Navia Weekly Roundup (Sep 15 – 19, 2025)

- Week in the Review

- Indices Analysis

- Interactive Zone!

- Sector Spotlight

- Top Gainers and Losers

- Currency Chronicles

- Commodity Corner

- Top Blogs of the Week!

- N Coins Rewards

Week in the Review

Despite Friday’s sell-off the Indian market extended the winning run on the third consecutive week, helping to closed above its nine-week high led by DII support, inline rate cut by Federal Reserve, rupee pullback, ahead of GST implementation next week, ignoring persistent FPI outflows, and unresolved US-India tariff issues.

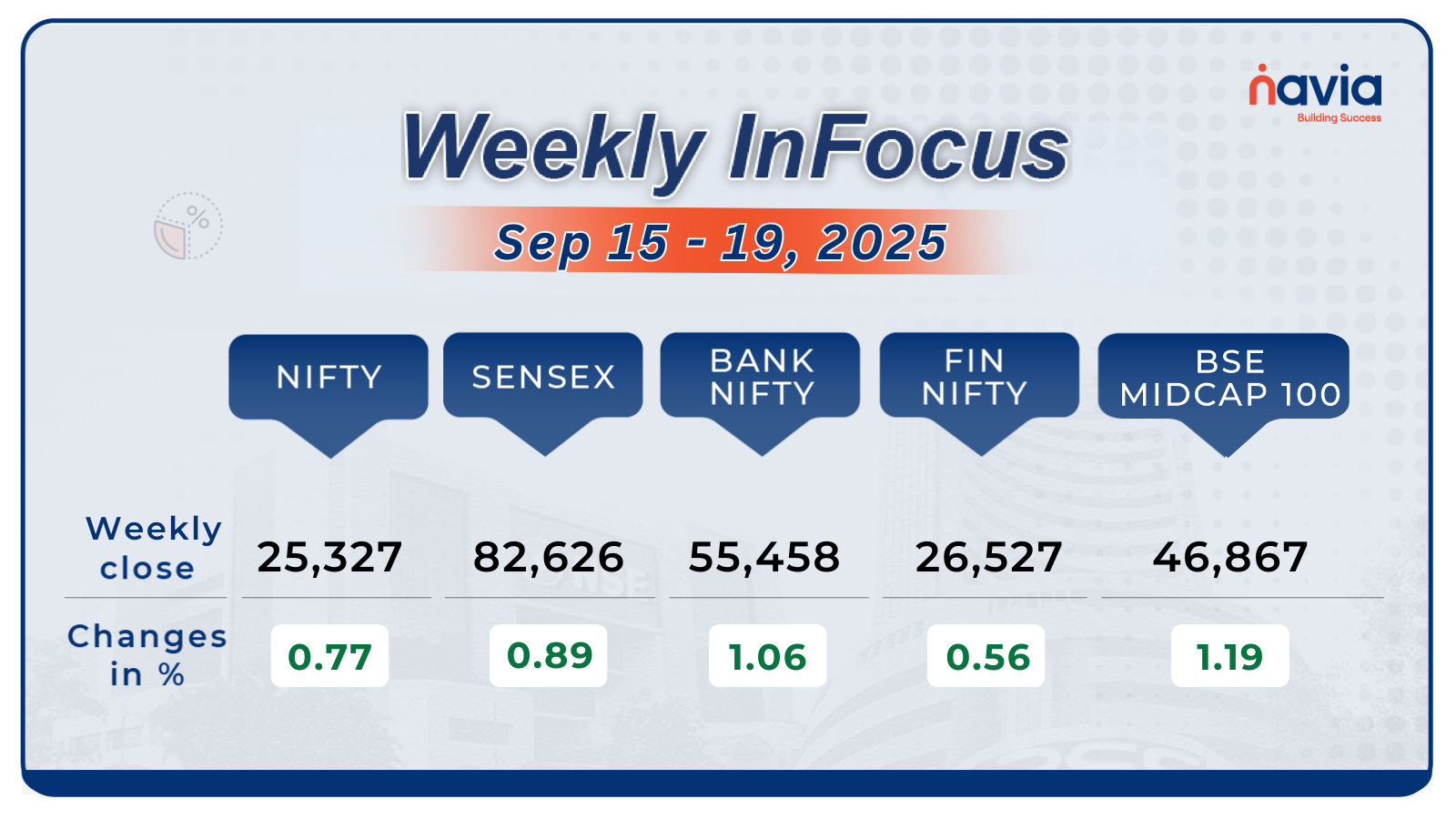

Indices Analysis

For the week, Nifty50 rose 0.77 percent to close at 25,327.05, while the BSE Sensex index gained 0.89 percent to close at 82,626.23.

The BSE Large-cap Index gained 1.1 percent supported by Hyundai Motor India, Swiggy, Eternal, Cholamandalam Investment and Finance Company, Bank Of Baroda, Kotak Mahindra Bank, Samvardhana Motherson International, SBI Cards & Payment Services, Punjab National Bank, Canara Bank.

The BSE Small-cap index added 2 percent with IRM Energy, Banco Products (India), Sindhu Trade Links, Hi-Tech Pipes, Ramco System, Redington, Welspun Enterprises, Redtape, Shalimar Paints, Bajaj Consumer Care adding 15-36 percent, while Balmer Lawrie Investment, LE Travenues Technology (IXIGO), KRBL, KR Rail Enginerring, Dreamfolks Services fell between 9-12 percent.

Foreign Institutional Investors’ (FIIs) outflow extended in the 12th straight week, as they sold equities worth Rs 1,327.38 crore, while Domestic Institutional Investors (DII) continued their buying in 23d week, as they bought equities worth Rs 11,177.37 crore.

Interactive Zone!

Test your knowledge with our Markets Quiz! React to the options and see how your answer stacks up against others. Ready to take a guess?

