STT Hike & Fee Cuts: How Navia Minimizes Your Trading Costs

Starting October 1, 2024, important changes to the Securities Transaction Tax (STT) and transaction charges will take effect, significantly impacting traders in the Equity and F&O segments. These adjustments, announced in the Union Budget 2024-25(sebi f&o new rules), are aimed at balancing the trading costs for investors and traders. Here, we’ll break down the impact of these changes with practical examples and explain how they affect the overall cost of transactions.

1. Increase in STT for Equity F&O Transactions

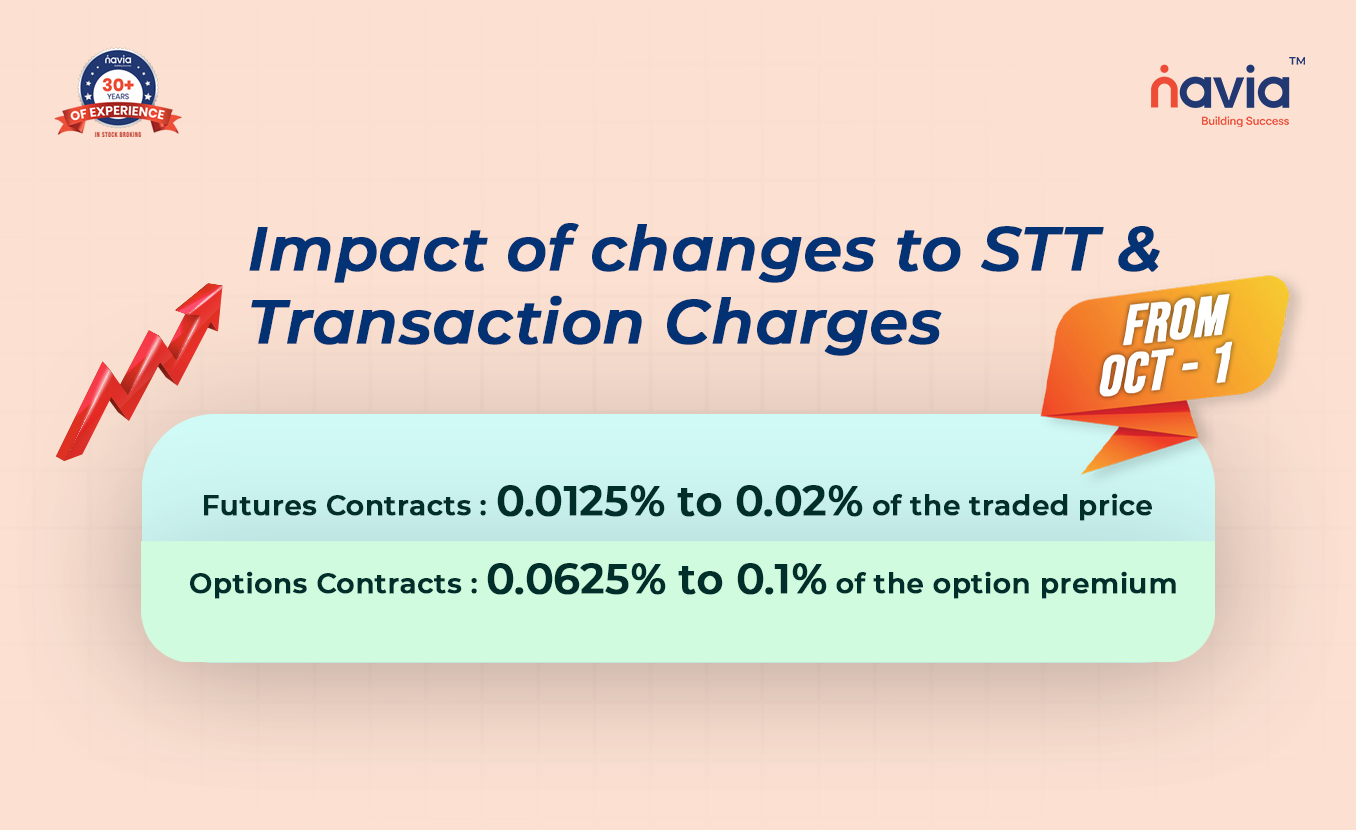

The key change affecting traders is the increase in STT for Futures and Options (F&O) contracts:

● Equity futures Contracts: STT increases from 0.0125% to 0.02% of the traded price.

