The Rise of ETFs in India: What Investors Should Know?

Introduction: Why ETFs are Gaining Popularity in India

Exchange-Traded Funds (ETFs) have experienced a sharp rise in popularity across the globe, and India is no exception. ETFs are gaining recognition among investors for their ability to offer broad market exposure, lower costs, and ease of trading. As Indian investors become more conscious of the importance of portfolio diversification, ETFs are emerging as one of the most effective and accessible tools to achieve this goal.

In this article, we will take a deep dive into what ETFs are, why they are growing in India, and why they should be a crucial part of your investment strategy. We’ll also look at how the Indian ETF market has evolved and how it can help you diversify your stock market investments.

What is an ETF?

An Exchange-Traded Fund (ETF) is a type of investment fund that holds a basket of securities like stocks, bonds, commodities, or a combination. ETFs are traded on stock exchanges, much like stocks, which means they can be bought or sold during market hours at market prices. The key distinction between ETFs and mutual funds is that ETFs are passively managed and track indices (like the Nifty 50, Sensex, etc.), rather than trying to beat the market through active stock picking.

Key Features of ETFs

| Feature | Explanation |

| Diversification | ETFs hold a basket of different assets, reducing risk compared to individual stocks. |

| Liquidity | ETFs can be bought and sold anytime during market hours on stock exchanges. |

| Cost-Effective | ETFs generally have lower expense ratios than mutual funds. |

| Transparency | ETFs usually disclose their holdings regularly, making it easy for investors to track. |

| Low Minimum Investment | Investors can buy just one unit of an ETF, making it accessible for small investors. |

The Rise of ETFs in India

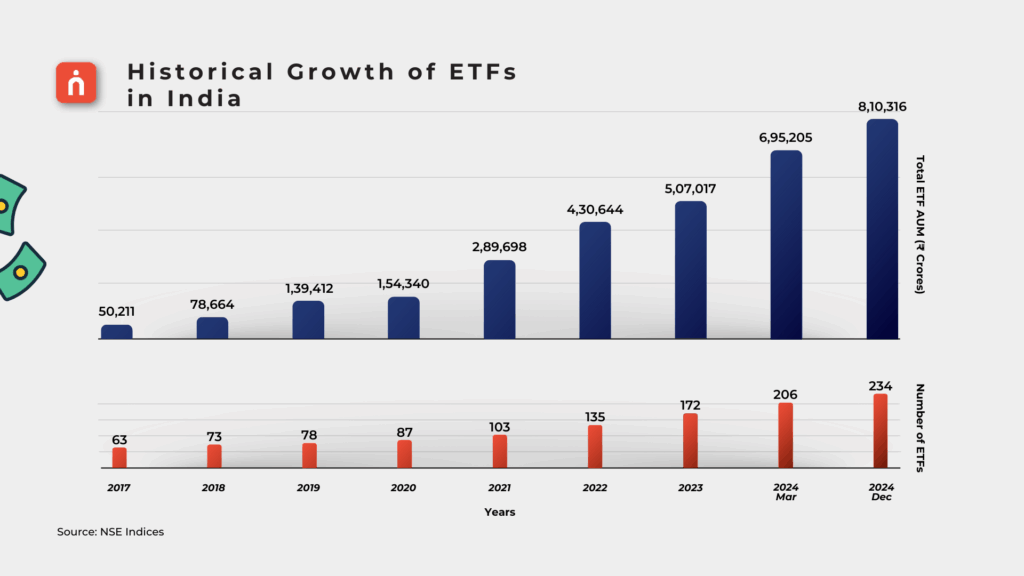

Over the past decade, ETFs in India have experienced rapid growth, both in terms of the number of ETFs available and the total assets under management (AUM). As of December 2024, the total AUM for ETFs in India reached an impressive ₹8,10,316 crores, with over 234 ETFs tracking 85 different indices.

Historical Growth of ETFs in India

From 2017 to 2024, both the number of ETFs and the assets under management have grown significantly. This reflects the increasing confidence among Indian investors in passive investment strategies and the benefits of ETFs.

