From Sparkles to Stocks: Ananya’s Journey to Financial Brilliance!

Ananya had a magpie’s eye for sparkly things. Every month, she’d religiously contribute to a savings scheme at her favorite jeweler. It was a simple plan – set aside a small sum each month, and after a year, she could redeem it for a coveted ring or delicate chain. It felt like a small victory every time she made her deposit, a tangible step closer to her desired bling.

One day, while chatting with her colleague Rohan, the conversation turned to finances. Ananya proudly mentioned her monthly savings scheme, the perfect way to indulge in her twinkle-loving heart. Rohan smiled, “That’s a great way to save for something special, but what about growing your money for the future? Have you heard of Stock SIPs?”

Intrigued, Ananya listened as Rohan explained the concept. Unlike her jewelry scheme, a Stock SIP wasn’t about acquiring a single, specific item. It was about building wealth over time. Just like her monthly deposit at the jewelers, she could invest a fixed amount, say Rs. 1,000, in a particular stock at regular intervals, typically monthly. This meant she could build a portfolio of different stocks, like a collection of glittering investments.

The best part? Just like her jewelry scheme, Stock SIPs didn’t require a hefty sum to begin. Unlike the immediate gratification of the jewelers’ scheme, Stock SIPs were about delayed gratification. They helped cultivate a disciplined habit of saving, crucial for long-term wealth creation, something a new pair of earrings couldn’t offer.

Rohan also spoke about rupee-cost averaging. Imagine buying your favorite gemstone. You’d be happy to pay a little less per carat, right? With a Stock SIP, Ananya would be buying more shares when the stock price was low and fewer shares when it was high. This could potentially lower the overall cost of her investment, like getting a bargain on those dazzling earrings she’d been eyeing.

But there was more! Rohan explained the magic of compounding. Ananya’s investments, even the small ones, could grow exponentially over time, just like her collection of sparkly trinkets. Some stocks even paid dividends, a share of the company’s profits. With a Stock SIP, these dividends could be automatically reinvested, buying even more shares and further accelerating her growth.

Finally, Rohan addressed Ananya’s concerns. Unlike the fixed goal of the jewelry scheme, the stock market might seem volatile. Stock SIPs allowed her to “average out” the cost. Instead of a risky lump sum investment in a single piece of jewelry, she was participating in the market across different cycles, highs and lows. This could potentially lead to better returns in the long run, a much more valuable treasure than a fleeting piece of jewelry.

Ananya’s initial apprehension melted away. Stock SIPs offered a structured, disciplined approach to growing her wealth, perfect for someone who craved a future filled with not just sparkly things, but financial security as well. With small, regular investments, she could watch her portfolio grow alongside her financial confidence. The path to a bright future, it seemed, wasn’t as flashy as she had imagined. All it took was a small step, a Stock SIP, and the power of time.

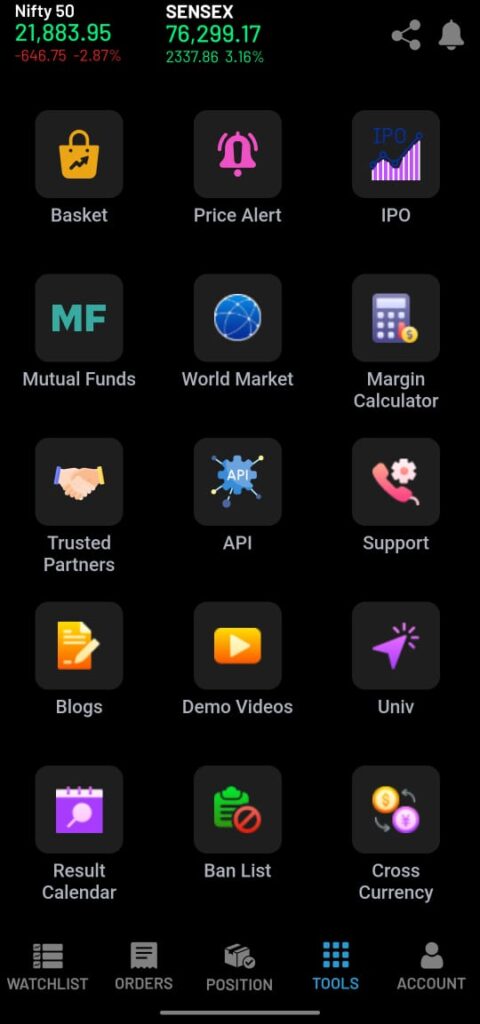

Now, let’s see how to Set SIP order through Navia App?