● Equity Options Contracts: STT rises from 0.0625% to 0.1% of the option premium.

Let’s look at an example of a transaction worth Rs 10,00,000 in both segments.

Example 1: Futures Contract

Transaction Value: ₹10,00,000

● Old STT: ₹10,00,000 * 0.0125% = ₹1,250

● New STT: ₹10,00,000 * 0.02% = ₹2,000

Impact: An additional ₹750 in STT cost for every ₹10,00,000 traded in the futures segment.

Example 2: Options Contract

Option Premium: Rs 10,00,000

● Old STT on Premium: Rs 10,00,000 * 0.0625% = Rs 625

● New STT on Premium: Rs 10,00,000 * 0.1% = Rs 1000

Impact: An additional Rs 375 in STT for every Rs 10,00,000 option premium, making options trading slightly more expensive.

2. Decrease in Transaction Charges for NSE, BSE, and MCX

While STT increases in F&O trades, there is a reduction in transaction charges across various segments, particularly on the NSE, BSE, and MCX exchanges.

Example 3: NSE – Equity Futures Transaction Charges

● Old Transaction Charges: Rs 10,00,000 * 0.00188% = Rs 18.80

● New Transaction Charges: Rs 10,00,000 * 0.00173% = Rs 17.30

Impact: A saving of Rs 1.50 on every Rs 10,00,000 traded in the equity futures market.

Example 4: NSE- Equity Options Transaction Charges

● Old Transaction Charges: 10,00,000 * 0.0495% = Rs 495

● New Transaction Charges: 10,00,000 * 0.03503% = Rs 350.3

Impact: A significant reduction of Rs 144.70 on every Rs 10,00,000 traded in options.

Example 5: MCX- Commodity Futures Transaction Charges

● Old Transaction Charges: Rs 10,00,000 * 0.0026% = Rs 26

● New Transaction Charges: Rs 10,00,000 * 0.0021% = Rs 21

Impact: A saving of Rs 5 on every Rs 10,00,000 traded in commodity futures.

3. Combined Impact: STT Increase vs. Transaction Charge Reduction

Let’s take a comprehensive look at how the changes in both STT and transaction charges impact traders overall for a transaction worth Rs 10,00,000.

Example 6: Equity Futures

● Increased STT Cost: Rs 75

● Reduced Transaction Charges Savings: Rs 1.50

Net Impact: An additional cost of Rs 73.50 for every Rs 10,00,000 traded in futures.

Example 7: Equity Options

● Increased STT Cost: Rs 375

● Reduced Transaction Charges Savings: Rs 144.70

Net Impact: A net loss of Rs 230.30 on every Rs 10,00,000 traded in options.

As seen from the above examples, while the STT increases result in additional costs, the reduction in transaction charges, especially in the options segment, significantly outweighs the increase, leading to net savings in many cases.

4. How Navia Markets Minimizes Your Trading Costs

At Navia, we understand the importance of reducing trading costs for our clients. With the introduction of these new STT and transaction charges, Navia has already been ahead of the curve by offering zero brokerage options trading. This unique feature ensures that while others are adjusting to the increased STT costs, our clients continue to enjoy brokerage-free trading, allowing them to make the most of the reduced transaction charges.

What Does This Mean for You?

➝ No brokerage fees, which means you already save significantly compared to other brokers.

➝ The new reduction in transaction charges complements our zero-brokerage model, helping you retain more of your profits.

➝ Even with the increased STT, Navia clients benefit from lower overall trading costs.

Conclusion

While the changes in STT may result in slightly higher costs for F&O traders, the reduction in transaction charges offers relief, especially in options trading. Combined with Navia’s zero brokerage services, traders can optimize their strategies and ensure minimal costs, maximizing profitability.

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.

We’d love to hear from you