Bottom Fishing with Precision: The Power of the Tweezer Bottom Pattern

- What is a Tweezer Bottom?

- Anatomy of the Tweezer Bottom Candle

- Psychology: Why Does It Work?

- Strategic Trading: How to Play the Tweezer Bottom

- Tweezer Bottom vs. Other Reversals

- Bottom Line

- Frequently Asked Questions

In the volatile landscape of the 2026 stock market, identifying the exact moment a downtrend loses its steam is the “Holy Grail” for swing traders and long-term investors alike. While many traders fear “falling knives,” professional technical analysts look for specific structural signals that indicate a price floor has been established. One of the most reliable and visually striking signals for this is the tweezer bottom.

When the market hits a level, it simply refuses to break below; it leaves a footprint. Understanding the tweezer bottom candlestick pattern allows you to read that footprint and position yourself for the ensuing bullish reversal.

What is a Tweezer Bottom?

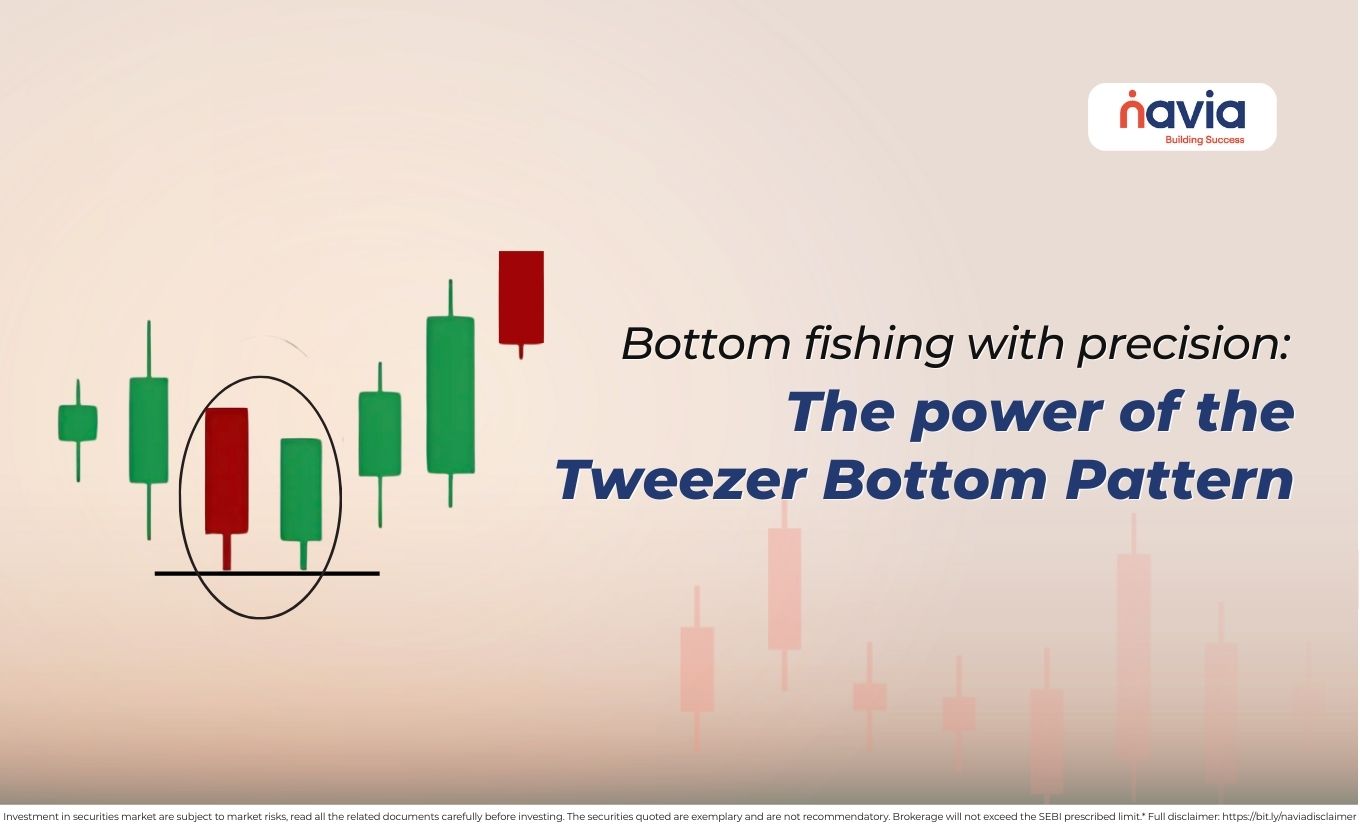

A tweezer bottom is a two-candle bullish reversal pattern that appears at the end of a downtrend. It is characterized by two or more candlesticks that have the exact same (or very nearly the same) low point.

The name is derived from the visual similarity to a pair of tweezers; the two matching lows act as the “tips” that pinch the price and prevent it from falling further. In technical terms, it represents a successful defense of a support level by the bulls.

For a formation to be classified as a valid tweezer bottom candle pattern, it must follow these four rules:

1. The Context: It must occur after a clear and sustained downtrend.

2. First Candle: A bearish candle that continues the downward move.

3. Second Candle: A bullish candle (usually) that hits the same low as the first candle but fails to break below it, eventually closing higher.

