Pharmabees ETF: Investing in the Future of Healthcare

Table of Contents

The healthcare and pharmaceutical sectors have always been pivotal, but recent global events have highlighted their importance like never before. For investors looking to tap into this critical and growing industry, the Nippon India Nifty Pharma ETF (PHARMABEES) offers an excellent opportunity. This ETF provides exposure to India’s leading pharmaceutical companies, enabling investors to benefit from the ongoing advancements in healthcare and medicine.

Why Invest in PHARMABEES ETF?

The PHARMABEES ETF is designed to track the Nifty Pharma Index, which includes top companies in the pharmaceutical sector. As the healthcare industry continues to expand, this ETF allows investors to participate in the growth of companies at the forefront of medical innovation and production.

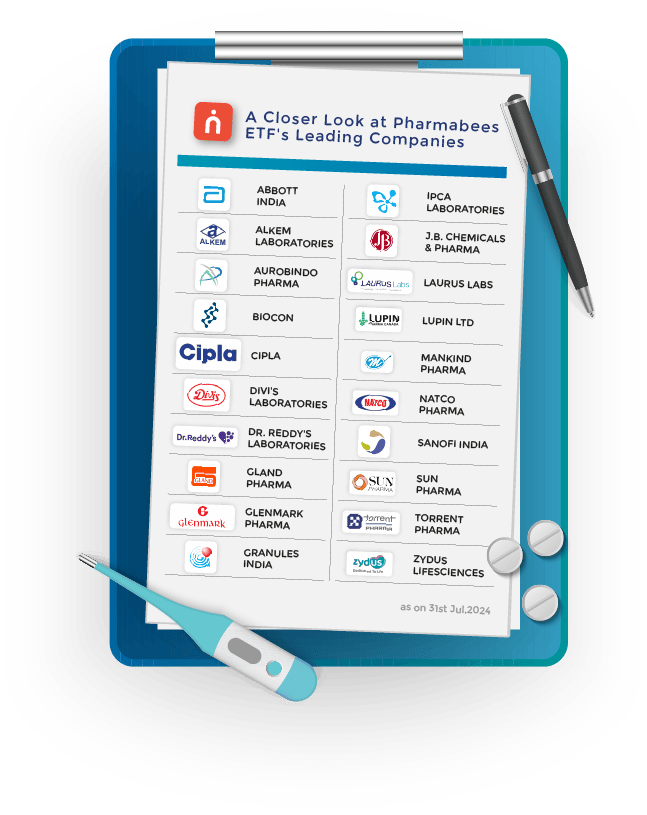

Top Companies in the Pharmabees ETF

Performance Overview

The PHARMABEES ETF has shown strong performance, reflecting the steady growth of the pharmaceutical sector. Below is a summary of the fund’s returns compared to its benchmark and category:

| Time Period | Fund Returns (%) | NIFTY Pharma Index Returns (%) |

|---|---|---|

| 1 Year | 45.60 | 46.00 |

| 3 Years Annualized | 15.32 | 15.59 |

| Since Inception | 14.68 | 14.96 |

The PHARMABEES ETF has consistently delivered strong returns, closely tracking the Nifty Pharma Index. The fund’s performance highlights its ability to deliver growth in line with the broader pharmaceutical market, making it a solid choice for investors seeking exposure to this vital sector.

Top Holdings

The PHARMABEES ETF is heavily weighted towards some of the biggest names in the Indian pharmaceutical industry. Here are the top holdings in the fund:

| Company | Sector | % of Total Holdings |

| Sun Pharmaceutical Industries Ltd | Pharmaceuticals | 24.62% |

| Dr. Reddy’s Laboratories Ltd | Pharmaceuticals | 10.90% |

| Cipla Ltd | Pharmaceuticals | 10.75% |

| Divi’s Laboratories Ltd | Pharmaceuticals | 8.32% |

| Lupin Ltd | Pharmaceuticals | 6.13% |

With over 60% of its assets invested in these top five companies, the PHARMABEES ETF provides concentrated exposure to industry leaders who are driving growth and innovation in the pharmaceutical sector.

Growth of ₹10,000 Investment

To put the performance into perspective, let’s consider how much an investment of ₹10,000 in the PHARMABEES ETF at its inception would have grown:

● Value of ₹10,000 Invested Since Inception: ₹15,252

● Annualized Returns Since Inception: 14.68%

This growth demonstrates the strong potential of the PHARMABEES ETF to generate significant returns, making it an attractive option for long-term investors.

Advantages of Investing in PHARMABEES ETF

🔹 Sector-Specific Exposure: The PHARMABEES ETF allows investors to focus on the pharmaceutical sector, which is poised for continued growth due to increasing demand for healthcare services and medical advancements.

🔹 Diversification: By investing in a basket of top pharmaceutical companies, the ETF reduces the risk associated with individual stock investments while providing exposure to the sector’s overall growth.

🔹 Cost-Effective: With a low expense ratio of 0.21%, the PHARMABEES ETF is a cost-effective way to gain exposure to the pharmaceutical sector, making it an attractive option for both retail and institutional investors.

🔹 Liquidity: As an ETF, PHARMABEES offers the advantage of liquidity, allowing investors to buy and sell shares on the exchange throughout the trading day.