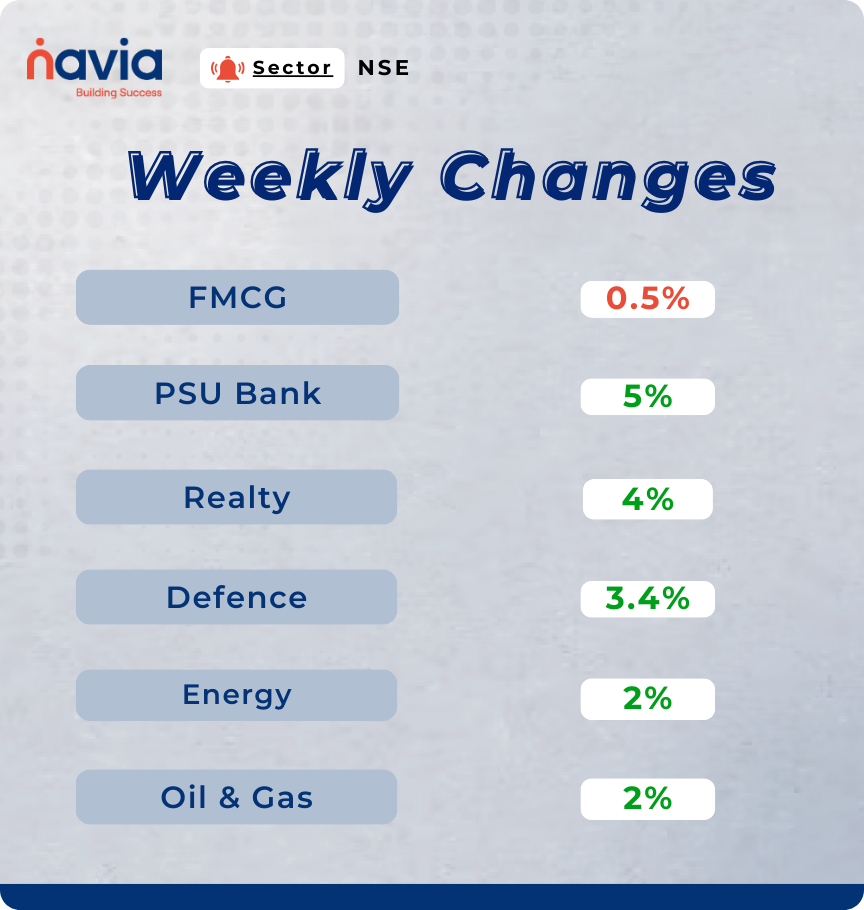

Sector Spotlight

Among sectors, except Nifty FMCG (down 0.5 percent), all other indices ended higher with Nifty PSU Bank index added nearly 5 percent, Nifty Realty index rose over 4 percent, Nifty Defence index added 3.4 percent, Nifty Energy, Oil & Gas rose 2 percent each.