Step 1: Navigate to the tools page and select the “Basket” option.

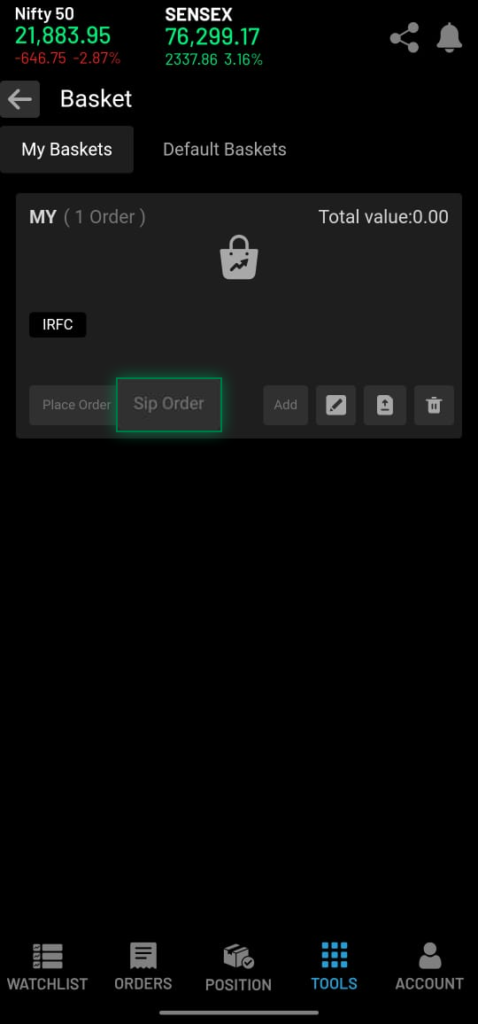

Step 2: Within the “Basket” section, locate and click on the “SIP order” option.

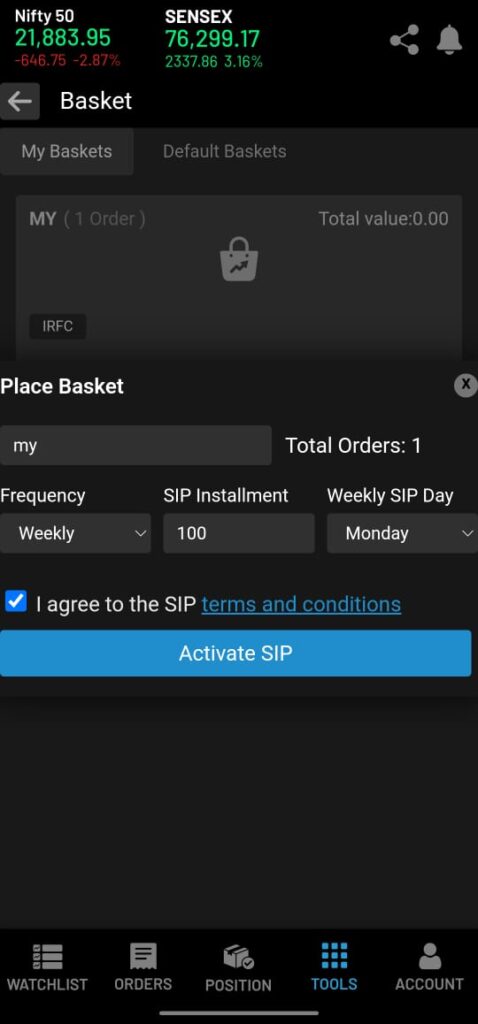

Step 3: Choose the desired frequency for your SIP, input the SIP installment amount, and acknowledge the Terms and Conditions to activate the SIP.

By following these steps, you can easily set up a SIP order using the Navia App.

We’d Love to Hear from you