Understanding the Engulfing Pattern (Bullish and Bearish Reversal) in Technical Analysis

The Engulfing Pattern is a common candlestick pattern in technical analysis that signals a potential reversal in the price trend of an asset. There are two types of engulfing patterns: Bullish Engulfing Pattern and Bearish Engulfing Pattern. These patterns are simple to spot on a candlestick chart and are highly effective in identifying possible trend reversals.

In this article, we’ll explain the Engulfing Pattern in both its bullish and bearish forms, with simple language and clear examples.

What is the Engulfing Pattern?

The Engulfing Pattern consists of two candlesticks:

1. The first candlestick represents the current trend (either bullish or bearish).

2. The second candlestick “engulfs” the first one, meaning it completely covers or is larger than the first candlestick.

The engulfing candle indicates that the market has changed sentiment, and this could lead to a reversal in the trend.

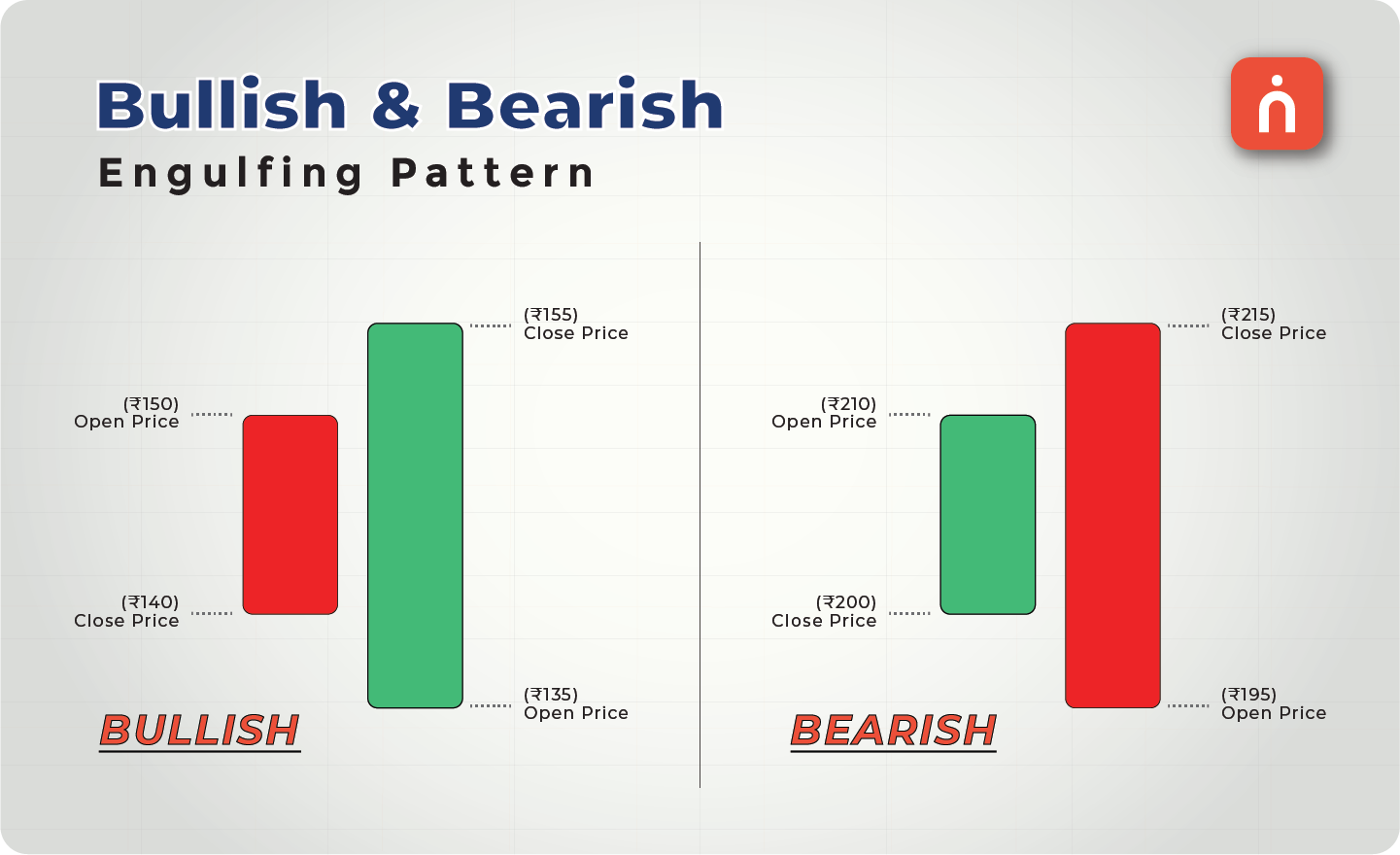

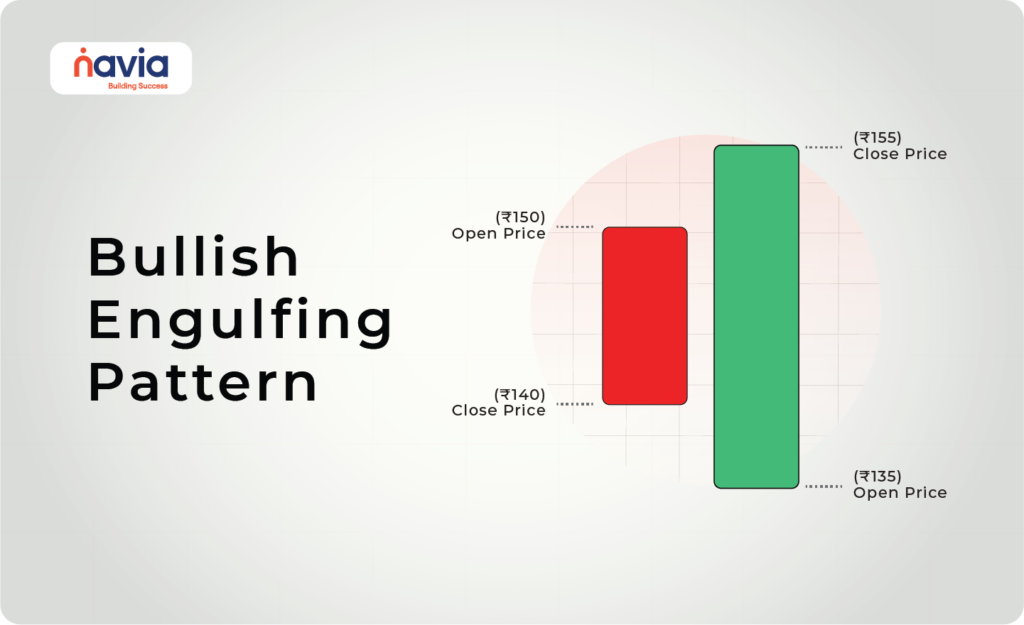

1. Bullish Engulfing Pattern

The Bullish Engulfing Pattern signals a potential reversal from a downtrend to an uptrend. It typically forms at the bottom of a downtrend and consists of two candlesticks:

🠖 The first candlestick is bearish (meaning the price closed lower than it opened), showing that the downtrend is still in play.

🠖 The second candlestick is bullish (the price closed higher than it opened) and is larger than the first one, completely “engulfing” it.

The second, larger bullish candlestick suggests that buyers have overwhelmed the sellers, and the price is likely to move upward.

Key Features of a Bullish Engulfing Pattern:

🔸 The second candle is bullish (green/white) and engulfs the previous bearish (red/black) candle.

🔸 The pattern appears at the end of a downtrend.

🔸 It signals a potential shift from bearish to bullish sentiment, indicating that prices might rise.

Example of a Bullish Engulfing Pattern:

| Day | Open Price (₹) | Close Price (₹) | Description |

|---|---|---|---|

| Day 1 | 150 | 140 | Bearish candle (downtrend continues) |

| Day 2 | 135 | 155 | Bullish candle that completely engulfs the previous day’s candle |

In this example, the market was in a downtrend on Day 1, with the price opening at ₹150 and closing lower at ₹140. However, on Day 2, the price opened even lower at ₹135 but closed significantly higher at ₹155, forming a large bullish candlestick that completely engulfed the bearish candle from Day 1. This signals that buyers have taken control, and the price is likely to rise.