Growth in ETF Folios

The growth in ETF folios (the number of individual investor accounts) also highlights the rise in retail participation. As of December 2024, there were over 16.7 million ETF folios, a 7x increase from 2017. This surge indicates that investors, including corporates, banks, and retail investors, are increasingly embracing ETFs.

Why Should You Invest in ETFs?

Cost-Effective Investment

One of the biggest draws of ETFs is their low cost. The average expense ratio for an ETF is far lower than that of actively managed mutual funds. With expense ratios as low as 0.05%, ETFs allow investors to maximize returns by keeping costs down.

Diversification at Low Cost

ETFs offer a simple way to diversify your investment portfolio. Whether you’re investing in the Nifty 50 ETF, which tracks the performance of the top 50 companies in India, or in a sector-specific ETF like the Nifty Bank ETF, you can easily spread your risk across multiple stocks within an index, sector, or theme.

Liquidity and Flexibility

ETFs are traded on stock exchanges, meaning that they can be bought and sold during market hours just like stocks. This gives investors the flexibility to react quickly to market movements. This liquidity makes ETFs an attractive choice compared to mutual funds, which can only be bought or sold at the day’s closing price.

Tax Benefits

In India, long-term capital gains from equity ETFs (held for more than a year) are taxed at 15%, with no tax on long-term gains up to ₹1.25 lakhs. This tax treatment is favorable compared to other investment options and further boosts the attractiveness of ETFs for long-term investors.

The Growth of Sector-Specific ETFs

India’s ETF market is not limited to broad indices. Over the years, there has been an increasing number of sector-specific ETFs focusing on industries like banking, technology, and gold. Some popular sector ETFs include:

| ETF Name | Tracks | AUM (₹ Crores) |

| Nifty IT ETF | Nifty IT Index | 2,509 |

| Nifty Bank ETF | Nifty Bank Index | 7,335 |

| Gold ETFs | Gold Prices | 1,497 |

| Nifty PSU Bank ETF | Nifty PSU Bank Index | 2,667 |

| Nifty Metal ETF | Nifty Metal Index | 99 |

These ETFs allow investors to bet on the performance of specific sectors rather than the overall market. For example, if you are bullish on the banking sector, you could invest in the Nifty Bank ETF, which gives you exposure to a range of banks in India.

New ETFs in the Market: A Wide Array of Choices

The introduction of new ETFs in India has further fueled the rise of passive investing. Some of the new ETFs launched in 2024 include:

| ETF Name | Tracks |

| Mirae Asset Nifty India Defence ETF | Nifty India Defence Index |

| ICICI Prudential Nifty200 Value 30 ETF | Nifty200 Value 30 Index |

| Groww Gold ETF | Gold Prices |

| Edelweiss Nifty500 Multicap Momentum Quality 50 ETF | Nifty500 Multicap Momentum Quality 50 |

These new ETFs provide more options for investors looking to diversify their portfolios by investing in specific sectors, themes, or commodities like gold. They also reflect the growing trend of niche investing in India, where investors are looking to capitalize on emerging trends and sectors.

