PPF vs. Equity Investments: Making the Right Choice

Introduction

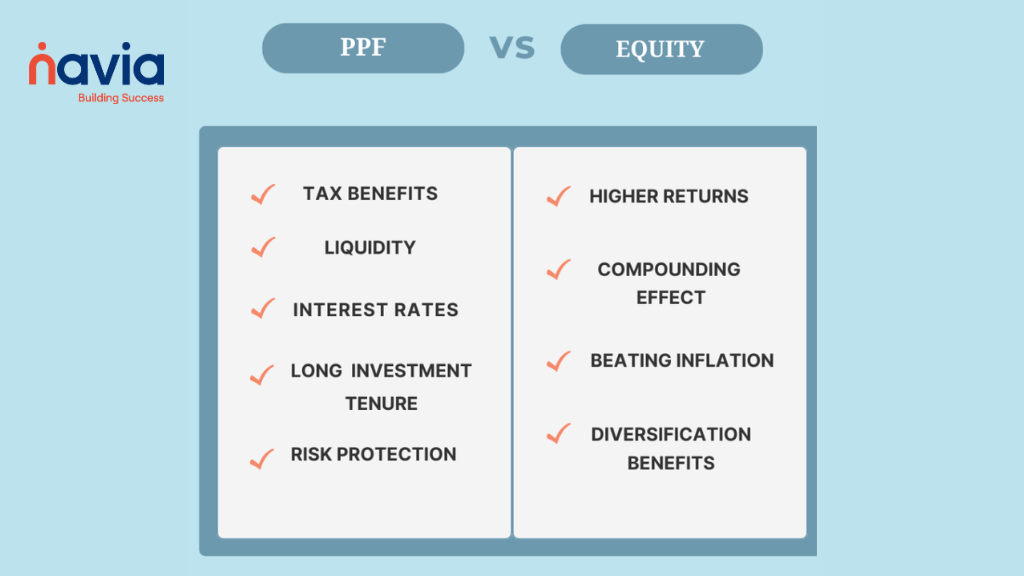

When it comes to saving and investing, the age-old question often arises: should you invest in Public Provident Fund (PPF) or in equity investments, such as stocks? Both PPF and stocks play substantially different roles in your investment portfolio, and making the right choice depends on your financial goals and risk tolerance. In this blog, we will simplify these complex financial concepts to help even non-finance individuals make informed investment decisions.

PPF: The Safe and Stable Option

Public Provident Fund (PPF) is often considered the go-to investment option for those looking for long-term savings, tax benefits, and safety. Here are some key reasons why PPF might be a suitable choice for certain investors:

1. Tax Benefits:

PPF contributions are eligible for tax deductions under Section 80C of the Income Tax Act. Additionally, the interest earned and the maturity amount are tax-free, giving PPF the coveted exempt-exempt-exempt (EEE) status. This means that you not only save on taxes during the investment period but also when you withdraw your money.

Example: Suppose you invest Rs. 1.5 lakh annually in PPF, and you fall in the highest tax bracket. You can save up to Rs. 46,800 per year in taxes, which can be a significant benefit over time.

2. Safety:

PPF is backed by the government, making it an extremely safe investment option. Your principal amount is secure, and you can rely on the guaranteed returns provided by PPF.

Example: If you invest Rs. 10,000 a year in PPF, you can be sure that your money is safe and will grow over time, regardless of market fluctuations.

3. Long-Term Savings:

PPF has a fixed tenure of 15 years, making it an ideal choice for those planning for retirement or long-term financial goals. You have the option to make partial withdrawals after the completion of five years.

Example: If you start investing in PPF at the age of 30, by the time you retire at 60, you will have a substantial corpus, providing you with financial security during your golden years.

Equity: The Path to Wealth Creation

Now, let’s delve into the exciting world of equity, where you can potentially achieve substantial wealth over the long term. The example below illustrates the power of equity investments:

1. Higher Returns:

Equity investments, such as stocks, have historically outperformed fixed-income options like PPF. Over a long investment horizon, the average annualized return from an equity investment has been significantly higher.

Example: Suppose you started investing Rs. 10,000 a year in the Sensex-equivalent investment in 1979. Over the next 44 years, your investment grew to Rs. 2.3 crore, as opposed to Rs. 59.7 lakh from PPF. This four-fold difference in returns can be life-changing for you.

2. Compounding Effect:

Equity investments benefit from the compounding effect, where your returns generate more returns over time. Even moderate differences in annual returns can result in substantial wealth creation.

Consider the example of niftybees ETF at the beginning the price was around 113.51 but after five years the price came around 218.57 the percentage change of 92.5% is known as the compounding effect. This is also one of the reasons why people consider investing in Equities.

3. Beating Inflation:

Equity investments have the potential to beat inflation, ensuring that your wealth grows in real terms. Fixed-income investments, on the other hand, struggle to keep pace with inflation.

Example: With equity investments, you have the opportunity to not only preserve your purchasing power but also increase your wealth over time, making you financially prosperous rather than just comfortable.

Conclusion

The choice between PPF and equity investments ultimately depends on your financial goals, risk tolerance, and investment horizon. If you prioritize safety, tax benefits, and long-term savings, PPF is an excellent option. On the other hand, if you seek to build substantial wealth over the long term, equity investments offer the potential for higher returns and inflation-beating growth.

It’s important to have a mix of PPF and stocks in your investment plan. This mix, called diversification, helps you in reaching your money goals while keeping the risks in check. Remember that the path to wealth creation can be challenging, but with informed decisions and a long-term perspective, you can turn your financial dreams into reality. So, whether you go for PPF or stocks, be sure to have a mix of both in your financial plan. This way, you can benefit from the growth potential of both PPF as well as Equities.

We’d Love to Hear from you-

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.