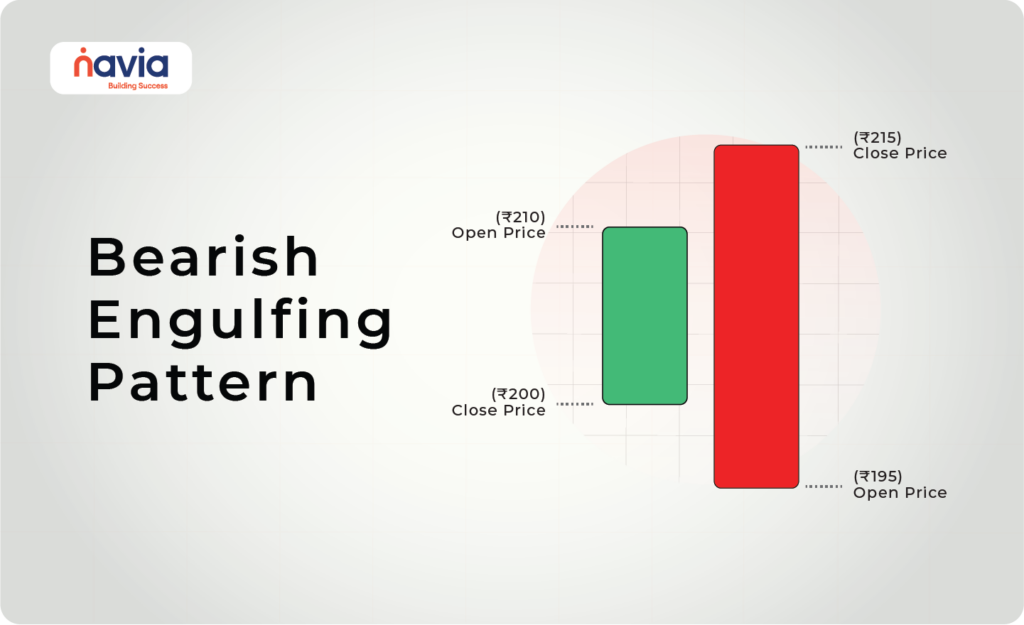

2. Bearish Engulfing Pattern

The Bearish Engulfing Pattern signals a potential reversal from an uptrend to a downtrend. It typically forms at the top of an uptrend and also consists of two candlesticks:

🠖 The first candlestick is bullish (price closed higher than it opened), showing that the uptrend is still in play.

🠖 The second candlestick is bearish (price closed lower than it opened) and is larger than the first one, completely “engulfing” it.

The second, larger bearish candlestick indicates that sellers have overpowered the buyers, and the price is likely to decline.

Key Features of a Bearish Engulfing Pattern:

🔸 The second candle is bearish (red/black) and engulfs the previous bullish (green/white) candle.

🔸 The pattern appears at the end of an uptrend.

🔸 It signals a potential shift from bullish to bearish sentiment, indicating that prices might fall.

Example of a Bearish Engulfing Pattern:

| Day | Open Price (₹) | Close Price (₹) | Description |

|---|---|---|---|

| Day 1 | 200 | 210 | Bullish candle (uptrend continues) |

| Day 2 | 215 | 195 | Bearish candle that completely engulfs the previous day’s candle |

In this example, the market was in an uptrend on Day 1, with the price opening at ₹200 and closing higher at ₹210. However, on Day 2, the price opened even higher at ₹215 but closed much lower at ₹195, forming a large bearish candlestick that completely engulfed the bullish candle from Day 1. This signals that sellers have taken control, and the price is likely to fall.

How to Trade the Engulfing Pattern

Bullish Engulfing Pattern (Buying Opportunity):

Entry Point: Enter a long position (buy) once the bullish engulfing pattern is confirmed. The ideal time to buy is right after the second (bullish) candlestick closes.

Stop-Loss: Place a stop-loss just below the low of the second bullish candle to protect against potential losses if the pattern fails.

Target Price: You can aim for a short-term target based on previous resistance levels or use a trailing stop to ride the uptrend.

Bearish Engulfing Pattern (Selling Opportunity):

Entry Point: Enter a short position (sell) after the bearish engulfing pattern is confirmed. The ideal time to sell is right after the second (bearish) candlestick closes.

Stop-Loss: Place a stop-loss just above the high of the second bearish candle to minimize risk if the pattern fails.

Target Price: Aim for support levels or use a trailing stop to manage the downtrend.

Significance of Volume in Engulfing Patterns

🔹 Bullish Engulfing with High Volume: If the bullish engulfing pattern occurs with high volume, it adds strength to the signal, indicating that buyers are stepping in with conviction, and the reversal is likely to hold.

🔹 Bearish Engulfing with High Volume: If the bearish engulfing pattern is accompanied by high volume, it shows that sellers are coming in forcefully, increasing the likelihood of a downward trend.

Summary of Key Differences Between Bullish and Bearish Engulfing Patterns

| Pattern | Market Trend Before Pattern | First Candle | Second Candle | Signal |

| Bullish Engulfing | Downtrend | Small Bearish | Large Bullish | Reversal to an uptrend (buy) |

| Bearish Engulfing | Uptrend | Small Bullish | Large Bearish | Reversal to a downtrend (sell) |

Conclusion

The Engulfing Pattern (both bullish and bearish) is a straightforward and powerful reversal signal in technical analysis. Whether it signals a reversal from a downtrend to an uptrend (bullish engulfing) or from an uptrend to a downtrend (bearish engulfing), this pattern is an essential tool for traders looking to capitalize on changes in market sentiment.

By understanding how to spot these patterns and confirming them with additional tools like volume, traders can improve their decision-making and take advantage of potential trend reversals.

Do You Find This Interesting?

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.