Learn to Share Investment Details with Nominees Through DigiLocker

Planning isn’t an easy word, in financial matters it’s more difficult but an essential process. Many investors are ensuring their heirs can access investments, stocks, mutual funds, and insurance policies when needed. To ensure the safety of these important documents in India you can use the platform called DigiLocker.

The platform offers a seamless and secure way to safeguard your financial data and grant access to your added nominees- if any unexpected happens. This guide will help you to understand the platform, step-by-step process and how Navia’s trusted customers can leverage DigiLocker to streamline asset sharing and succession planning.

What is DigiLocker?

DigiLocker is India’s official digital locker, that offering a secure vault storing your financial data by authenticate via Aadhaar and OTP. These files are legally equal to physical documents under the IT Act, so you don’t need to worry about your data. For identifying documents through Aadhaar, PAN, and driving licenses, DigiLocker now supports automated fetching financial statements that include demat holdings, insurance policies, bank FDs, mutual fund portfolios and NPS accounts.

Why Use DigiLocker for Financial Information?

Centralized Storage

You can keep all your financial records like demat holdings, mutual funds, loans, insurance, etc. in one place.

Security & Legitimacy

It’s a government platform so you can keep all your documents safely as valid as originals.

Nominee Access

Until your lifetime, you will only have access. After you pass away, the nominee who is added by you gets the read access after completing proper verification.

Simplified Successions

It will eliminate the hassle and delays of locating physical documents, so you can easily locate your data.

How to Fetch Financial Documents into DigiLocker?

Here you can see the process of fetching your financial documents into DigiLocker.

Sign Up and Login

Download the DigiLocker app or visit the web portal, then Login by using your Aadhaar or mobile number. Then, a One-Time Password will come to the registered mobile number. You must enter it, after that choose a secure PIN.

Fetch Demat and Mutual Fund Data

Navigate to “Issued Documents” → Search, for demat account, search issues like, “Central Depository Services Limited” (CDSL) or “National Securities Depository Limited (NSDL). Then enter your PAN and Demat Account ID.

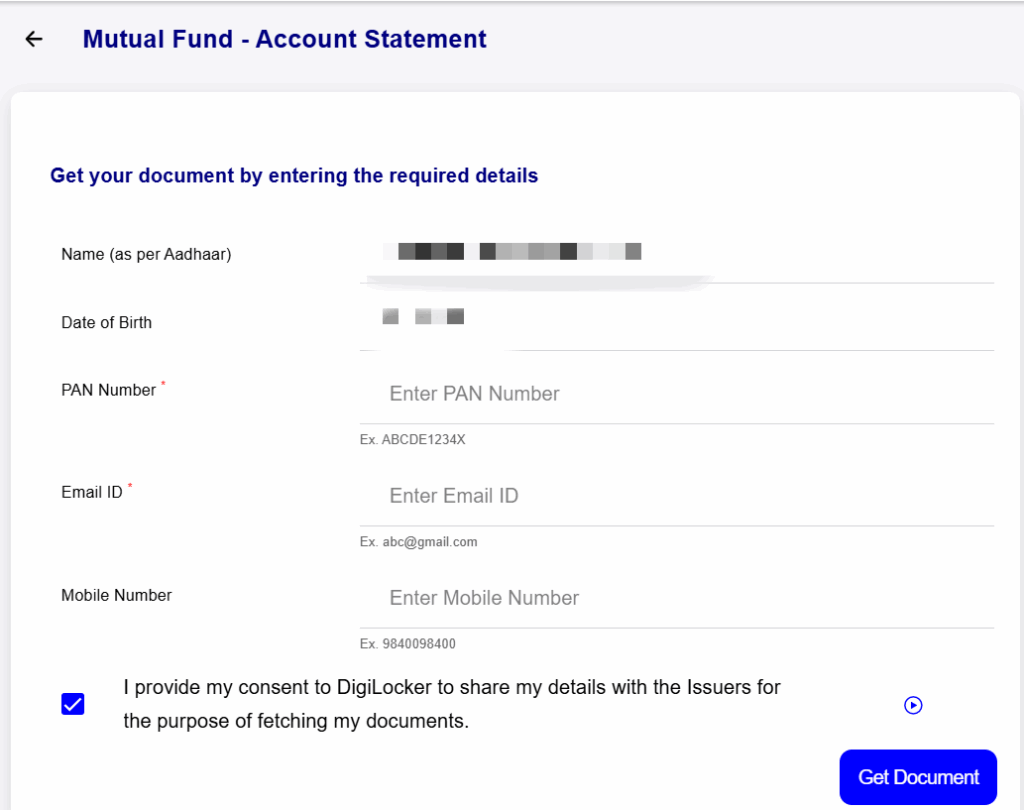

For mutual funds, select RTAs like “CAMS” or “KFintech”, then provide PAN and Registered Email and fetch statements.