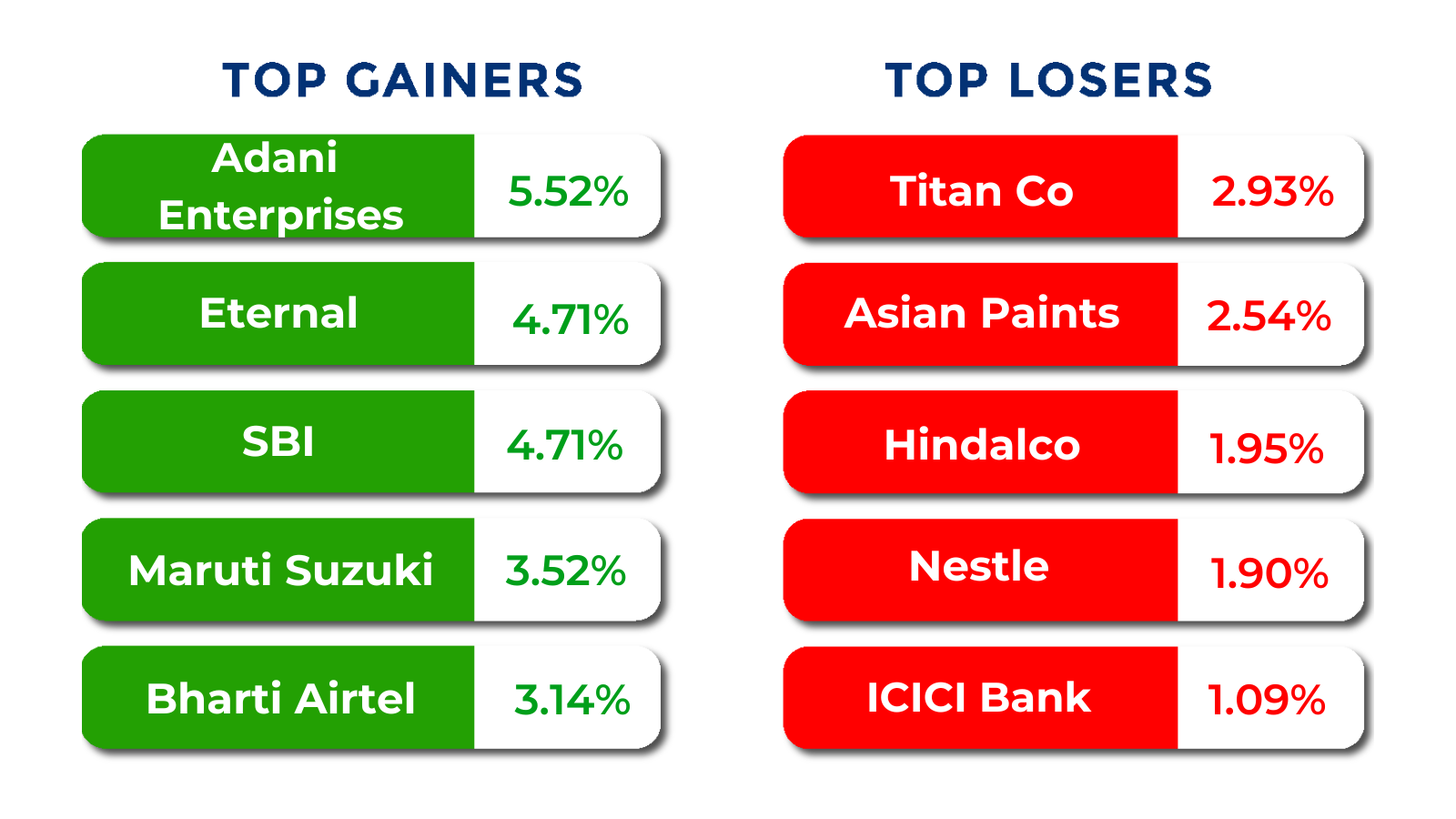

Top Gainers and Losers

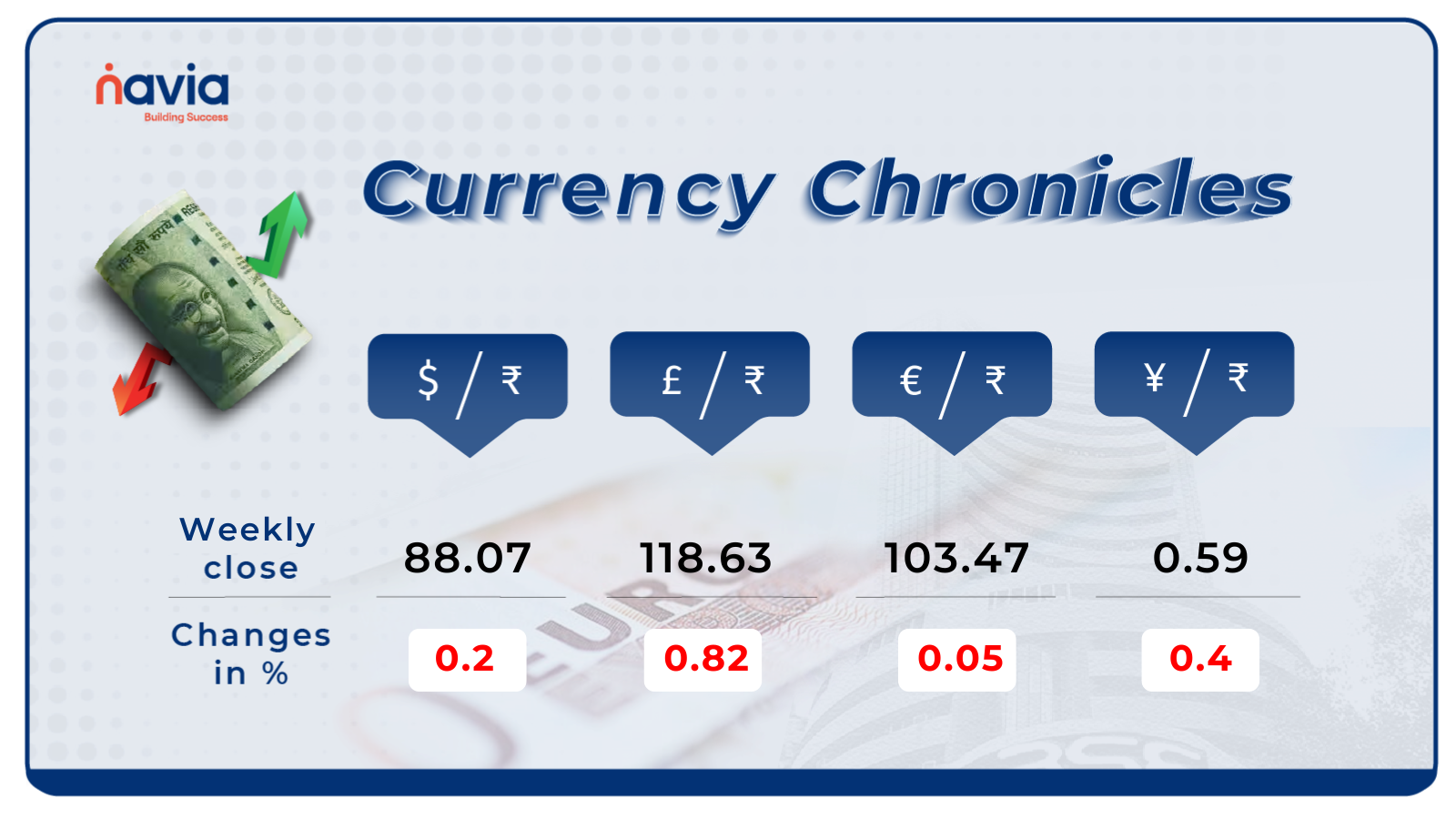

Currency Chronicles

USD/INR:

The USD/INR rate closed at ₹88.07 per dollar, losing 0.2% during the week, reflecting a bearish market sentiment.

EUR/INR:

The EUR/INR rate closed at ₹103.47 per euro, losing 0.05% during the week, reflecting a bearish market sentiment.

JPY/INR:

The JPY/INR rate closed at ₹0.59 per yen, losing by 0.4% during the week, reflecting a bearish market sentiment.

Stay tuned for more currency insights next week!

