and less about “Which Date”, “Which Frequency”, “At what stage of the Market Cycle” etc.

Key Benefits of SIP Top-Up:

1. Faster Goal Achievement:

● Increasing the SIP amount over time can help investors reach financial goals sooner.

● Example: Retire earlier by boosting retirement savings through annual SIP Top-Ups.

2. Start Small, Grow Big:

● New investors can start with modest SIP amounts and increase contributions as income rises.

● Suitable for young professionals starting their careers.

3. Enhanced Discipline:

● Committing to higher SIP amounts in advance ensures that future surpluses are invested consistently, removing emotional biases.

Comparative SIP Performance (BSE Sensex TRI as on May 31, 2024):

| SIP Period | Normal SIP – Invested Amount (₹ Lakh) | Normal SIP – Current Value (₹ Lakh) | Normal SIP – XIRR (%) | Fixed Top-Up -Rs.1K Invested Amount (₹ Lakh) | Fixed Top-Up – Current Value (₹ Lakh) | Fixed Top-Up – XIRR (%) | Variable Top-Up -10% Invested Amount (₹ Lakh) | Variable Top-Up – Current Value (₹ Lakh) | Variable Top-Up – XIRR (%) |

| Last 5 Years | 6.0 | 9.0 | 16.1 | 7.2 | 10.7 | 17.0 | 7.3 | 10.9 | 16.9 |

| Last 10 Years | 12.0 | 25.6 | 14.5 | 17.4 | 34.7 | 14.7 | 19.1 | 37.2 | 14.8 |

| Last 15 Years | 18.0 | 54.6 | 13.6 | 30.6 | 82.0 | 13.8 | 38.1 | 94.9 | 13.9 |

| Last 20 Years | 24.0 | 113.2 | 13.7 | 46.8 | 176.9 | 13.7 | 68.7 | 221.4 | 13.8 |

| Last 25 Years | 30.0 | 273.6 | 14.9 | 66.0 | 426.3 | 14.8 | 118.0 | 552.6 | 14.7 |

This table highlights the invested amounts, current values, and corresponding XIRRs for different SIP strategies over varying time periods. It shows how fixed and variable top-up strategies enhance returns compared to a normal SIP.

Takeaways:

· Who Should Consider SIP Top-Up?

➝ Those with growing income or expected expense reductions.

➝ New professionals with limited initial surplus.

➝ Investors targeting specific financial goals within tight timelines.

· Why It Works:

➝ Compounding Effect: Regularly increasing SIPs maximizes compounding.

➝ Financial Discipline: Ensures future income surpluses are automatically invested.

By opting for SIP Top-Up, investors can harness the full potential of systematic investing, secure financial goals faster, and maintain long-term investment discipline.

Do You Find This Interesting?

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.