Anatomy of a Straddle or Strangle: A Comprehensive Guide for Options Traders

Options trading provides a variety of strategies to suit different market conditions and trading goals. Among these strategies, the Straddle and Strangle are two popular approaches that traders use to profit from significant price movements, regardless of the direction. In this blog, we will explore the anatomy of a straddle and a strangle, discussing how they work, when to use them, and providing easy-to-understand examples. We will also highlight how you can use the Navia Mobile App to enhance your options trading with these strategies.

What is a Straddle?

A straddle is an options strategy that involves buying both a call and a put option with the same strike price and expiration date on the same underlying asset. The straddle is designed to profit from significant price movements in either direction—up or down. This strategy is ideal when you expect the underlying asset to experience high volatility but are uncertain about the direction of the move.

How Does a Straddle Work?

When you enter a straddle, you purchase a call option and a put option simultaneously:

● Call Option: This gives you the right to buy the underlying asset at the strike price.

● Put Option: This gives you the right to sell the underlying asset at the strike price.

If the price of the underlying asset moves significantly in either direction, one of the options will become profitable, potentially offsetting the cost of both options and generating a profit.

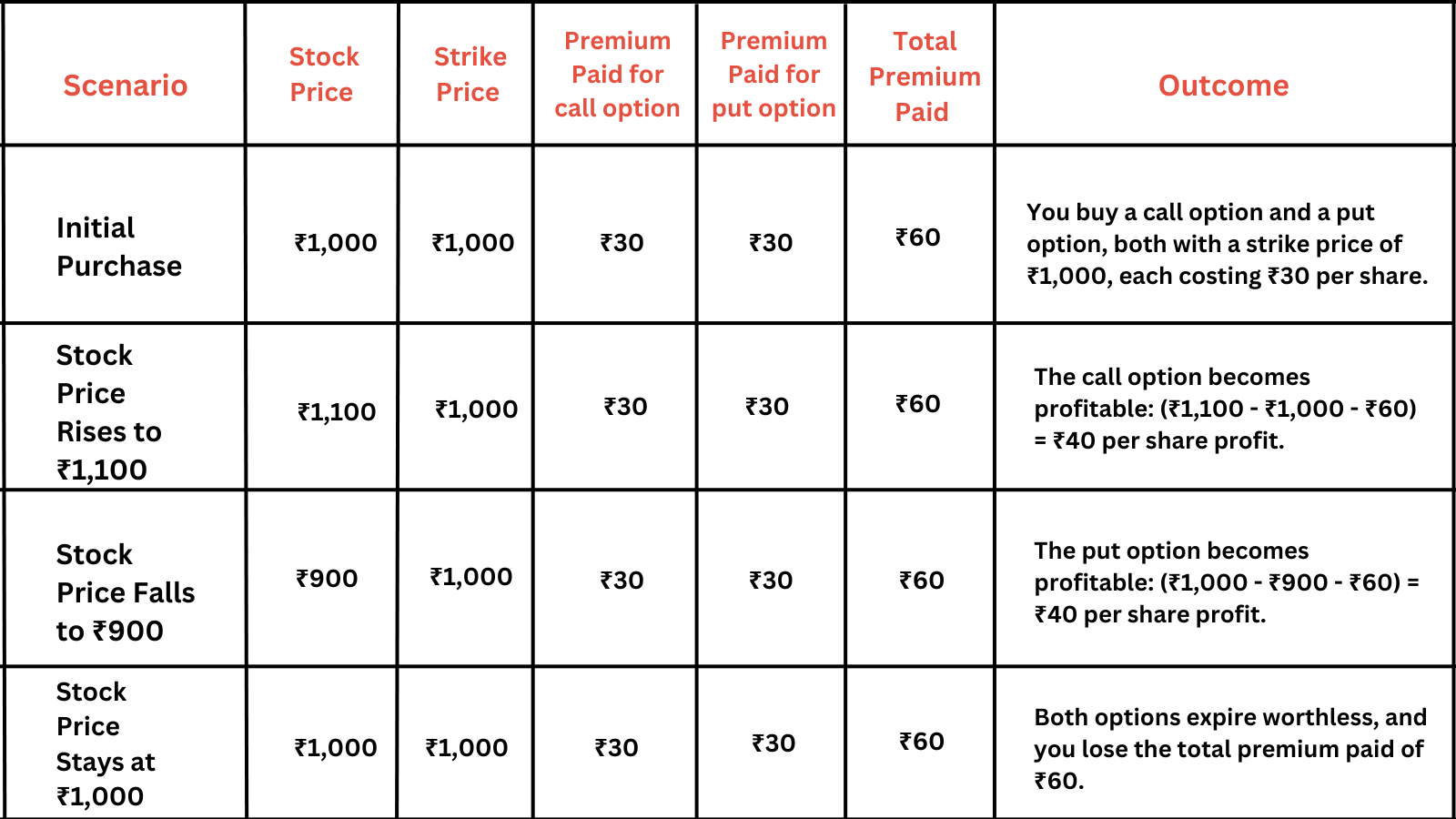

Example of a Straddle

Let’s walk through a practical example of a straddle:

What is a Strangle?

A strangle is similar to a straddle but involves buying a call and a put option with different strike prices. Typically, the call option will have a higher strike price, and the put option will have a lower strike price. This strategy is also used to profit from significant price movements, but it is generally cheaper to execute than a straddle because the options are further out-of-the-money.

How Does a Strangle Work?

In a strangle, you purchase a call option with a higher strike price and a put option with a lower strike price:

● Call Option: Gives you the right to buy the underlying asset at the higher strike price.

● Put Option: Gives you the right to sell the underlying asset at the lower strike price.

The strangle requires a more significant move in the underlying asset’s price to become profitable, but it has a lower initial cost compared to a straddle.

