Picking the Right Strike Price in Options: A Comprehensive Guide for Traders

Selecting the right strike price is one of the most critical decisions an options trader can make. The strike price determines the price at which you can buy or sell the underlying asset if the option is exercised, and it plays a significant role in determining the potential profitability, risk, and likelihood of your options trade. In this blog, we’ll explore how to pick the right strike price in options trading, using easy-to-understand examples. We’ll also discuss how the zero brokerage on f&o can assist you in making informed decisions.

What is a Strike Price?

The strike price, also known as the exercise price, is the predetermined price at which the buyer of the option can buy (in the case of a call option) or sell (in the case of a put option) the underlying asset. The strike price is one of the key components of an options contract and plays a crucial role in determining the option’s value and the trader’s potential profit or loss.

Factors to Consider When Picking the Right Strike Price

Choosing the right strike price involves evaluating several factors, including your market outlook, risk tolerance, and trading goals. Here are some key considerations:

Market Outlook

🔷 Bullish Outlook: If you expect the underlying asset’s price to rise, you might prefer to buy call options with strike prices close to or slightly above the current market price.

🔷 Bearish Outlook: If you anticipate a decline in the underlying asset’s price, put options with strike prices close to or slightly below the current market price may be more suitable.

🔷 Neutral Outlook: If you expect the market to remain stable, strategies such as selling options with strike prices farther away from the current price might be advantageous.

Intrinsic vs. Extrinsic Value

In-the-Money (ITM) Options: These options have intrinsic value, meaning the strike price is favorable compared to the current market price. For example, a call option with a strike price lower than the current stock price is ITM. ITM options are more expensive but have a higher probability of expiring in the money.

Out-of-the-Money (OTM) Options: These options have no intrinsic value, meaning the strike price is not favorable compared to the current market price. They are cheaper but have a lower probability of expiring in the money.

At-the-Money (ATM) Options: These options have a strike price close to the current market price. ATM options offer a balance between risk and reward, with moderate premiums and potential for profit.

Time to Expiration

The time remaining until the option’s expiration date affects the option’s premium. Options with longer expiration dates have higher premiums due to the greater time value, while those closer to expiration have lower premiums.

Implied Volatility

Implied volatility reflects the market’s expectations of future price fluctuations. Higher implied volatility increases the option’s premium, making it more expensive. When selecting a strike price, consider how volatility might impact the option’s value.

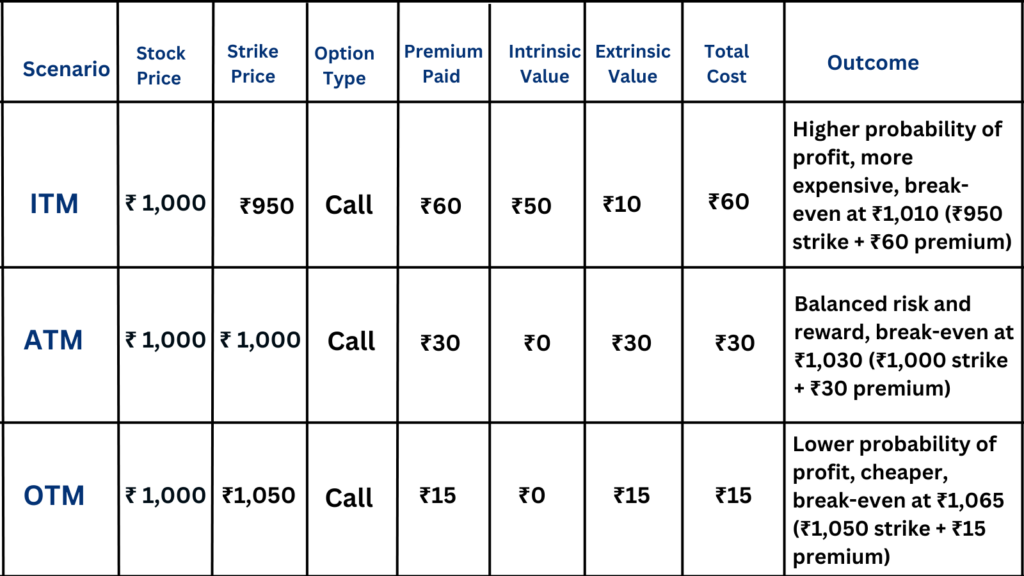

Example of Picking the Right Strike Price

Let’s consider a scenario where you are evaluating different strike prices for a call option on a stock currently trading at ₹1,000:

When to Choose ITM, ATM, and OTM Options

In-the-Money (ITM) Options

🔷 When to Use: ITM options are ideal when you are confident about the direction of the market and expect a significant move. These options offer lower risk but higher costs.