4. The Lows: The “shadows” or “wicks” of both candles must hit the same price floor.

Anatomy of the Tweezer Bottom Candle

The candlestick tweezer bottom can manifest in several ways, each carrying a slightly different weight of conviction:

| The Standard Tweezers | A long red candle followed by a long green candle with identical lows. This shows a violent rejection of lower prices and an immediate takeover by buyers. |

| Wick-to-Wick Tweezers | The bodies of the candles may be small, but the long lower wicks touch the same price point. This indicates that intraday attempts to push the price lower were met with massive buying pressure. |

| The Hammer Tweezer | Often, the second candle in a tweezer bottom pattern is a “Hammer” candlestick. When a Hammer’s low matches the previous day’s low, the bullish signal is considered “supercharged.” |

Psychology: Why Does It Work?

To master the tweezer bottom candlestick pattern, you must look beyond the colors and understand the emotional shift in the market. On the first day of the pattern, the bears are in total control. They push the price to a fresh low, and fear is at its peak. However, by the end of the session, the selling slow down.

On the second day, the bears attempt to “break the floor” once more. They push the price back down to the previous day’s low, expecting a breakdown. Instead, they hit a “wall of money.” Buyers-often institutional players recognize the value at this price level and start accumulating. When the bears realize the price won’t break, they begin to cover their short positions, fueling the tweezer bottom candle to close significantly higher.

The matching lows signify that the bears have “thrown everything they have” at the support level and failed.

Strategic Trading: How to Play the Tweezer Bottom

Simply spotting a tweezer bottom pattern isn’t enough; you need a disciplined entry and exit strategy to thrive in 2026’s fast-moving markets. Let’s see some of the strategies (educational purpose only).

| Confirm the Location | A tweezer bottom in the middle of a trading range is often just “noise.” Look for this pattern at: Major historical support levels. The lower boundary of a Bollinger Band. Key Fibonacci retracement levels (like the 61.8% mark). |

| Wait for the Close | Never enter a trade while the second tweezer bottom candle is still forming. Wait for the candle to close to ensure the lows actually match, and the price hasn’t “leaked” lower. |

| The Entry Point | A conservative entry is to buy when the price moves above the high of the second candle in the pattern. This provides confirmation that the bullish momentum is actually following through. |

| Stop-Loss Placement | The tweezer bottom offers one of the most logical stop-loss placements in all technical analysis. Place your stop-loss just a few pips below the matching lows. If the price breaks at that level, the “floor” has failed, and you should exit the trade immediately. |

Tweezer Bottom vs. Other Reversals

| Pattern | No. of Candles | Key Visual Feature | Psychological Signal | Relative Reliability |

|---|---|---|---|---|

| Tweezer Bottom | 2 | Matching Lows (Wicks or Bodies) | Immediate rejection of a specific support price | Moderate (Needs confirmation) |

| Bullish Engulfing | 2 | The 2nd candle body completely covers the 1st. | Strong takeover; buyers have totally overpowered sellers | High |

| Hammer | 1 | Small body with a very long lower wick | Buyers pushed the price back up significantly within one session | Moderate |

| Morning Star | 3 | 3Big Red ➜ Tiny “Star” ➜ Big Green | Slow transition from fear to indecision to hope | Very High |

| Bullish Harami | 2 | 2nd small candle sits inside the 1st large candle | Selling momentum has suddenly stalled (like a “pause”) | Low (Signal of caution) |

| Double Bottom | Many | Two distinct price troughs with a peak in between | Long-term tug-of-war where a floor is tested over weeks | Excellent |

Bottom Line

The tweezer bottom is a simple yet profound signal of market exhaustion. It tells you that for two consecutive periods, the market looked into the abyss and decided the price was too cheap. By incorporating the tweezer bottom candlestick pattern into your 2026 trading toolkit, you gain a clear, objective way to identify market floors and manage your risk with surgical precision.

Respect the floor, watch the volume, and let the tweezers point the way to the next bull run.

Do You Find This Interesting?

We’d Love to Hear from you-

Frequently Asked Questions

What is a tweezer bottom candlestick?

A tweezer bottom is a two-candle bullish reversal pattern that appears at the end of a downtrend. It is named because the two candles have matching (or nearly identical) lows, resembling the tips of a pair of tweezers.

Is tweezer Bottom bullish?

Yes. It is a strictly bullish reversal signal. It indicates that the selling pressure has been exhausted at a specific price level. When the second candle refuses to break the first candle’s low, it shows that buyers are aggressively defending that “floor” and are ready to push the price back up.

How do you confirm a tweezer bottom?

Relying on just the two candles can lead to “false signals.” To confirm the pattern, traders look for:

🔹Context: The pattern must appear after a clear downtrend (not in a sideways market).

🔹The Third Candle: Wait for the next candle to close above the high of the second (bullish) candle.

🔹Volume: A spike in trading volume on the second candle proves that big institutional “buyers” are entering the market at that level.

🔹Support Zones: It is much more reliable if it forms at a major historical support level or an oversold RSI level.

What timeframes are best for tweezer bottoms?

The reliability of the signal increases with the timeframe:

➢ Daily and Weekly (Best): These are the most dependable for long-term trend reversals as they represent the collective sentiment of major banks and funds.

➢ 1-Hour and 4-Hour (Good): Effective for swing traders looking for medium-term moves.

➢ Intraday (1-min to 15-min): These often produce “false tweezers” due to market noise and are considered much less reliable unless they align with a higher timeframe support.

What happens after tweezer bottom?

Once a tweezer bottom is confirmed, the following typically occurs:

▶ Bullish Reversal: The previous downward momentum stops, and the price begins to trend upward.

▶ New Support Level: The matching lows of the tweezers often become a “hard” support level for the future.

▶ Short Covering: Traders who were “shorting” the stock often rush to buy back their positions (cover), which adds extra fuel to the upward move.

DISCLAIMER: Investment in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Full disclaimer: https://bit.ly/naviadisclaimer.