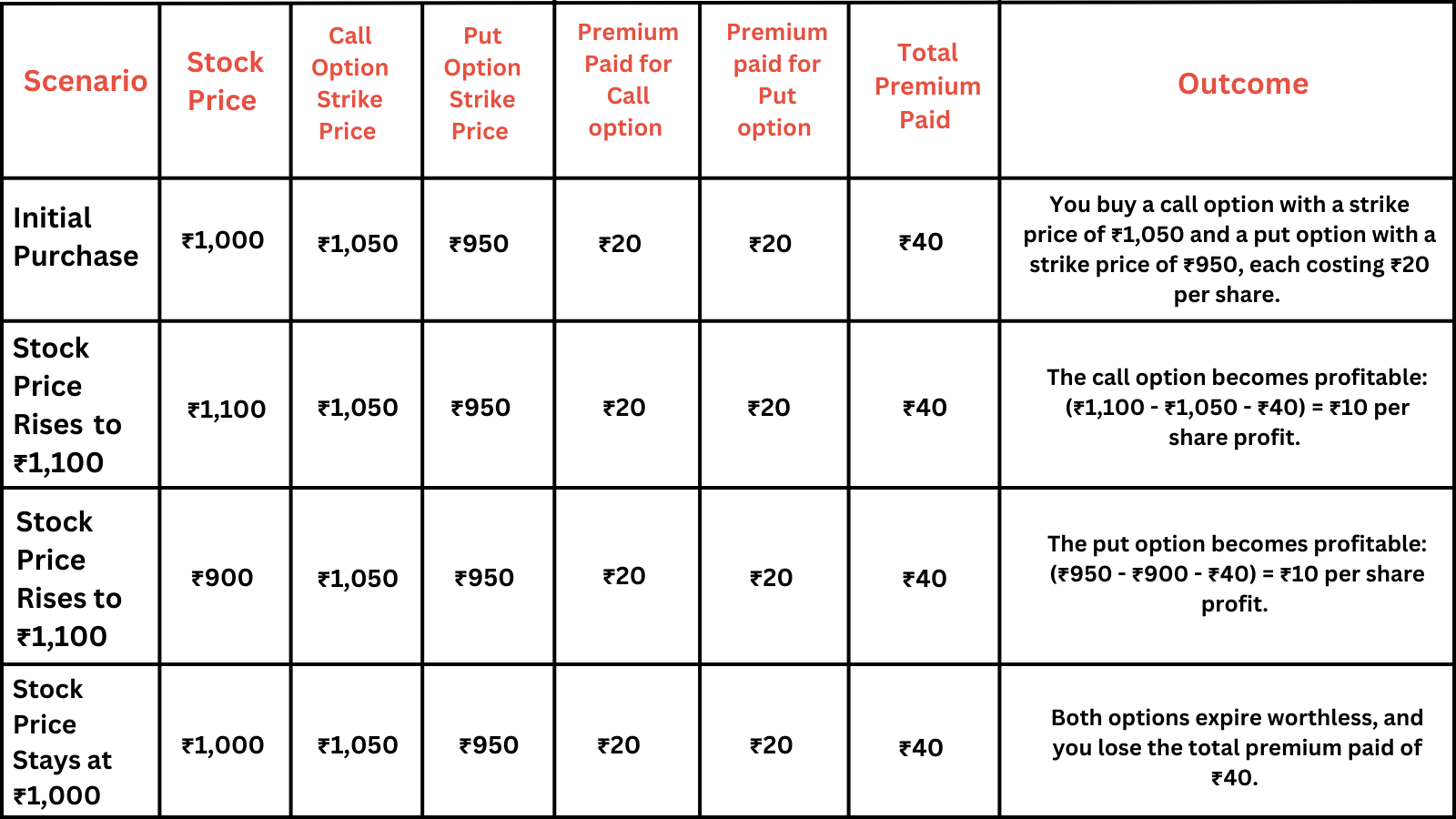

Example of a Strangle

Let’s look at an example of a strangle:

When to Use a Straddle or Strangle

Choosing between a straddle and a strangle depends on your expectations of market volatility and your willingness to pay a higher premium.

Use a Straddle When:

You Expect High Volatility: A straddle is best used when you expect the underlying asset to experience significant price movement but are unsure of the direction.

You Expect High Volatility: A straddle is best used when you expect the underlying asset to experience significant price movement but are unsure of the direction.

Use a Strangle When:

You Expect Moderate Volatility: A strangle is ideal when you expect significant price movement but not as extreme as what would justify a straddle.

You Want Lower Costs: The premium cost of a strangle is typically lower than a straddle because the options are further out-of-the-money.

Benefits of Straddles and Strangles

1) Profit from Volatility: Both strategies allow you to profit from significant price movements, regardless of the direction.

2) Limited Risk: The maximum loss is limited to the total premium paid for the options.

3) Flexibility: These strategies can be adjusted as the market moves, allowing you to roll the options or close out the positions based on market conditions.

Drawbacks of Straddles and Strangles

1) Premium Costs: Both strategies involve paying two premiums, which can be expensive, particularly for straddles.

2) Time Decay: As the options approach expiration, the time decay (Theta) erodes the value of the options, which can result in a loss if the underlying asset doesn’t move significantly.

3) Requires Significant Movement: For these strategies to be profitable, the underlying asset must move significantly. Small movements or stagnation will result in a loss of the premiums paid.

| Comparative Summary: Straddle vs. Strangle | ||||

| Strategy | Strike prices | Premium cost | Profit Potential | Best Used When |

| Straddle | Same strike price for both options | Higher | Higher with moderate movement | Expecting high volatility, unsure of direction |