💬 Example: If you believe a stock trading at ₹1,000 will rise to ₹1,100, buying a call option with a ₹950 strike price (ITM) gives you intrinsic value right away. The option is more expensive, but you have a higher chance of making a profit.

At-the-Money (ATM) Options

🔷 When to Use: ATM options are suitable when you expect a moderate move in the underlying asset. They offer a balance between cost and risk.

💬 Example: If you expect the stock to move moderately upwards, an ATM call option with a ₹1,000 strike price provides a reasonable chance of profit at a moderate cost.

Out-of-the-Money (OTM) Options

🔷 When to Use: OTM options are best when you anticipate a large price movement but want to limit your initial investment. These options are cheaper but riskier.

💬 Example: If you expect the stock to surge significantly, a call option with a ₹1,050 strike price (OTM) offers a lower premium, but the stock must rise significantly to make a profit.

Impact of Time to Expiration on Strike Price Selection

The time remaining until the option’s expiration date plays a crucial role in selecting the strike price. Here’s how time affects your decision:

Long-Term Options (LEAPS): If you’re trading options with a long time to expiration (e.g., 6 months or more), you may choose a strike price that is further OTM, anticipating a significant move in the underlying asset over time.

Short-Term Options: For options with a short time to expiration, you may prefer ITM or ATM strike prices to capitalize on a quick move in the market, reducing the impact of time decay.

Example: Time Impact on Strike Price

| Time to Expiration | Strike Price | Option Type | Premium Paid | Time Decay Impact | Potential Outcome |

| Long-Term | ₹1,050 | Call | ₹40 | Lower | Lower initial investment, more time for the underlying asset to move in your favor, higher potential reward |

| Short-Term | ₹1,000 | Call | ₹25 | Higher | Higher probability of success, reduced time for the underlying asset to reach the strike price |

How to Use Navia Mobile App for Picking the Right Strike Price

The Navia Mobile App offers several features that can assist you in selecting the right strike price for your options trades:

1. Real-Time Data: The app provides real-time data on stock prices, option premiums, and implied volatility, helping you make informed decisions about which strike prices to choose.

2. Option Calculator: Use the app’s option calculator to simulate different strike price scenarios. This tool allows you to see how changes in the underlying asset’s price, time to expiration, and volatility affect your potential profits and losses.

3. Strategy Builder: Navia’s strategy builder feature allows you to create and backtest various options strategies, including those with different strike prices. This can help you identify the most profitable and suitable strike prices for your trading goals.

4. Portfolio Tracking: Track your options portfolio in real-time, monitor the performance of your trades, and adjust your positions as needed based on the strike prices you’ve selected.

Summary Table: Picking the Right Strike Price

| Strike Price | Option Type | Premium | Risk Level | Profit Potential | Best Used When |

| ITM | Call/Put | Higher | Lower | Moderate | Confident in a significant market move, willing to pay a higher premium for lower risk |

| ATM | Call/Put | Moderate | Moderate | Balanced | Expecting a moderate market move, seeking a balance between cost and risk |

| OTM | Call/Put | Lower | Higher | High (if successful) | Anticipating a large market move, looking for lower-cost options with higher risk |

Conclusion

Selecting the right strike price is crucial to the success of your options trading strategy. By considering factors such as market outlook, intrinsic vs. extrinsic value, time to expiration, and implied volatility, you can choose the strike price that best aligns with your trading goals and risk tolerance.

The Navia Mobile App provides powerful tools and real-time data to help you make informed decisions when picking strike prices. Whether you’re a beginner or an experienced trader, leveraging these tools can enhance your ability to select the right strike prices and optimize your options trading strategy. Happy trading!

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.

We’d Love to Hear from you-