Is PHARMABEES Right for You?

If you believe in the long-term growth potential of the healthcare and pharmaceutical sectors, the PHARMABEES ETF is an excellent choice. It provides a balanced mix of growth potential, diversification, and cost efficiency, making it a smart choice for both long-term investors and those looking to capitalize on short- to medium-term trends in the healthcare industry.

How to Invest in PHARMABEES ETF?

Investing in the PHARMABEES ETF is simple and straightforward. You can purchase units through any brokerage account, just like you would with individual stocks. Additionally, if you’re interested in systematic investments, you can set up an SIP to regularly invest in the ETF, allowing you to build your exposure over time.

Why Choose Navia’s Zero Brokerage Stock Investing App to invest in PHARMABEES ETF?

Investing in the PHARMABEES ETF through Navia’s zero brokerage stock investing app offers several advantages:

🔸 Cost Savings: Zero brokerage ensures that investors save on transaction costs, enhancing overall returns.

🔸 User-Friendly Interface: Navia’s app is designed to be intuitive and easy to use, making the investment process seamless.

🔸 Easy Stock/ETF SIP baskets: Easily create a stock/ETF basket of your choice and start an SIP.

🔸 24/7 Accessibility: Investors can manage their investments anytime, anywhere, providing convenience and flexibility. Check out the how to video’s here.

Here is a list of other Pharma ETF’s and their returns as on 28th September 2024.

| ETF Name | 30 Day Return | 365 Day Return | Underlying Index | Live NAV |

| PHARMABEES | 1.75% | 56.72% | Nifty Pharma TRI | Click here |

| MOHEALTH (Motilal Oswal S&P BSE Healthcare ETF) | 4.01% | 60.29% | S&P BSE Healthcare Index | Click here |

| HEALTHADD (DSP Nifty Healthcare ETF) | 3.68% | NA | Nifty Healthcare Index | Click here |

| HEALTHY | 3.47% | 56.54% | Nifty Healthcare TRI | Click here |

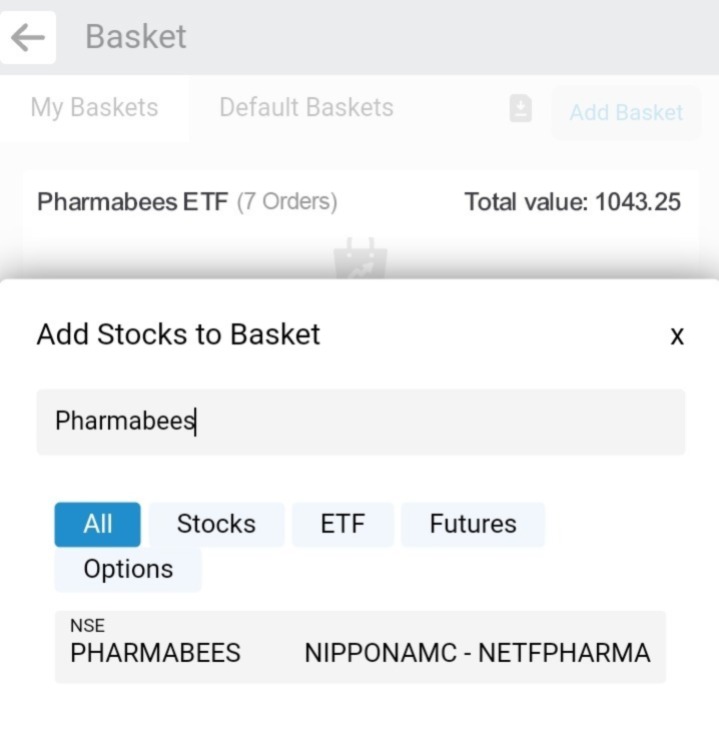

Steps to Set up SIP for PHARMABEES ETF on Navia APP:

1. Download and Log In to the Navia app.

2. Goto Tools->Basket and create a Basket with name of your choice. Setup a Weekly or Monthly SIP. If you are setting a weekly SIP, select the day of the week. If you are setting a monthly SIP, selected the day of the month for the SIP to be executed.

3. Use the Add option to add PHARMABEES to the basket and select the quantity and price. Market price is most preferable if you are setting a SIP.

4. Confirm and Activate the SIP. You can always Pause the SIP when needed. You can also edit the Stock price and QTY in the SIP by using the Edit option.

With zero brokerage, setting up a SIP on the Navia app is cost-effective and hassle-free, making it an excellent option for long-term investors. Navia also provides FREE Ready made ETF baskets for hassle free SIP investment on selected TOP ETF’s. To know more about these curated basket click here

Conclusion

The Nippon India Nifty Pharma ETF (PHARMABEES) offers a powerful way to invest in the future of healthcare. With its strong performance, strategic holdings, and sector-specific focus, it’s an ideal vehicle for investors looking to benefit from the continued growth of India’s pharmaceutical sector.

Don’t miss out on the opportunity to be a part of this dynamic industry. Start investing in the PHARMABEES ETF today and position yourself for future success.

Explore the PHARMABEES ETF and start your investment journey now!

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.

We’d Love to hear from you