| Strangle | Different strike prices (call higher, put lower) | Lower | Higher with significant movement | Expecting significant but not extreme volatility, lower cost |

How to Use Navia Mobile App for Better Option Trading

The Navia Mobile App is an excellent tool for implementing straddle and strangle strategies effectively. Here’s how:

➝ Strategy Builder: The Navia Mobile App offers a built-in strategy builder that allows you to create custom straddle and strangle strategies. You can experiment with different strike prices and expiration dates to find the best combination for your market outlook.

➝ Real-Time Data: Access real-time market data, including underlying asset prices and option premiums. This information is crucial for making informed decisions when entering or adjusting straddle or strangle positions.

➝ Option Calculator: Use the app’s option calculator to estimate the potential profitability of your straddle or strangle strategy. Input the relevant data and analyze different market scenarios to understand the risks and rewards.

➝ Portfolio Tracking: Monitor the performance of your straddle and strangle positions in real-time. The app allows you to track your trades and adjust as needed based on market movements.

Conclusion

The straddle and strangle are powerful options strategies that allow traders to profit from significant price movements, regardless of direction. By understanding the anatomy of these strategies, when to use them, and how they work, you can better navigate the complexities of options trading and capitalize on market volatility.

The Navia Mobile App enhances your ability to implement these strategies by providing real-time data, an option calculator, and a strategy builder. Whether you’re new to options trading or an experienced trader, using the Navia Mobile App can help you execute straddle and strangle strategies more effectively, ensuring you make the most of volatile market conditions. Happy trading!

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.

We’d Love to Hear from you-