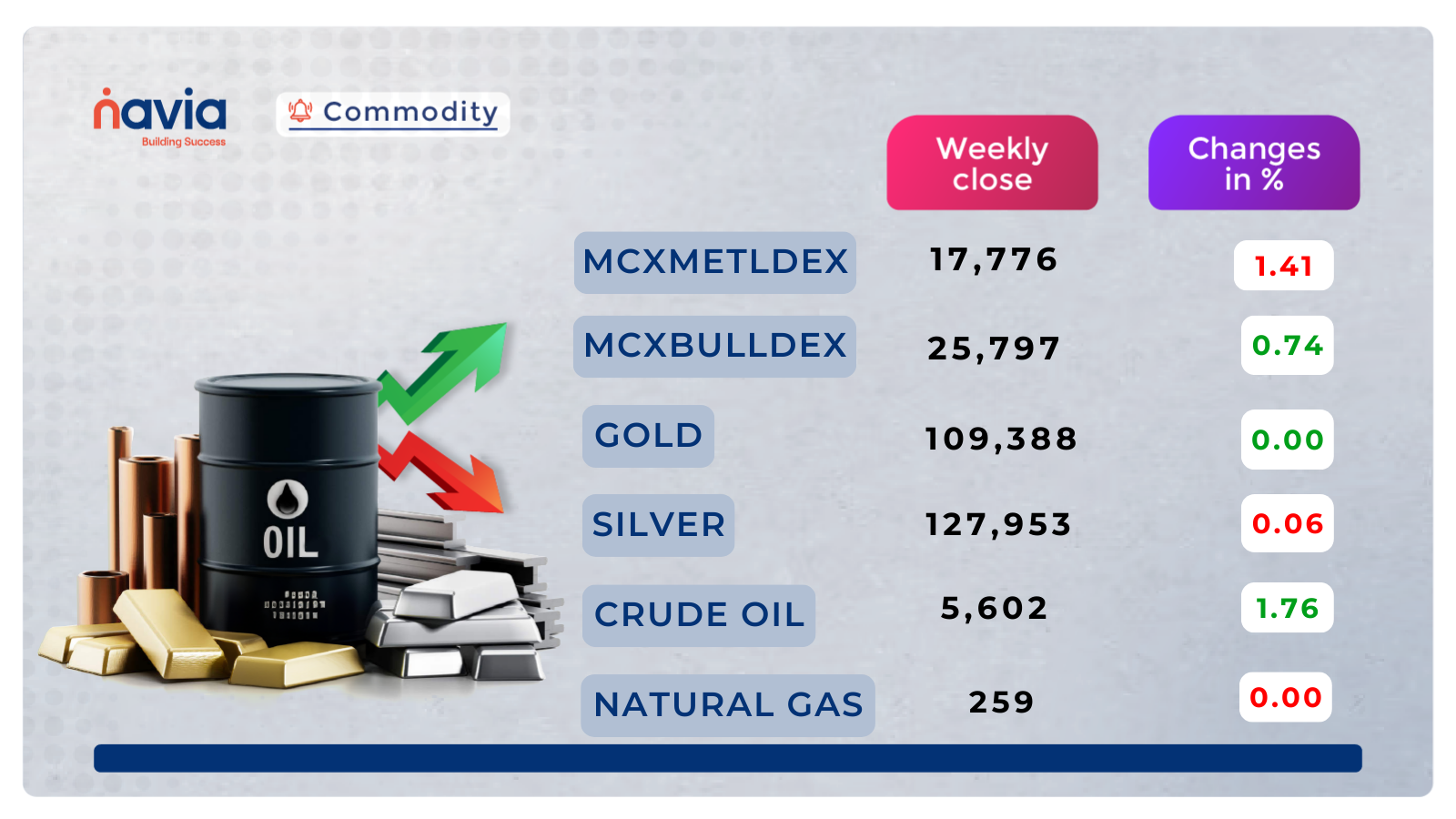

Commodity Corner

MCX Crude Oil futures are currently trading near 5,610 per barrel with a slight downward bias following recent volatility. The price is testing an important support level of 5,580; holding this support could provide a platform for a short-term rally. Technical analysis indicates that crude oil is testing support near 5,580. A break above 5,600 may open higher levels; while below 5,570, downside pressure may resume. Conversely, if crude oil closes below 5,570 with strong bearish momentum, it may signal further downside potential toward 5,520 levels.

In the last session, Gold closed at 109,388. MCX Gold futures are hovering around 109,030 on the 4-hour chart, demonstrating ongoing strength above a rising trendline after a bounce from the 108,600–110,700 consolidation area. This pattern signals sustained bullish momentum within an upward channel, making the current zone a key region of support and resistance for short-term trading. As long as the price holds above the trendline, the outlook remains optimistic—utilizing a tight stoploss at nearby support levels enhances risk management, making this setup appealing for traders and media updates alike.

Natural Gas futures have recently pulled back from the resistance zone around 282–290 and are now trading near 259.4, closely testing an ascending trendline that has consistently acted as support throughout September. The present market structure is moderately bullish to sideways, as long as this trendline