Investing in Nippon India Gilt 5-Year Benchmark G-Sec ETF (GILT5YBEES)

The Nippon India Gilt 5-Year Benchmark G-Sec ETF (GILT5YBEES) is an exchange-traded fund that offers investors exposure to government securities (G-Secs) with a 5-year maturity. This ETF is ideal for those seeking a low-risk, stable investment option with the security of government bonds. By investing in the GILT5YBEES ETF, investors can gain exposure to the debt market, diversify their portfolio, and benefit from the stability of government-backed securities. In this blog, we will explore the features, holdings, and performance of the GILT5YBEES ETF.

What is GILT5YBEES ETF?

The Nippon India Gilt 5-Year Benchmark G-Sec ETF (GILT5YBEES) aims to replicate the performance of the Nifty 5-Year Benchmark G-Sec Total Return Index, providing investors with returns that closely correspond to government securities of 5-year maturity. The ETF focuses on a single government bond with the objective of delivering a low-cost, low-risk alternative for investors who seek stability and fixed returns.

Key Features of GILT5YBEES ETF

🔶 Stock Market Investing: Gain exposure to government securities (G-Secs), which are considered one of the safest investments.

🔶 Low-Cost ETF: The ETF has a low expense ratio of 0.09%, making it a cost-effective investment option.

🔶 Systematic Investing: Investors can set up a Systematic Investment Plan (SIP) through the Navia Zero Brokerage Stock Investing APP, allowing them to invest regularly with minimal cost.

Holdings of GILT5YBEES ETF

The GILT5YBEES ETF invests primarily in government securities, providing exposure to high-quality bonds. Here are the details of its holdings:

| Holding Name | Sector | Holding (%) |

|---|---|---|

| 7.04% Government Stock 2029 | Government | 97.36% |

| Cash & Equivalents | Cash | 2.64% |

The ETF is heavily invested in a single government security, ensuring that the portfolio is high quality with minimal credit risk. The 7.04% Government Stock maturing in 2029 makes up 97.36% of the portfolio, while the remaining 2.64% is held in cash and equivalents for liquidity purposes.

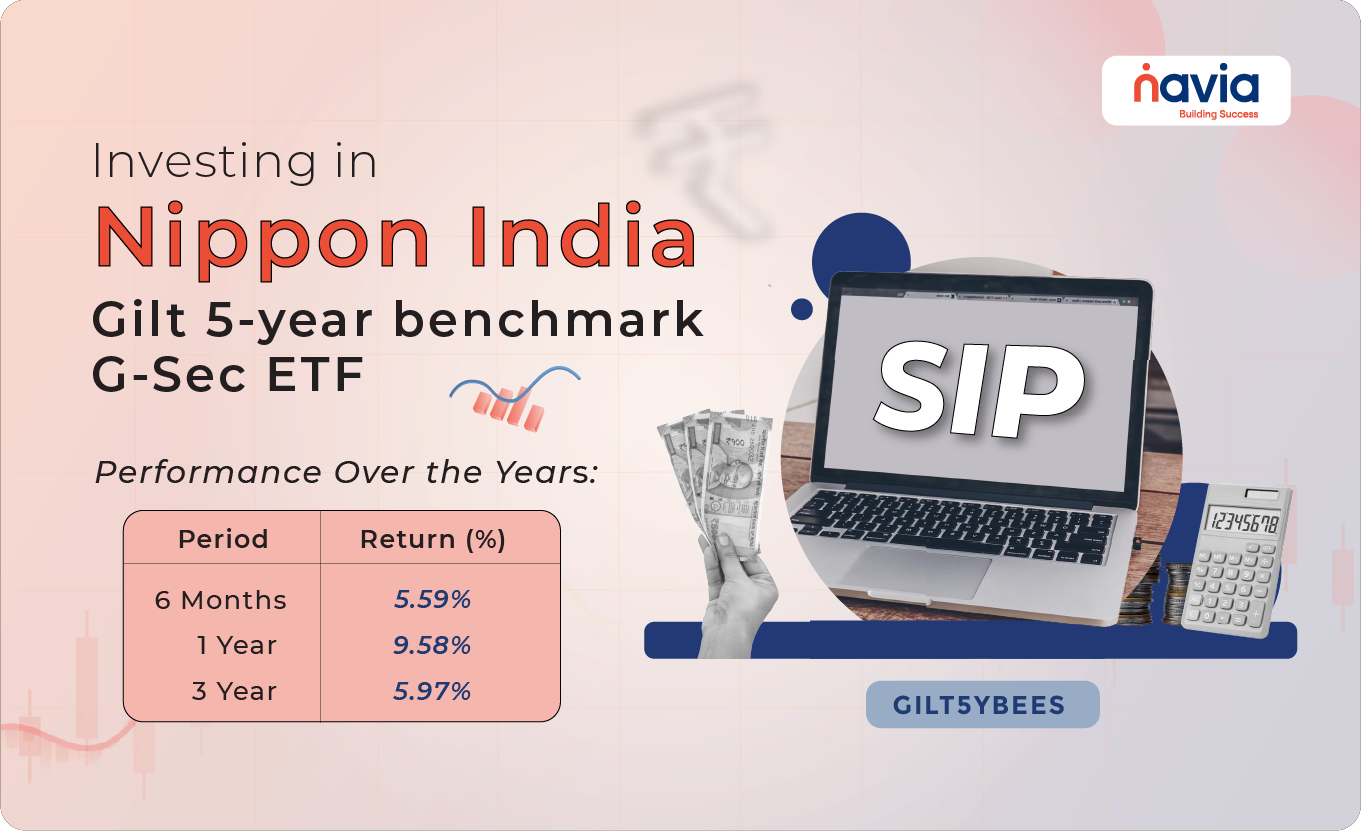

Performance of GILT5YBEES ETF

The GILT5YBEES ETF has delivered consistent returns, aligning closely with the performance of the underlying 5-year government securities. Here’s a breakdown of its performance over different timeframes:

Returns:

🔷 6-Month Return: 5.59%

🔷 1-Year Return: 9.58%

🔷 3-Year Return: 5.97% (annualised)

Growth of ₹1 Lakh Investment

Let’s see how an investment of ₹1 Lakh would have grown over these periods:

| Period | Return (%) | Investment Growth (₹) |

|---|---|---|

| 6 Months | 5.59% | ₹1,05,590 |

| 1 Year | 9.58% | ₹1,09,580 |

| 3 Years (Annualised) | 5.97% | ₹1,19,460 |

These returns indicate that GILT5YBEES has delivered stable, moderate growth, making it suitable for conservative investors looking for steady income.

Benefits of Investing in GILT5YBEES ETF

Low Risk:

The ETF invests in government securities, which are considered one of the safest investment instruments due to the sovereign guarantee backing them.

Low Cost:

With an expense ratio of 0.09%, the GILT5YBEES ETF offers one of the lowest costs among available fixed-income ETFs, ensuring that most of the returns go directly to the investor.

Systematic Investment Plans (SIPs):

Investors can easily set up a SIP using the Navia Zero Brokerage Stock Investing APP, allowing them to regularly invest small amounts and benefit from rupee cost averaging.

Diversification:

Investing in government securities can add a layer of diversification to an investor’s portfolio, balancing out more volatile investments like stocks and equity ETFs.

Liquidity:

As an exchange-traded fund, GILT5YBEES offers liquidity, allowing investors to buy and sell units on the stock exchange during market hours.

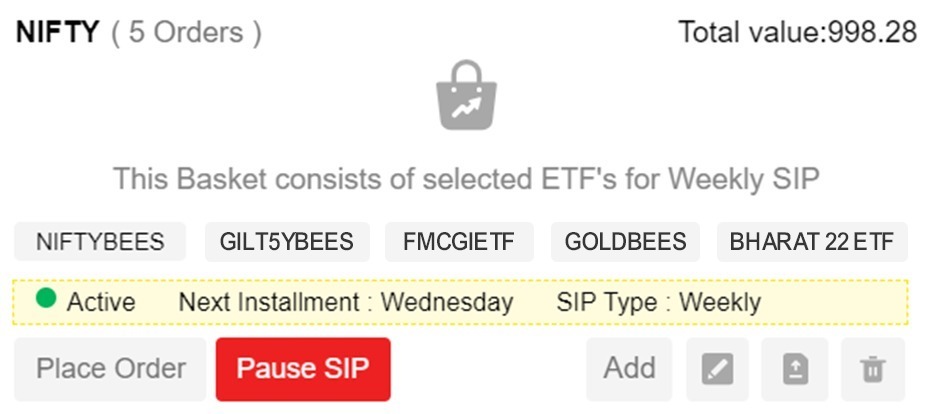

Steps to Set Up a SIP for GILT5YBEES ETF Using the Navia APP

Investing in Midcap 150 BeES using the Navia Zero Brokerage Stock Investing APP is simple and convenient. Follow these steps to set up a SIP:

1) Download and Log In to the Navia app.

2) Go to Tools -> Basket and create a basket with a name of your choice.

3) Set up a Weekly or Monthly SIP, selecting the day of the week or month for the SIP to be executed.

4) Use the Add option to add GILT5YBEES to your basket and select the quantity and price (market price is preferred for SIP).

5) Confirm and Activate the SIP. You can pause, edit the stock price, or adjust the quantity anytime using the Edit option.

With zero brokerage, setting up a SIP on the Navia app is cost-effective and hassle-free, making it an excellent option for long-term investors. Navia also provides FREE Ready made ETF baskets for hassle free SIP investment on selected TOP ETF’s. To know more about these curated basket read here

Is GILT5YBEES ETF Right for You?

For conservative investors seeking a low-risk, steady return investment, the Nippon India Gilt 5-Year Benchmark G-Sec ETF is an excellent option. The ETF offers exposure to government-backed securities with a low expense ratio, making it a cost-effective way to invest in the bond market.

By setting up a SIP through the Navia Zero Brokerage Stock Investing APP, you can benefit from consistent investments and the safety of government securities. Whether you are looking to diversify your portfolio or seeking stable returns in volatile markets, GILT5YBEES provides a reliable investment avenue.

With its focus on government bonds, low fees, and strong historical performance, the GILT5YBEES ETF is an ideal choice for those looking for low-cost, fixed-income exposure in the Indian market.

We’d Love to Hear from you-

DISCLAIMER: Investments in the securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Brokerage will not exceed the SEBI prescribed limit.