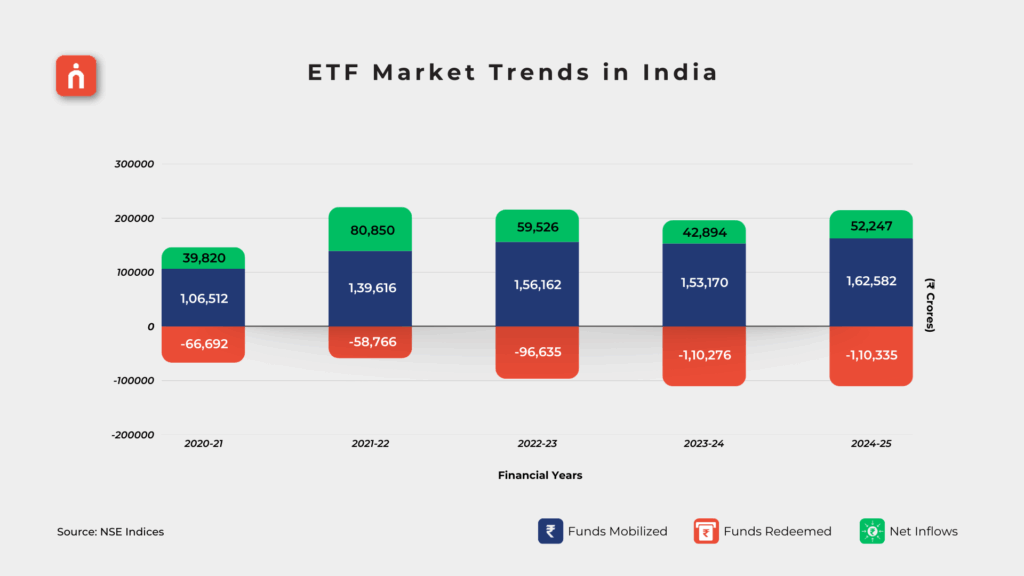

ETF Market Trends in India

The trend of passive investing through ETFs has seen substantial growth, with equity-focused ETFs leading the pack. The total ETF market saw a substantial increase in funds mobilized in 2023-24, with over ₹1.53 lakh crores flowing into these funds.

This growth indicates a clear preference for ETFs among Indian investors who are moving away from actively managed mutual funds and seeking low-cost, diversified investment vehicles.

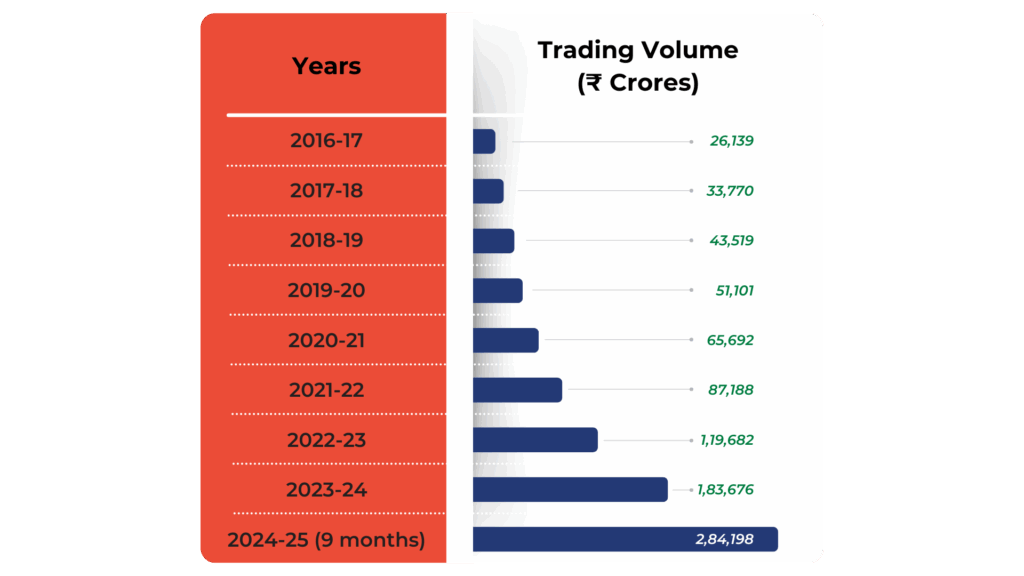

Trading Volume of ETF’s

This table shows the growth in trading volume of ETFs from FY 2016-17 through to the first nine months of FY 2024-25, illustrating the increasing popularity and market activity in ETFs over time.

Conclusion: Why You Should Diversify with ETFs

As the Indian stock market continues to evolve, the rise of ETFs offers an exciting opportunity for investors. Whether you’re a seasoned investor or a beginner, ETFs provide a cost-effective, transparent, and flexible way to diversify your portfolio and gain exposure to different sectors, industries, and asset classes.

Given the recent growth in the Indian ETF market, now is a great time for investors to start exploring the benefits of passive investing through ETFs. By investing in ETFs, you can reduce risk, minimize fees, and enjoy the potential for long-term growth—all while ensuring that your investment strategy is aligned with the broader market trends.

So, if you’re looking to build a diversified, low-cost investment portfolio, ETFs should definitely be a part of your strategy.

Do You Find This Interesting?

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.