holds. Price action near this level will be key for short-term direction holding above it signals continued bullish momentum, while a breakdown would likely shift the bias to bearish. Traders are advised to use tight stoploss levels to manage risk efficiently at this pivotal support.

Do you have a question? Ask here and we’ll publish the information in the coming weeks.

Top Blogs of the Week!

Introducing Navia Backup: An Emergency-Mode Trading Safety Net

Navia Backup is a lightweight, independent system built to protect traders during rare disruptions. Unlike regular trading apps, it isn’t overloaded with features — it focuses solely on one mission: giving you the power to square off positions instantly, even if the main systems are down. Accessible via the Navia app or website, it ensures you stay in control when it matters most.

The Overconfidence Trap in Investing – When Being Too Sure Backfires

This blog shares the story of Ravi, who lost money by being overconfident, and Suresh, who stayed disciplined and protected his portfolio. The lesson? Confidence is good, but unchecked overconfidence can be dangerous. Stay humble, diversify, and let data guide your investments.

N Coins Rewards

Refer your Friends & Family and GET 500 N Coins.

Do You Find This Interesting?

DISCLAIMER: Investment in securities market are subject to market risks, read all the related documents carefully before investing. The securities quoted are exemplary and are not recommendatory. Full disclaimer: https://bit.ly/naviadisclaimer.