Add Other Financial Records

For Insurance Policies:

Search Banking and Insurance sections, then you have to select your insurance company. Select your type of policy like health, two-wheeler, etc. Add policy number and mobile number that is registered with the policy.

To fetch the document, click on the “Get Document” or similar button. Then it will store automatically in your “Issued Document” section.

For Stocks:

Search for Depositories like;

🠖 CDSL

🠖 NSDL

In the app you should use the full name of depositories instead of using abbreviations, like for CDSL, use Central Depository Services Limited. After you generate a report, you get a consolidated statement of stocks. Fetch the data through providing your PAN and demat account ID. If your name is not the same in the PAN and Aadhaar cards, the document may not load.

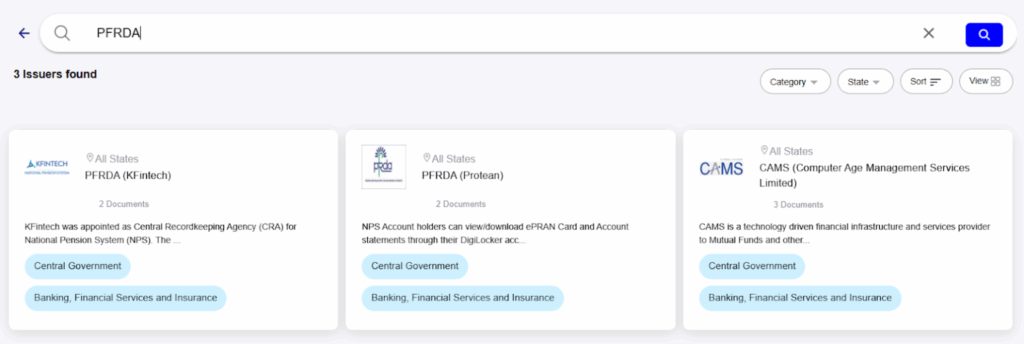

For NPS (National Pension System):

Search for CRAs (Centre Recordkeeping Agencies) like;

🠖 Protean

🠖 CAMS

🠖 KFintech

You must enter your PRAN (Permanent Retirement Account Number) number. If you have forgotten it, you should check the CRA portal. Without your PRAN number, you cannot fetch your documents.

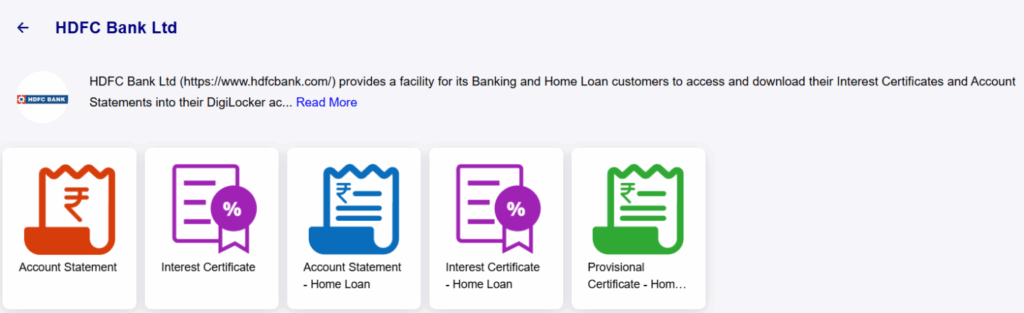

For Bank Account:

You can easily get your bank account statement, but if we talk about FD details, it’s not an easy process. For that, you should provide your account number or CIF number. Some of the banks will provide loan statements and interest certificates through DigiLocker. So, it is necessary to fetch the bank details in DigiLocker.

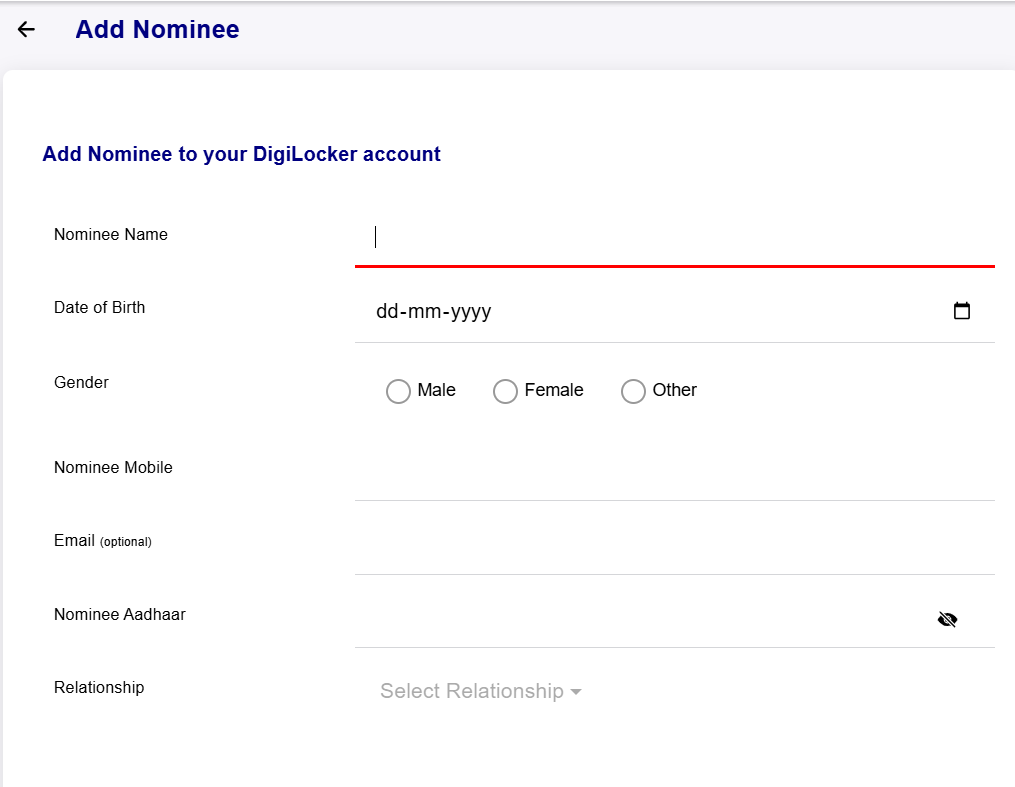

How to Add a Nominee in DigiLocker?

The nomination process of DigiLocker is very simple, but follow the steps given below;

Step 1: Go to the Settings menu, then click on Nominee

Step 2: Now click on the Add Nominee option

Step 3: Fill in details like Nominee Name, Date of Birth, Gender, Nominee Mobile, Email ID (optional), Nominee Aadhaar, and Relationship. You can add multiple nominees as per your choice.

Step 4: Submit the form and complete the process via OTP

After the submission DigiLocker will send an SMS/email to your nominee too.

What Can a Nominee Do Through DigiLocker Access?

DigiLocker is integrated with both death registries and regulatory bodies, so if your demise is officially recorded, your nominee can receive an automatic SMS/email notification. After that they should log into their own DigiLocker account, verify identity, and get access to your stored documents in read-only mode.

This makes it easy for the nominee to access the information, but many people are still unsure about what the nominee can and cannot do. Here’s a quick explanation.

Yes→ Read-only access to view and download the stored documents

No→ Direct transferring of your assets; the nominee must follow legal procedures

In many cases, being a DigiLocker nominee may speed up the process—but isn’t a substitute for legal heirship.

Benefits of Using DigiLocker

🠖 Legally valid digital documents backed by Indian law

🠖 Central storage for multi-asset documentation of stocks, mutual funds, loans, etc.

🠖 Heirs can quickly locate and claim finances

🠖 You don’t need to hunt physical papers during emotional time

🠖 Government provided platform so it is encrypted and cost friendly

Best Practices for a Smooth Experience

🠖 Ensure Accurate Identity Matching: Your name across Aadhaar, PAN, and DigiLocker should be the same. If the platform finds any mismatch, it will affect the process.

🠖 Annual Review: Maintain your nominee information and renew expiring digital permissions on time.

🠖 Educate Your Nominee: Let them know how the platform works and how to access it.

Wrap Up

Creating an effective plan to ensure heirs can locate and access your financial data is DigiLocker. You can save all your important documents by using this Government platform. If you are organizing and sharing your assets in advance, it means you are actively protecting your legacy by reducing your family stress.

Being a Navia trusted client you have to use this platform to store your investment data and appoint nominee access is a secure and efficient step. So, take a few minutes now—link your financial documents and build peace of mind for your loved ones.

Do You Find This Interesting?

Frequently Asked Questions

Can I share financial documents with multiple nominees?

Yes, DigiLocker allows multiple nominees with read-only access.

What types of documents can be fetched in DigiLocker?

Demat holdings, mutual fund statements, CAS, insurance policies, NPS statements, bank account/FD/loan records.

Is DigiLocker legally valid for financial documents?

Yes, under the IT Act, documents in DigiLocker are legally valid.

When does the nominee get access to documents?

Only after official confirmation of your death via registry or KRA, followed by nominee verification.

DISCLAIMER: Investment in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Full disclaimer: https://bit.ly/naviadisclaimer.